Table of Contents

IRS Form 4506-T – Request for Transcript of Tax Return – In today’s fast-paced financial world, accessing your tax records quickly and securely is essential—whether you’re applying for a mortgage, verifying income for a job, or simply replacing lost documents. Enter IRS Form 4506-T, Request for Transcript of Tax Return, a free tool that lets you obtain detailed summaries of your tax history without the hassle and cost of full return copies. Updated for 2025, this form remains a cornerstone for taxpayers seeking efficient IRS interactions. In this comprehensive guide, we’ll break down everything you need to know about Form 4506-T, from its purpose to step-by-step filing instructions, optimized for anyone searching “how to get IRS tax transcript” or “Form 4506-T explained.”

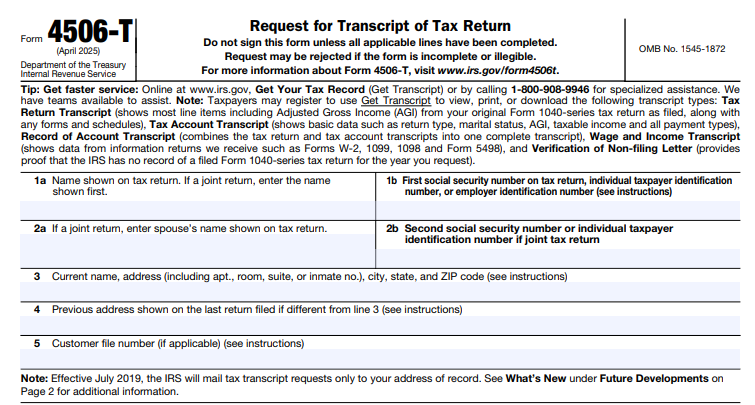

What Is IRS Form 4506-T?

IRS Form 4506-T is an official document used to request various types of tax transcripts from the Internal Revenue Service (IRS). Unlike Form 4506, which provides exact photocopies of your tax returns (for a $30 fee per year), Form 4506-T delivers free, summarized transcripts that mask sensitive personal data like your full Social Security Number (SSN) while fully displaying financial details such as income, deductions, and payments. This privacy-focused format makes it ideal for sharing with lenders, employers, or tax professionals without exposing unnecessary personal information.

Launched as part of the IRS’s efforts to streamline services, Form 4506-T has been refined over the years, with the latest revision emphasizing digital alternatives for faster access. As of October 2025, no major structural changes have been announced, but the IRS continues to promote online tools to reduce paper filings.

Key Benefits of Using Form 4506-T

- Cost-Free: No fees for any transcript type.

- Privacy Protection: Only the last four digits of your SSN appear, safeguarding against identity theft.

- Quick Access: Most requests process in 10 business days via mail or fax.

- Versatile: Covers individuals, businesses, estates, and trusts.

Types of Tax Transcripts Available via Form 4506-T

Form 4506-T offers five main transcript types, each serving specific needs. Choose based on your situation— the IRS recommends the Record of Account Transcript for the most comprehensive overview.

| Transcript Type | Description | Best For | Availability |

|---|---|---|---|

| Return Transcript | Shows most line items from your original tax return (e.g., AGI, deductions) as filed, without post-filing adjustments. | Reconstructing lost returns or confirming filed data. | Current year + 3 prior years. |

| Account Transcript | Details account status, including payments, penalties, and IRS adjustments after filing. | Tracking balances, audits, or payment history. | Most returns; current + prior years. |

| Record of Account Transcript | Combines Return and Account Transcripts for a full picture. | General verification or tax prep. | Current year + 3 prior years. |

| Wage and Income Transcript | Summarizes data from W-2s, 1099s, 1098s, and 5498s reported to the IRS. | Income proof for loans or employment. | Up to 10 years; current year data available next year. |

| Verification of Non-Filing Letter | Confirms no Form 1040-series return was filed for a specific year. | Proving non-filing for lenders or schools. | Current year after June 15; no limits for prior years. |

For fiscal-year filers (tax years spanning calendar years), Form 4506-T is mandatory—skip the shorter Form 4506-T-EZ.

When Should You Use IRS Form 4506-T? Common Reasons and Examples

You don’t always need a full tax return copy; transcripts suffice for most scenarios. Here’s when to reach for Form 4506-T:

- Loan or Mortgage Applications: Lenders require transcripts to verify income and filing history. Example: A bank requests your 2024 Wage and Income Transcript to approve a home loan.

- Income Verification for Jobs or Aid: Employers or schools may ask for proof of earnings. Example: Proving non-filing for 2023 to qualify for student financial aid.

- Tax Preparation or Amendments: Replace lost records to file accurately. Example: A tax pro needs your 2022 Account Transcript to amend a return for missed deductions.

- Audit or Dispute Resolution: Review IRS adjustments. Example: Challenging a penalty by requesting a Record of Account Transcript.

- Identity Theft Recovery: Confirm filings during fraud investigations.

If your need falls outside these (e.g., exact copies for court), use Form 4506 instead. Always check IRS.gov for the latest guidance, as processing availability can vary for older years (pre-2010 may require special requests).

Step-by-Step Guide: How to Fill Out IRS Form 4506-T

Downloading the form is easy—head to IRS.gov and search for “Form 4506-T PDF.” It’s a one-page fillable PDF. Follow these line-by-line tips for accuracy:

- Lines 1a–2b: Taxpayer Identification

Enter the primary name and SSN/ITIN/EIN from your return (first spouse on joint returns). Include spouse’s details if applicable. - Line 3: Current Address

Provide your mailing address, including any apartment or suite numbers. - Line 4: Previous Address

Optional—use if it differs from the return’s address to speed processing. - Line 5: Customer File Number

Optional: Add a 10-digit code (not your SSN) for tracking; it prints on the transcript. - Line 6: Transcript Type

Specify the tax form (e.g., 1040) and check one box (a–e) for the desired transcript. Limit to one form per request. - Line 8: Wage/Income Transcript Details

If selecting this, note it covers only IRS-reported data—contact payers for originals. - Line 9: Year/Period Requested

Use MM/DD/YYYY format (e.g., 12/31/2024). For quarters, list each separately. - Signature Section

Sign and date (must be within 120 days). Check the authority box. Joint returns need one spouse’s signature; attach Form 2848 for representatives. Include phone and title if applicable.

Pro Tip: Complete all lines to avoid rejection. For businesses, attach authorization docs.

IRS Form 4506-T Download and Printable

Download and Print: IRS Form 4506-T

How and Where to Submit Form 4506-T

Preferred Method: Online or Phone (Fastest!)

Skip the form—use the IRS’s “Get Transcript” tool at IRS.gov or call 800-908-9946 for instant access (if registered via ID.me). Expect delivery in 5–10 days.

Mail or Fax Option

Print, sign, and send to the address based on your last return’s state and transcript type. Processing takes about 10 business days.

Mailing Addresses for Individual Transcripts (Form 1040/W-2)

- AL, AZ, AR, FL, GA, LA, MS, NM, NC, OK, SC, TN, TX, or foreign/U.S. territories/APO/FPO:

Internal Revenue Service, RAIVS Team, Stop 6716 AUSC, Austin, TX 73301 (Fax: 855-587-9604) - CT, DE, DC, IL, IN, IA, KY, ME, MD, MA, MN, MO, NH, NJ, NY, PA, RI, VT, VA, WV, WI:

Internal Revenue Service, RAIVS Team, Stop 6705 S-2, Kansas City, MO 64999 (Fax: 855-821-0094) - AK, CA, CO, HI, ID, KS, MI, MT, NE, NV, ND, OH, OR, SD, UT, WA, WY:

Internal Revenue Service, RAIVS Team, P.O. Box 9941, Mail Stop 6734, Ogden, UT 84409 (Fax: 855-298-1145)

Mailing Addresses for All Other Transcripts

- AL, AK, AZ, AR, CA, CO, FL, HI, ID, IA, KS, LA, MN, MS, MO, MT, NE, NV, NM, ND, OK, OR, SD, TX, UT, WA, WY, or foreign/U.S. territories/APO/FPO:

Internal Revenue Service, RAIVS Team, P.O. Box 9941, Mail Stop 6734, Ogden, UT 84409 (Fax: 855-298-1145) - CT, DE, DC, GA, IL, IN, KY, ME, MD, MA, MI, NH, NJ, NY, NC, OH, PA, RI, SC, TN, VT, VA, WV, WI:

Internal Revenue Service, RAIVS Team, Stop 6705 S-2, Kansas City, MO 64999 (Fax: 855-821-0094)

For multiple transcripts from different states, use the address for your most recent return.

Processing Times and What to Expect

- Online/Phone: Immediate viewing; mailed copies in 5–10 calendar days.

- Mail/Fax: 10 business days from receipt.

- Delays: Peak seasons (January–April) or incomplete forms may add time. Track via IRS.gov account.

If urgent, prioritize digital methods—paper requests aren’t expedited.

Alternatives to Form 4506-T

- Get Transcript Online: Best for self-service; requires IRS account creation.

- Form 4506-T-EZ: Simplified for current-year individual return transcripts only.

- Form 4506: For certified copies ($30/year, 75 days processing).

- Third-Party Requests: Use Form 4506-C for mortgage lenders via IVES.

FAQs About IRS Form 4506-T

Q: Can I request transcripts for someone else?

A: Only with proper authorization (e.g., Form 2848) or if you’re a legal representative.

Q: What if I need transcripts older than 10 years?

A: Availability is limited; contact the IRS directly for archives.

Q: Is there a fee in 2025?

A: No—transcripts remain free.

Q: How do I know which transcript I need?

A: Start with Record of Account for broad coverage.

Final Thoughts: Streamline Your Tax Records Today

IRS Form 4506-T is your go-to for secure, no-cost tax transcripts, saving time and money in 2025. Whether verifying income for a big purchase or resolving IRS discrepancies, this form empowers you with official data at your fingertips. Head to IRS.gov to download and get started—remember, online requests are quickest. For personalized advice, consult a tax professional. Stay compliant and informed; your financial future thanks you!

Sources: All information is based on official IRS guidelines as of December 2025. Always verify on IRS.gov for the latest updates.