Table of Contents

IRS Form 15397 – Application for Extension of Time to Furnish Recipient Statements – Tax season deadlines can be relentless, especially for businesses juggling thousands of information returns like W-2s, 1099s, and ACA forms. If you’re an issuer or transmitter facing delays in preparing recipient copies—due to data issues, system glitches, or high volume—IRS Form 15397, Application for Extension of Time to Furnish Recipient Statements, offers a one-time lifeline: up to 30 extra days without penalties. For 2025, this streamlined form (Rev. 3-2025) must be faxed by the original due date, ensuring compliance while avoiding the $340 per-form fines for late furnishing. This SEO-optimized guide, based on the latest IRS updates (effective January 2025), covers eligibility, filing steps, and best practices to keep your reporting on track amid the January 31 deadline for most forms.

What Is IRS Form 15397?

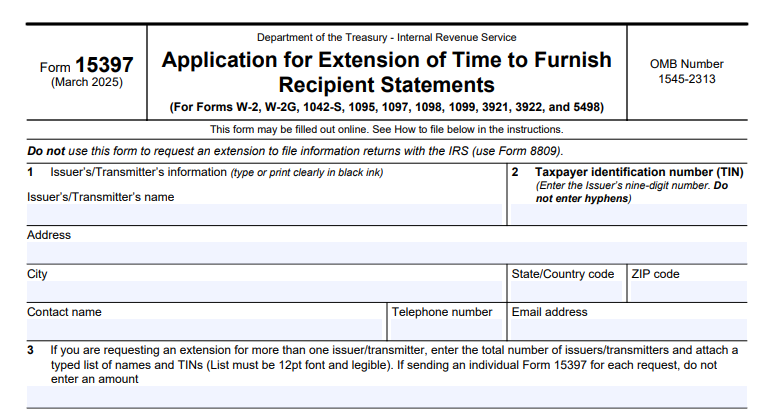

IRS Form 15397 is a simple, one-page application allowing issuers and transmitters to request a 30-day extension for furnishing recipient statements (Copy B) of specified information returns. It replaces ad-hoc letter requests outlined in the General Instructions for Certain Information Returns, providing a structured process under IRC Section 6050. This extension applies only to recipient copies—not IRS filings (use Form 8809 for those). Approval is generally automatic if timely and complete, helping avoid penalties for late delivery to employees, contractors, or payees.

Key features:

- One-Time Limit: Up to 30 days; no renewals—plan accordingly.

- Covered Forms: W-2, 1099 series (e.g., NEC, MISC), 1042-S, ACA (1095 series), 5498 series, and more (listed on line 4).

- No Fee: Free to file; fax-only submission.

The March 2025 revision (Cat. No. 62979N) clarifies Box 5 for W-2/1099-NEC specifics and aligns with updated fax numbers. Download the PDF and instructions from IRS.gov/pub/irs-pdf/f15397.pdf.

Who Needs IRS Form 15397 in 2025?

File Form 15397 if you’re an issuer (employer, payer) or transmitter unable to meet the original due date for recipient statements, typically January 31 for W-2/1099s. It’s essential for HR teams, payroll providers, and accounting firms handling high volumes—e.g., 1,000+ forms—where data aggregation delays occur.

| Filer Type | When to File | Examples |

|---|---|---|

| Employers/Payers | If delayed on W-2, 1099-NEC/MISC, 1095 | Businesses with seasonal hiring; need extra time for corrections. |

| Transmitters/Service Providers | For client forms like 1042-S, 5498 | Payroll firms aggregating data; fax on behalf of clients. |

| IRA Custodians | For 5498 series (contributions/rollovers) | Trustees needing time for 2024 contributions through April 15, 2025. |

| Exemptions | If no delay or IRS filing extension only | Use Form 8809 for IRS deadlines; not for prior years. |

No filing before January 1; request as soon as needed, but by original due date (e.g., January 31 for W-2/1099-NEC).

Filing Deadlines and Submission for Form 15397 in 2025

Submit Form 15397 by the original recipient statement due date—no extensions for this request itself. Approval grants 30 days from that date; e.g., for January 31 W-2 deadline, extension to March 2, 2025.

| Form Type | Original Due Date | Extension Deadline | Extended Date |

|---|---|---|---|

| W-2/1099-NEC | January 31, 2026 | January 31, 2026 | March 2, 2026 |

| 1099-MISC/INT/DIV | February 1, 2026 (Jan 31 weekend) | February 1, 2026 | March 3, 2026 |

| 1042-S | March 15, 2026 (March 17) | March 17, 2026 | April 16, 2026 |

| 5498 Series | May 31, 2026 | May 31, 2026 | June 30, 2026 |

- Submission: Fax only—no mail/e-file. U.S.: 877-477-0572; International: 304-579-4105.

- Approval: Automatic if complete/timely; IRS confirms via fax/email (if provided).

- No Extensions for IRS Filing: Use Form 8809 separately.

File early (e.g., January 15 for W-2) to beat lines; providers like TaxBandits can fax on your behalf.

IRS Form 15397 Download and Printable

Download and Print: IRS Form 15397

Step-by-Step Guide to Completing IRS Form 15397

The form is concise—fillable PDF speeds it up. Gather form lists and due dates.

- Line 1: Name – Issuer/transmitter name (e.g., “ABC Payroll Services”).

- Line 2: Address – Full business address.

- Line 3: Contact Name/Phone/Email – Responsible person; email for confirmation.

- Line 4: Forms Requesting Extension For – Check boxes (e.g., W-2, 1099-NEC, 1042-S, 5498); list specifics if needed.

- Line 5: Number of Recipients – Total payees (e.g., 5,000 for W-2/1099-NEC).

- Line 6: Reason for Extension – Brief explanation (e.g., “Data aggregation delays from multiple clients”).

- Line 7: Signature & Title – Authorized signer (e.g., CEO); date (≤ due date).

- Fax It: Include cover sheet if multi-page; retain confirmation.

For 1042-S, file by March 17, 2025. Approval via fax within days.

Common Mistakes When Filing Form 15397 and How to Avoid Them

Extensions are straightforward, but errors void approvals:

- Late Fax: After original due date—submit by January 31 for W-2.

- Incomplete Boxes: Missing Line 5 counts or unchecked forms—list all.

- Wrong Number: 877-477-0572 U.S. only—international: 304-579-4105.

- Pre-January Filing: Not allowed—wait until January 1.

- No Reason: Vague Line 6—specify “system upgrade delays.”

Use checklists; providers automate.

Penalties for Late Furnishing Without Form 15397 in 2025

Missing extensions risks steep fines under IRC §6722, inflation-adjusted:

| Violation | Penalty per Statement | Max (Small Business) |

|---|---|---|

| Within 30 Days Late | $60 | $239,000/year |

| 31+ Days to Aug 1 | $130 | $683,000/year |

| After Aug 1/No Furnish | $340 | $1,366,000/year |

| Intentional | $680 + 10% amount | No max |

For 5,000 W-2s, late = $300K+ exposure—Form 15397 prevents this. Reasonable cause waives; first-time abatement available.

Frequently Asked Questions About IRS Form 15397

What’s the max extension from Form 15397?

30 days—one-time; e.g., W-2 from January 31 to March 2, 2026.

Can I file Form 15397 online?

No—fax only to 877-477-0572 (U.S.) or 304-579-4105 (intl).

Does Form 15397 extend IRS filing?

No—use Form 8809 for that; separate processes.

When to file for 5498 in 2025?

By May 31, 2026, for May 30 extension.

Is approval automatic?

Generally yes if timely/complete; IRS confirms.

Visit IRS.gov/forms-pubs/extension-of-time-to-furnish-statements-to-recipients for more.

Final Thoughts: Avoid Penalties with IRS Form 15397 in 2025

IRS Form 15397 is your buffer against the January 31 rush, granting a crucial 30-day extension for W-2/1099 recipient statements without fees or fuss—fax by deadline to sidestep $340-per-form fines. The March 2025 revision’s simplicity makes it indispensable for payroll pros; download from IRS.gov today, detail your reason, and confirm via fax receipt. Compliance isn’t just mandatory—it’s a smart extension of your operations.

This article is informational only—not tax advice. Consult IRS.gov or a professional.