Table of Contents

IRS Form 2159 – Payroll Deduction Agreement – If you’re facing tax debt and looking for a manageable way to repay it, IRS Form 2159 could be a valuable tool in your financial toolkit. This form allows taxpayers to set up a payroll deduction agreement, where your employer automatically withholds a portion of your wages to pay off your federal tax liabilities. In this comprehensive guide, we’ll explore everything you need to know about IRS Form 2159, including its purpose, how to fill it out, eligibility requirements, benefits, and alternatives. Whether you’re a wage earner dealing with back taxes or simply researching IRS installment options, this article will help you navigate the process with confidence.

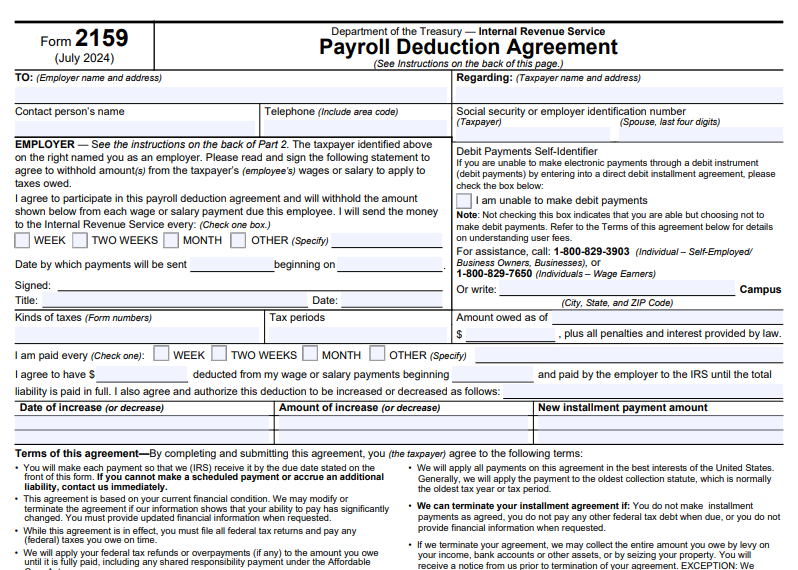

What Is IRS Form 2159?

IRS Form 2159, officially titled the Payroll Deduction Agreement, is a document that establishes an agreement between a taxpayer, their employer, and the Internal Revenue Service (IRS) for repaying tax debts through regular payroll deductions. This form is particularly useful for wage earners who want to automate their payments, reducing the risk of missed deadlines and potential penalties.

The form facilitates a type of installment agreement known as a Payroll Deduction Installment Agreement (PDIA). Under this setup, your employer deducts a specified amount from each paycheck—weekly, bi-weekly, monthly, or otherwise—and sends it directly to the IRS. This applies to various federal taxes, including income taxes (Form 1040), employment taxes, or other liabilities, as long as the total owed, including penalties and interest, is outlined on the form.

Key features of Form 2159 include:

- Three Copies: An acknowledgment copy for the IRS, an employer’s copy, and a taxpayer’s copy.

- User Fees: A standard setup fee of $178, which may be reduced to $43 for low-income taxpayers (those at or below 250% of federal poverty guidelines). Fees can be waived or reimbursed under certain conditions, such as completing the agreement without default.

- Compliance Requirements: While the agreement is active, you must file all federal tax returns on time and pay any new taxes owed promptly.

The latest revision of Form 2159 is from July 2024, ensuring it aligns with current IRS policies.

Who Should Use IRS Form 2159?

Form 2159 is ideal for employed individuals who prefer automated payments over manual ones. It’s especially recommended for:

- Wage Earners with Tax Debt: If your total assessed balance (taxes, penalties, and interest) is $50,000 or less, you may qualify for a streamlined installment agreement that can incorporate payroll deductions.

- Federal Employees: Federal agencies are required to participate in these agreements, making it a straightforward option for government workers.

- Taxpayers with Past Defaults: If you’ve defaulted on previous installment plans, a payroll deduction can help demonstrate reliability and reduce default risks.

- Businesses or Self-Employed: While primarily for employees, out-of-business sole proprietors or businesses owing non-trust fund taxes up to $50,000 may use it with payroll deductions if applicable.

However, it’s not suitable for everyone. For instance, seasonal or intermittent workers may find it challenging due to irregular income. Additionally, if your debt exceeds certain thresholds or involves trust fund taxes, you might need to explore other options like a Partial Payment Installment Agreement.

To qualify, you generally need to be current on your tax filings and unable to pay the full amount immediately. Low-income taxpayers may benefit from reduced fees by indicating their inability to make direct debit payments on the form.

How to Complete IRS Form 2159 Step by Step

Filling out Form 2159 is straightforward but requires attention to detail. Here’s a breakdown:

- Taxpayer Information: Enter your name, address, Social Security Number (SSN) or Employer Identification Number (EIN), and spouse’s details if it’s a joint liability.

- Employer Details: Provide your employer’s name, address, contact person, and phone number.

- Debt Details: Specify the types of taxes (e.g., Form 1040), tax periods, and total amount owed as of a specific date, plus accruing penalties and interest.

- Payment Terms: Indicate your pay frequency (weekly, bi-weekly, etc.), the deduction amount, start date, and any planned increases or decreases in payments.

- Debit Payments Self-Identifier: Check this box if you’re unable to make direct debit payments, which may qualify low-income taxpayers for fee reimbursements.

- Signatures: Sign and date the form (include spouse if joint). Then, have your employer sign, agreeing to withhold and remit payments.

The IRS section (for official use) includes fields for agreement locator numbers, review cycles, and lien determinations. Once completed, return the acknowledgment copy to the IRS address provided in your notice or on the form.

For assistance, taxpayers can call 1-800-829-7650, while businesses should use 1-800-829-3903.

Benefits of a Payroll Deduction Agreement

Opting for a payroll deduction via Form 2159 offers several advantages:

- Automation and Reliability: Payments are deducted automatically, minimizing the chance of defaults and additional penalties.

- Lower User Fees: Compared to other installment plans, payroll deductions often come with reduced setup costs, especially for low-income individuals.

- Tax Refund Application: Any federal refunds will be applied to your debt, accelerating repayment.

- Employer Involvement: For federal employees, participation is mandatory, ensuring smooth implementation.

- Flexibility: Agreements can be modified if your financial situation changes significantly.

This method can also help avoid more aggressive collection actions, like levies or liens, as long as you stay compliant.

Potential Drawbacks and Cautions

While beneficial, there are some pitfalls:

- Employer Discretion: Non-federal employers aren’t required to participate, so you’ll need their approval.

- Third-Party Contact Rules: The IRS may need to contact your employer, requiring prior notice under IRC 7602(c).

- Default Risks: If you change jobs or fail to comply, the agreement could terminate, leading to reinstatement fees of $89 (or $43 reduced).

- Not for All Employment Types: Avoid for seasonal jobs or if you’re self-employed without a payroll system.

- Lien Possibility: The IRS may file a Notice of Federal Tax Lien to protect its interests.

Always provide updated financial information if requested to avoid termination.

Alternatives to IRS Form 2159

If payroll deduction isn’t right for you, consider these IRS payment options:

- Direct Debit Installment Agreement: Automatic bank withdrawals with potentially lower fees.

- Online Payment Agreement: Apply via IRS.gov for streamlined plans if your debt is $50,000 or less.

- Partial Payment Installment Agreement: For those unable to full-pay within the collection statute (usually 10 years), requiring financial statements.

- Offer in Compromise: Settle for less if you qualify based on doubt as to collectibility.

- Short-Term Payment Plan: Pay within 180 days without fees for debts under $100,000.

For businesses, options like In-Business Trust Fund Express Agreements may apply.

IRS Form 2159 Download and Printable

Download and Print: IRS Form 2159

How to Submit and Monitor Your Agreement

Submit the signed Form 2159 acknowledgment copy to the IRS address on your bill or notice. Use the Online Payment Agreement tool for initial requests, or mail Form 9465 if needed. Once approved, monitor your account via IRS.gov or by calling the provided numbers. Agreements are reviewed periodically, especially partial payment ones every two years.

In conclusion, IRS Form 2159 provides a structured, automated path to resolving tax debt for many taxpayers. By understanding its requirements and leveraging it correctly, you can regain financial stability while staying compliant with IRS rules. If your situation is complex, consult a tax professional for personalized advice.

Frequently Asked Questions (FAQs)

What happens if I default on my payroll deduction agreement?

The IRS may terminate the agreement, apply levies, and charge a reinstatement fee. You’ll need to reapply and provide updated financial info.

Can I change the deduction amount later?

Yes, you can authorize increases or decreases on the form, or contact the IRS if your financial condition changes significantly.

Is Form 2159 available in Spanish?

Yes, there’s a Spanish version (Form 2159-SP) for non-English speakers.

How do I know if I’m low-income for fee reductions?

Check if your adjusted gross income is at or below 250% of federal poverty guidelines; use Form 13844 to apply for waivers.

Does this affect my credit score?

Installment agreements themselves don’t directly impact credit, but unpaid taxes or liens might. Timely payments help avoid further issues.