Table of Contents

IRS Form 15110 – Additional Child Tax Credit Worksheet – Families with children know the financial strain of raising kids in today’s economy, but the Additional Child Tax Credit (ACTC) offers a vital lifeline—up to $1,700 per qualifying child as a refundable boost beyond the non-refundable $2,000 Child Tax Credit (CTC). If you received IRS Notice CP08, you may be eligible for unclaimed credits due to unreported dependents or calculation errors on your 2024 return. Enter IRS Form 15110—the Additional Child Tax Credit Worksheet—a simple tool to verify eligibility and unlock refunds. For tax year 2025, with the CTC remaining at $2,000 ($1,700 refundable) under current law (potential expansions eyed for 2026), Form 15110 (Rev. 4-2025) streamlines claims via electronic upload or mail. This SEO-optimized guide, based on the latest IRS instructions, breaks down eligibility, step-by-step completion, and tips to maximize your 2025 refund—potentially $1,700 per child.

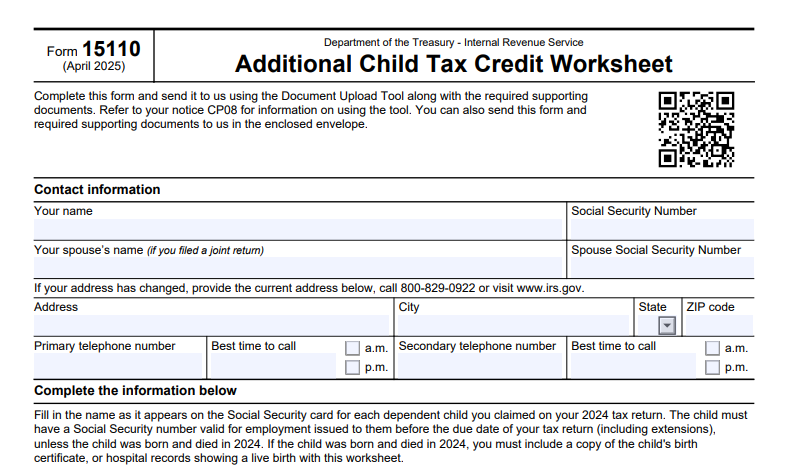

What Is IRS Form 15110?

IRS Form 15110 is a one-page worksheet designed to help taxpayers confirm qualifying children for the ACTC and calculate their refundable amount when responding to IRS Notice CP08. Issued as part of the notice, it lists eligibility factors and requires supporting documents like birth certificates or SSNs. Unlike Schedule 8812 (used on your original return), Form 15110 focuses on post-filing adjustments for missed dependents, ensuring low-income families (typically under $200,000 AGI) receive the refundable portion of the CTC.

Key features:

- Eligibility Check: Verifies children under 17 with valid SSNs, meeting residency and support tests.

- Refund Calculation: Ties into Schedule 8812 for the final ACTC amount (up to $1,700/child in 2025).

- Notice-Specific: Primarily for CP08 recipients; can’t amend original returns—use Form 1040-X instead.

The April 2025 revision (OMB No. 1545-0074) adds clarity on electronic submission via the IRS Document Upload Tool and aligns with Pub. 972 (Child Tax Credit). Download the PDF from IRS.gov/pub/irs-pdf/f15110.pdf for the current version.

Who Needs IRS Form 15110 in 2025?

Form 15110 is essential for taxpayers receiving Notice CP08, which flags potential ACTC eligibility based on IRS data (e.g., unreported children from SSA records). It’s ideal for families who filed without claiming all dependents or miscalculated credits. No form needed if you already claimed on your original return.

| Eligibility Factor | Details for 2025 |

|---|---|

| Notice CP08 Recipients | Must complete if verifying additional children; respond within 30 days. |

| Qualifying Children | Under 17 at year-end, U.S. citizen/resident, valid SSN, lived with you >half year, you provided >half support. |

| Income Limits | Full $2,000 CTC up to $200K single/$400K joint; phaseout $50 per $1K over (ACTC refundable up to $1,700). |

| Other Claimants | Low-income families with earned income ≥$2,500; can’t use for original returns—amend via 1040-X. |

| Exclusions | Non-citizens without SSNs, children born/died in 2025 (wait for next year). |

Adopted or foster children qualify with proper docs; other dependents (e.g., 17+) get $500 non-refundable only.

How to Use IRS Form 15110: Step-by-Step Guide

Completing Form 15110 takes 15-30 minutes—gather SSNs, birth/death certificates, and your original return. Use alongside Schedule 8812 for calculations.

- Enter Personal Info (Lines 1-3): Name, address, SSN, filing status, and AGI from Form 1040.

- List Children (Line 4): For each additional child, provide name, SSN, birth/death dates, relationship, and months lived with you.

- Verify Eligibility (Line 5): Answer yes/no for factors: U.S. citizen? Lived with you >half year? You provided >half support? Under 17? Valid SSN by due date?

- Qualifying Check (Line 6): If “Yes” to all for a child, they qualify; tally total qualifying children.

- Attach Schedule 8812: Complete and include for ACTC math (earned income × 15% minus non-refundable CTC, max $1,700/child).

- Sign & Submit: Date and sign; attach docs (e.g., birth cert for 2025 births/deaths).

- Send Within 30 Days: Use IRS upload tool or mail to the address on CP08.

For 2025 births/died, include hospital records. IRS reviews in 8-10 weeks; denials come with explanation letters.

Calculating the Additional Child Tax Credit with Form 15110

The ACTC is the refundable part of the CTC: $2,000 total per child, with up to $1,700 refundable based on earned income.

| Step | Calculation for 2025 | Example (2 Qualifying Children) |

|---|---|---|

| Non-Refundable CTC | $2,000/child, phaseout over $200K/$400K AGI | $4,000 total (full if AGI <$200K). |

| Refundable ACTC | Lesser of: (Earned income × 15%) or ($1,700 × children) minus non-refundable CTC | Earned income $20K: $3,000 (15% × $20K); ACTC = $3,000 – $4,000 = $0 (but cap per child). Wait, correct: Max refundable $1,700/child after non-refundable. |

| Total Credit | Non-refundable + ACTC | $4,000 non-refundable + $3,400 ACTC = $7,400 max refund. |

Use Schedule 8812 lines 5-14 for precise math; earned income excludes SSI/unemployment. Coordinate with EITC to avoid double-dipping.

Submitting Form 15110: Deadlines and Methods for 2025

Respond to CP08 within 30 days of the notice date (e.g., if mailed November 2025, due December). No extensions—late claims risk denial.

- Electronic Upload: Preferred; use IRS.gov Document Upload Tool—scan and submit PDF with docs.

- Mail: Use pre-addressed envelope from CP08 or send to the specified IRS center.

- Processing Time: 8-10 weeks for refunds; track via “Where’s My Refund?” on IRS.gov.

- Amendments: If no CP08 but missed credit, file Form 1040-X with Schedule 8812 by April 15, 2029 (3-year limit).

For 2025 returns (filed 2026), use Schedule 8812 directly—no Form 15110 unless noticed.

Common Mistakes When Using Form 15110 and How to Avoid Them

Errors delay refunds—top pitfalls for 2025:

- Incomplete Eligibility: Answering “No” to one factor disqualifies—double-check residency/support.

- Missing Docs: Forgetting SSNs/birth certs—attach copies upfront.

- Wrong Children: Including non-qualifiers (e.g., 17+ or non-residents)—review Pub. 972.

- Late Submission: Beyond 30 days—respond immediately upon notice.

- No Schedule 8812: Form 15110 alone insufficient—complete both.

Consult a VITA/TCE site for free help; video walkthroughs available on IRS.gov.

Benefits of the Additional Child Tax Credit in 2025

The ACTC reduces child poverty by providing cash refunds—up to $3,400 for two kids—directly boosting family budgets for essentials like food and housing. Unlike the non-refundable CTC, it delivers even if you owe no tax, with 15% of earned income formula favoring low-wage workers. Potential 2026 expansions (to $3,000/child) make 2025 claims timely.

| Income Level | Max ACTC (1 Child) | Max ACTC (3 Children) |

|---|---|---|

| $0–$2,500 Earned | $0 (min threshold) | $0 |

| $20,000 Earned | $1,700 | $5,100 |

| $50,000+ Earned | $1,700 | $5,100 (capped) |

Phaseouts start at $200K/$400K AGI—file early to lock in.

IRS Form 15110 Download and Printable

Download and Print: IRS Form 15110

Frequently Asked Questions About IRS Form 15110

Do I need Form 15110 if I didn’t get CP08?

No—for original 2025 returns, use Schedule 8812; amend via 1040-X if missed.

What’s the max ACTC per child in 2025?

$1,700 refundable, part of $2,000 total CTC.

Can adopted children qualify?

Yes—with SSN and support tests met; include adoption decree if needed.

How long to get my ACTC refund after Form 15110?

8-10 weeks; track on IRS.gov.

Does ACTC affect EITC?

No—stackable; coordinate on Form 1040.

For more, visit IRS.gov/CP08.

Final Thoughts: Claim Your 2025 Additional Child Tax Credit with Form 15110

IRS Form 15110 turns IRS notices into opportunities, unlocking up to $1,700 per child in refundable ACTC for overlooked dependents—essential for families navigating tight budgets. With the April 2025 revision’s electronic upload option, responding to CP08 is quicker than ever; pair it with Schedule 8812 and submit within 30 days for an 8-10 week refund. Download from IRS.gov today, gather your docs, and consult a tax pro or VITA for accuracy—don’t leave money on the table.

This article is informational only—not tax advice. Verify with IRS.gov or a professional.