Table of Contents

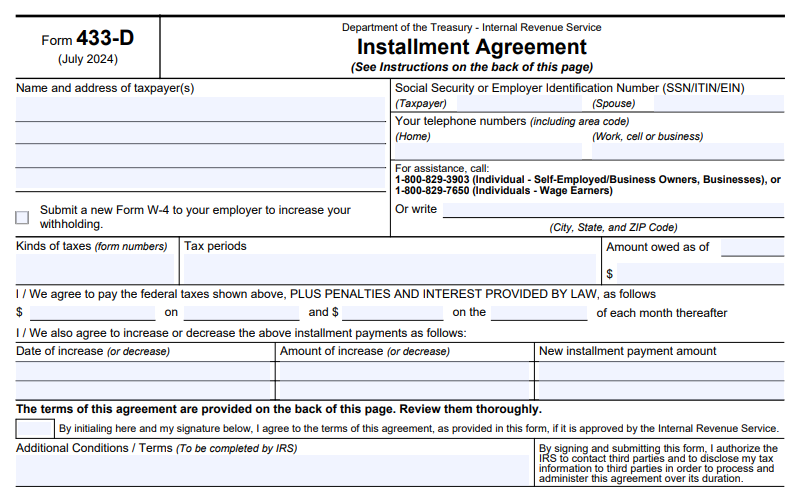

IRS Form 433-D – Installment Agreement – If you’re facing a tax bill you can’t pay in full, an IRS installment agreement (also called a payment plan) allows you to pay your debt over time in manageable monthly payments. IRS Form 433-D, titled “Installment Agreement,” is the official document that formalizes this arrangement between you and the IRS.

This SEO-optimized guide explains what Form 433-D is, when it’s used, how to complete it, eligibility requirements, fees, and alternatives like online applications. Information is based on current IRS guidelines as of late 2025.

What Is IRS Form 433-D?

IRS Form 433-D is the Installment Agreement form that establishes a formal payment plan for federal taxes owed, including penalties and interest. It outlines:

- The taxes and periods covered

- Monthly payment amounts

- Due dates

- Payment methods (often direct debit)

Taxpayers sign the form to agree to the terms, and the IRS approves it to make the plan official.

Unlike Form 9465 (Installment Agreement Request), which you use to apply for a plan, Form 433-D is the binding agreement document. The IRS often prepares and sends it for signature in certain cases, especially for direct debit or payroll deduction plans.

When Is Form 433-D Used?

The IRS uses Form 433-D primarily in these situations:

- Direct Debit Installment Agreements (DDIA) → Payments automatically withdraw from your bank account.

- Payroll Deduction Agreements → Payments deduct directly from your wages.

- Manually processed agreements → When the IRS proposes specific terms based on your financial information (e.g., via Collection Information Statement).

- Agreements secured through phone, mail, or in-person contact (rather than fully online).

Many taxpayers never see Form 433-D because they apply online and get instant approval without a signed document. However, if your case requires manual review or direct debit setup, you may receive Form 433-D to sign and return.

Types of IRS Installment Agreements

The IRS offers several payment plan options:

- Short-term payment plan — Pay in full within 180 days (no setup fee for individuals owing less than $100,000).

- Long-term payment plan — Monthly installments for larger balances or longer periods.

- Simple/Streamlined — For individuals owing $50,000 or less (tax, penalties, interest combined).

- Partial Payment Installment Agreement (PPIA) — Payments less than full ability if financial hardship exists.

- Direct Debit — Required for some higher-balance plans; often lower fees.

Businesses can qualify for plans owing $25,000 or less online.

Eligibility Requirements for Installment Agreements

To qualify:

- File all required tax returns.

- Be current on estimated tax payments (if applicable).

- Owe within limits for streamlined plans ($50,000 or less for individuals).

- Demonstrate ability to pay over time.

The IRS may request financial statements (Forms 433-F or 433-A/B) for non-streamlined cases.

IRS Form 433-D Download and Printable

Download and Print: IRS Form 433-D

How to Apply for an IRS Payment Plan

Most taxpayers apply online via the IRS Online Payment Agreement tool for fastest approval.

Alternatives:

- Submit Form 9465 (Installment Agreement Request) by mail or with your tax return.

- Call the IRS (800-829-1040 for individuals).

- Work with an IRS revenue officer if already in collections.

If approved manually, you may receive Form 433-D to sign.

How to Complete IRS Form 433-D (Step-by-Step)

If you receive Form 433-D:

- Enter taxpayer name(s), address, SSN/EIN, and contact info.

- List tax types, periods, and amounts owed.

- Specify proposed monthly payment and due date (1st–28th).

- Provide bank details for direct debit (recommended for lower fees).

- Review terms on the back, initial, and sign.

- Attach a voided check if using direct debit.

- Mail to the address provided by the IRS.

Key Terms and Conditions of Form 433-D

By signing:

- Agree to make timely payments.

- File all future returns and pay taxes on time.

- Allow IRS to apply refunds to your debt.

- Accept potential filing of a Federal Tax Lien.

- Permit changes if your financial situation improves.

The agreement stays in effect until paid in full or the collection statute expires. Default can lead to termination and collection actions like levies.

Installment Agreement Fees (2025)

Setup fees vary by method and payment type:

- Online Direct Debit — $22 (often waived for low-income).

- Online non-direct debit — $69.

- Phone/mail/in-person — Up to $178 (non-direct debit) or $107 (direct debit).

- Low-income taxpayers (≤250% federal poverty guidelines) — Reduced to $43 or waived/reimbursed.

- Reinstatement after default — Additional fees may apply.

Interest and penalties continue accruing until the balance is zero.

Tips for Getting Your Installment Agreement Approved

- Apply online if eligible for lower fees and faster processing.

- Propose a realistic payment amount.

- Set up direct debit to avoid higher fees.

- Stay compliant with future filings and payments.

- Provide requested financial info promptly.

Frequently Asked Questions About Form 433-D and Installment Agreements

Do I need to file Form 433-D to get a payment plan?

No—most use the online tool or Form 9465. Form 433-D is for formalizing certain agreements.

Can I change my payment amount later?

Yes, revise online or contact the IRS.

What if I default on the agreement?

The IRS may terminate it and resume collection actions. Reinstatement is possible with fees.

Is a tax lien filed automatically?

Not always, but possible for larger balances.

For the latest details, visit IRS.gov/payments or download Form 433-D (Rev. July 2024).

Setting up an installment agreement can provide peace of mind and prevent aggressive collection actions. Apply today if you owe taxes you can’t pay immediately. Always consult a tax professional for personalized advice.