Table of Contents

IRS Form 4506 – Request for Copy of Tax Return – Are you in need of a duplicate copy of your previously filed tax return? Whether it’s for a loan application, legal proceedings, or simply replacing a lost document, IRS Form 4506 is your go-to tool for obtaining an exact replica from the Internal Revenue Service (IRS). As of 2025, this form remains a reliable option for taxpayers seeking certified or uncertified copies of returns filed up to seven years prior. In this comprehensive guide, we’ll walk you through everything you need to know about IRS Form 4506, including how to fill it out, fees, processing times, and smarter alternatives. Optimized for quick answers on “how to request a copy of tax return” and “Form 4506 instructions 2025,” this article draws from official IRS resources to ensure accuracy.

What Is IRS Form 4506?

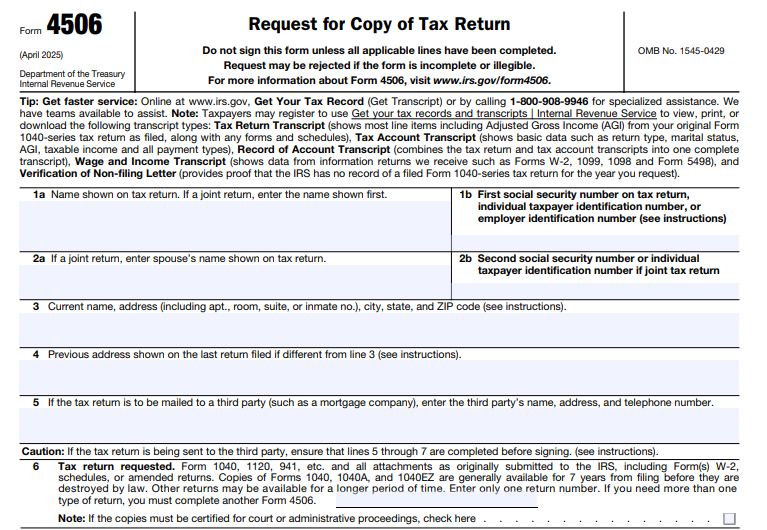

IRS Form 4506, Request for Copy of Tax Return, allows individuals, businesses, and authorized third parties to request a photocopy of a tax return exactly as it was originally filed, including all attachments like W-2s, schedules, and amended forms. Unlike summaries or transcripts, this form provides a full, unaltered duplicate—ideal for scenarios requiring the original document’s integrity.

Key features include:

- Availability: Copies of Forms 1040, 1040A, and 1040EZ are accessible for the current tax year and up to seven years back. Other return types (e.g., business forms like 1120 or 941) may be available longer.

- Third-Party Designation: You can direct the IRS to send the copy to a mortgage lender, attorney, or other authorized recipient.

- Certification Option: For court or administrative use, request certified copies by checking the appropriate box.

The latest revision of Form 4506 (Rev. April 2025) was released on August 28, 2025, ensuring compliance with current IRS protocols. Download it directly from the IRS website at irs.gov.

When Should You Use IRS Form 4506?

Opt for Form 4506 when a complete, verbatim copy of your tax return is essential. Common situations include:

- Financial Applications: Lenders often require exact copies for mortgage approvals or refinancing.

- Legal or Audit Needs: Attorneys, courts, or IRS audits may demand the original filed version.

- Lost Records: If you’ve misplaced your copy and need a replacement for personal records.

- Business Compliance: Corporations or partnerships requesting prior-year returns for regulatory filings.

However, if you only need key financial data (like income or deductions) without the full document, consider free transcript options instead—more on that later. Remember, Form 4506 is not for current-year unprocessed returns; wait until your filing is fully reflected in IRS systems.

How to Complete IRS Form 4506: Step-by-Step Instructions

Filling out IRS Form 4506 is straightforward but requires precision to avoid delays. Estimated completion time: 16 minutes for preparation, plus 10 minutes to review instructions. Here’s a line-by-line breakdown:

- Line 1: Taxpayer Identification

Enter the primary name (first name for joint filers) and SSN/ITIN/EIN as shown on the original return. - Line 2: Spouse’s Information (Joint Returns Only)

Add the spouse’s name and second SSN/ITIN. - Line 3: Current Address

Provide your mailing address, including any P.O. box, apartment, or inmate number if applicable. - Line 4: Previous Address

List the address from your last filed return if it’s different; update your address officially via Form 8822 if needed. - Line 5: Third-Party Delivery

If sending to someone else (e.g., a bank), include their name, address, and phone number. Complete this before signing. - Line 6: Return Details

Specify the form type (e.g., “1040”) and request all attachments. Limit to one return type per form—use multiples for different types. - Line 7: Tax Year/Period

Enter the ending date in MM/DD/YYYY format (e.g., 12/31/2024 for 2024). - Line 8: Fee Calculation

Multiply $30 (per return) by the number of returns requested. - Line 9: Refund Instructions

Check if refunds should go to the third party. - Signature and Date

Sign exactly as on the original return (both spouses for joint). Forms must reach the IRS within 120 days of signing. For businesses or representatives, attach authorization (e.g., Form 2848).

Pro Tip: Use black ink, print clearly, and avoid erasures. Incomplete forms get rejected.

IRS Form 4506 Download and Printable

Download and Print: IRS Form 4506

Fees and Processing Time for Form 4506

- Cost: $30 per tax return requested—no exceptions, even for certified copies. Pay by check or money order payable to “United States Treasury,” noting your ID and “Form 4506 request.” Attach payment; otherwise, your request is denied. If the IRS can’t locate the return, they’ll refund the fee.

- Processing Time: Up to 75 calendar days from receipt—plan ahead, especially during peak tax season. Track status via IRS account or by calling 1-800-829-1040.

No e-filing option exists; everything goes by mail.

Where to Mail Your Completed Form 4506

Mail your form and payment to the IRS address based on your state (or business location) at filing time. Use the most recent return’s state if requesting multiples. Addresses are divided regionally:

For Individual Returns (1040 Series):

- AL, AZ, AR, FL, GA, LA, MS, NM, NC, OK, SC, TN, TX, or Territories/APO/FPO: Internal Revenue Service, RAIVS Team, Stop 6716 AUSC, Austin, TX 73301.

- CT, DE, DC, IL, IN, IA, KY, ME, MD, MA, MN, MO, NH, NJ, NY, PA, RI, VT, VA, WV, WI: Internal Revenue Service, RAIVS Team, Stop 6705 S-2, Kansas City, MO 64999.

- AK, CA, CO, HI, ID, KS, MI, MT, NE, NV, ND, OH, OR, SD, UT, WA, WY: Internal Revenue Service, RAIVS Team, P.O. Box 9941, Mail Stop 6734, Ogden, UT 84409.

For Business/Other Returns:

Similar regional splits—check the form’s instructions for exact matches.

Don’t mail to the IRS Forms Publications address; use the RAIVS (Return of Account Information Verification System) teams only.

Alternatives to IRS Form 4506: Faster and Free Options

Full copies aren’t always necessary. For most needs, IRS transcripts suffice and are free:

- Tax Return Transcript: Summarizes your return’s line items (online, phone, or mail via Form 4506-T).

- Account Transcript: Shows adjustments and balances.

- Wage & Income Transcript: Lists reported income sources.

How to Get Transcripts:

- Online: IRS.gov “Get Transcript” tool (instant for most).

- Phone: Call 1-800-908-9946.

- Mail: Form 4506-T (10-30 days, free).

Transcripts mask sensitive data for privacy while revealing financials—perfect for loans or verification. Use Form 4506-T-EZ for simple individual requests.

Frequently Asked Questions (FAQs) About IRS Form 4506

Can I request a copy of my 2025 tax return now?

No—wait until processed (typically post-filing deadline). Available after full IRS acceptance.

What’s the difference between Form 4506 and 4506-T?

Form 4506 gets a full copy ($30, 75 days); 4506-T gets a free transcript (faster, summarized).

Do I need to pay for certified copies?

No extra fee, but check Line 6 for certification.

How far back can I request?

Up to 7 years for individual 1040s; longer for others.

What if I’m incarcerated?

Include your inmate number on Line 3.

For more, visit IRS.gov or consult a tax professional.

Final Thoughts: Streamline Your Tax Record Requests in 2025

Navigating IRS Form 4506 ensures you get the exact tax return copy you need without hassle. With a modest $30 fee and clear mailing instructions, it’s a straightforward process for essential requests. However, for everyday verifications, prioritize free transcripts to save time and money. Stay compliant and informed—bookmark IRS.gov for updates, and file early to avoid 75-day waits. If you’re dealing with complex tax issues, consider professional help from a CPA.

This article is for informational purposes only and not tax advice. Consult the IRS or a qualified advisor for personalized guidance.