Table of Contents

IRS Form 4720 – Return of Certain Excise Taxes Under Chapters 41 and 42 of the Internal Revenue Code – RS Form 4720 plays a crucial role for tax-exempt organizations, private foundations, and related individuals in reporting and paying specific excise taxes. Whether you’re a nonprofit manager, tax professional, or foundation trustee, knowing how to navigate this form is essential to avoid penalties and ensure compliance with the Internal Revenue Code (IRC). In this article, we’ll break down what Form 4720 is, who needs to file it, the taxes it covers, filing instructions, deadlines, and recent updates as of 2025.

What Is IRS Form 4720?

IRS Form 4720, officially titled “Return of Certain Excise Taxes Under Chapters 41 and 42 of the Internal Revenue Code,” is used to calculate and pay excise taxes imposed on certain prohibited activities by tax-exempt organizations. These taxes act as penalties for violations that could undermine the charitable purpose of entities like private foundations, public charities, and donor-advised funds. The form addresses initial taxes on issues such as self-dealing, excess benefit transactions, and failure to distribute income, among others.

Introduced to enforce accountability, Form 4720 ensures that exempt organizations operate within IRC guidelines. It’s not a standard income tax return but a specialized form for reporting excise liabilities under Chapters 41 (public charity excise taxes) and 42 (private foundation excise taxes). For the 2025 tax year, the form includes updates to certain headers and encourages electronic filing for efficiency.

Who Must File IRS Form 4720?

Filing Form 4720 is required for various parties liable for excise taxes, including:

- Private Foundations: If they’ve engaged in prohibited acts like self-dealing or failing to meet distribution requirements.

- Public Charities and Other Exempt Organizations: For issues such as excess lobbying, political expenditures, or excess executive compensation.

- Disqualified Persons, Managers, and Self-Dealers: Individuals or entities involved in taxable transactions, who must file separately from the organization.

- Sponsoring Organizations of Donor-Advised Funds: For taxable distributions or prohibited benefits.

- Hospital Organizations: For failing community health needs assessments.

- Certain Private Colleges and Universities: Subject to net investment income tax under Section 4968.

- Other Entities: Such as those involved in prohibited tax shelter transactions.

If an organization or person is liable for taxes under multiple sections, they complete the relevant schedules. Separate returns are needed for each liable party, and Item B in the header (revised for 2025) allows filing for multiple organizations with an attached list. Note that foreign organizations report in U.S. currency but may owe no tax if support is foreign-sourced.

Excise Taxes Covered Under IRC Chapters 41 and 42

Form 4720 covers a range of excise taxes designed to deter misuse of tax-exempt status. Here’s a breakdown:

Chapter 42 Taxes (Private Foundations)

- Self-Dealing (Section 4941): 10% tax on self-dealers and 5% on foundation managers for transactions like sales or loans with disqualified persons (capped at $20,000 per act).

- Undistributed Income (Section 4942): 30% on income not distributed timely.

- Excess Business Holdings (Section 4943): 10% on excess holdings in businesses, with exceptions like de minimis rules.

- Jeopardizing Investments (Section 4944): 10% on risky investments not aligned with charitable purposes.

- Taxable Expenditures (Section 4945): 20% on improper grants or lobbying, plus 5% on managers.

Chapter 41 Taxes (Public Charities and Others)

- Political Expenditures (Section 4955): 10% on organizations and 2.5% on managers for campaign interventions.

- Excess Lobbying (Section 4911): Tax on excesses for electing charities.

- Disqualifying Lobbying (Section 4912): 5% for organizations losing exempt status due to lobbying.

- Excess Benefit Transactions (Section 4958): 25% on disqualified persons and 10% on managers for excessive benefits.

- Prohibited Tax Shelters (Section 4965): Taxes on entities and managers involved in avoidance schemes.

- Taxable Distributions from Donor-Advised Funds (Section 4966): 20% on sponsoring organizations and 5% on managers.

- Prohibited Benefits from Donor-Advised Funds (Section 4967): 125% on advisors/recipients and 10% on managers.

- Community Health Needs Assessment Failures (Section 4959): $50,000 per hospital facility.

- Excess Executive Compensation (Section 4960): 21% on amounts over $1 million or excess parachutes.

- Net Investment Income for Private Colleges (Section 4968): 1.4% flat rate on qualifying institutions with large endowments.

Taxes are calculated based on the “amount involved” and are joint and several among liable parties. Exceptions include program-related investments and timely corrections.

Key Schedules in Form 4720

The form is organized into schedules for specific taxes:

| Schedule | Tax Section | Key Details |

|---|---|---|

| A | 4941 (Self-Dealing) | Lists acts, corrections, and taxes. |

| B | 4942 (Undistributed Income) | Calculates 30% tax on undistributed amounts. |

| C | 4943 (Excess Holdings) | Separate for each enterprise; 10% initial tax. |

| D | 4944 (Jeopardizing Investments) | 10% on foundation and managers. |

| E | 4945 (Taxable Expenditures) | 20% on expenditures like non-qualified grants. |

| F | 4955 (Political Expenditures) | For 501(c)(3) organizations. |

| G | 4911 (Excess Lobbying) | For electing charities. |

| H | 4912 (Disqualifying Lobbying) | 5% tax. |

| I | 4958 (Excess Benefits) | 25% on disqualified persons. |

| J | 4965 (Tax Shelters) | Greater of percentages on proceeds/income. |

| K | 4966 (Taxable Distributions) | For donor-advised funds. |

| L | 4967 (Prohibited Benefits) | 125% on beneficiaries. |

| M | 4959 (CHNA Failures) | $50,000 per facility. |

| N | 4960 (Excess Compensation) | 21% on excesses over $1M. |

| O | 4968 (Net Investment Income) | 1.4% for eligible colleges. |

Complete only relevant schedules and attach explanations for corrections.

How to File IRS Form 4720 in 2025

Filing involves:

- Gather Information: Review transactions for liabilities.

- Complete Header and Parts: Enter EIN/SSN, check boxes (e.g., amended return), and compute taxes in Parts I (organizations) and II (individuals/managers).

- Attachments: Include lists for multiples, correction details, or Form 8050 for refunds.

- Rounding and Currency: Round to whole dollars; convert foreign amounts.

- Signature: By authorized person; include paid preparer info if applicable.

Electronic filing is mandatory for private foundations filing Form 4720 for 2025 and encouraged for others. Use IRS e-file systems or mail to Ogden, UT. Payments via EFTPS; no estimated payments for certain taxes like 4960/4968.

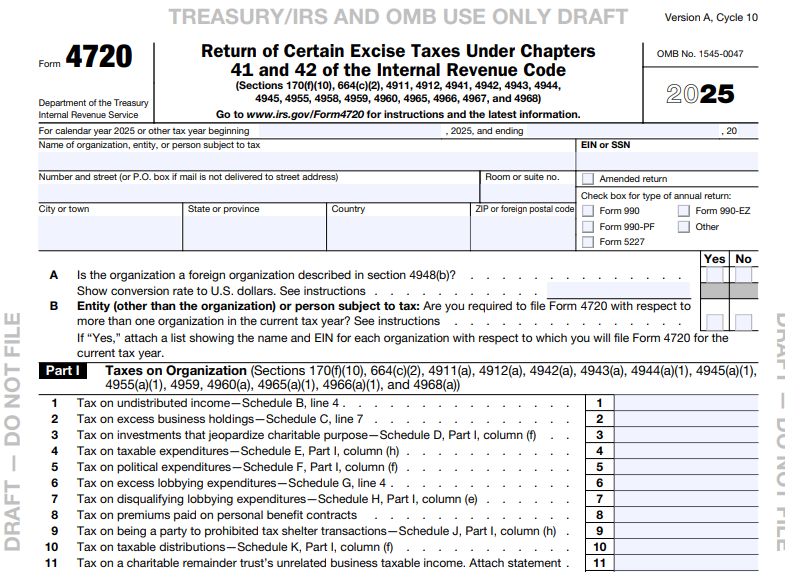

For a visual reference, here’s a sample of IRS Form 4720:

Filing Deadlines and Extensions

- Due Date: 15th day of the 5th month after tax year-end (May 15 for calendar-year filers).

- Extensions: File Form 8868 for automatic 6-month extension, but pay any balance due to avoid penalties.

- Amended Returns: File a complete form with changes explained.

Paying taxes is required annually during the taxable period until corrected.

Penalties for Non-Compliance

Late filing or payment incurs penalties under Section 6651 (up to 25%) and interest. Additional taxes apply if corrections aren’t made (e.g., 200% second-tier taxes). Abatement possible via Form 843 for first-tier taxes with reasonable cause. Common errors include incorrect proration, failing to cap manager taxes, or not reporting corrections.

IRS Form 4720 Download and Printable

Download and Print: IRS Form 4720

Recent Updates and Changes for IRS Form 4720 in 2025

For 2025, key updates include:

- Revised Item B for multi-organization filings.

- Continued emphasis on electronic filing for private foundations.

Looking ahead, the One Big Beautiful Bill Act (OBBBA), signed July 4, 2025, amends Section 4968 effective for tax years starting after December 31, 2025 (i.e., 2026). Changes include raising the student threshold to 3,000 tuition-paying students, removing religious exemptions, introducing tiered rates (1.4% for $500K-$750K SAE, 4% for $750K-$2M, 8% over $2M), and expanding net investment income to include student loan interest and royalties. Private colleges should prepare for potential higher taxes.

Other nonprofit tax developments in 2025 focus on IRS reforms and legislative impacts, but no major overhauls to Form 4720 beyond these.

Tips for Completing and Optimizing Your IRS Form 4720 Filing

- Consult Professionals: Work with a tax advisor to identify liabilities and corrections.

- Document Corrections: Always explain steps taken to undo violations to potentially avoid additional taxes.

- Use Software: Electronic tools can help with calculations and e-filing.

- Stay Updated: Check IRS.gov for guidance, as rules evolve.

By understanding Form 4720, you can maintain compliance and minimize excise tax burdens.

Frequently Asked Questions (FAQs)

What happens if I don’t file Form 4720?

You may face penalties, interest, and second-tier taxes up to 200% of the initial amount.

Can I file Form 4720 electronically?

Yes, it’s required for private foundations and encouraged for others in 2025.

How do I correct a taxable event on Form 4720?

Report “Yes” in the relevant schedule, describe actions, dates, and attach explanations.

For more details, visit the official IRS resources or consult a professional.