Table of Contents

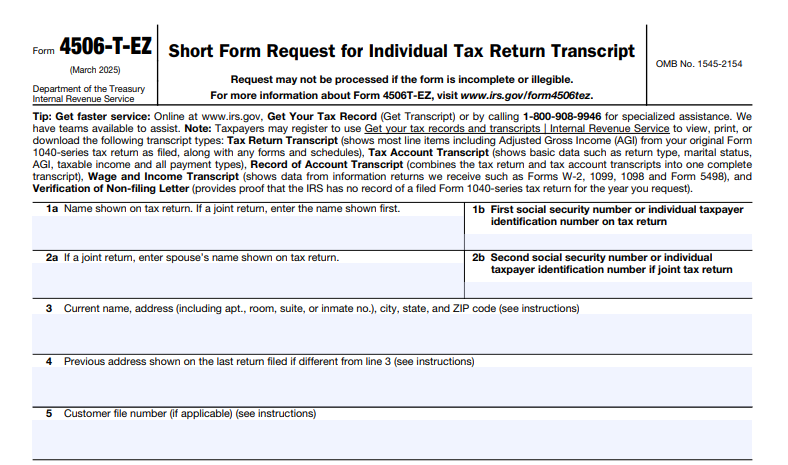

IRS Form 4506-T-EZ – Short Form Request for Individual Tax Return Transcript – Navigating tax records shouldn’t add stress to your financial life, whether you’re applying for a mortgage, verifying income for a loan, or resolving an IRS notice. IRS Form 4506-T-EZ—the Short Form Request for Individual Tax Return Transcript—makes it simple and free to obtain a summary of your Form 1040-series return, including most line items like adjusted gross income (AGI) and taxable income. For tax year 2025, this streamlined form (Rev. March 2025) processes requests in as little as 10 business days, with options for mail or fax delivery. This SEO-optimized guide, based on the latest IRS updates (reviewed October 15, 2025), covers eligibility, step-by-step filing, and tips to avoid delays—helping you access transcripts for the current year and prior three without the full Form 4506-T’s complexity.

What Is IRS Form 4506-T-EZ?

IRS Form 4506-T-EZ is a concise, one-page request for tax return transcripts of your individual Form 1040-series returns (e.g., 1040, 1040-SR) for the current tax year and up to the three prior years. Unlike the full Form 4506-T, which handles multiple transcript types (e.g., account or wage transcripts), the EZ version focuses solely on return transcripts—a line-by-line summary of your original filing, excluding payments, penalties, or post-filing adjustments for privacy. It’s free, processed faster, and ideal for income verification.

Key features:

- Masked Privacy: SSNs/ITINs show only last four digits; add a Customer File Number (e.g., loan ID) for easy tracking.

- Limited Scope: Only for calendar-year individual returns; fiscal years or business transcripts require Form 4506-T.

- No Fee: Unlike Form 4506 ($43/copy), transcripts are free.

The March 2025 revision (Cat. No. 54185S) includes updated filing addresses and emphasizes the 120-day signature validity rule. Download the PDF from IRS.gov/pub/irs-pdf/f4506tez.pdf.

Who Needs IRS Form 4506-T-EZ in 2025?

Individuals or authorized third parties (e.g., lenders, with consent) use Form 4506-T-EZ for quick access to recent return transcripts. It’s perfect for mortgage applications, FAFSA verification, or IRS disputes, but not for copies (use Form 4506) or non-individual returns.

| User Type | When to Use | Alternatives |

|---|---|---|

| Taxpayers | Verifying AGI/income for loans or audits; current/prior 3 years. | Get Transcript online (IRS.gov) for self-service. |

| Lenders/Attorneys | Income proof for mortgages/FAFSA; with taxpayer authorization. | Form 4506-T for account/wage transcripts. |

| Joint Filers | Either spouse can request; include both names/SSNs. | Form 4506 for full copies ($43). |

| Fiscal-Year Filers | Not eligible—use Form 4506-T. | N/A |

| Businesses | Not for 1120/1065—use Form 4506-T. | Wage transcripts via Form 4506-T. |

No SSN? Use ITIN; foreign addresses OK. Requests processed only to your address of record since July 2019—no third-party mailings.

Step-by-Step Guide to Completing IRS Form 4506-T-EZ

The form is straightforward—fillable PDF available. Gather your SSN/ITIN, tax years, and prior address if changed.

- Line 1a: Name on Return – Enter as on Form 1040 (first name for joint).

- Line 1b: SSN/ITIN – Primary taxpayer’s number (full; masked on transcript).

- Line 2: Second SSN/ITIN – Spouse’s for joint returns.

- Line 3: Current Address – Full details (apt/room/suite); include if incarcerated.

- Line 4: Prior Address – If different from Line 3 and on the return.

- Line 5: Customer File Number – Optional (e.g., “Loan #12345”)—prints on transcript for tracking.

- Line 6: Tax Years – List years (e.g., “2024, 2023, 2022, 2021”)—current + up to 3 prior.

- Line 7: Reason – Check “Transcript of Return” (only option for EZ).

- Signature & Date – Sign/date; valid 120 days from date (e.g., signed Nov 28, 2025—expires Mar 28, 2026).

- Submit – Mail/fax per “Where to File” chart on form (state-based; e.g., CA to Fresno, CA).

Joint: Either spouse signs. Processing: 10 business days + mail (5-10 days).

Processing Time and Delivery for Form 4506-T-EZ in 2025

Expect 10 business days from receipt, plus 5-10 days mail—faster via fax (same-day processing). Availability varies: E-filed refunds in 2-3 weeks; paper-filed in 6 weeks. Track via IRS.gov “Get Transcript” or call 800-829-1040.

- Delivery: Mailed to address of record; no third-party since 2019.

- Fax Advantage: Use state-specific numbers on form for quicker turnaround.

- Delays: Peak season (Jan-Apr) adds 1-2 weeks; balances due delay availability.

If urgent, try “Get Transcript” online first—free and instant if eligible.

IRS Form 4506-T-EZ vs. Form 4506-T: Which to Use in 2025?

The EZ form suits simple needs; full Form 4506-T offers versatility.

| Feature | Form 4506-T-EZ | Form 4506-T |

|---|---|---|

| Transcript Types | Return only (1040 lines) | Return, account, wage, record of account, non-filing verification |

| Years Covered | Current + prior 3 | Any year |

| Complexity | 1 page, simple | Multi-page, detailed |

| Best For | Mortgage/loan verification | Audits, full history |

| Fiscal/Business | No—calendar individuals only | Yes |

EZ faster (10 days) but limited; full form for complex requests.

IRS Form 4506-T-EZ Download and Printable

Download and Print: IRS Form 4506-T-EZ

Common Mistakes When Filing Form 4506-T-EZ and How to Avoid Them

Delays stem from simple errors—here’s how to sidestep:

- Expired Signature: Form invalid after 120 days—sign close to submission.

- Address Mismatch: Using current vs. return address—enter both if changed.

- Incomplete Years: Listing wrong years—specify “2024, 2023, etc.” clearly.

- Wrong Form: Using EZ for wage transcripts—switch to 4506-T.

- No Customer File Number: For third-party tracking—add loan ID to avoid mix-ups.

Double-check with IRS.gov/Form4506T-EZ; fax for speed.

No Penalties for IRS Form 4506-T-EZ—But Delays Hurt

Form 4506-T-EZ incurs no filing penalties—it’s informational and free. However, errors cause rejections/delays (10+ days), risking loan timelines. Fraudulent requests (false info) trigger audits/penalties under IRC §7206 (up to 3 years prison/fines). Always sign truthfully; IRS verifies via masked PII.

Frequently Asked Questions About IRS Form 4506-T-EZ

How long does it take to get a transcript in 2025?

10 business days processing + 5-10 mail; fax same-day.

Can I request via Get Transcript online?

Yes—for self; Form 4506-T-EZ for third-party or mailed copies.

What’s masked on the transcript?

SSN/ITIN (last 4 digits shown); full financials visible.

Is there a fee for Form 4506-T-EZ?

No—free; Form 4506 copies cost $43.

Why use EZ over full 4506-T?

Simpler/faster for basic return transcripts; full for other types/years.

Visit IRS.gov/Form4506T-EZ for more.

Final Thoughts: Simplify Tax Verification with IRS Form 4506-T-EZ in 2025

IRS Form 4506-T-EZ is your fast track to free return transcripts, essential for loans, audits, or peace of mind—delivered in 10-15 days without fees or fuss. The March 2025 revision’s fillable PDF and fax options make it lender-friendly; sign within 120 days, match addresses precisely, and submit to avoid delays. Download from IRS.gov today—whether verifying AGI for a mortgage or resolving a notice, accurate records unlock opportunities.

This article is informational only—not tax advice. Consult IRS.gov or a professional.