Table of Contents

IRS Form 4563 – Exclusion of Income for Bona Fide Residents of American Samoa – If you’re a bona fide resident of American Samoa, you may qualify to exclude certain income from U.S. federal taxes under Internal Revenue Code (IRC) Section 931. IRS Form 4563, Exclusion of Income for Bona Fide Residents of American Samoa, allows eligible taxpayers to calculate and claim this exclusion when filing their U.S. tax return. This provision helps prevent double taxation for residents who pay taxes to the American Samoa government.

As of 2025, the rules remain governed by the latest revision of Form 4563 (September 2024) and IRS Publication 570, Tax Guide for Individuals With Income From U.S. Territories. American Samoa is unique among U.S. territories as the only one fully qualifying for this possession exclusion under Section 931.

What Is IRS Form 4563?

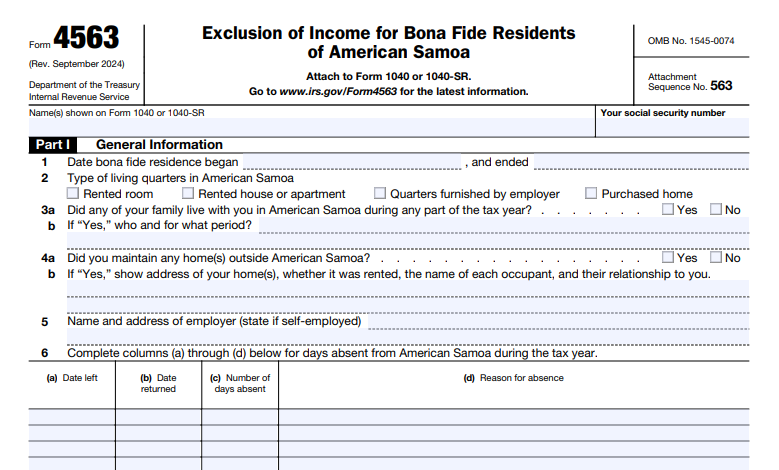

Form 4563 is a one-page IRS document used to figure the amount of qualifying income from American Samoa that you can exclude from your gross income on Form 1040 or 1040-SR. You must attach the completed Form 4563 to your federal tax return if claiming the exclusion.

The form includes:

- Questions to verify your residency status.

- Lines to report qualifying income types (e.g., wages, interest, dividends, rentals).

- A total exclusion amount on Line 15.

Key note: U.S. government employees (including military) cannot exclude income earned from federal service, even if sourced in American Samoa.

IRS Form 4563 Download and Printable

Download and Print: IRS Form 4563

Who Qualifies for the Income Exclusion?

To claim the exclusion on Form 4563, you must meet these requirements for the entire tax year:

- Bona Fide Resident of American Samoa:

- You must be a bona fide resident for the full taxable year (e.g., January 1 to December 31 for calendar-year filers).

- This is determined under IRC Section 937: You have a tax home in American Samoa, a closer connection to American Samoa than to the U.S. or any foreign country, and meet presence tests (generally at least 183 days present).

- Special rules apply for the year you move to or from American Samoa (see Publication 570).

- Qualifying Income:

- Income from sources within American Samoa, or

- Income effectively connected with a trade or business in American Samoa.

Examples of sourced income:

- Wages for services performed in American Samoa.

- Interest from banks in American Samoa.

- Dividends from companies organized in American Samoa.

- Rental income from property in American Samoa.

- Gains from sale of real property in American Samoa.

Non-qualifying income includes U.S. government pay and certain investment gains under special rules.

There is a de minimis exception for temporary work in American Samoa (up to 90 days and $3,000 earned) if you’re not a bona fide resident.

How to Determine Bona Fide Residency

The IRS uses three main tests (detailed in Publication 570 and Treas. Reg. §1.937-1):

- Presence Test: Generally, present in American Samoa for at least 183 days in the year, with limited exceptions.

- Tax Home Test: Your principal place of business or employment is in American Samoa.

- Closer Connection Test: Stronger ties (family, home, voting, banking) to American Samoa than elsewhere.

If you begin or end residency during the year, file Form 8898 to notify the IRS.

How to Complete and File Form 4563

- Download the latest Form 4563 from IRS.gov (Rev. September 2024 as of late 2025).

- Answer residency questions (Lines 1–6).

- Report qualifying amounts on Lines 7–14 (e.g., wages, interest, dividends).

- Total the excludable income on Line 15.

- Attach to your Form 1040 or 1040-SR.

Filing address: Generally, Department of the Treasury, Internal Revenue Service, Austin, TX 73301-0215 (or as specified in your return instructions).

You may still need to file a territorial return with the American Samoa Tax Office.

Important Limitations and Considerations for 2025

- No Exclusion for U.S. Federal Employees: Pay from the U.S. government is not excludable.

- Credits and Deductions: Certain deductions/credits allocable to excluded income may be limited.

- Earned Income Credit (EIC) and Others: Bona fide residents generally cannot claim EIC, ACTC, or AOTC on U.S. returns; check territorial equivalents.

- Self-Employment Tax: Excluded income may still be subject to self-employment tax (report on Form 1040-SS if no wages).

For military members: Compensation may be sourced to American Samoa under the Servicemembers Civil Relief Act (SCRA).

Where to Find More Information

- Official Form 4563 and instructions: IRS.gov/Form4563

- Publication 570 (2024 edition, applicable for 2025 filings): IRS.gov/Pub570

- IRC Section 931: Detailed in U.S. Code and regulations.

Always consult a tax professional or the IRS for your specific situation, as rules can have nuances based on individual facts.

This exclusion can significantly reduce your U.S. tax liability if you qualify—ensure accurate reporting to avoid penalties. For the 2025 tax season (filing in 2026), use the most current forms available on IRS.gov.