Table of Contents

IRS Form 3922 – Transfer of Stock Acquired Through An Employee Stock Purchase Plan Under Section 423(c) – Employee stock purchase plans (ESPPs) offer a powerful way for workers to invest in their company’s future, often at a discount that can yield significant returns. But when it comes to taxes, accuracy is key—especially with IRS Form 3922, the Transfer of Stock Acquired Through an Employee Stock Purchase Plan Under Section 423(c). This form reports the transfer of discounted stock shares to employees, helping the IRS track potential bargain element income and ensuring employees have the data for correct cost basis reporting on their taxes. For 2025, with the form revised in April and e-filing mandatory for 10+ forms, staying compliant avoids penalties up to $310 per form. This SEO-optimized guide, based on the latest IRS instructions (Rev. April 2025), covers filing requirements, deadlines, and step-by-step completion to simplify your 2025 reporting.

What Is IRS Form 3922?

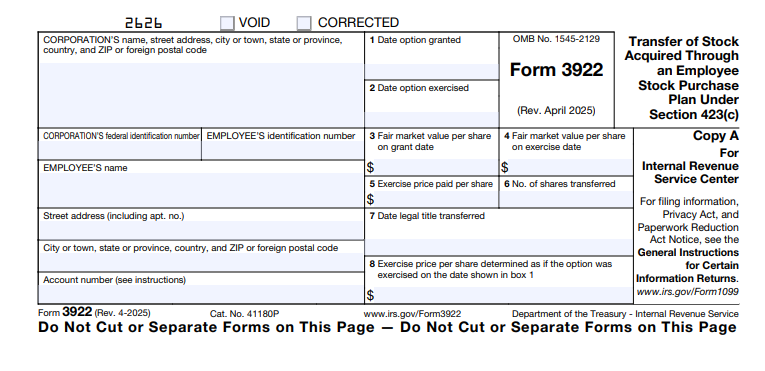

IRS Form 3922 is an information return that corporations must file to report the first transfer of legal title to shares acquired by employees through a qualified ESPP under IRC Section 423(c). It captures details like the grant date, exercise price, fair market value (FMV) at exercise, and number of shares, which inform the employee’s cost basis for future sales and any disqualifying disposition income. Unlike Form 3921 (for ISOs), Form 3922 focuses on ESPPs where the exercise price is less than 100% of the stock’s FMV on the grant date or isn’t fixed/determinable then.

Key elements:

- Bargain Element Reporting: Helps calculate ordinary income on sales (up to 15% discount, max $25,000/year purchased).

- Cost Basis Adjustment: Employees use Box 5 (FMV at exercise) minus Box 4 (price paid) for basis.

- No Tax Withholding: ESPPs don’t trigger immediate withholding, but Form 3922 aids AMT or capital gains calculations.

The April 2025 revision (Cat. No. 41180P) includes fillable PDFs for Copies A/B and aligns with e-filing rules in Pub. 1220. Download the form and instructions from IRS.gov/Form3922.

Who Must File IRS Form 3922 in 2025?

Every corporation (or its agent, like a transfer agent) that records a transfer of ESPP stock in 2025 must file Form 3922 for each qualifying transfer. This applies to the first transfer of legal title, often when shares hit the employee’s brokerage account.

| Filing Requirement | Details for 2025 |

|---|---|

| Trigger Event | Transfer of shares under Section 423(c) ESPP where price <100% FMV at grant or not fixed. |

| Per Transfer | One form per employee per transfer; aggregate if multiple accounts. |

| E-Filing Threshold | Mandatory if 10+ Forms 3922 (or combined with other info returns like 3921). |

| Exceptions | No filing for nonresident aliens without W-2 requirement; subsequent transfers after first. |

Use EIN for the corporation; obtain employee TINs via Form W-9. Brokers may file if acting as agent.

Filing Deadlines and Extensions for Form 3922 in 2025

Deadlines are calendar-year based for 2025 transfers, reported in early 2026. Miss them, and penalties apply.

| Deadline Type | Date for 2025 Transfers | Notes |

|---|---|---|

| Furnish to Employee (Copy B) | January 31, 2026 | Mail/email; fillable PDF eases delivery. |

| File with IRS (Copy A) | February 28, 2026 (paper) or March 31, 2026 (e-file) | Include Form 1096 transmittal. |

| Extensions | Automatic 30 days via Form 8809 (file by original due date) | For IRS filing only; employee furnish extension requires IRS letter approval. |

- Where to File: Paper to IRS at the address in Pub. 1220; e-file via FIRE system (requires Transmitter Control Code).

- Disaster Relief: Automatic extensions in declared areas (e.g., hurricanes)—check IRS.gov for 2025 updates.

E-file for faster acknowledgment (3–7 days) and to meet the 10-form threshold.

Step-by-Step Guide to Completing IRS Form 3922

Gather employee details, grant/exercise records, FMV quotes, and brokerage confirmations. Use the April 2025 fillable PDF for accuracy.

- Copy A (IRS): Enter corporation name, EIN, address; check “3922” box.

- Employee Info (Boxes 1–3): Transferor’s name, address, TIN (SSN/ITIN); optional account number for multiples.

- Dates (Boxes 4–6): Option grant date (Box 4), exercise date (Box 5), transfer date (Box 6).

- Values (Boxes 7–9): FMV per share at grant (Box 7), exercise price per share (Box 8), FMV per share at exercise (Box 9)—use closing price or appraisal.

- Shares (Boxes 10–11): Number transferred (Box 10); if readily tradable, check Box 11.

- ESPP Details (Boxes 12–14): Aggregate shares purchased under plan (Box 12), FMV at grant for those (Box 13), aggregate exercise price (Box 14).

- Sign & Copies: Officer signs Copy A; prepare Copy B for employee (include instructions).

For e-file, use IRS-approved software like Tax1099; paper requires scannable red-ink forms. Round to whole dollars; truncate TINs on employee copies.

Key Boxes on IRS Form 3922 Explained

Form 3922’s boxes provide critical data for tax reporting—employees use them for Schedule D/Form 8949.

| Box | Description | Tax Impact |

|---|---|---|

| 1–3 | Employee name/address/TIN | Identifies recipient for IRS matching. |

| 5 & 9 | Exercise date & FMV at exercise | Basis for ordinary income on disqualifying dispositions (FMV – price paid). |

| 8 | Exercise price per share | Shows discount (up to 15%); ordinary income if sold too soon. |

| 10 | Shares transferred | Total for the transaction; aggregate in Box 12 for plan totals. |

| 11 | Readily tradable stock | Yes for public companies; affects basis rules. |

FMV is the average between high/low trading prices; document sources for audits.

IRS Form 3922 Download and Printable

Download and Print: IRS Form 3922

E-Filing vs. Paper Filing for Form 3922 in 2025

E-filing is required for 10+ forms and recommended for all to avoid errors and get instant IRS acknowledgment.

- E-Filing Pros: Faster (3–7 days), lower error rates, automatic extensions easier; use FIRE or vendors like TaxZerone.

- Paper Pros: Simpler for <10 forms; mail with Form 1096.

- Threshold Note: Counts separately from Form 3921 but aggregates with other info returns for the 10-form e-file rule.

Switch to e-file for 2025 to comply with updated Pub. 1220.

Common Mistakes When Filing Form 3922 and How to Avoid Them

Errors can trigger audits or penalties—top pitfalls for 2025:

- Incorrect FMV/Price: Using wrong date or non-closing prices—verify with stock exchange data.

- Missing TINs: Incomplete employee SSNs—collect via W-9 upfront.

- Late Employee Copies: Forgetting January 31 furnish—use e-delivery for proof.

- No Account Numbers: For multiples—assign unique IDs early.

- Aggregation Errors: Wrong Box 12 totals—reconcile with plan records.

Use software validations; review with HR/stock admins before filing.

Penalties for Late or Incorrect Form 3922 Filings

The IRS enforces via Notice 972CG:

- Failure to File/Furnish: $310 per form (up to $3,783,000/year; $1,261,000 small business).

- Intentional Disregard: $630 per form, no cap.

- Corrections: File amended with explanation; inconsequential errors (e.g., typos) may waive.

- Relief: Reasonable cause (e.g., vendor error) via response to notice; first-time abatement possible.

Double penalties if both IRS and employee copies fail.

Frequently Asked Questions About IRS Form 3922

Do I need Form 3922 for every ESPP purchase?

Only for the first transfer of legal title under qualifying plans; exceptions for nonresident aliens.

How does Form 3922 affect my taxes?

It provides basis data—no direct tax, but errors lead to underreported income on sales.

Can I e-file Form 3922 for free?

No—use paid vendors; IRS FIRE is free but technical.

What’s the penalty for missing the January 31 deadline?

Up to $310 per statement; request relief for cause.

Is Form 3922 required for private companies?

Yes, if ESPP qualifies under Section 423(c).

Visit IRS.gov/Form3922 for more.

Final Thoughts: Ensure Compliant ESPP Reporting with Form 3922 in 2025

IRS Form 3922 is more than paperwork—it’s essential for transparent ESPP administration, protecting both your company from penalties and employees from tax surprises. With 2025’s April revision emphasizing e-filing and fillable copies, now’s the time to audit your processes and choose a reliable vendor. Download the form from IRS.gov today and consult a tax advisor to align with your equity strategy.

Equity compensation builds wealth—accurate reporting keeps it that way.

This article is informational only—not tax advice. Verify with IRS or a professional.