Table of Contents

IRS Form 433-A (OIC) – Collection Information Statement for Wage Earners and Self-Employed Individuals – Tax debt can spiral quickly with penalties and interest, but relief options like installment agreements, currently not collectible status, or an Offer in Compromise (OIC) provide a lifeline for struggling taxpayers. Central to proving your financial hardship is IRS Form 433-A (OIC)—the Collection Information Statement for Wage Earners and Self-Employed Individuals. This detailed form reveals your income, expenses, assets, and equity, helping the IRS assess your ability to pay. For 2025, with the revised April edition emphasizing streamlined OIC calculations and low-income waivers, Form 433-A (OIC) is key for OIC applicants, boasting acceptance rates around 25-35% for viable cases. This SEO-optimized guide, based on the latest IRS resources, covers eligibility, step-by-step completion, and tips to strengthen your application amid updated standards for reasonable collection potential (RCP).

What Is IRS Form 433-A (OIC)?

IRS Form 433-A (OIC) is a comprehensive financial disclosure required for individuals (wage earners or self-employed) seeking tax relief, particularly an OIC under IRC Section 7122. It calculates your RCP—net equity in assets plus future disposable income—to determine if the IRS can collect the full debt reasonably. Unlike the shorter Form 433-F (for initial inquiries), the OIC version (Rev. 4-2025) spans 8 pages, integrating income/expense analysis with asset valuation for OIC proposals.

Key purposes:

- OIC Qualification: Proves Doubt as to Collectibility (can’t pay full) or Effective Tax Administration (hardship/unfairness).

- Relief Pathways: Supports installment agreements, partial payment plans, or CNC status.

- Self-Employed Focus: Includes business income/expenses for Schedule C filers.

The April 2025 revision (Catalog No. 55896Q) refines RCP multipliers (12 for lump-sum, 24 for periodic offers) and aligns with Pub. 656 (OIC Booklet). Download the PDF from IRS.gov/pub/irs-pdf/f433aoi.pdf for the full form and instructions.

Who Needs to File IRS Form 433-A (OIC) in 2025?

Submit Form 433-A (OIC) if applying for an OIC via Form 656, or when requested for other relief like a partial payment installment agreement (PPIA) or CNC. It’s mandatory for individuals with business income; spouses file jointly if shared liability.

| Scenario | Filing Required? | Details |

|---|---|---|

| OIC Applicants | Yes | Attach to Form 656; proves RCP < debt for Doubt as to Collectibility. |

| Installment Agreements/PPIA | If requested | For debts >$50K; shows affordability beyond standard plans. |

| CNC Status | Often | If hardship; IRS may request for verification. |

| Self-Employed | Yes | Include Schedule C details; wage earners skip business sections. |

| Exemptions | Businesses use 433-B (OIC) | Joint filers complete one form; no need for Doubt as to Liability (use 656-L). |

Pre-qualify via IRS OIC Tool; low-income (AGI ≤$62K single/$125K joint) waives $205 fee. Non-filers or in bankruptcy? Resolve first.

Filing Deadlines and Submission for Form 433-A (OIC) in 2025

No fixed deadline—submit with Form 656 anytime, but apply before collections escalate (e.g., liens). OIC processing: 6-24 months; respond to IRS requests within 15 days.

- With OIC: Include in Form 656-B package; online via IRS.gov/account or mail to Centralized OIC Unit (Kansas City, MO 64999).

- Standalone Relief: Mail to revenue officer or service center per notice.

- Extensions: None formal; request via letter for good cause.

- Electronic Options: Upload docs via IRS Online Account; full e-filing for OIC in pilot phase.

Certified mail for proof; track via “Where’s My OIC?” on IRS.gov.

Step-by-Step Guide to Completing IRS Form 433-A (OIC)

The 8-page form demands accuracy—use Pub. 656 for standards. Gather 3 months’ bank statements, pay stubs, bills, and appraisals.

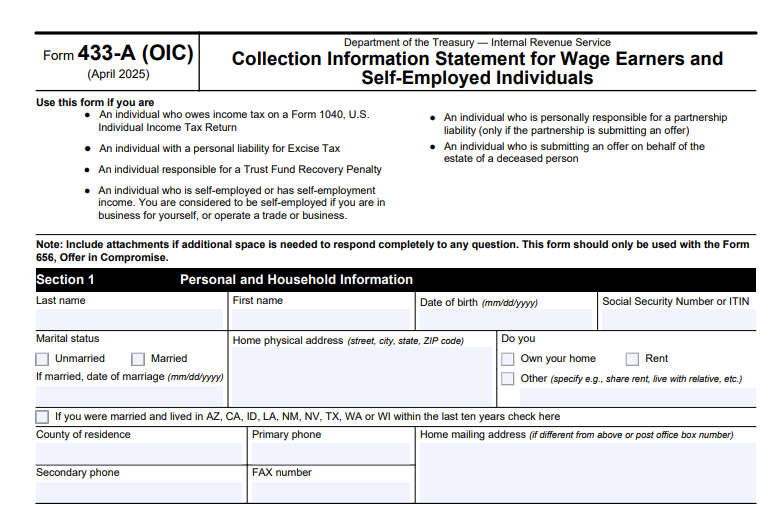

- Section 1: Personal/Household Info – Names, DOBs, SSNs, dependents, marital status, contact.

- Section 2: Employment/Self-Employment – Job details, income (wages, business gross/net); attach P&Ls for self-employed.

- Section 3: Income/Expenses – Monthly totals: Wages (line 5), net business (11), other (e.g., alimony 14); allowable expenses (housing 19-20, food 21, transport 22-23, healthcare 24, etc.) per national/local standards.

- Section 4: Assets/Equity – Real property (values, loans, equity); personal (vehicles, bank accounts, investments, life insurance cash value); required liquidation unless hardship.

- Section 5: Release of Claims – Sign to allow IRS verification.

- Section 6: Tax Returns Filed – Certify all filed/paid current.

- Section 7: Offer Terms – Propose amount (min RCP); payment type (lump-sum/periodic).

- Section 8: Signature – Under perjury; spouse if joint.

Calculate RCP in Section 9: Assets equity + (monthly disposable × 12/24). Submit with $205 fee/initial payment.

Key Sections of IRS Form 433-A (OIC) Explained

The form’s structure uncovers your full picture—focus on accuracy to avoid rejection.

| Section | Focus | 2025 Tip |

|---|---|---|

| 2: Income | Wages, business net, rentals | Use 3 months’ averages; self-employed: Gross – expenses (attach P&L). |

| 3: Expenses | Allowable living costs | National standards: $800/month food (family of 4); justify deviations (e.g., medical). |

| 4: Assets | Equity in real/personal property | Appraise vehicles/investments; release liens for equity >$0. |

| 9: RCP Calculation | Min offer | Lump-sum: Equity + 12×disposable; periodic: Equity + 24×disposable/12. |

Disposable income = Income – allowable expenses; IRS rejects if RCP ≥ debt.

IRS Form 433-A (OIC) Download and Printable

Download and Print: IRS Form 433-A (OIC)

Recent Updates to IRS Form 433-A (OIC) for 2025

The April 2025 revision (Rev. 4-2025) refines OIC-specific calculations:

- RCP Multipliers: Clarified 12/24 months for lump-sum/periodic; aligns with Pub. 656 updates.

- Low-Income Waiver: Expanded AGI charts (e.g., $62K single) for $205 fee exemption.

- Digital Submission: Enhanced upload via Online Account; pilot e-forms for full OIC.

- Section 965(h): Added repatriation tax references for global filers.

These changes, per IRM 5.8.1, boost processing efficiency amid 25-35% acceptance rates.

Common Mistakes When Filing Form 433-A (OIC) and How to Avoid Them

Rejections often stem from incomplete forms—top errors:

- Underreported Assets: Omitting bank accounts/life insurance—list all, even low-value.

- Inflated Expenses: Exceeding standards without proof—attach bills; use IRS allowances.

- Inaccurate Income: Averages too low—use 3 months’ data; self-employed: Verify P&L.

- Missing Docs: No statements/appraisals—scan/upload 3 months’ financials.

- Wrong Version: Using standard 433-A for OIC—download OIC-specific from Pub. 656.

Pre-qualify; pros increase approval 50%.

Penalties and Risks of an Incomplete Form 433-A (OIC)

No direct penalty for filing, but:

- Rejection/Delay: Incomplete = return without review; 6-24 month wait.

- Collections Resume: If rejected, liens/levies restart.

- Fraud: False statements = perjury (up to 5 years prison); audits.

- Default on Accepted OIC: Full debt revives + interest.

Appeal rejections via Form 13711; alternatives like IA if denied.

Frequently Asked Questions About IRS Form 433-A (OIC)

What’s the difference between Form 433-A and 433-A (OIC)?

Standard 433-A for IA/CNC; OIC version adds RCP calc for settlements.

Do I need Form 433-A (OIC) for business debts?

No—use 433-B (OIC); individuals with Schedule C include in 433-A.

How to calculate disposable income on the form?

Income – national/local standards (Pub. 656); justify extras.

Can I e-file Form 433-A (OIC) in 2025?

Upload docs online; full e-OIC pilot expanding.

What’s the OIC acceptance rate in 2025?

25-35%; higher with complete 433-A (OIC).

Visit IRS.gov/oic for more.

Final Thoughts: Strengthen Your OIC with IRS Form 433-A (OIC) in 2025

IRS Form 433-A (OIC) is your financial blueprint for tax relief, proving hardship to unlock settlements below full debt—vital for wage earners facing RCP scrutiny. With the April 2025 revision’s refined calculations and online uploads, accuracy is paramount; download from IRS.gov today, attach verifiable docs, and consult a pro for 50%+ approval boost. OIC isn’t easy, but a solid 433-A (OIC) tips the scales.

This article is informational only—not tax advice. Verify with IRS or a professional.