Table of Contents

IRS Form 3800 – General Business Credit – In today’s competitive business landscape, unlocking tax savings through incentives like the general business credit can be a game-changer for entrepreneurs, corporations, and nonprofits alike. IRS Form 3800, the “General Business Credit,” serves as the central hub for consolidating and calculating over 30 component credits—from research and development to clean energy investments—designed to spur innovation, hiring, and sustainability. If you’re a small business owner pondering “how to file IRS Form 3800 for 2025” or a tax pro seeking the latest on elective payments under the Inflation Reduction Act (IRA), this comprehensive, SEO-optimized guide has you covered.

Drawing from trusted sources like the IRS’s official 2025 draft instructions and recent legislative updates, we’ll demystify eligibility, walk through filing steps, and highlight 2025-specific changes. Whether you’re optimizing for “Form 3800 instructions 2025” or “general business credit carryforward rules,” read on to maximize your tax benefits and ensure compliance before the April 2026 deadline.

What Is IRS Form 3800 and Why Does It Matter?

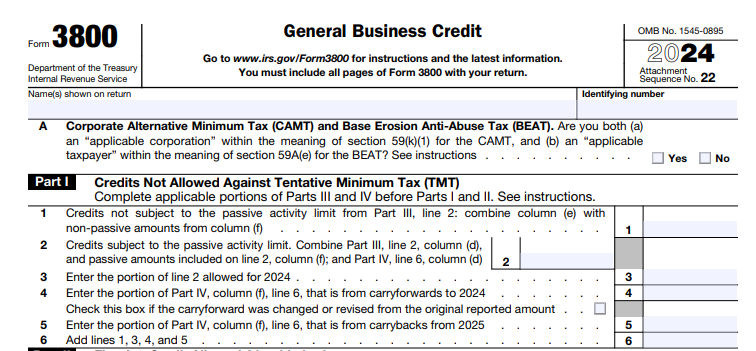

IRS Form 3800 is the IRS’s master form for claiming the general business credit under Internal Revenue Code (IRC) Section 38. It aggregates credits from individual source forms (e.g., Form 6765 for R&D, Form 3468 for investment), applies limitations like tentative minimum tax (TMT) and passive activity rules, and determines the allowable amount against your tax liability. This nonrefundable credit reduces your federal income tax dollar-for-dollar but doesn’t generate refunds beyond your tax owed—unused portions can carry back one year or forward up to 20 years.

For tax year 2025, Form 3800 is pivotal amid economic shifts, with expanded clean energy credits from the IRA and CHIPS Act of 2022. Businesses claiming even modest credits—like $10,000 in work opportunity credits—could save thousands, freeing capital for growth. It’s required for most entities: C corporations, S corporations, partnerships, sole proprietors, estates, trusts, and certain tax-exempt organizations filing Form 990-T. Only skip it if your total credit is under $1,000 and no carrybacks apply.

The form’s redesign since 2023 reflects IRA-driven complexities, including elective payment elections (EPE) for tax-exempts and credit transfers to unrelated parties, making accurate filing essential to avoid audits or denied claims.

Who Is Eligible for the General Business Credit on Form 3800?

Eligibility hinges on qualifying for at least one component credit and meeting overall limitations. Here’s a breakdown for 2025:

Eligible Taxpayers

- Business Entities: Corporations (C and S), partnerships, and sole proprietors with qualifying activities.

- Individuals: Self-employed or those with pass-through income claiming credits like R&D or fuel credits.

- Tax-Exempt Organizations: Applicable entities (e.g., nonprofits, governments) under IRA Section 6417 for clean energy EPE; must pre-register.

- Pass-Throughs: Partnerships/S corps report on Schedule K; recipients claim on their Form 3800.

Key Component Credits for 2025

Form 3800 funnels dozens of credits into Part III. Top ones include:

| Credit Type | Source Form | Key Eligibility | 2025 Limit/Note |

|---|---|---|---|

| Research Credit | Form 6765 | Qualified R&D expenses (wages, supplies) | Up to 20% of excess over base; eligible small businesses can offset payroll taxes up to $500,000 |

| Work Opportunity Credit | Form 5884 | Hiring from targeted groups (e.g., veterans) | 40% of first-year wages, up to $9,600 per employee |

| Investment Credit | Form 3468 | Solar/wind investments | 30% base for solar; new clean electricity (Section 48E) available for fiscal years ending 2025 |

| Clean Fuel Production | Form 7218 | Sustainable aviation/low-emission fuels | $1.75/gallon; new for 2025 filers |

| Disabled Access Credit | Form 8826 | Accessibility improvements | $5,000 max for small businesses |

Exclusions: Credits can’t offset TMT fully (specified credits limited), and passive activities require Form 8582-CR. Pre-register for EPE/transfers via IRS.gov.

Recent Changes to IRS Form 3800 for Tax Year 2025

The IRS released draft Form 3800 and instructions in late 2024, with minor post-release tweaks like fillable field corrections in March 2025. Building on 2023-2024 redesigns for IRA/CHIPS, 2025 emphasizes clean energy and transferability:

- New Credit Availability: Clean electricity production (Section 45Y, Form 7211, Part III line 1gg), clean fuel production (Section 45Z, Form 7218, line 1q), and clean electricity investment (Section 48E, Form 3468, line 1v) now eligible for fiscal years ending in 2025.

- Passive/Non-Passive Splits: Enhanced columns in Parts III-VI for passive (d/e) vs. non-passive (f) tracking; passive credits limited to passive income tax.

- EPE and Transfers: Mandatory pre-filing registration; new net EPE line (Part III, column j) treats credits as payments for applicable entities. Transfers require Schedule A with details; no EPE on transferred credits.

- Part II Overhaul: Renamed with sections A-D for limitations under IRC 38(c)(1)-(4); carryforwards to 2025 explicitly calculated.

- Carryover Adjustments: Eligible small business credit (ESBC) column removed; report on Part IV line 4y. Revocation of Section 6417 elections added April 2025.

These updates, per IRS Notice 2025-67 and Pub. 5884, boost accessibility but demand precise record-keeping.

IRS Form 3800 Download and Printable

Download and print: IRS Form 3800

Step-by-Step Guide: How to Complete IRS Form 3800 for 2025

Form 3800 spans six parts—start with III-VI for credits, then I-II for limitations. Use tax software for accuracy; attach source forms. Based on 2025 drafts:

Preparation

- Calculate component credits on source forms.

- Register for EPE/transfers if applicable.

- Gather prior-year carryovers (Part IV) and breakdowns (Parts V/VI for multiples).

Part III: Current-Year Credits

- List credits by line (e.g., 1c for R&D).

- Columns: (a) # items; (b) registration #; (c) EIN; (d/e) passive/non-passive; (f) transfers; (g) net; (h/i/j) EPE details.

- Example: $50,000 R&D credit (non-passive) enters line 1c, column (e).

Part IV: Carryovers

- Mirror Part III lines; columns for year, passive/non-passive, applied, carryforward to 2025 (column i = prior – applied/recaptured).

- Example: $10,000 unused 2024 credit carries to line 1c, column (f).

Parts V/VI: Breakdowns

- Detail multiples (e.g., facilities per credit); sum to Parts III/IV.

Part I: TMT-Limited Credits

- Line 1: Non-passive current (Part III col e).

- Line 4: Non-passive carryforwards (Part IV col f).

Part II: Allowed After Limitations

- Section A: Line 7 = net income tax; limit to tax liability.

- Section B: Empowerment zone credits.

- Section C: Specified credits (e.g., energy); Line 30 = non-passive from Part III.

- Line 38: Total allowed; report on return (e.g., Form 1120, line 54).

Filing

- Attach to 2025 return (e-file preferred); deadlines match return (April 15, 2026 for calendar filers).

- Carryback: Amend prior year via Form 1139/1040-X.

Common Mistakes to Avoid When Filing Form 3800

Pitfalls can trigger penalties—here’s a quick table:

| Mistake | Why It Happens | How to Fix It |

|---|---|---|

| Forgetting Pre-Registration | Overlooking IRA EPE/transfers | Register at IRS.gov before filing |

| Misapplying Passive Rules | Ignoring Form 8582-CR | Split credits correctly in new columns |

| Incorrect Ordering | Using current before carryforwards | Follow FIFO: carryforwards first |

| Omitting Transfers | No Schedule A | Attach with TINs/amounts |

| TMT Overclaim | Claiming specified credits fully | Limit per Section C |

Retain records 3+ years; amend for errors.

Why Claim the General Business Credit? Real Impact for 2025

A mid-sized manufacturer claiming $100,000 in R&D and energy credits could slash its tax bill by that amount, per TurboTax estimates. With 2025’s clean fuel expansions, green businesses stand to gain most—potentially $1M+ in EPE for large projects.

Final Thoughts: Unlock Your 2025 Savings with Form 3800

IRS Form 3800 empowers businesses to harness tax incentives amid 2025’s evolving landscape, from IRA clean credits to streamlined transfers. By mastering eligibility, updates, and filing, you’ll avoid pitfalls and amplify refunds.

Download the 2025 draft from IRS.gov and consult a CPA for tailored advice. For more, check our guides on Form 6765 or energy credits. Questions on “Form 3800 carryforward 2025”? Comment below!

This article is informational only—not tax advice. See a professional for your situation.