Table of Contents

IRS Form 3911 – Taxpayer Statement Regarding Refund – If you’re waiting for a tax refund that never arrived, IRS Form 3911, officially titled Taxpayer Statement Regarding Refund, is the key tool to initiate a refund trace. This form helps the IRS locate lost, stolen, destroyed, or undelivered refunds issued by check or direct deposit. Whether your refund check went missing in the mail or a direct deposit failed, filing Form 3911 starts the process for a replacement.

As of 2025, Form 3911 remains essential for resolving missing refund issues, especially when online tools like “Where’s My Refund?” confirm the IRS issued your payment but you never received it.

What Is IRS Form 3911?

IRS Form 3911 is a simple one-page document that provides the information needed to trace a non-received or problematic refund. It applies to:

- Refunds never received

- Lost, stolen, or destroyed checks

- Issues with direct deposits (e.g., wrong account)

- Expired uncashed checks (valid for one year from issue date)

Note: This form is not for disputing refund amounts or eligibility—use it only after the IRS has issued the refund.

When Should You File Form 3911?

Before filing, confirm your refund status:

- Use the IRS “Where’s My Refund?” tool or IRS2Go app.

- Wait appropriate times:

- Direct deposit: At least 5 days after issuance

- Mailed check: 4–9 weeks depending on location

- For joint returns or complex cases, automated traces may not work—go straight to Form 3911 or call the IRS.

File if:

- The refund was issued but never arrived

- Your check was lost/stolen/destroyed

- A direct deposit went to the wrong account (contact your bank first; wait 2 weeks if no resolution)

Alternatives: Call 800-829-1954 (automated) or 800-829-1040 (representative) for non-joint filers.

How to Download IRS Form 3911

Download the latest version (Rev. 10-2022, current as of 2025) directly from the IRS website: Form 3911 PDF.

The IRS may mail you the form with a prepaid envelope if they detect an issue.

IRS Form 3911 Download and Printable

Download and Print: IRS Form 3911

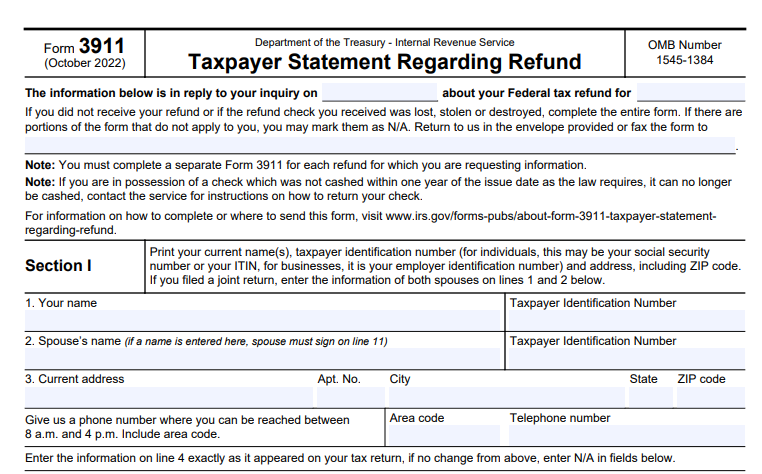

Step-by-Step Guide: How to Fill Out Form 3911

Complete a separate form for each tax year/refund. Mark “N/A” for non-applicable sections.

Section I: Taxpayer Information

- Lines 1–2: Enter current name(s), SSN/ITIN (or EIN for businesses), and spouse info if joint return.

- Line 3: Current address and phone number (reachable 8 a.m.–4 p.m.).

- Line 4: Name/address as on original return (or N/A if unchanged).

- Lines 5–6: Representative info if someone was authorized to receive the refund.

- Additional details: Return type, refund method (check/direct deposit), amount, bank info, tax period, and filing date.

Section II: Refund Status

- Check boxes for: Didn’t receive refund, or received but lost/stolen/destroyed.

- If endorsed and cashed by someone else: No replacement possible (no forgery).

Section III: Signature

- Sign and date (both spouses for joint returns).

- Declare under penalty of perjury and agree to return duplicate if received.

Where to Submit Form 3911

Mail or fax the completed form. Use the address/fax number based on your state or the IRS center where you filed your return. Visit the official page for the full list: About Form 3911.

Do not send other documents to fax numbers—Form 3911 only.

What Happens After Filing Form 3911?

The IRS and Bureau of the Fiscal Service trace the refund:

- Uncashed: Replacement issued after cancellation.

- Cashed: Claim package sent with check copy; review takes up to 6 weeks.

- Processing: Typically 6+ weeks; longer during peak seasons.

You’ll receive notification by mail.

Frequently Asked Questions About Form 3911

Can I file Form 3911 online?

No—mail or fax only.

How long does a refund trace take?

6–8 weeks typically, but varies.

What if my check expired?

Return it to IRS for reissue instructions.

Is Form 3911 for stimulus payments?

Yes, if treated as a refund.

For the most current details, always check IRS.gov. If your missing tax refund has you stressed, acting quickly with Form 3911 can get your money back on track.