Table of Contents

IRS Form 4029 – Application for Exemption From Social Security and Medicare Taxes and Waiver of Benefits – In today’s complex tax landscape, certain individuals may qualify for exemptions from standard payroll taxes due to religious beliefs. IRS Form 4029, officially titled “Application for Exemption From Social Security and Medicare Taxes and Waiver of Benefits,” provides a pathway for members of recognized religious groups to opt out of these taxes. This form is particularly relevant for groups like the Amish or Mennonites, allowing them to align their tax obligations with their faith. If you’re exploring religious exemptions from Social Security taxes or Medicare tax waivers, this guide covers everything you need to know, including eligibility, filing process, and potential implications.

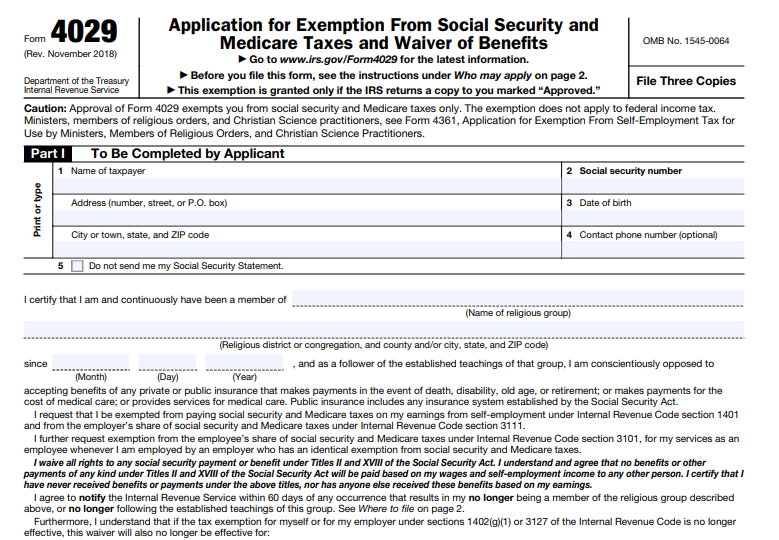

What Is IRS Form 4029?

IRS Form 4029 is a specialized application used by qualifying individuals to request an exemption from paying Social Security and Medicare taxes on their wages and self-employment income. By filing this form, applicants also irrevocably waive their rights to any benefits under Social Security Titles II (old-age, survivors, and disability insurance) and XVIII (Medicare). This exemption applies to both employee and employer shares of these taxes, ensuring that no contributions are made on behalf of the exempt individual.

The form’s purpose stems from provisions in the Internal Revenue Code (IRC) sections 1401, 3101, and 3111, which allow for religious-based opt-outs. It’s a one-time election that, once approved, remains in effect as long as the individual meets the requirements. Note that this does not exempt you from federal income taxes—only Social Security and Medicare.

Who Is Eligible for the Form 4029 Exemption?

Eligibility for the religious exemption from Social Security taxes is strictly limited to members of recognized religious groups that meet specific criteria set by the IRS and Social Security Administration (SSA). To qualify:

- Membership in a Recognized Religious Group: You must be a member of a religious sect or division that has been in continuous existence since December 31, 1950. The group must be conscientiously opposed to accepting public or private insurance benefits for death, disability, old age, retirement, or medical care (including Social Security and Medicare).

- Adherence to Teachings: You must personally follow the group’s established teachings opposing such insurance benefits.

- Group Support System: The religious group must provide a reasonable level of living support for its dependent members.

- No Prior Benefits Received: You cannot have received (or be entitled to) Social Security or Medicare benefits based on your earnings, unless you’ve repaid them in full.

Common examples include Amish and Mennonite communities, but the SSA certifies whether a group qualifies. Ministers, members of religious orders, or Christian Science practitioners should use Form 4361 instead. Partnerships can apply if all partners qualify and file individually.

As of 2025, there have been no major updates to these eligibility rules, though taxpayers should check for any guidance related to child tax credits or other intersecting benefits.

How to File IRS Form 4029: Step-by-Step Guide

Filing for a Social Security tax exemption via Form 4029 requires careful preparation. Here’s how to apply:

- Obtain the Form: Download the latest version from the IRS website (IRS.gov). The form was last revised in November 2018, with no significant changes noted in 2025.

- Complete Part I (Applicant Section): Provide your personal details, including name, address, Social Security Number (SSN), date of birth, and membership details. Certify your opposition to insurance benefits and waive rights to Social Security payments. If you don’t have an SSN, apply using Form SS-5.

- Obtain Certification (Part II): An authorized representative of your religious group must sign, confirming your membership and the group’s qualifications.

- Submit the Form: Mail the original and two copies to the Social Security Administration at: Security Records Branch, Attn: Religious Exemption Unit, P.O. Box 7, Boyers, PA 16020. File it by the due date of your tax return for the first year you have self-employment income or join the group.

- Await Approval: The IRS will review and return an approved or disapproved copy. Keep the approved version for your records.

For self-employed individuals, the exemption is retroactive to qualifying years. For employees, it starts the first quarter after filing. If your status changes (e.g., you leave the group), notify the IRS within 60 days.

IRS Form 4029 Download and Printable

Download and Print: IRS Form 4029

Consequences and Implications of Filing Form 4029

Opting for this Medicare tax waiver and Social Security exemption has long-term effects:

- Tax Savings: You won’t pay the 12.4% Social Security tax (split between employee and employer) or the 2.9% Medicare tax on exempt income.

- Loss of Benefits: The waiver is irrevocable, meaning no future access to Social Security retirement, disability, survivors’ benefits, or Medicare based on your earnings. This applies even to dependents.

- Employer Responsibilities: If approved, employers don’t withhold or pay these taxes. Mark “Exempt—Form 4029” on relevant tax forms like Form 1040 or W-2.

- Potential Risks: If the exemption ends, benefits are only payable based on post-exemption earnings. False information can lead to penalties.

Rely on your religious community’s support system, as you’ll forgo government safety nets.

Related Forms and Publications

When dealing with Form 4029, you may encounter:

- Form 4361: For ministers and similar roles.

- Form 1040: To report self-employment tax exemptions.

- Publication 15-A: Employer’s Supplemental Tax Guide for handling exempt employees.

- Form W-2: For noting exemptions on wage statements.

Frequently Asked Questions About IRS Form 4029

Can I revoke Form 4029 after approval?

No, the waiver is irrevocable for the period it’s effective.

Does this exemption apply to state taxes?

No, it only covers federal Social Security and Medicare taxes.

What if I’m self-employed and an employee?

The exemption covers both, as long as you qualify.

Are there any 2025 updates to Form 4029?

As of late 2025, no major changes have been announced, but always verify with IRS.gov for the latest.

Conclusion: Is the Form 4029 Exemption Right for You?

IRS Form 4029 offers a vital religious exemption from Social Security and Medicare taxes for eligible individuals, but it comes with the permanent waiver of associated benefits. If your faith prohibits participation in such programs, consult with your religious leader and a tax professional before filing. For the most current information, visit the official IRS and SSA websites. This guide is for informational purposes—professional advice is recommended for personal tax situations.