Table of Contents

IRS Form 3903 – Moving Expenses – Relocating for a new job or military assignment can be a major financial undertaking, but the IRS offers relief through targeted deductions. IRS Form 3903, Moving Expenses, allows eligible taxpayers—primarily active-duty military members—to claim qualified moving costs as an above-the-line adjustment to income. This reduces your taxable income without itemizing, potentially lowering your overall tax bill.

In this SEO-optimized guide for the 2025 tax year (filed in 2026), we’ll explore Form 3903 eligibility, step-by-step filing instructions, and key rules from IRS Publication 521. Whether you’re a service member navigating a permanent change of station (PCS) or simply researching deductions, this article provides actionable insights. Updated with the latest IRS data, including the 2025 standard mileage rate of 21 cents per mile, it’s your roadmap to compliant tax savings.

What Is IRS Form 3903?

IRS Form 3903 is a one-page IRS worksheet used to calculate and report deductible moving expenses tied to a job-related relocation. It helps determine the portion of costs not reimbursed by your employer (or the government) that you can subtract from your gross income on Form 1040 or 1040-SR.

Historically, this form supported broad deductions for work-related moves, but the Tax Cuts and Jobs Act (TCJA) of 2017 suspended them for most taxpayers from 2018 through 2025. Now, it’s primarily for active-duty Armed Forces members moving due to a PCS. The form ensures you only claim unreimbursed, reasonable expenses, avoiding audits or penalties.

Key stat: In 2025, eligible filers can deduct costs like shipping household goods or temporary storage, but never meals or house-hunting trips. Download the 2025 Form 3903 and instructions from IRS.gov, available since late 2025.

Who Is Eligible to File IRS Form 3903 in 2025?

Under current law, Form 3903 is limited to specific groups—most civilians can’t deduct moving expenses, and employer reimbursements are taxable income. Here’s who qualifies:

- Active-duty members of the U.S. Armed Forces (including Coast Guard) relocating due to a permanent change of station ordered for your benefit, not just convenience.

- Spouses or dependents of deceased, imprisoned, or deserted service members—treated as PCS moves.

- U.S. citizens or resident aliens moving to a job outside the U.S. or its possessions (e.g., Puerto Rico), though this overlaps with military eligibility.

Non-qualifiers: Self-employed individuals, retirees (unless military), or anyone moving without a job tie-in. The suspension ends after 2025 unless extended, but for now, non-military moves are nondeductible.

To qualify, pass these tests (waived for military PCS):

- Distance Test: New workplace at least 50 miles farther from old home than old workplace was.

- Time Test: Full-time work for 39 weeks in the 12 months post-move (78 weeks for self-employed; prorated for couples).

Pro tip: Foreign moves (outside U.S. possessions) follow similar rules but exclude temporary assignments under 1 year.

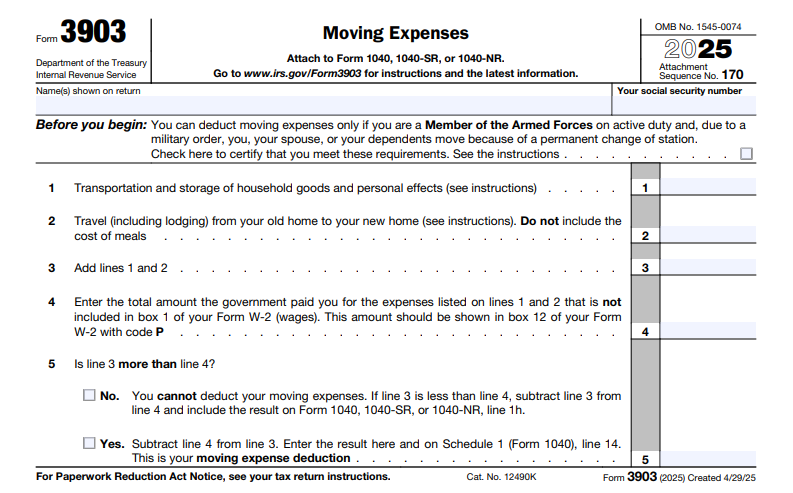

Step-by-Step Instructions: How to Complete IRS Form 3903

Grab the 2025 Form 3903 from IRS.gov—it’s simple but requires receipts and W-2 data. Attach it to your Form 1040, Schedule 1, Line 14. Here’s a line-by-line guide from the official instructions:

Part I: General Location and Type of Move

- Line 1: Old home address and ZIP code.

- Line 2: New home address and ZIP code.

- Line 3: New workplace address (or city if abroad).

- Line 4: Date left old home and arrived at new home.

- Line 5: Check boxes for Armed Forces PCS or foreign move.

Part II: Deductible Moving Expenses

Calculate unreimbursed costs—only “reasonable” amounts qualify (e.g., shortest route by conventional transport).

- Line 6: Transportation and storage of household goods (e.g., moving van rental, professional movers). Include shipping pets or plants.

- Line 7: Travel and lodging en route (e.g., gas, hotels). Use 21 cents per mile for your vehicle in 2025—no meal deductions.

- Line 8: Temporary storage (up to 30 days) and insurance for goods.

- Line 9: Total deductible expenses (Lines 6 + 7 + 8).

Part III: Reimbursements

- Line 10: Taxable reimbursements (from W-2, Box 12, Code P). Subtract from Line 9.

- Line 11: Nontaxable reimbursements (e.g., military allowances)—report but don’t deduct.

- Line 12: Net deductible amount (Line 9 minus taxable reimbursements). Enter on Schedule 1 (Form 1040), Line 14.

If expenses exceed reimbursements, claim the difference. For multiple moves, file separate forms. Use IRS Pub 521 worksheets for distance/time tests.

Filing Deadlines and Where to Submit IRS Form 3903

Form 3903 follows your Form 1040 deadline: April 15, 2026, for 2025 taxes (or October 15 with Form 4868 extension). E-file if possible—most software auto-generates it—or mail with your return.

- E-file: Through IRS Free File, TurboTax, or H&R Block; attach as a PDF.

- Paper file: To your regional IRS center (e.g., Austin, TX for most). Include all receipts for 3 years.

Amended returns? Use Form 1040-X within 3 years. Late filing incurs 5% monthly penalties on unpaid tax.

Common Mistakes to Avoid When Filing Form 3903

Even eligible filers trip up—here’s how to stay audit-proof:

- Claiming Nondeductibles: No meals, real estate fees, or job-hunt costs—stick to Pub 521’s list.

- Ignoring Reimbursements: Forgetting to report taxable portions inflates deductions, triggering IRS notices.

- Failing Tests: Civilians must document distance/time; military skips but prove PCS orders.

- Mileage Errors: Use 2025’s 21-cent rate exactly—actual expenses OK if lower.

- No Records: Keep bills, logs, and W-2s; audits hit 1-2% of returns.

Penalties range from $290 for frivolous claims to 20% accuracy-related fines.

Recent Changes to IRS Form 3903 (2024-2025)

No structural updates to Form 3903 for 2025—it mirrors 2024 with year-specific tweaks. The big news: TCJA suspension persists through 2025, limiting deductions to military PCS. Standard mileage dropped to 21 cents/mile from 23 cents in 2024, reflecting fuel trends. Reimbursements remain taxable for non-military, per Pub 521.

Watch for post-2025 revival—Congress could reinstate broader deductions. Check IRS.gov/Form3903 for drafts (last revised December 2025).

FAQs About IRS Form 3903 and Moving Expense Deductions

Can civilians deduct moving expenses in 2025?

No—suspended until 2026, except for military PCS or certain foreign moves.

What’s the 2025 mileage rate for Form 3903?

21 cents per mile for vehicle use in moving.

Do employer reimbursements affect my Form 3903 deduction?

Yes—only unreimbursed amounts qualify; taxable portions go on W-2.

How does Form 3903 differ from pre-2018 rules?

Broader eligibility then; now military-only, with taxable reimbursements.

Final Thoughts: Maximize Your 2025 Moving Deductions with Form 3903

For active-duty military facing PCS, IRS Form 3903 is a vital tool to offset relocation costs legally and efficiently. With the 2025 suspension in place, confirm eligibility early and gather docs now. File by April 15, 2026, to secure your adjustment—potentially saving hundreds.

Consult a tax pro for complex cases or call IRS at 1-800-829-1040. Track updates at IRS.gov—tax relief evolves, but smart planning endures.

This article is for informational purposes only and not tax advice. Verify with official IRS sources.

IRS Form 3903 Download and Printable

Download and Print: IRS Form 3903