Table of Contents

IRS Form 15662 – Application for Private Letter Rulings – Are you a business owner, tax advisor, or attorney seeking clarity on complex tax scenarios like entity classifications or transaction treatments? Filing IRS Form 15662, the Application for Private Letter Rulings, is your gateway to binding IRS guidance tailored to your facts. Introduced in September 2025 under Rev. Proc. 2025-4, this streamlined one-page form standardizes PLR requests, replacing narrative submissions with a structured process to expedite reviews. In this authoritative guide to Form 15662, we’ll unpack its role, eligibility, filling instructions, and 2025 enhancements—so you can secure reliable tax certainty without surprises.

Whether you’re navigating mergers, equity grants, or exempt organization status, understanding Private Letter Rulings applications minimizes audit risks and supports strategic planning. Let’s dive in.

What Is IRS Form 15662?

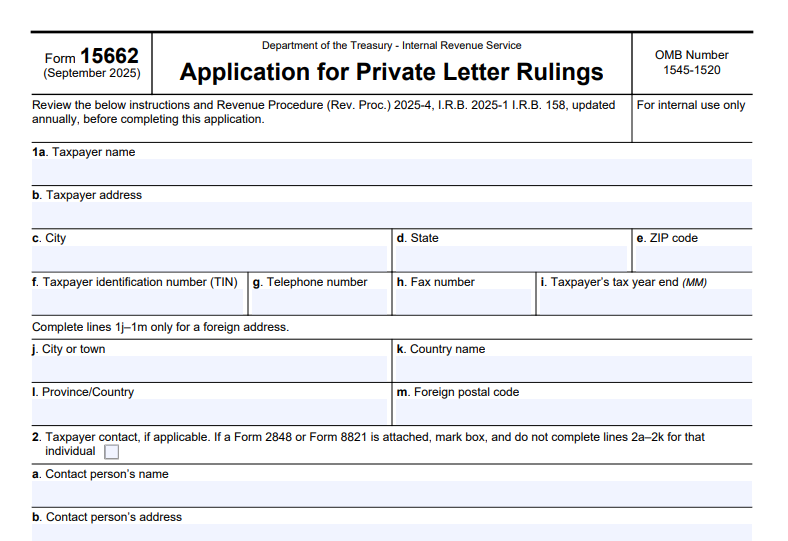

IRS Form 15662 is a dedicated application form for requesting Private Letter Rulings (PLRs)—written IRS interpretations applying tax laws to specific taxpayer facts. Issued by Associate Chief Counsel offices, PLRs provide non-precedential but binding assurance on issues like revenue recognition or like-kind exchanges, per IRC sections 6110 and 7805.

The September 2025 revision (Catalog No. 95555C, OMB No. 1545-1520) simplifies prior ad-hoc letters, aligning with Rev. Proc. 2025-4 for user fees and procedures. Estimated completion time: 30 minutes, plus ruling request prep. Download the PDF from IRS.gov—it’s not e-fileable; attach to your narrative submission with payment.

PLRs differ from revenue rulings (precedential) or determination letters (e.g., for 501(c)(3) status); they’re taxpayer-specific, with redacted versions published annually.

Who Needs to File IRS Form 15662?

Taxpayers or their representatives submit Form 15662 when requesting PLRs on prospective or completed transactions where law application is unclear. Ideal for:

- Corporations or partnerships seeking advance approval on reorganizations.

- Individuals or estates clarifying deductions, credits, or basis issues.

- Exempt organizations confirming qualification or unrelated business income.

No PLR needed for routine matters—use IRS FAQs or publications first. Foreign taxpayers or those with multi-jurisdictional facts qualify if U.S. tax implications exist. Attach Form 2848 (Power of Attorney) if represented; incomplete apps without fees are returned unprocessed.

Purpose and Benefits of IRS Form 15662

Under Rev. Proc. 2025-4, Form 15662 standardizes PLR intake, enabling IRS efficiency while giving taxpayers enforceable guidance. It verifies submission details, fee payment, and consents, triggering review by the appropriate Associate Office.

Benefits include:

- Binding Certainty: IRS commits to the ruling if facts are accurate, shielding against future audits.

- Risk Reduction: Avoids penalties (e.g., 20% accuracy-related) on ambiguous positions.

- Streamlined Process: 2025 form cuts processing time from months to weeks for complete requests.

- Strategic Value: Supports deal structuring; over 1,000 PLRs issued annually per IRS data.

In 2025, with economic flux driving restructurings, PLRs via Form 15662 offer vital planning tools amid evolving laws like the Inflation Reduction Act.

Step-by-Step Guide: How to Fill Out IRS Form 15662

Download the fillable PDF from IRS.gov/pub/irs-pdf/f15662.pdf. Use black ink or type; review Rev. Proc. 2025-4 for ruling specifics. Attach to your detailed request letter.

- Review Rev. Proc. 2025-4: Confirm your issue is rulable (e.g., no substantial authority needed); calculate user fee (starts at $2,400 for most, up to $58,000 for complex).

- Header (Line 1): Enter taxpayer name, address (U.S. or foreign with lines 1j–1m), EIN/SSN/ITIN.

- Contact Info (Line 2): Provide representative details if attaching Form 2848/8821; otherwise, mark box and skip.

- Ruling Description (Line 3): Briefly state the issue (e.g., “Ruling on Section 351 nonrecognition for property contribution”).

- Relevant Code Sections (Line 4): List IRC sections (e.g., 351, 368).

- User Fee (Line 5): Check fee category (Appendix A of Rev. Proc.); enter amount.

- Attachments (Line 6): Confirm enclosing check/money order to “United States Treasury”; note Form 15662 attachment to request.

- Sign and Date (Line 7): Taxpayer or authorized signer under perjury penalties.

- Assemble and Submit: Staple fee to left side; mail to Associate Chief Counsel per Rev. Proc.

Tip: For 2025, electronic payment via EFTPS is encouraged—reference your submission.

IRS Form 15662 Download and Printable

Download and Print: IRS Form 15662

Key Sections of IRS Form 15662 Explained

The concise 2025 form focuses on essentials (Rev. 9-2025):

Taxpayer Identification (Line 1)

- Name, address, TIN. Foreign: Specify country, province.

Contact and Representation (Line 2)

- Practitioner info if authorized; checkbox for attachments.

Request Details (Lines 3–4)

- Concise issue summary; cite statutes/regulations.

Fee and Certification (Lines 5–7)

- Fee selection; payment confirmation; signature affirming completeness.

Privacy: Protected under IRC 6109; PLRs published redacted (IRC 6110). No refunds on fees.

Submission Process for Form 15662

Mail the completed Form 15662, fee, and ruling request (narrative + facts/analysis) to the mailing address in Rev. Proc. 2025-4, Section 9 (e.g., CC:PA:LPD:DRU, PO Box 7604, Ben Franklin Station, Washington, DC 20044). Do not send Form 15662 alone—it’s an attachment. Use certified mail for tracking.

Processing: 90-day initial response goal; full rulings in 6–12 months. Expedite requests for imminent transactions via cover letter. Track status via IRS hotline (202-317-5270); amendments require new form/fee.

Privacy, Security, and Important Notes

Submissions comply with Privacy Act (5 U.S.C. 552a); sensitive data redacted pre-publication. 2025 Notes:

- Aligns with Rev. Proc. 2025-4 updates for digital payments and hybrid issues.

- No PLR for frivolous positions; pre-filing conferences available.

- Retain copies 3+ years; appeals via IRS Office of Appeals if denied.

Penalties: Late or incomplete apps returned; fees non-refundable.

Frequently Asked Questions (FAQs) About IRS Form 15662

What’s new in the 2025 Form 15662?

One-page standardization; auto-fee categories per Rev. Proc. 2025-4—no burden increase.

How much is the PLR user fee?

$2,400–$58,000 based on complexity; see Appendix A.

Can I request a PLR orally?

No—written via Form 15662 and narrative only.

How long until I get a PLR?

6–12 months; request conference for clarifications.

Where to find prior PLRs?

IRS Electronic Reading Room or Tax Notes database (1997+).

Conclusion: Unlock Tax Clarity with IRS Form 15662 Today

IRS Form 15662 transforms PLR requests from cumbersome to concise, empowering taxpayers with actionable IRS insights under the efficient September 2025 framework. Whether closing deals or optimizing structures, this form is your compliance cornerstone—file accurately to safeguard your position.

Download Form 15662 and Rev. Proc. 2025-4 from IRS.gov now. For complex needs, consult a tax professional.

This article is informational only and not official IRS guidance. Refer to IRS.gov for authoritative details.