Table of Contents

IRS Form 2553 – Election by a Small Business Corporation – Are you a small business owner considering a switch to S corporation status to optimize your taxes? Filing IRS Form 2553 is the key step to make this election. This form allows eligible corporations to pass income, losses, deductions, and credits directly to shareholders, avoiding double taxation at the corporate level. In this comprehensive guide, we’ll cover everything you need to know about IRS Form 2553, from eligibility to filing deadlines and common pitfalls. Whether you’re starting a new business or converting an existing C corp, understanding this process can save you time and money in 2025.

What is an S Corporation?

An S corporation (S corp) is a special type of corporation that elects to be taxed under Subchapter S of the Internal Revenue Code. Unlike traditional C corporations, which face corporate-level taxes on profits followed by shareholder taxes on dividends, S corps treat income as “pass-through” to owners. Shareholders report their share of the business’s income on personal tax returns, taxed at individual rates.

This structure is ideal for small businesses seeking simplicity and tax efficiency. However, S corps must still pay taxes on certain built-in gains or excess passive income. To qualify and activate this status, businesses file Form 2553, Election by a Small Business Corporation.

Who is Eligible to File IRS Form 2553?

Not every business can elect S corp status. The IRS outlines strict eligibility criteria to ensure only qualifying entities benefit. Here’s a breakdown:

- Domestic Corporation Requirement: The entity must be a U.S.-based corporation or a domestic entity eligible for corporate tax treatment.

- Shareholder Limits: No more than 100 shareholders, with family members (as defined in IRC Section 1361) counted as one. Spouses and estates may also combine.

- Allowable Shareholders: Only individuals, certain trusts (like QSSTs or ESBTs), estates, or tax-exempt organizations under Sections 401(a) or 501(c)(3). No partnerships, corporations, or nonresident aliens (except specific trust beneficiaries).

- Single Class of Stock: All shares must provide identical rights to distributions and liquidation proceeds, though voting rights can differ.

- Ineligible Entities: Banks using reserve method accounting (Section 585), insurance companies taxed under Subchapter L, or Domestic International Sales Corporations (DISCs) cannot qualify.

- Tax Year Flexibility: The business must use a permissible tax year, such as calendar year-end (December 31) or one established with business purpose.

A parent S corp can also elect to treat a wholly owned subsidiary as a Qualified Subchapter S Subsidiary (QSub) using Form 8869. All shareholders must consent to the election for it to be valid.

If your business meets these tests, you’re ready to proceed with Form 2553.

Benefits of Electing S Corporation Status

Switching to an S corp via IRS Form 2553 offers several advantages for small businesses:

- Avoid Double Taxation: Profits pass through to shareholders, taxed only once at personal rates—potentially lower than corporate rates.

- Self-Employment Tax Savings: Owners can pay themselves a reasonable salary (subject to payroll taxes) and take remaining profits as distributions (not subject to self-employment tax).

- Loss Deductions: Shareholders can deduct business losses against personal income, subject to basis and at-risk rules.

- Asset Protection: Retains corporate liability shields while simplifying taxes.

- Credibility: S corp status enhances business legitimacy for loans and contracts.

However, remember that S corps require careful compliance, like annual Form 1120-S filings and shareholder reporting.

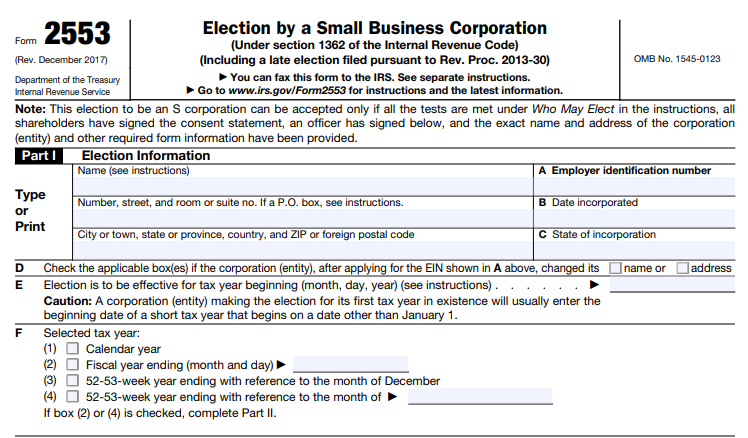

IRS Form 2553 Download and Printable

Download and print: IRS Form 2553

How to Complete and File IRS Form 2553: Step-by-Step Guide

Filing IRS Form 2553 is straightforward but requires precision. The form has four parts—focus on accuracy to avoid delays. Here’s how to do it:

- Gather Information: Collect your Employer Identification Number (EIN)—apply at IRS.gov if needed. List all shareholders, their SSNs/EINs, share percentages, and acquisition dates.

- Complete Part I (Election Information):

- Enter business name, address, and EIN.

- Specify the effective date (Item E): Typically the start of the tax year.

- Select tax year end (Item F): Calendar year or fiscal; complete Part II for non-standard years.

- List shareholders (Item J-M): Include consents (signatures or statements) from all, including spouses in community property states.

- Sign as an authorized officer.

- Complete Part II (Selection of Fiscal Tax Year): Only if choosing a non-calendar year. Provide gross receipts schedules or business purpose statements.

- Complete Part III (QSST Election): For qualifying small business trusts; attach if applicable.

- Review and File: No copies needed—mail the original to the IRS Service Center in Kansas City, MO (for most states) or Ogden, UT (check instructions for your location). Fax options are available. Use certified mail for proof.

Attach shareholder consent statements if space is limited. For 2025 filings, confirm addresses via IRS.gov, as changes occurred in 2019 for certain states.

Filing Deadlines for IRS Form 2553

Timely filing is crucial—late submissions may require relief procedures. Key deadlines:

- Current Tax Year: File within 2 months and 15 days from the tax year’s start (e.g., January 1 to March 15 for calendar year).

- Next Tax Year: File anytime in the preceding year.

- New Businesses: File after acquiring shareholders, assets, or starting business, but before the tax year ends.

For short years or fiscal years, calculate the 2-month-15-day window from the start date. Missing it? See late relief below.

Late Election Relief for S Corporations

Forgot the deadline? The IRS offers relief under Revenue Procedure 2013-30 for inadvertent late filings. To qualify:

- Note “FILED PURSUANT TO REV. PROC. 2013-30” on the form.

- File within 3 years and 75 days of the intended effective date.

- Show reasonable cause, consistent income reporting by shareholders, and no prior IRS notice.

- For entities also needing Form 8832 (entity classification), similar rules apply.

If outside this window, request a private letter ruling with a user fee. Attach to your first Form 1120-S or file separately.

Common Mistakes to Avoid When Filing Form 2553

Steer clear of these pitfalls to ensure smooth approval:

- Incomplete Shareholder Consents: All must sign, including representatives for minors or trusts.

- Wrong Effective Date: Use the actual business start for new entities.

- Ignoring Tax Year Rules: Non-calendar years need justification to avoid rejection.

- Outdated Addresses: Verify mailing based on your state.

- Missing EIN: Apply first—forms without it get returned.

Consult a tax professional for complex setups.

FAQs About IRS Form 2553

Can a single-member LLC elect S corp status with Form 2553?

Yes, if it first elects corporate treatment via Form 8832, then files Form 2553.

How long does IRS approval take?

Typically 60 days; you’ll receive a CP 261 notice if accepted.

What if my S corp election is revoked?

Refile Form 2553 after 5 years, or seek IRS consent.

Is Form 2553 required annually?

No, it’s a one-time election unless revoking or re-electing.

Conclusion: Take the Next Step Toward S Corp Savings

Electing S corporation status with IRS Form 2553 can transform your small business’s tax strategy, offering pass-through benefits and reduced self-employment taxes. With clear eligibility rules and a simple filing process, it’s accessible for most owners—but deadlines and details matter. For the latest 2025 updates, download the form and instructions from IRS.gov. Ready to file? Gather your docs and submit today to unlock these advantages.

Disclaimer: This guide is for informational purposes. Consult a qualified tax advisor for personalized advice.