Table of Contents

IRS Form 4136 – Credit for Federal Tax Paid On Fuels – Fuel costs can eat into your business or farming profits, but what if you could reclaim the federal excise taxes paid on gasoline, diesel, or kerosene used off-highway? IRS Form 4136, the “Credit for Federal Tax Paid on Fuels,” offers a refundable tax credit for just that—helping farmers, contractors, and nonprofits offset expenses on qualifying nontaxable fuel uses. If you’re searching for “Form 4136 instructions 2025,” “fuel tax credit eligibility,” or “how to claim diesel fuel credit on taxes,” this SEO-optimized guide has you covered with step-by-step advice, drawn from the IRS’s latest 2025 draft instructions and key updates.

With rising fuel prices and scam alerts around improper claims, accurate filing is crucial—incorrect claims can trigger a $5,000 penalty per return. For tax year 2025, expect the new mandatory supporting statement for individuals and expirations on biodiesel-related credits. File by April 15, 2026 (or October 15 with extension) to maximize your refund. Let’s break it down.

What Is IRS Form 4136?

Form 4136 allows taxpayers to claim a refundable credit for federal excise taxes paid on fuels used in nontaxable ways, such as off-highway business operations, farming, or aviation. This includes credits for alternative fuels, diesel-water emulsions, and exported dyed fuels. Unlike deductions, this credit directly reduces your tax bill or boosts your refund—up to 24.4 cents per gallon for gasoline in farming, for example.

The form supports three main categories:

- Nontaxable Uses: Fuel for non-highway purposes (e.g., construction equipment, tractors).

- Alternative Fuel Credit: For compressed natural gas (CNG), propane, or hydrogen (though some expire post-2024).

- Mixture Credits: For biodiesel or sustainable aviation fuel (SAF) blending, but note expirations for sales after 2024.

Per IRS Publication 510, the credit reimburses the excise tax (e.g., 18.4 cents/gallon on gasoline) embedded in fuel prices. It’s claimed annually on your income tax return but can be filed quarterly via Form 8849 for faster refunds. For 2025, the form integrates with Form 3800 for general business credits if applicable.

Who Is Eligible for the Fuel Tax Credit on Form 4136 in 2025?

Eligibility requires a qualifying business activity and proof of nontaxable use—no personal or highway driving qualifies. The ultimate purchaser (you, if you bought the fuel) claims most credits, but registration via Form 637 is mandatory for vendors, blenders, or producers.

Key Eligible Taxpayers

| Taxpayer Type | Eligible Credits | Requirements |

|---|---|---|

| Farmers & Off-Highway Businesses (e.g., construction, logging) | Nontaxable gasoline/diesel/kerosene (Lines 1–4) | Business use only; keep mileage/fuel logs. |

| Aviation Operators (commercial/nonprofit) | Aviation gasoline/kerosene (Lines 2, 5) | Registered aircraft; no personal flights. |

| Nonprofits & Governments | Sales to exempt entities (Lines 6–8) | Ultimate vendors must have buyer certificates. |

| Fuel Blenders/Producers | Biodiesel/SAF mixtures (Line 10); alternative fuels (Line 12) | IRS registration; ASTM/EPA compliance; certificates attached. |

| Exporters | Dyed fuels/gasoline blendstocks (Line 16) | Proof of export (e.g., bill of lading). |

| Individuals/Sole Proprietors | All, if business-related | Must attach new 2025 supporting statement for nontaxable uses. |

Exclusions: No claims for highway use, personal vehicles, or fuels sold/used after 2024 for biodiesel/renewable diesel mixtures (expired per Section 40A/6426). Partnerships report via Schedule K-1; can’t file directly. Penalty for frivolous claims: $5,000 (IRC 6702).

Recent Changes to IRS Form 4136 for Tax Year 2025

The IRS released the 2025 draft Form 4136 and instructions in December 2025, building on 2024’s anti-fraud measures. Key updates focus on scam prevention and expirations:

- New Mandatory Supporting Statement: For individuals claiming nontaxable uses of gasoline, aviation gasoline, undyed diesel, or kerosene on Form 1040, attach “Statement Supporting Fuel Tax Credit (FTC) Computation – 1.” This includes business details (name/EIN), vehicle/machinery info (make/model/type), and a table reconciling estimated vs. actual fuel costs/gallons. Failure delays processing; located in instructions page 9.

- Credit Expirations: Biodiesel, agri-biodiesel, renewable diesel mixture credits (Line 10), and alternative fuel credits expire for sales/uses after 2024. SAF credit ends September 30, 2025 (Line 10). Liquefied hydrogen ineligible since 2023.

- Registration Emphasis: All claimants on Lines 6–8, 10, 12, 13, 15 must have a Form 637 number; no claims without it.

- Inflation Adjustments: Fuel rates unchanged from 2024 (e.g., 24.4¢/gallon gasoline farm use), but Clean Fuel Production Credit (Section 45Z) starts January 1, 2025, at $1/gallon non-SAF (up to $1.75 SAF with wage/apprenticeship compliance)—separate from Form 4136 but related for producers.

- Scam Alerts: Fuel credits added to IRS “Dirty Dozen” list; social media promoters face heightened scrutiny.

These changes, per IR-2025-12, aim to curb improper claims amid rising fraud.

Step-by-Step Guide: How to Complete IRS Form 4136 for 2025

Download the 2025 draft from IRS.gov. Gather receipts, odometer logs, and certificates. Use tax software for calculations; attach to your return (e.g., Form 1040, line 72).

Preparation

- Verify eligibility and registration (Form 637).

- Complete the new FTC Computation Statement for nontaxable uses.

- For multiple businesses: Use Schedule A (Form 4136) per activity; total on Part II.

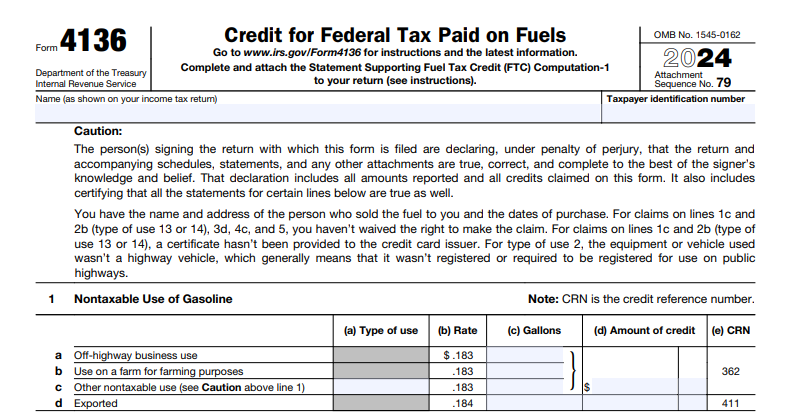

Part I: Nontaxable Use of Fuels (Lines 1–5)

Enter gallons in column (a), rate in (b), credit in (c). Type of use codes (1–16) from instructions (e.g., 1=farm, 2=off-highway business).

Example (Line 1 – Gasoline for Farming): 500 gallons × $0.244 = $122 credit.

| Line | Fuel Type | Common Uses (Type Codes) | 2025 Rate Examples |

|---|---|---|---|

| 1 | Gasoline | Farm (1), Off-highway (2), Export (3) | $0.244/gallon (farm); $0.183 (export) |

| 2 | Aviation Gasoline | Nontaxable aviation (9/10), Export (3) | $0.193/gallon |

| 3 | Undyed Diesel | Off-highway (2), Train (6), Export (3) | $0.244/gallon (most); $0.199 (bus) |

| 4 | Undyed Kerosene | Off-highway (2), Home heating ($0.243) | $0.244/gallon |

| 5 | Kerosene in Aviation | Commercial (5a: $0.218), Noncommercial (5c: $0.025) | Varies by use |

Part II: Other Credits (Lines 6–16)

- Lines 6–8: Sales to vendors/governments; attach buyer lists.

- Line 10: SAF/biodiesel; enter gallons, attach certificates (expires post-2024 for mixtures).

- Line 11: Alternative fuels (e.g., propane: $0.50/GGE); bus rate reduced.

- Line 12: Producer credit (first on Form 720).

- Line 13: Credit card issuers for government sales.

- Line 14: Diesel-water emulsion ($0.198/gallon).

- Line 15: Blending credit.

- Line 16: Exported dyed fuels ($0.244/gallon diesel).

Line 17: Total credit; enter on tax return.

Filing Tips

- Attach: Form 4136, supporting statement, certificates/waivers (e.g., Model P from Pub. 510).

- E-File: Preferred; paper to your service center.

- Deadlines: With return (April 15, 2026); extend via Form 4868.

- Records: Keep 3 years (receipts, logs); no submission needed.

Common Mistakes to Avoid When Filing Form 4136

Fuel credit scams are rampant—avoid these to prevent audits or penalties:

| Mistake | Why It Happens | How to Fix It |

|---|---|---|

| Skipping Supporting Statement | Overlooking 2025 requirement for individuals | Complete “FTC Computation – 1” and attach to Form 1040. |

| Claiming Highway Use | Mixing personal miles with business | Use logs to separate; only nontaxable qualifies. |

| No Registration | Forgetting Form 637 | Apply early; enter number on form or STOP. |

| Expired Credits | Claiming biodiesel post-2024 | Check instructions; use Section 45Z for new clean fuels. |

| Math Errors | Wrong rates/gallons | Use Pub. 510 rates; double-check with software. |

Why Claim the Fuel Tax Credit? Real-World Savings for 2025

A farmer using 10,000 gallons of diesel off-highway could reclaim $2,440 ($0.244/gallon), per IRS rates—enough for new equipment. With 2025’s clean fuel expansions under Section 45Z, producers gain up to $1.75/gallon for SAF, but Form 4136 remains key for traditional claims. Beware scams promising “everyone qualifies“—only business users do.

Final Thoughts: Maximize Your 2025 Fuel Tax Refund with Form 4136

IRS Form 4136 turns paid excise taxes into cash back for qualifying fuel uses, but 2025’s supporting statement and expirations demand diligence. Start with records, verify eligibility, and file accurately to avoid delays or penalties.

Download the 2025 draft instructions from IRS.gov and consult a tax pro for complex claims. For more on excise taxes, see Pub. 510. Questions on “fuel tax credit for farmers 2025“? Comment below!

This article is informational only—not tax advice. Consult a qualified professional for your situation.

IRS Form 4136 Download and Printable

Download and print: IRS Form 4136