Table of Contents

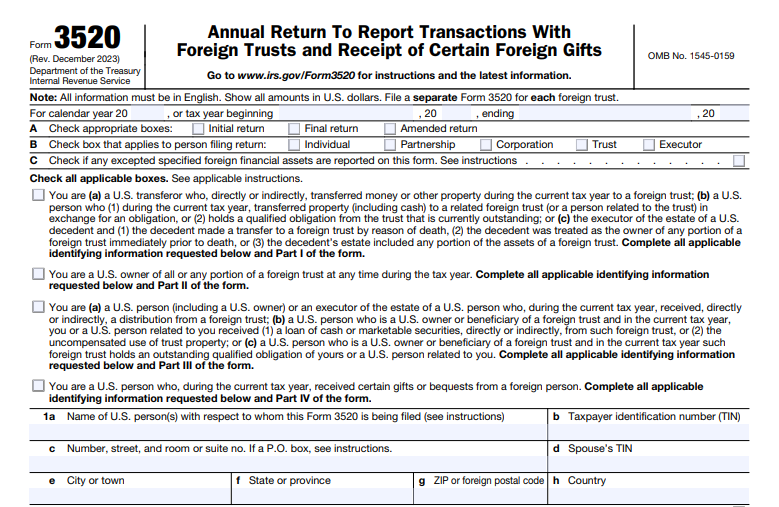

IRS Form 3520 – Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts – IRS Form 3520, officially titled “Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts,” is an informational return required by the Internal Revenue Service (IRS). U.S. persons use it to report specific interactions with foreign trusts and large gifts or bequests from foreign sources. Filing this form ensures compliance with U.S. tax laws on international transactions, even though no tax is typically due on the form itself.

As of 2025, understanding Form 3520 is crucial for U.S. taxpayers with international ties, such as expats, immigrants, or those receiving inheritances from abroad. This guide covers who must file, deadlines, penalties (including recent relief), and tips to avoid issues.

What Is IRS Form 3520?

Form 3520 is an annual informational return that reports:

- Certain transactions with foreign trusts (e.g., transfers or distributions).

- Ownership of foreign trusts under grantor trust rules (Internal Revenue Code sections 671–679).

- Receipt of large gifts or bequests from nonresident aliens, foreign estates, corporations, or partnerships.

A separate Form 3520 must be filed for each foreign trust involved. It is distinct from Form 3520-A, which foreign trusts with U.S. owners file separately.

Note: Receiving foreign gifts is generally not taxable income for the recipient, but failure to report can trigger significant penalties.

Who Must File Form 3520 in 2025?

U.S. persons (including citizens, residents, and executors of U.S. decedents’ estates) must file if any of the following apply during the tax year:

- Transfers to a foreign trust: You transferred property (including cash) to a foreign trust or hold a qualified obligation from it.

- Ownership of a foreign trust: You are treated as the owner of any portion of a foreign trust under grantor trust rules (complete Part II, even if no changes occurred).

- Distributions or loans from a foreign trust: You received a distribution, loan (including cash or securities), or uncompensated use of trust property.

- Large foreign gifts or bequests (Part IV):

- Aggregate gifts/bequests exceeding $100,000 from nonresident alien individuals or foreign estates (including related parties).

- Aggregate gifts exceeding the inflation-adjusted threshold (approximately $19,000–$20,000 in recent years; check IRS.gov for the exact 2025 amount) from foreign corporations or partnerships.

Qualified tuition or direct medical payments are excluded from reporting. Distributions from foreign trusts are reported in Part III, not Part IV.

Key Parts of Form 3520

- Part I: Reportable events like transfers to foreign trusts.

- Part II: U.S. owners of foreign trusts (annual requirement).

- Part III: Distributions, loans, or use of property from foreign trusts.

- Part IV: Large foreign gifts or bequests.

If you are a U.S. owner and the foreign trust fails to file Form 3520-A, attach a substitute Form 3520-A to your Form 3520.

Form 3520 Due Dates and Extensions for 2025

Form 3520 is due by the 15th day of the 4th month after the end of your tax year (typically April 15 for calendar-year filers).

Special rules:

- Automatic extension to the 15th day of the 6th month (June 15) for U.S. citizens/residents living and working abroad or in military service outside the U.S./Puerto Rico.

- If you file for an income tax extension (e.g., Form 4868), Form 3520 extends to the 15th day of the 10th month (October 15)—check box 1k and note your income tax form.

- No extensions beyond October 15, even with additional income tax extensions.

File by mail to: Internal Revenue Service Center, P.O. Box 409101, Ogden, UT 84409. Electronic signatures are allowed.

IRS Form 3520 Download and Printable

Download and Print: IRS Form 3520

How to File IRS Form 3520

- Download the latest form and instructions from IRS.gov.

- Complete all applicable parts and attachments.

- File separately from your income tax return (Form 1040).

- Keep records of fair market values and supporting documents.

Consult a tax professional for complex foreign trust transactions.

Penalties for Not Filing Form 3520

Penalties under section 6677 (trust-related) and 6039F (gifts) can be substantial:

- Trust transfers/distributions/ownership: Greater of $10,000 or 35% of the unreported amount.

- Foreign gifts: 5% per month of the gift value, up to 25%.

- Continuation penalties: Additional $10,000 every 30 days after IRS notification (capped at the unreported amount).

Important 2025 Update: Since late 2024, the IRS no longer automatically assesses these penalties for late-filed Forms 3520 (particularly Part IV foreign gifts) or 3520-A. The IRS now reviews reasonable cause statements submitted with late filings. Demonstrating reasonable cause (e.g., lack of knowledge or good faith effort) can eliminate or reduce penalties.

Always file as soon as possible and include a reasonable cause explanation if late.

Exceptions and Exemptions

Common exceptions include:

- Certain Canadian RRSPs/RRIFs (Rev. Proc. 2014-55).

- Tax-favored foreign retirement or non-retirement trusts for eligible individuals (Rev. Proc. 2020-17).

- Fair market value transfers in many cases.

- Transfers to U.S. tax-exempt organizations.

Other reporting (e.g., FBAR or Form 8938) may still apply.

Common Mistakes to Avoid

- Treating Form 3520 as part of your 1040 (file separately).

- Missing the October 15 extended deadline.

- Forgetting to check box 1k when on tax extension.

- Not filing for ownership even with no activity.

- Underreporting aggregated gifts from related foreign parties.

FAQs About IRS Form 3520

Is there tax due on foreign gifts reported on Form 3520?

No, it’s informational only—the U.S. does not tax gifts received.

What if I receive an inheritance from abroad?

Inheritances (bequests) over $100,000 from foreign estates trigger reporting.

Do I need to file if the gift is under $100,000?

No, unless from foreign entities exceeding the annual threshold.

Where can I find the latest form?

Visit IRS.gov and search for Form 3520.

Final Thoughts

Filing IRS Form 3520 is essential for U.S. persons with foreign trust transactions or large foreign gifts to avoid penalties and ensure compliance. With the IRS’s recent shift away from automatic penalties, late filers have more opportunity for relief via reasonable cause—but timely filing remains the best approach.

For personalized advice, consult a qualified tax professional. Always refer to official IRS sources for the most current information.