Table of Contents

IRS Form 433-B (OIC) – Collection Information Statement for Businesses – Business tax debt can cripple operations, from payroll shortfalls to accumulated liabilities threatening solvency. For corporations, partnerships, and LLCs facing overwhelming IRS balances, the Offer in Compromise (OIC) program offers a potential lifeline—settling for less than owed if full collection isn’t feasible. But proving that requires IRS Form 433-B (OIC), the Collection Information Statement for Businesses, which unveils your financials to calculate reasonable collection potential (RCP). For 2025, with the April revision emphasizing asset equity at 80% FMV and 12/24-month income projections, this form is pivotal for OIC success, where business acceptance rates align with the overall 25-35% program average. This SEO-optimized guide, based on the latest IRS resources, covers eligibility, step-by-step filing, and strategies to bolster your application amid stricter RCP scrutiny.

What Is IRS Form 433-B (OIC)?

IRS Form 433-B (OIC) is the business counterpart to Form 433-A (OIC), a detailed financial disclosure for OIC applicants under IRC Section 7122. It assesses RCP—net asset equity plus future disposable income—to justify settling debts for less, typically under Doubt as to Collectibility (can’t pay full) or Effective Tax Administration (hardship/unfair). Spanning 8 pages, it covers business structure, income/expenses, assets, and affiliates, enabling IRS evaluators to verify solvency.

Key purposes:

- OIC Support: Proves RCP < debt; required with Form 656.

- Relief Alternatives: Aids partial payment installment agreements (PPIA) or currently not collectible (CNC) status.

- Business-Specific: Tailored for entities like S-Corps, partnerships, and LLCs (corporation-classified).

The April 2025 revision (Catalog No. 55897B) refines RCP calculations (e.g., 80% FMV for quick-sale equity) and aligns with Pub. 656 updates for income-producing assets. Download the PDF from IRS.gov/pub/irs-pdf/f433boi.pdf, including instructions.

Who Needs to File IRS Form 433-B (OIC) in 2025?

Business entities (corporations, partnerships, LLCs taxed as such) must file if submitting an OIC via Form 656, or when requested for PPIA/CNC. Sole proprietors use Form 433-A (OIC). Approval requires current compliance—no open bankruptcies or unfiled returns.

| Entity Type | Filing Required? | Details |

|---|---|---|

| Corporations (C/S) | Yes | For payroll, corporate tax debts; include shareholder info if >10% ownership. |

| Partnerships/LLCs | Yes | Report partner/member details; aggregate for joint OIC with individuals. |

| PPIA/CNC Applicants | If >$50K debt | IRS requests for long-term plans; shows affordability. |

| Sole Proprietors | No—use 433-A (OIC) | Business income goes on individual form. |

| Exemptions | Doubt as to Liability | Use Form 656-L—no financial statement. |

Pre-qualify via IRS OIC Tool; low-income businesses (per Pub. 656 chart) waive $205 fee. Businesses must cease operations for some SBA EIDL OICs, but IRS OIC allows ongoing viability if RCP low.

Filing Deadlines and Submission for Form 433-B (OIC) in 2025

Submit with Form 656 anytime—no deadline, but before liens/levies. OIC processing: 6-24 months; respond to IRS queries within 15 days.

- With OIC: Include in Form 656-B package; online via IRS.gov/account or mail to Centralized OIC Unit (Kansas City, MO 64999-0005).

- Standalone: Per revenue officer notice; email/upload secure.

- Extensions: Informal via letter; no formal process.

- Electronic: Upload via Online Account; full e-OIC pilot expanding.

Certified mail for proof; track at IRS.gov/oic.

Step-by-Step Guide to Completing IRS Form 433-B (OIC)

Accuracy is crucial—use Pub. 656 standards. Gather 3 months’ statements, P&Ls, appraisals, and legal docs.

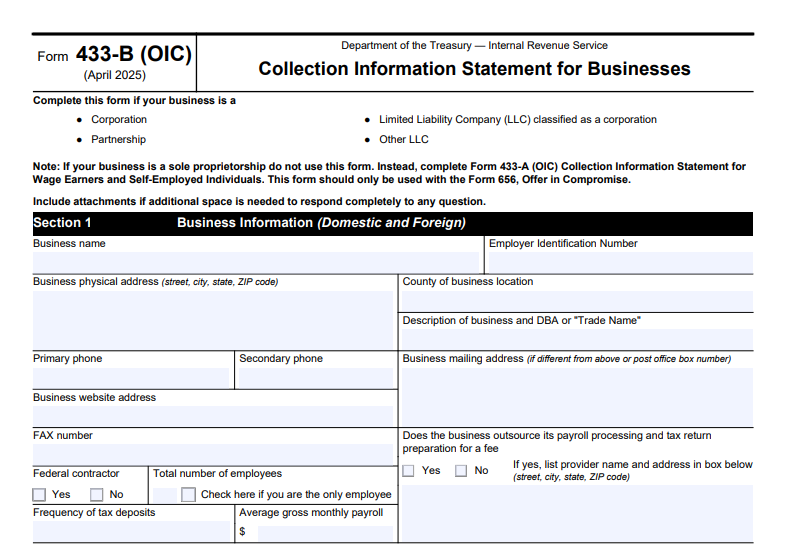

- Section 1: Business Info – Entity name, EIN, address, type (Corp/Partnership), years in business, NAICS code.

- Section 2: Ownership/Affiliates – List partners/officers (>10% owners), related entities; disclose transfers >$10K in 10 years.

- Section 3: Income/Expenses – Gross/monthly (line 5), net profit (11), other (e.g., rentals 14); allowable expenses (COGS 19, rent 20, utilities 21, etc.) per standards.

- Section 4: Assets/Equity – Real property (FMV, loans, 80% equity); personal (vehicles, accounts receivable, inventory); liquidate unless hardship.

- Section 5: Release of Claims – Authorize IRS verification.

- Section 6: Tax Compliance – Certify returns filed/current payments.

- Section 7: Offer Terms – Propose min RCP; payment type.

- Section 8: Signature – Authorized rep signs; under perjury.

RCP in Section 9: Equity + (disposable ×12/24). Submit with $205 fee/20% initial payment.

Key Sections of IRS Form 433-B (OIC) Explained

The form exposes business viability—precise data avoids rejection.

| Section | Focus | 2025 Tip |

|---|---|---|

| 2: Ownership | Affiliates, transfers | Disclose >10% owners; flag undervalued sales to avoid fraud flags. |

| 3: Income/Expenses | Gross/net, COGS | 3-month averages; justify above-standards (e.g., high utilities with bills). |

| 4: Assets | Equity at 80% FMV | Appraise inventory/AR; exclude income-producing except real estate. |

| 9: RCP | Min offer | Lump-sum: Equity +12×disposable; periodic: Equity + (24×disposable)/12. |

Disposable = Income – standards; IRS rejects if RCP ≥ debt.

IRS Form 433-B (OIC) Download and Printable

Download and Print: IRS Form 433-B (OIC)

Recent Updates to IRS Form 433-B (OIC) for 2025

The April 2025 revision (Rev. 4-2025) enhances business OIC efficiency:

- Equity Calc: Explicit 80% FMV for quick-sale; excludes income-producing assets (except realty) from RCP.

- Transfer Scrutiny: Expanded questions on 10-year asset transfers >$10K.

- Digital Tools: Online upload integration; pilot e-forms for full OIC.

- Pub. 656 Alignment: Updated multipliers (12/24 months); low-income charts expanded.

These, per IRM 5.8.1, support 25-35% acceptance, with businesses facing higher scrutiny for solvency.

Common Mistakes When Filing Form 433-B (OIC) and How to Avoid Them

Rejections hit 65-75%—common errors:

- Undervalued Assets: Lowballing inventory/AR—use appraisals/P&Ls.

- Excess Expenses: Non-allowable (e.g., luxuries)—stick to standards; document deviations.

- Incomplete Affiliates: Omitting >10% owners—list all for transparency.

- Outdated Financials: Stale statements—provide 3 months’ current.

- Wrong Version: Using standard 433-B for OIC—grab OIC-specific.

Pre-qualify; enrolled agents boost odds 50%.

Penalties and Risks of an Incomplete Form 433-B (OIC)

No filing penalty, but:

- Rejection/Delay: Incomplete = auto-return; 6-24 months lost.

- Collections Resume: Liens/levies if denied.

- Fraud: False info = perjury (5 years prison); audits.

- OIC Default: Full debt revives + interest.

Appeal via Form 13711 (30 days); PPIA as fallback.

Frequently Asked Questions About IRS Form 433-B (OIC)

When is Form 433-B (OIC) required?

With Form 656 for business OIC; optional for PPIA/CNC if requested.

How does RCP work for businesses?

Equity (80% FMV – loans) + disposable income ×12/24 months.

Can ongoing businesses get OIC?

Yes—if RCP low; ceased operations easier but not required.

Is e-filing available in 2025?

Upload docs online; full e-OIC pilot for businesses.

What’s the business OIC success rate?

25-35%, like overall; higher with complete forms.

Visit IRS.gov/oic for more.

Final Thoughts: Empower Your Business OIC with IRS Form 433-B (OIC) in 2025

IRS Form 433-B (OIC) is the financial cornerstone of business tax relief, quantifying hardship to secure OIC settlements below full debt—crucial for solvency amid 25-35% acceptance rates. The April 2025 revision’s 80% FMV equity and online uploads make it more accessible; download from IRS.gov today, verify with P&Ls/appraisals, and engage pros for 50%+ odds. OIC revives businesses— a robust 433-B (OIC) revives your case.

This article is informational only—not tax advice. Verify with IRS or a professional.