Table of Contents

IRS Form 2555 – Foreign Earned Income – As global mobility surges—with over 9 million Americans living abroad in 2025—the U.S. tax code’s worldwide reach can feel burdensome. Enter IRS Form 2555, Foreign Earned Income, a powerful tool allowing qualifying expats to exclude up to $130,000 of foreign-earned income from U.S. federal taxes, plus a housing exclusion or deduction that can add another $20,000+ depending on location. For the 2025 tax year, the exclusion limit rises from $126,500 in 2024, providing inflation relief amid rising living costs in hotspots like London or Tokyo.

This SEO-optimized guide, based on the official 2025 Instructions for Form 2555 (Rev. December 2024) and IRS Publication 54 (Tax Guide for U.S. Citizens and Resident Aliens Abroad), covers eligibility, step-by-step completion, deadlines, and strategies to maximize benefits. Whether you’re a digital nomad in Bali or a corporate exec in Singapore, Form 2555 can slash your U.S. tax bill—yet only 25% of eligible expats claim it, leaving millions unexcluded. Download the 2025 PDF from IRS.gov and reclaim your earnings before the April 15, 2026, deadline.

What Is IRS Form 2555?

Form 2555 is the gateway to two major expat tax breaks: the Foreign Earned Income Exclusion (FEIE) and the Foreign Housing Exclusion/Deduction. It proves your foreign tax home and qualifying period, calculating exclusions for earned income (wages, self-employment) up to $130,000 and housing costs (rent, utilities) exceeding a base amount ($20.76/day in 2025, or $7,579 annually).

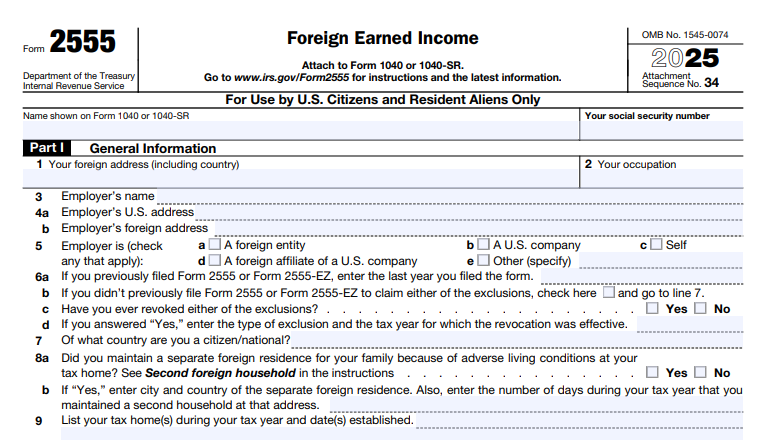

The 6-page form includes:

- Parts I–III: Tests for bona fide residence or physical presence.

- Part IV: Foreign earned income details.

- Parts V–VI: Housing amounts and exclusions.

- Part VII: Proration for partial years.

- Part VIII: Total exclusions for 1040 attachment.

- Part IX: Self-employment tax computation.

For 2025, instructions clarify reporting deferred compensation (e.g., bonuses earned abroad but paid later) and emphasize currency conversion using spot rates at receipt. Attach to Form 1040 (Schedule 1, line 8d); e-file supported. It doesn’t reduce self-employment tax—pair with Schedule SE for that.

Key Fact: FEIE excludes earned income only—passive (dividends, rentals) requires Form 1116 for foreign tax credits.

Who Qualifies for the Foreign Earned Income Exclusion Using Form 2555?

U.S. citizens or resident aliens qualify if they have a foreign tax home and meet one test, excluding up to $130,000 of foreign-earned income (prorated for partial years).

Foreign Tax Home

- Principal place of business/abode abroad (not U.S.-centric).

- Intent to return to U.S. doesn’t disqualify if abroad >183 days/year.

Qualifying Tests

- Bona Fide Residence: Uninterrupted foreign residency for full tax year (e.g., Jan. 1–Dec. 31, 2025); facts/circumstances (family, voting, bank accounts).

- Physical Presence: 330 full days abroad in any 12-month period (rolling; overlaps OK).

Eligible Income

- Wages/salaries from foreign employers.

- Self-employment abroad.

- Bonuses/deferred comp earned/performed abroad.

Ineligible: U.S. government employees, passive income, or services in international waters/U.S. Housing applies to employer-provided or self-paid costs exceeding $7,579 base (location-adjusted, e.g., Tokyo +30%).

Step-by-Step Guide: How to Complete IRS Form 2555 for 2025

The 2025 Form 2555 is detailed but straightforward—use tax software for proration or download the PDF from IRS.gov. Convert foreign currency to USD at receipt date rates (Treas. Reg. 1.988-1).

1. Part I: General Info

- Name, SSN, address (foreign OK).

- Employer details; qualifying period start/end.

2. Parts II/III: Tests

- Bona Fide: Dates, foreign residence facts (attach statement if needed).

- Physical Presence: 330+ days; list travel (country/dates).

3. Part IV: Foreign Earned Income

- Days abroad; prorate $130,000 (line 38: days/365 × $130,000).

- Report wages/self-employment; exclude U.S. sources.

4. Parts V/VI: Housing

- Expenses (rent/utilities); subtract base ($7,579).

- Location adjustment (e.g., Paris 15%); max exclusion.

5. Part VII: Proration

- Short year: Qualifying days/total days × max.

6. Part VIII: Totals

- Line 45: FEIE + housing; enter on 1040 Schedule 1, line 8d.

Pro Tip: Elect once via timely 1040; irrevocable for 5 years without consent—file Form 2555-EZ for simple cases.

Deadlines and How to File Form 2555 for 2025

Attach to Form 1040/1040-SR—due April 15, 2026; expats abroad get automatic 2-month extension to June 15 (pay by April to avoid interest). Further extend to October 15 via Form 2350 (if needed for tests) or 4868.

- E-File: Supported; mail if paper.

- Amended: Use 1040-X within 3 years for missed exclusions.

- Housing Deadline: Expenses through December 31, 2025.

Refunds in 21 days e-file; use direct deposit.

Common Mistakes to Avoid When Filing Form 2555

Eligibility errors cost expats $1B+ annually—here’s a table of pitfalls:

| Mistake | Why It Happens | How to Fix/Avoid | Potential Consequence |

|---|---|---|---|

| Wrong Test (Parts II/III) | Confusing bona fide vs. physical. | Document days/travel; attach statements. | Denial; $5,000 accuracy penalty. |

| Proration Error (Part VII) | Full-year assumption. | Days/365 × $130,000; include leap year. | Over-exclusion; repayment + interest. |

| Housing Overclaim (Part VI) | Ignoring base adjustment. | Subtract $7,579; use IRS tables for locations. | Audit; recapture. |

| Currency Conversion | Using average rates. | Spot rates at receipt; IRS tables. | Underreporting; penalties. |

| No Election | Assuming automatic. | File with timely 1040; irrevocable 5 years. | Lost exclusion. |

| Self-Employment Oversight | Forgetting SE tax. | Exclude for income tax only; pay SE on full. | Underpaid SE tax + 15.3%. |

Amend via 1040-X; retain records 3 years.

IRS Form 2555 Download and Printable

Download and Print: IRS Form 2555

2025 Updates and Special Considerations for Form 2555

The 2025 instructions (Rev. Dec. 2024) feature inflation tweaks:

- FEIE Limit: $130,000 (up $3,500 from 2024).

- Housing Base: $7,579 ($20.76/day; up from $7,315).

- Election: Timely 1040/1040X; 5-year lockout on revocation.

- Deferred Income: Exclude if earned/performed abroad (attach statement).

- E-File: Supported; automatic June 15 extension abroad.

- Interactions: No EITC/child credit if claiming; pair with FTC for passive.

For dual-status (U.S./foreign), prorate carefully.

Final Thoughts: Empower Your Expat Taxes with Form 2555 in 2025

IRS Form 2555 is a game-changer for expats, excluding up to $130,000 in income and housing costs to ease double taxation. For 2025, meet the tests, prorate accurately, and file by June 15, 2026 (abroad)—unlocking savings that fund your next adventure. With housing add-ons reaching $40,000+ in high-cost cities, don’t leave it unclaimed.

Consult Pub. 54 or a tax advisor for tests. This guide is informational; verify IRS.gov.

Not tax advice. Refer to official IRS sources.

FAQs About IRS Form 2555

What is the 2025 foreign earned income exclusion limit?

$130,000 per qualifying individual.

How do I qualify for Form 2555 abroad?

Establish foreign tax home + bona fide residence (full year) or physical presence (330 days/12 months).

Can I claim housing exclusion with FEIE on Form 2555?

Yes—up to location-adjusted max exceeding $7,579 base.

When is the 2025 Form 2555 due?

April 15, 2026; automatic June 15 extension abroad.