Table of Contents

IRS Form 2220 – Underpayment of Estimated Tax By Corporations – Corporate tax planning in 2025 demands precision, especially with quarterly estimated payments that can make or break your bottom line. Failing to pay enough estimated tax on time triggers penalties under IRC Section 6655, but IRS Form 2220, “Underpayment of Estimated Tax by Corporations,” offers a way to calculate, potentially reduce, or even waive these costs. With the corporate alternative minimum tax (CAMT) introducing new complexities and interest rates holding steady at 7% for underpayments (9% for large corporations), accurate filing is more critical than ever.

This SEO-optimized guide, based on the latest IRS resources, walks you through Form 2220 for tax year 2025—covering who files, how to compute penalties, and strategies to minimize exposure. Whether you’re a C corp facing CAMT relief or a seasonal business opting for annualized methods, mastering this form ensures compliance and cash flow protection. Download the draft 2025 instructions from IRS.gov to prepare for your March 15, 2026, filing deadline.

What Is IRS Form 2220?

IRS Form 2220 helps corporations, tax-exempt organizations subject to unrelated business income tax (UBIT), and private foundations determine if they owe penalties for underpaying estimated taxes. It calculates the penalty based on the shortfall, duration, and applicable interest rates, but also allows exceptions like safe harbor rules or annualized income adjustments to lower or eliminate it.

Key purposes:

- Penalty Assessment: Under Section 6655, the penalty is the underpayment amount times the underpayment rate (federal short-term rate + 3%, or +5% for large corps), compounded daily.

- Exception Calculations: Use Parts II–IV for annualized or seasonal methods if income fluctuates.

- CAMT Integration: For 2025, exclude CAMT liability from required payments to avoid penalties on that portion.

Generally, the IRS computes and bills the penalty automatically, so filing Form 2220 is optional unless claiming exceptions or as a large corporation. Attach it to Form 1120 (line 34) or equivalent returns.

Who Needs to File IRS Form 2220 in 2025?

Corporations must consider Form 2220 if their required annual payment exceeds actual payments. File if:

- Total tax (after credits) > $500, and estimated payments < 100% of current-year tax (90% for large corps) or 100% of prior-year tax (110% if gross receipts/assets >$1M/$10M).

- You’re a “large corporation” (average gross receipts/taxable income >$1M over prior 3 years).

- Claiming exceptions via annualized income (Part II) or seasonal method (Part III).

- Subject to CAMT but seeking relief (file even if penalty is zero).

Exemptions (no filing needed):

- Tax ≤$500.

- First tax year or short year <9 months.

- 100% prior-year safe harbor met without shortfall.

Tax-exempts (Form 990-T) and private foundations (Form 990-PF) follow similar rules for UBIT. E-file if required; otherwise, paper attach to your return.

Understanding the Underpayment Penalty: Rates and Safe Harbors for 2025

The penalty accrues from due dates (April 15, June 15, Sept 15, Dec 15) until paid or return due date. For 2025:

- Standard Rate: 7% (federal short-term rate +3%).

- Large Corporations: 9% (+5%).

- Overpayments: 6% (4.5% for >$10,000 corporate excess).

Safe harbors avoid penalties if payments equal:

- 100% of prior-year tax (110% for large corps with receipts >$1M).

- 100% of current-year tax (90% for large corps).

CAMT relief: Exclude CAMT from “required annual payment” calculations; file Form 2220 with zero penalty entry on line 34 of Form 1120 to claim.

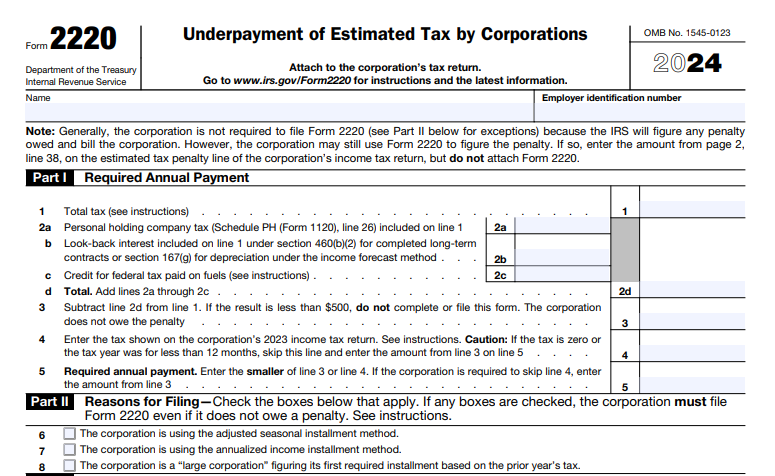

IRS Form 2220 Download and Printable

Download and Print: IRS Form 2220

How to Complete IRS Form 2220: Step-by-Step Guide for 2025

Gather Form 1120 data, payment records, and prior-year tax. Use tax software for rate tables; manual filers reference IRS quarterly bulletins.

Part I: Required Annual Payment

- Line 1: Total tax from Form 1120 (exclude personal holding company tax, look-back interest).

- Line 2: Refundable credits.

- Line 3: Net tax (line 1 – 2).

- Line 4: Prior-year tax (110% if large corp and receipts >$1M).

- Line 5: Smaller of line 3 or 4 (required payment).

Example: 2025 tax $100,000; prior $80,000 (not large) → Required: $80,000 ($20,000/quarter).

Part II: Short Method (Standard Installments)

Skip if using annualized/seasonal.

- Line 6: Enter 25% of line 5 in each column (a–d) for quarters.

- Lines 7–9: Cumulative payments by due dates (adjust for overpayments).

- Line 10: Required installments (25% each).

- Line 11: Payment shortfalls (line 10 – 9, if positive).

- Line 14: Underpayment periods (# days late).

- Line 15: Penalty (shortfall × days/365 × rate).

Part III: Annualized Income Installment Method

For uneven income (e.g., Q4-heavy sales). Elect by checking box.

- Line 19: Annualize periods (e.g., Option 1: 3, 6, 9, 12 months).

- Lines 20–31: Compute annualized tax (income × 4/period months, apply rates/credits).

- Line 32: Adjusted installments (smaller of cumulative required or annualized).

- Lines 33–37: Shortfalls and penalties as in Part II.

Tip: Use for startups or cyclicals; attach explanation.

Part IV: Exception for Federal Disaster Declarations

If affected by a 2025 disaster (e.g., hurricanes), enter declaration dates to waive penalties for that period.

Total penalty (line 38) goes to Form 1120, line 34. If zero, still file for CAMT relief.

Key Changes to IRS Form 2220 for 2025

Form 2220 is stable, but 2025 highlights:

- CAMT Penalty Relief: Per Notice 2025-27, exclude CAMT from required payments; file Form 2220 (even zero penalty) to avoid notices and abatement requests.

- Interest Rates: Unchanged at 7%/9% from Q2 2025 (Rev. Rul. 2025-?); monitor quarterly updates.

- Short-Year Rules: Prorate for <12 months; no major inflation adjustments.

No form redesign; use 2025 draft for CAMT notes.

Common Mistakes to Avoid When Filing Form 2220

- Misclassifying Large Corp Status: Average >$1M triggers 90%/110% rules—audit risk high.

- Ignoring CAMT: Forgetting exclusion leads to erroneous penalties.

- Incorrect Annualization: Wrong periods inflate required payments; use IRS tables.

- Overlooking Overpayments: Apply to earliest quarter for max offset.

- Late Filing: Attach to timely return; extensions don’t waive penalties.

Review Pub. 505 for details.

Tips for Avoiding and Minimizing Underpayment Penalties in 2025

- Quarterly Projections: Use Form 1120-W worksheet for estimates; adjust mid-year.

- Safe Harbor Strategy: Pay 100% prior-year to defer calculations.

- Elect Annualized Method: Ideal for Q4 income; reduces Q1–Q3 requirements.

- Leverage Software: TurboTax Business or CCH auto-populates rates and CAMT.

- Disaster Waivers: Check IRS.gov for 2025 declarations.

- Professional Review: CPAs spot exceptions; worth it for >$10K penalties.

Proactive payments can save 7–9% annually.

Final Thoughts: Stay Penalty-Free with IRS Form 2220 in 2025

IRS Form 2220 isn’t just a penalty calculator—it’s a tool for strategic tax management, especially with CAMT relief easing burdens for applicable corporations. By understanding safe harbors, electing methods, and filing accurately, you can shield your business from unnecessary costs in 2025.

For the official 2025 Form 2220 and instructions, visit IRS.gov/Form2220. Complex scenarios like consolidations or disasters? Consult a tax advisor. Start forecasting your estimates today—your 2026 finances depend on it.