Table of Contents

IRS Form 15111 – Earned Income Credit (EIC) Worksheet (CP 09) – The Earned Income Tax Credit (EITC)—one of the IRS’s most powerful tools for supporting working families—can deliver up to $8,046 in refundable cash for households with three or more qualifying children in 2025, helping combat child poverty and reward modest earners. But if you filed a return without claiming it due to overlooked dependents or calculation errors, the IRS may send Notice CP 09, flagging potential eligibility. Responding with IRS Form 15111—the Earned Income Credit (EIC) Worksheet (CP 09)—can unlock that missed refund without amending your original return. For tax year 2025, with EITC phaseouts at $63,398 for singles with three+ kids and the March 2025 form revision emphasizing electronic uploads, this guide—drawn from official IRS sources—walks you through eligibility, completion, and submission to secure your credit within the three-year claim window (e.g., by April 15, 2028, for 2025 returns).

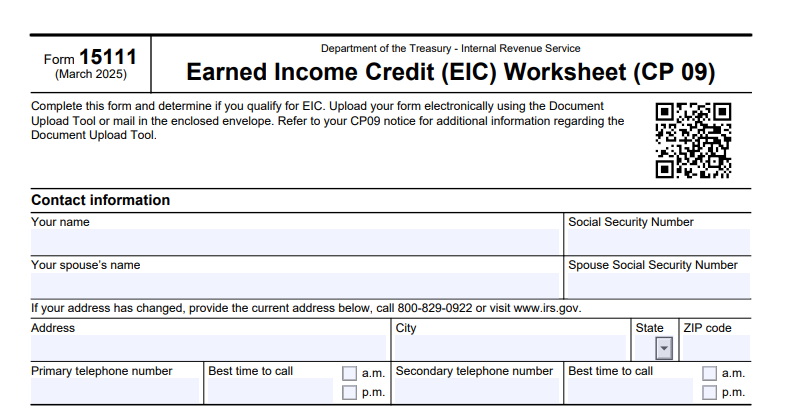

What Is IRS Form 15111?

IRS Form 15111 is a concise worksheet included with Notice CP 09, designed to verify your EITC eligibility and trigger a refund if you qualify but didn’t claim it on your prior-year return. Sent proactively based on IRS data matching (e.g., SSA records of births or unreported children), it screens for basic qualifiers like child age, residency, and income before referencing Schedule EIC or Pub. 596 for the full calculation. Unlike the general EITC worksheet in your tax software, Form 15111 is notice-specific, focusing on post-filing verification to issue refunds in 6-8 weeks.

Key features:

- Eligibility Quick-Check: Answers yes/no questions on children under 17, support, and residency.

- Refund Path: If eligible, the IRS processes your EITC (up to $8,046 for 3+ kids) and mails a check—no need for Form 1040-X.

- No Cost: Free; electronic submission via the Document Upload Tool speeds processing.

The March 2025 revision (Rev. 3-2025, OMB No. 1545-0074) updates income limits and adds upload instructions, aligning with Pub. 596 (EITC rules). Download the PDF from IRS.gov/pub/irs-pdf/f15111.pdf.

Understanding IRS Notice CP 09 and When You Need Form 15111

Notice CP 09 arrives unannounced when the IRS’s algorithms detect you may qualify for EITC but didn’t claim it—often from mismatched dependent data or low reported income. It’s an opportunity, not an audit: Respond with Form 15111 within 30 days (or by the original return’s due date, e.g., April 15, 2028, for 2025 claims) to confirm and receive your refund. Ignoring it means forfeiting the credit—potentially thousands lost.

| Scenario | Do You Need Form 15111? | Next Steps |

|---|---|---|

| Received CP 09 | Yes—mandatory for verification | Complete and submit; expect 6-8 weeks for refund check. |

| No Notice, Suspect Missed EITC | No—amend original return | File Form 1040-X with Schedule EIC within 3 years. |

| Ineligible (e.g., No Kids, High AGI) | Still respond | Mark “no” on qualifiers; IRS closes the case. |

| Prior Years (e.g., 2022) | If CP 09 specifies | Deadline: April 15, 2026; up to 3 years back. |

CP 09 targets low/moderate-income filers (AGI ≤$63,398 for 3+ kids); even if unsure, submit to resolve.

Step-by-Step Guide to Completing IRS Form 15111

Form 15111 is straightforward—about 15 minutes with your prior return and child docs. It leads into Schedule EIC for the credit amount.

- Contact Info (Top): Name, SSN, spouse details, address (update if changed via IRS.gov or 800-829-1040).

- Filing Status (Line 1): Select single, married filing jointly, etc., matching your original return.

- Child Details (Lines 2-4): For each potential qualifier: Name, SSN, birth/death dates, relationship (son/daughter, etc.), months lived with you (>6?).

- Qualifier Questions (Line 5): Yes/no: U.S. citizen/resident? Lived with you >half year? You provided >half support? Under 17 at year-end? SSN valid by filing date?

- Total Qualifiers (Line 6): Count full “yes” responses—e.g., 2 children = Line 6: 2.

- Attach Schedule EIC: Complete the EITC worksheet (Pub. 596) and include; factor earned income (wages minus exclusions like 401(k)).

- Sign & Date (Step 4): Under penalty of perjury; within 30 days of CP 09.

- Submit: Mail in enclosed envelope or upload PDF via IRS Document Upload Tool (irs.gov).

For 2022 claims (via 2025 CP 09), respond by April 15, 2026. Processing: 6-8 weeks; call 800-829-1040 after 8 weeks.

2025 EITC Eligibility and Maximum Credits with Form 15112

Form 15111 verifies basics; Schedule EIC computes the refundable credit based on earned income and kids. Max: $8,046 (3+ kids); requires ≥$1 earned income, no foreign disqualification.

| Family Size | Max Credit | Phaseout Start (Single) | Phaseout End (Single) |

|---|---|---|---|

| No Children | $632 | $10,000 | $18,591 |

| 1 Child | $4,213 | $22,720 | $49,084 |

| 2 Children | $6,960 | $29,404 | $55,768 |

| 3+ Children | $8,046 | $37,034 | $63,398 |

Joint filers add $6,660 to phaseout start. Form 15111 ensures kids meet tests—respond to claim retroactively (e.g., 2022 by April 15, 2026).

IRS Form 15111 Download and Printable

Download and Print: IRS Form 15111

Submitting Form 15111: Methods and Processing in 2025

Reply within 30 days of CP 09 (or return deadline). No fee; electronic fastest.

- Mail: Enclosed envelope—6-8 weeks.

- Upload: IRS.gov Document Upload Tool—scan PDF, 4-6 weeks.

- Phone: 800-829-1040 for status after 8 weeks.

Denials include explanations; appeal via letter. Use EITC Assistant on IRS.gov to pre-verify.

Common Mistakes When Completing Form 15111 and How to Avoid Them

80%+ approvals if done right—pitfalls to dodge:

- Vague Child Info: No SSNs/months—attach certs.

- Status Mismatch: Not aligning with return—check copy.

- Skipping Schedule EIC: Required for amount—use Pub. 596.

- Late Reply: Over 30 days—mail ASAP.

- Assumed Ineligibility: “No” to one test disqualifies—review carefully.

Free VITA/TCE aid; IRS videos guide.

No Penalties for Form 15111—But Forfeited EITC Hurts

No fines for filing—it’s optional verification. Ignore CP 09? Lose the credit (e.g., $8,046 gone). False answers risk perjury (§7206). Respond for closure; denials detail recourse.

Frequently Asked Questions About IRS Form 15111

What prompts CP 09 in 2025?

IRS matching flags missed EITC—e.g., unreported kids.

Max EITC for 3+ kids in 2025?

$8,046; phaseout $63,398 single.

Submit electronically?

Yes—Document Upload Tool for 4-6 weeks processing.

Claim 2022 EITC via 2025 CP 09?

Yes—by April 15, 2026.

Need Schedule EIC?

Yes—attach for calculation.

Visit IRS.gov/CP09 for more.

Final Thoughts: Seize Your EITC with IRS Form 15111 in 2025

IRS Form 15111 transforms a CP 09 notice into a refund windfall, verifying eligibility for up to $8,046 to ease family budgets amid 2025’s $63,398 phaseout. The March 2025 revision’s upload ease makes it simple—respond within 30 days, include Schedule EIC, and pocket your 6-8 week check. Download from IRS.gov today; use the EITC Assistant to confirm and VITA for free support—don’t forfeit this game-changer.

Informational only—not tax advice. Consult IRS.gov or a professional.