Table of Contents

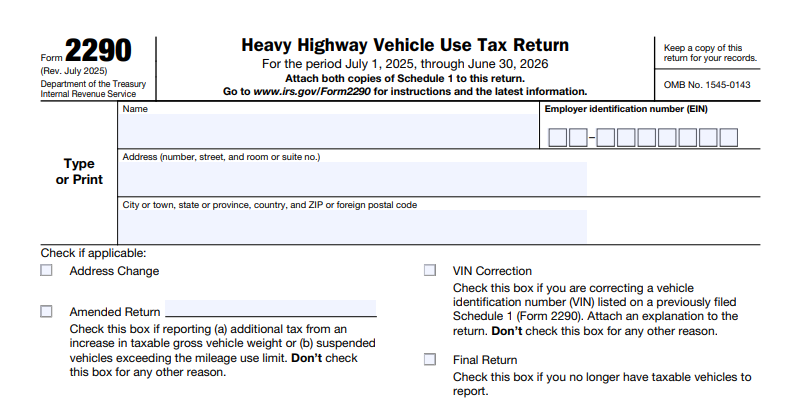

IRS Form 2290 – Heavy Highway Vehicle Use Tax Return – For truckers, fleet managers, and commercial operators, staying compliant with federal excise taxes is crucial to avoid registration halts and hefty penalties. IRS Form 2290—the Heavy Highway Vehicle Use Tax Return (HVUT)—is your key to funding America’s highways while keeping your rigs road-ready. The tax period runs from July 1, 2025, to June 30, 2026, with filings now open and the deadline for July first-use vehicles extended to September 2, 2025, due to the holiday weekend. With e-filing mandatory for 25+ vehicles and encouraged for all, this SEO-optimized guide breaks down Form 2290 requirements, rates, deadlines, and tips based on the latest IRS instructions (Rev. July 2025).

What Is IRS Form 2290?

IRS Form 2290 calculates and reports the annual Heavy Vehicle Use Tax on highway motor vehicles with a taxable gross weight of 55,000 pounds or more used on public roads. Enacted under the Surface Transportation Assistance Act of 1982, HVUT generates funds for highway maintenance and repairs—over $1.5 billion annually. The form also handles suspensions for low-mileage vehicles, credits for sold/destroyed rigs, and prorated taxes for mid-year additions.

Key uses:

- Tax Payment: For full-year or partial-period use.

- Suspension Claims: No tax if under 5,000 miles (7,500 for ag vehicles).

- Schedule 1 Reporting: Lists vehicles; stamped copy proves compliance for DMV registration.

The July 2025 revision includes enhanced e-filing guidance and prorated tables. Download Form 2290 and instructions from IRS.gov.

Who Needs to File IRS Form 2290 in 2025-2026?

If you own, operate, or register a qualifying heavy vehicle, filing is mandatory—regardless of tax owed. Exemptions exist, but you must still report via suspension statements.

| Category | Filing Requirement |

|---|---|

| Taxable Vehicles | Highway trucks, tractors, buses ≥55,000 lbs gross weight, first used July 1, 2025–June 30, 2026. |

| Operators | Owner-operators, fleets, lessees under state/Canadian/Mexican law. |

| Low-Mileage | File for suspension if ≤5,000 miles (≤7,500 ag); pay full tax if exceeded. |

| Used Vehicles | Report acquisitions; prorate if seller paid tax. |

| Exemptions | Federal/state vehicles, nonprofits (Red Cross, fire depts.), tribal essential ops, blood collectors, off-highway machinery. |

No filing if under 55,000 lbs or non-highway use. Use EIN (not SSN); apply via IRS if needed.

Filing Deadlines and Extensions for Form 2290

Deadlines hinge on the vehicle’s First Used Month (FUM)—the month it’s first on public highways. The tax period: July 1, 2025–June 30, 2026.

| First Used Month | Due Date |

|---|---|

| July 2025 | September 2, 2025 (extended from Aug. 31). |

| August 2025 | September 30, 2025 |

| September 2025 | October 31, 2025 |

| October–June | End of following month |

- Multiple FUMs: Separate forms per month.

- Extensions: Written request to IRS (up to 6 months); payment due on original date to avoid interest.

- Where to File: E-file via providers; paper to P.O. Box 932500, Louisville, KY 40293-2500 (full payment) or 932504 (no/partial).

E-file for instant stamped Schedule 1; paper takes 4–6 weeks.

Step-by-Step Guide to Completing IRS Form 2290

Gather VINs, weights, FUMs, and mileage logs. Use IRS-approved software for e-filing.

- Part I: Filer Info – Name, EIN, address; check amended/mileage exceeded boxes if applicable.

- Part II: Tax Computation – Select FUM; enter vehicle counts per weight category (A–V) on page 2.

- Page 2 Columns: (1) Full annual tax; (2) Prorated for FUM. Total on line 3.

- Line 4–6: Subtract credits (line 5); balance due/refund.

- Part III: Suspension – Certify low-mileage; attach Schedule 1.

- Schedule 1 (2 Copies): List VIN, make, model, weight; one for IRS, stamped for you.

- Sign & Submit: Under perjury; pay via EFTPS, card, or check with 2290-V.

For logging vehicles, use reduced rates in column (1)(b). Amended returns: Note changes.

HVUT Tax Rates for 2025-2026

Rates are unchanged: Progressive by weight, max $550/year. Prorate for partial periods (e.g., 11/12 for August FUM).

| Weight Category | Annual Tax (Full Year) |

|---|---|

| 55,000–75,000 lbs | $100 + $22/1,000 lbs over 55,000 |

| 75,001+ lbs | $550 max |

| Logging Vehicles | Reduced (e.g., $100 flat for most). |

Use Form 2290 page 2 Table I/II for exacts. Example: 60,000-lb truck first used July: $244 full year.

IRS Form 2290 Download and Printable

Download and Print: IRS Form 2290

E-Filing vs. Paper: Which to Choose for Form 2290?

E-filing is required for 25+ taxed vehicles; recommended for all to get Schedule 1 in minutes vs. weeks. Providers like EZ2290 or ExpressTruckTax handle bulk filings.

- Pros: Instant acceptance, electronic payments, error checks.

- Cons: Provider fees ($10–$50/return).

- Paper: Mail only if <25 vehicles; slower proof.

Pre-file from June 1, 2025, for queue priority.

Claiming Suspension or Credits on Form 2290

- Suspension: Line 3; expect ≤5,000 miles. If exceeded, file amended by June 30, 2026, paying full tax.

- Credits: Line 5 for sold/stolen/destroyed vehicles (Form 8849 for refunds); prorate unused months.

Document mileage; ag vehicles get 7,500-mile threshold.

Common Mistakes When Filing Form 2290 and How to Avoid Them

Avoid these pitfalls to dodge audits:

- Wrong FUM: Use actual first highway use, not purchase date—review logs.

- VIN Errors: Double-check; correct via amended return ($25 fee if e-filed).

- Mileage Overruns: Track odometers; amend promptly.

- Missing Schedule 1: Always attach both copies.

- Late Payments: Pay on time despite extensions—use EFTPS.

E-file reduces errors by 90%; consult providers for VIN corrections.

Penalties for Late or Incorrect Form 2290 Filings

Non-compliance risks vehicle impoundment and fines:

- Late Filing: 5% of tax/month (max 25%).

- Late Payment: 0.5%/month + interest (0.54%/month).

- Non-Filing: Up to $270/vehicle + suspension of registration.

- Relief: Request abatement for reasonable cause (e.g., illness) via IRS letter.

A $550 tax can balloon to $700+ in 5 months—file early.

Frequently Asked Questions About IRS Form 2290

Who qualifies for HVUT exemption in 2025?

Government, nonprofit, or low-mileage vehicles; file suspension anyway.

Can I prorate tax for mid-year vehicles?

Yes, based on remaining months from FUM.

What’s the max HVUT for 2025?

$550 for 75,000+ lbs full year.

How do I get stamped Schedule 1?

E-file for instant digital copy; paper via mail.

Is e-filing free?

No—providers charge; IRS doesn’t.

Visit IRS.gov/2290 for more.

Final Thoughts: File Form 2290 On Time to Keep Your Fleet Moving in 2025

IRS Form 2290 ensures fair contributions to highway infrastructure while preventing costly disruptions. With the September 2, 2025, deadline looming for most, e-file today via an IRS-approved provider to secure your stamped Schedule 1 and avoid penalties. Proper HVUT compliance isn’t just regulatory—it’s essential for seamless operations.

Download the July 2025 form from IRS.gov and consult a tax pro for complex fleets. Drive safe and stay compliant.

This article is informational only—not tax advice. Verify with IRS or a professional.