Table of Contents

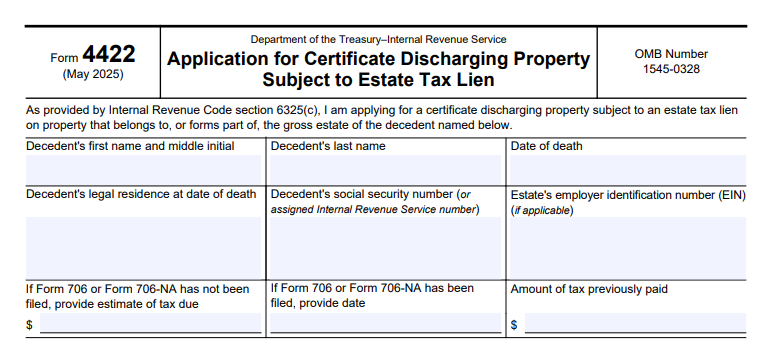

IRS Form 4422 – Application for Certificate Discharging Property Subject To Estate Tax Lien – Estate administration can hit roadblocks when selling or transferring property, thanks to the automatic federal estate tax lien that attaches at death under IRC Section 6324. For executors, beneficiaries, or buyers dealing with estates required to file Form 706, IRS Form 4422—Application for Certificate Discharging Property Subject to Estate Tax Lien—offers a solution. This form requests IRS clearance to release specific assets from the lien, enabling smooth transactions without compromising the government’s interest in unpaid taxes. In 2025, with the federal estate tax exemption at $13.99 million, fewer estates face filing requirements, but those that do (about 0.1% of decedents) must navigate liens carefully to avoid delays. This SEO-optimized guide, updated with the May 2025 revision (Catalog No. 41642G), provides step-by-step filing advice, deadlines, and tips based on official IRS resources to keep your estate settlement on track.

What Is IRS Form 4422?

IRS Form 4422 is a one-page application allowing executors, administrators, beneficiaries, or purchasers to request a certificate discharging specific property from the statutory estate tax lien. The lien automatically arises upon death on all gross estate assets, lasting 10 years or until taxes are paid, to secure potential liabilities. Approval doesn’t forgive taxes—it simply clears title for the targeted property, often by escrowing proceeds or confirming adequate security elsewhere.

Key purposes:

- Clear Title for Sales: Essential for real estate closings, refinancings, or transfers where title companies demand lien release.

- Protect Buyer Interests: Ensures the purchaser takes property free of IRS claims.

- Estate Liquidity: Allows monetizing assets to pay debts or taxes without full lien satisfaction.

The May 2025 revision (Rev. 5-2025) clarifies submission via fax and aligns with post-2016 procedural changes emphasizing escrow for taxable estates. Download the form and related guidance from IRS.gov/Form4422.

Who Needs to File IRS Form 4422 in 2025?

File if the estate requires Form 706 (gross estate + gifts > $13.99 million) or Form 706-NA (nonresidents with U.S. assets >$60,000), and you’re selling or transferring lien-attached property. No filing for small estates below thresholds—liens don’t apply.

| Scenario | Filing Required? | Notes |

|---|---|---|

| Form 706 Estate Selling Real Estate | Yes | Executor applies; escrow proceeds if tax estimated > net sale. |

| Nonresident with U.S. Property | Yes (Form 706-NA) | Use transfer certificate if no U.S. executor. |

| Refinancing Estate Assets | Yes | Lender requires clean title. |

| No 706 Filing (Under Exemption) | No, but optional | Request Letter 1352 via Form 4422 for confirmation. |

| Income Tax Liens (Not Estate) | No | Use Form 14135 instead. |

Appoint a U.S.-based executor; otherwise, seek a transfer certificate. Contact the Estate Tax Advisory Group at (669) 229-1504 for questions.

Filing Deadlines and Submission for Form 4422

No fixed statutory deadline, but submit at least 45 days before the needed certificate date (e.g., closing) for IRS review—processing takes 30–45 days. Delays risk transaction fallout.

- No Extensions: File timely; late submissions may require escrow or payment to expedite.

- Where to Submit:

- Mail: Internal Revenue Service, Advisory Estate Tax Lien Group, 55 South Market St., Mail Stop 5350, San Jose, CA 95113-2324, Attn: Group Manager.

- Fax: 877-477-9243 (preferred for speed).

- Related Forms: Attach Form 4768 if extending 706 filing/payment; Form 15056 for escrow agreements.

For 2025 decedents, align with the 9-month 706 deadline—pre-file if sales are imminent.

Step-by-Step Guide to Completing IRS Form 4422

The form is simple but requires robust attachments. Use the May 2025 PDF; no e-filing—paper/fax only.

- Line 1: Decedent Info – Name, address, SSN, death date.

- Line 2: Applicant Details – Name, address, relationship (e.g., executor), phone; attorney info if applicable.

- Line 3: Property Description – Detailed info (e.g., “123 Main St., legal description”); value, valuation basis (attach appraisal, title report).

- Line 4: Transaction Details – Sale/refinance purpose; attach contract, proposed closing statement.

- Line 5: Gross Estate Estimate – Total value, deductions; attach draft Form 706 or asset inventory.

- Line 6: Tax Estimate – Projected liability; note payments/escrows.

- Line 7: Remaining Assets – List other lien-subject property/values to secure IRS interest.

- Signature: Applicant signs under perjury; date and title.

Attachments Checklist:

- Letters testamentary/will.

- Property appraisal/legal description.

- Sale contract/closing statement.

- Draft Form 706 or asset list.

- Escrow agreement (Form 15056) if required.

Review IRM 5.5.8 for IRS considerations.

How the IRS Processes Form 4422 Requests

Upon receipt, the Advisory Estate Tax Lien Group reviews for adequate security (e.g., remaining assets ≥ 2x liability per IRC §6325(b)).

- Approval: Issues Certificate on Form 792 if lien discharged; proceeds to escrow if partial.

- Escrow Requirement: For taxable estates, net proceeds held via Form 15056 until 706 closing letter.

- No Tax Due: Letter 1352 confirms no lien for sub-exemption estates.

- Denial: Rare; if liability unsecured, pay/escrow full amount.

Processing: 30–45 days; fax for faster turnaround.

Escrow Agreements and Securing the Lien on Form 4422

Post-2016, taxable estates often escrow proceeds under Form 15056—a tri-party agreement (IRS, estate, agent) holding funds until tax clearance. If estimated tax > net proceeds, escrow 100%; otherwise, discharge without if other assets suffice.

| Scenario | Escrow Needed? |

|---|---|

| Tax > Proceeds | Yes, full net amount. |

| Proceeds Cover Tax | Optional; pay IRS directly. |

| No Tax Due | No; Letter 1352 suffices. |

Agents must be banks/attorneys; funds released post-closing letter.

IRS Form 4422 Download and Printable

Download and Print: IRS Form 4422

Common Mistakes When Filing Form 4422 and How to Avoid Them

Title freezes often stem from incomplete packets—avoid these:

- Insufficient Lead Time: Submit <45 days—plan 60+ for safety.

- Incomplete Attachments: Missing appraisals/contracts—use checklists from Pub. 783.

- Inaccurate Valuations: Over/understating estate—attach professional appraisals.

- Wrong Lien Type: Using for income liens—reserve for estate only.

- No Escrow Plan: For taxable sales—draft Form 15056 upfront.

Engage estate attorneys early; fax submissions cut wait times.

Penalties and Risks of Delaying Form 4422 Approval

No direct penalties for Form 4422, but unresolved liens risk:

- Transaction Delays: Closings halted, buyers walk.

- Interest Accrual: On unpaid estate taxes (0.5%/month post-due).

- Lien Enforcement: IRS seizure after 10 years if unpaid.

- Personal Liability: Executors liable for negligence under §6324.

Mitigate with timely 706 filing and escrow—reasonable cause waives some interest.

Frequently Asked Questions About IRS Form 4422

Do I need Form 4422 if the estate is under $13.99 million?

No lien exists—request Letter 1352 via the form for confirmation.

How long does IRS approval take in 2025?

30–45 days; fax to expedite.

What’s the difference between Form 4422 and Form 14135?

4422 for estate liens; 14135 for general federal tax liens.

Can buyers file Form 4422?

Yes, purchasers may apply jointly with executors.

Is e-filing available?

No—mail or fax only.

For more, visit IRS.gov/Form4422.

Final Thoughts: Streamline Estate Closings with IRS Form 4422 in 2025

IRS Form 4422 empowers executors to unlock estate assets without full tax resolution, safeguarding transactions amid the $13.99 million exemption. With the May 2025 updates emphasizing fax submissions and escrow clarity, proactive filing prevents costly stalls. Download the form from IRS.gov today, assemble your packet 60 days early, and consult an estate tax specialist to navigate liens seamlessly.

Estate planning is about legacy—don’t let liens derail it.

This article is informational only—not tax advice. Verify with IRS or a professional.