Table of Contents

IRS Form 15620 – Section 83(b) Election – Equity compensation like restricted stock units (RSUs) or early-exercised stock options can supercharge your financial future, but vesting schedules often defer—and inflate—your tax bill. What if you could pay taxes upfront on the current low value, then enjoy future appreciation at favorable capital gains rates? That’s the power of the Section 83(b) election, and for 2025, IRS Form 15620 makes it easier than ever with electronic filing options. Introduced in late 2024 and updated for online submission in mid-2025, Form 15620 standardizes this irrevocable choice, helping founders, executives, and contractors lock in tax savings amid rising stock values. This SEO-optimized guide breaks down eligibility, deadlines, and filing steps based on the April 2025 revision, empowering you to make informed decisions before the strict 30-day window closes.

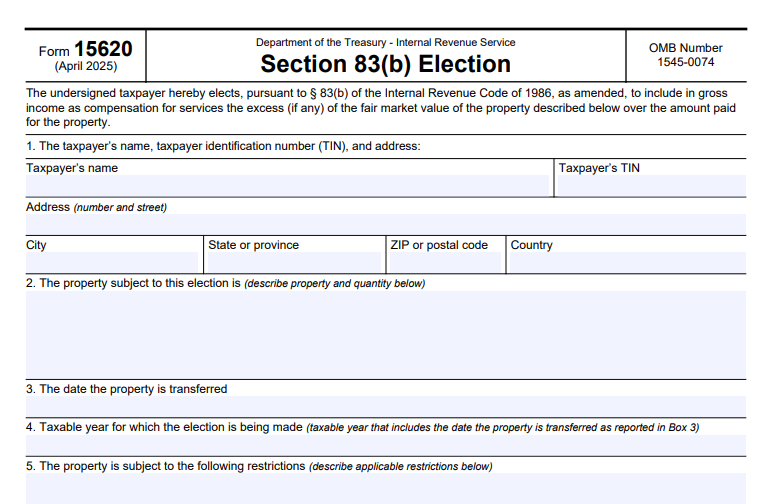

What Is IRS Form 15620?

IRS Form 15620 is the official, standardized election statement for taxpayers to invoke IRC Section 83(b), allowing immediate inclusion of unvested property’s fair market value (FMV) in gross income rather than waiting for vesting. This shifts taxation from ordinary income rates (up to 37% in 2025) on vesting-date FMV to capital gains (0-20%) on future sales, potentially saving thousands if the property appreciates.

Historically, filers drafted custom statements per Treas. Reg. §1.83-2(c); Form 15620 (Rev. 4-2025) simplifies this with fillable fields for property details, FMV, and payment amounts, plus optional employer info. It’s voluntary but IRS-preferred, paving the way for full e-filing. Once elected, it’s irrevocable without consent—ideal for low-FM V grants but risky if forfeiture looms.

Download the PDF from IRS.gov/pub/irs-pdf/f15620.pdf for the April 2025 version, complete with instructions referencing Pub. 525 (Taxable and Nontaxable Income).

Who Should File IRS Form 15620 in 2025?

File if you’ve received substantially nonvested property (e.g., restricted stock, LLC interests, or early-exercised options) for services, and the FMV exceeds what you paid—expecting appreciation. It’s common for startup founders, executives, and advisors in tech, biotech, or venture-backed firms.

| Eligibility Scenario | File If… | Don’t File If… |

|---|---|---|

| Restricted Stock/RSUs | Grant FMV > purchase price; vesting over 4 years. | Fully vested at grant (taxed immediately under §83(a)). |

| Early Exercise Options | Exercised below FMV; unvested shares at risk. | ISO disqualifying dispositions (use Form 3921 instead). |

| Profits Interests | Vested LLC units with $0 FMV at grant. | Property not for services (e.g., pure investment). |

| Foreign Recipients | U.S. tax resident; property U.S.-situs. | Non-residents without U.S. income nexus. |

Only the recipient files—not the employer. Consult a tax advisor: Elections suit rising-value assets but expose you to taxes on potential forfeitures.

The Strict 30-Day Deadline for Section 83(b) Elections in 2025

Timing is everything: File within 30 calendar days of the transfer date (grant approval, not receipt)—no extensions, even for weekends/holidays (next business day applies). For a November 1, 2025, grant, deadline is December 1; miss it, and you’re taxed on vesting FMV.

- Electronic Filing (New in 2025): Submit via IRS.gov online portal (ID.me login required) for instant confirmation—preferred method since July 2025.

- Mail Option: Certified mail with return receipt to your IRS service center (per Pub. 525); postmark by deadline suffices.

- Copy to Employer: Provide duplicate within 30 days—employers track for withholding.

- Attach to Return: Include with your 2025 Form 1040 (due April 15, 2026).

Late filings are invalid—no relief, per Treas. Reg. §1.83-2(b).

Step-by-Step Guide to Completing IRS Form 15620

Form 15620 is concise (one page)—fill digitally or print. Gather grant agreement, FMV appraisal (e.g., 409A valuation), and payment proof.

- Box 1: Taxpayer Info – Name, address, SSN/ITIN.

- Box 2: Taxpayer’s Identifying Number – Confirm SSN/ITIN.

- Box 3: Transfer Date – MM-DD-YYYY of grant (e.g., 11-01-2025).

- Box 4: Taxable Year – “Calendar year 2025” or fiscal year ending.

- Box 5: Description of Property – E.g., “1,000 shares of XYZ Corp. restricted stock.”

- Box 6: Aggregate FMV – Total value at transfer (e.g., $10,000); use appraisal.

- Box 7: Amount Paid – Price per item/total (e.g., $0.01/share = $10); see Treas. Reg. §1.83-3(g).

- Box 8: Substantial Risk of Forfeiture – Describe vesting (e.g., “4-year cliff/grade, forfeiture if unvested on termination”).

- Box 9: Employer Info (Optional) – Name, EIN, address—eases IRS processing.

- Signature & Date – Taxpayer signs; date ≤30 days post-transfer.

- Submit: Online (preferred) or mail; copy to employer.

Attach to 2025 return; retain records 3+ years.

Benefits and Risks of Making a Section 83(b) Election in 2025

Electing upfront taxes low FMV but commits you—ideal for high-growth equity.

| Pros | Cons |

|---|---|

| Tax Deferral Shift: Pay ordinary income now (37% max); future gains at 0-20% LTCG. | Forfeiture Risk: If unvested shares forfeit, no refund on prepaid taxes. |

| Holding Period Starts: Vesting day counts as long-term (>1 year) for sales. | Cash Flow Hit: Upfront tax on $0 FMV grants is minimal, but high-value ones sting. |

| Employer Deduction: Aligns with company expense timing. | Irrevocable: No undoing without IRS relief (rare). |

In 2025, with 37% top rate vs. 20% LTCG, elections shine for appreciating startups—e.g., $10K grant vesting to $100K saves ~$18K in taxes.

IRS Form 15620 Download and Printable

Download and Print: IRS Form 15620

Recent Changes to Section 83(b) Elections and Form 15620 for 2025

The IRS modernized in 2025:

- Electronic Filing Launch: July 2025 rollout via IRS.gov (ID.me login)—instant receipt, no mail anxiety.

- Form Standardization: April 2025 Rev. adds optional Box 9 for employer details; fillable PDF for all copies.

- Pub. 525 Update: Now references Form 15620 explicitly for restricted property.

- No Deadline Changes: Strict 30 days intact—no extensions.

These ease compliance for remote workers and global teams.

Common Mistakes When Filing Form 15620 and How to Avoid Them

The 30-day trap claims many—avoid these:

- Missing Deadline: Count 30 calendar days from grant—use calendars; e-file for proof.

- Incomplete FMV: No appraisal—get 409A valuation pre-grant.

- Wrong Transfer Date: Using receipt vs. approval—check grant docs.

- No Employer Copy: Forgets sharing—email PDF immediately.

- Revocation Attempts: Filing late/revoking without consent—consult pros first.

Retain certified mail receipts or e-confirmations; advisors flag issues.

Consequences of Missing the Section 83(b) Election Deadline

No election means §83(a) default: Tax on vesting FMV as ordinary income—e.g., $10K grant vesting at $100K = $33,700 tax (37%) vs. $3,700 upfront. No IRS relief for lateness; audits may recharacterize if suspected. Forfeiture post-election? No deduction—pure loss.

Frequently Asked Questions About IRS Form 15620

Can I e-file Form 15620 in 2025?

Yes—since July 2025 via IRS.gov (ID.me required); instant confirmation preferred.

What’s the exact 30-day deadline?

Calendar days from transfer (grant date); next business day if weekend/holiday.

Does Form 15620 work for profits interests?

Yes—for vested LLC units with $0 FMV.

What if I forfeit after electing?

No tax refund—irrevocable; weigh risks.

Where to mail if not e-filing?

Your IRS service center (per Pub. 525); certified mail recommended.

Visit IRS.gov/taxtopics/tc427 for more.

Final Thoughts: Secure Your Equity Future with IRS Form 15620 in 2025

IRS Form 15620 transforms Section 83(b) elections from a paperwork hassle into a strategic tax win, letting you bet on appreciation with upfront ordinary income taxes—potentially slashing your bill by 17%+ on gains. With 2025’s e-filing debut, the 30-day deadline feels less daunting; file online for proof and peace. Download from IRS.gov today, appraise FMV promptly, and consult a tax advisor—don’t let a missed window forfeit your upside.

Equity builds wealth—elections build savings.

This article is informational only—not tax advice. Verify with IRS or a professional.