Table of Contents

IRS Form 433-A – Collection Information Statement for Wage Earners and Self-Employed Individuals – In today’s complex tax landscape, dealing with IRS debt can be overwhelming. If you’re a wage earner or self-employed and facing collection actions, IRS Form 433-A—also known as the Collection Information Statement for Wage Earners and Self-Employed Individuals—plays a crucial role in communicating your financial situation to the IRS. This form helps the agency determine your ability to pay outstanding tax liabilities, potentially leading to options like installment agreements, offers in compromise, or temporary delays in collection. In this article, we’ll break down what Form 433-A is, who needs it, how to fill it out step by step, and key tips to avoid common pitfalls. We’ll draw from official IRS sources to ensure accuracy and relevance as of late 2025.

What Is IRS Form 433-A?

IRS Form 433-A is a detailed financial disclosure form that provides the IRS with a snapshot of your assets, income, expenses, and liabilities. It’s primarily used to evaluate whether you can pay your tax debt in full, partially, or not at all due to financial hardship. The form is essential for individuals seeking relief from IRS collection efforts, such as marking an account as “currently not collectible” (CNC) or negotiating an offer in compromise (OIC).

There are two main variants:

- Standard Form 433-A: For general collection purposes, like requesting installment agreements or CNC status. The latest revision is July 2024.

- Form 433-A (OIC): A specialized version for offers in compromise, revised in April 2025. This version includes calculations for your minimum offer amount based on asset equity and future income potential.

The purpose of both is to help the IRS assess your reasonable collection potential (RCP), which factors in your equity in assets and disposable income after allowable expenses. Failing to complete it accurately can delay relief or lead to unfavorable decisions.

Who Needs to File IRS Form 433-A?

Form 433-A is designed for:

- Wage Earners: Individuals who receive W-2 income from employers.

- Self-Employed Individuals: Those with business income, including sole proprietors, partners in partnerships, LLC members, or corporate officers with personal liability.

You may need to file if:

- You owe back taxes and can’t pay in full.

- You’re requesting a temporary delay in collection (CNC status) due to hardship.

- You’re applying for an installment agreement for debts over $50,000.

- You’re submitting an offer in compromise to settle debt for less than owed (using the OIC version).

Businesses typically use Form 433-B instead, but self-employed individuals with personal tax debts use 433-A. If you’re married, include your spouse’s information even if they’re not liable for the debt, as household finances are considered.

When Should You Use IRS Form 433-A?

Submit Form 433-A when the IRS requests it during collection proceedings or when proactively seeking relief. Common scenarios include:

- After receiving a collection notice or levy threat.

- To demonstrate financial hardship for CNC status, where collection is paused but interest and penalties accrue.

- As part of an OIC application, where you propose settling debt based on your RCP.

For OIC, eligibility requires filed returns, no open bankruptcy, and current estimated payments. Use the IRS Pre-Qualifier Tool to check viability. Note that while in review, collection activities are suspended, but the IRS may file a tax lien.

IRS Form 433-A Download and Printable

Download and Print: IRS Form 433-A

How to Fill Out IRS Form 433-A: Step-by-Step Guide

Filling out Form 433-A requires gathering financial documents like bank statements, pay stubs, and tax returns. Use U.S. dollars, round to the nearest whole number, and answer all questions or mark “N/A.” Here’s a breakdown:

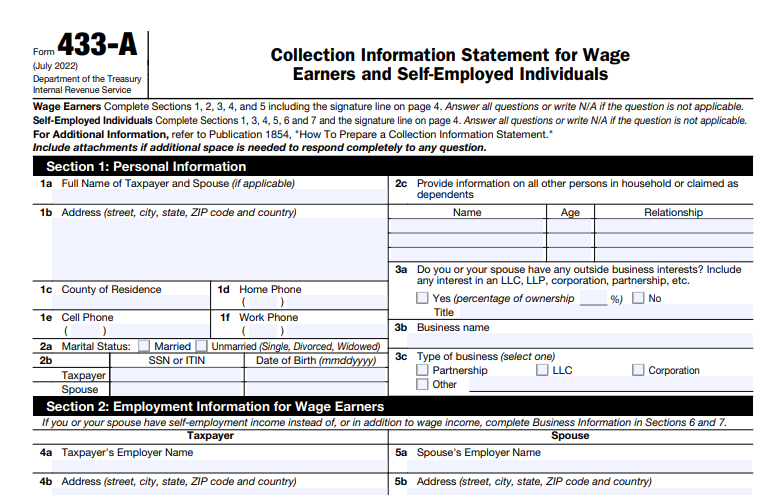

Section 1: Personal and Household Information

- Provide your name, SSN/ITIN, date of birth, marital status, address, and phone numbers.

- List dependents and any business interests.

- For self-employed, note if you have employees or partnerships.

Section 2: Employment Information for Wage Earners

- Enter employer details, occupation, and pay frequency (e.g., weekly, bi-weekly).

- If self-employed, skip to business sections.

Section 3: Other Financial Information

- Disclose lawsuits, bankruptcies, foreign assets, trusts, safe deposit boxes, or recent asset transfers. Be honest—omissions can lead to perjury charges.

Section 4: Personal Asset Information (Domestic and Foreign)

- List cash on hand, bank accounts (average balances), investments, digital assets (e.g., crypto), life insurance cash value, real estate, vehicles, and other valuables.

- Calculate equity by subtracting loans/encumbrances from fair market value.

- For OIC version, apply reductions (e.g., 80% of value for real property) and deductions (e.g., $3,450 per vehicle).

Section 5: Monthly Income and Expenses

- Income: Gross wages, business net income, rentals, pensions, etc.

- Expenses: Use IRS allowable standards for housing, utilities, food, clothing, medical, transportation, and child care. Don’t exceed national/local standards unless justified.

- Calculate disposable income (income minus expenses).

Sections 6-7: Business Information (Self-Employed Only)

- Detail business name, EIN, cash, receivables, assets, and payment processors.

- Provide gross receipts, expenses, and net business income using recent profit/loss statements (average over 3-12 months).

Additional Sections in Form 433-A (OIC)

- Section 8: Calculate minimum offer by adding asset equity and multiplied disposable income (12 or 24 months).

- Sign under penalty of perjury.

For self-employed, average fluctuating income over recent periods. Attach supporting docs if requested.

Required Documents and Verification for Form 433-A

The IRS may require verification post-submission, such as:

- Last 3 months’ pay stubs or business P&L statements.

- Bank statements (3 months personal, 6 months business).

- Investment and loan docs.

- Proof of expenses (bills, receipts).

For OIC, include Form 656, $205 fee (waived for low-income), and initial payment. Mail to the address in Form 656-B or submit online.

Common Mistakes to Avoid When Completing IRS Form 433-A

To ensure your form is processed smoothly:

- Underreporting Assets or Income: This can lead to rejection or audits. Include foreign and digital assets.

- Exceeding Allowable Expenses: Stick to IRS standards; overclaiming can reduce credibility.

- Incomplete Sections: Fill everything or explain why not.

- Not Attaching Docs: Proactive submission speeds review.

- Ignoring Spouse’s Info: Even if not liable, household finances matter.

- Miscalculating Equity: Use accurate market values and deductions.

From trusted tax law sources, common errors include forgetting asset transfers or using outdated forms.

Alternatives and Related IRS Forms

If Form 433-A doesn’t apply:

- Form 433-F: Simplified version for debts under $50,000.

- Form 433-B: For businesses.

- Form 433-A (OIC): Specifically for OIC, with built-in offer calculations.

Explore other relief like innocent spouse relief or hardship withdrawals if applicable.

Final Thoughts on IRS Form 433-A

Navigating IRS Form 433-A can unlock tax relief options for wage earners and self-employed individuals struggling with debt. By providing a clear financial picture, you empower the IRS to make informed decisions on payment plans or settlements. However, accuracy is key—consult a tax professional or use IRS resources like Publication 1854 for guidance. If you’re considering an OIC, remember it’s not guaranteed; explore all alternatives first.

For the latest updates, visit the IRS website or call 800-829-1040. Handling tax issues promptly can prevent escalation, so act today to secure your financial future.