Table of Contents

IRS Form 4797 – Sales of Business Property – Selling business property can significantly impact your tax liability, especially when it involves depreciable assets or capital gains. Whether you’re disposing of equipment, real estate, or vehicles used in your trade or business, the IRS requires accurate reporting to determine if the transaction results in ordinary income, capital gains, or losses. Enter IRS Form 4797, “Sales of Business Property”—a critical tool for handling these complex transactions. This guide breaks down everything you need to know about Form 4797 for the 2025 tax year, including who must file, what it covers, and a step-by-step walkthrough. By optimizing your reporting, you can minimize errors and maximize deductions.

If you’re a business owner, freelancer, or investor preparing for 2025 taxes, understanding Form 4797 ensures compliance and potentially lowers your tax bill through proper depreciation recapture and loss offsetting.

What Is IRS Form 4797?

IRS Form 4797 is designed to report the sale, exchange, or involuntary conversion of business property, as well as certain capital and noncapital assets. It captures gains or losses that don’t fit neatly on other forms like Schedule D (Capital Gains and Losses). Key uses include:

- Calculating depreciation recapture under sections 1245, 1250, and others, which treats part of the gain as ordinary income.

- Reporting section 1231 transactions, where net gains may qualify for favorable long-term capital gains rates.

- Handling dispositions of property held by partnerships or S corporations, including section 179 deductions.

For 2025, the form remains largely unchanged from 2024, with no major legislative updates noted as of the latest IRS review in January 2025. Always check IRS.gov for any last-minute adjustments before filing.

Who Needs to File IRS Form 4797?

You must file Form 4797 if you:

- Sold or exchanged property used in your trade or business, such as real estate, depreciable tangible assets (e.g., machinery, vehicles), or oil/gas/mineral properties.

- Experienced an involuntary conversion (non-casualty/theft) of business property or capital assets held over one year.

- Disposed of noncapital assets (not inventory) or capital assets not reported on Schedule D.

- Are a partner or S corporation shareholder reporting gains/losses from section 179 property dispositions via Schedule K-1.

- Need to recapture deductions under sections 179 or 280F(b)(2) due to decreased business use (below 50%).

Individuals, sole proprietors, partnerships, and corporations alike use this form. Attach it to your Form 1040, 1065, or 1120-S. If your transaction involves casualties/thefts, pair it with Form 4684.

Types of Property Covered by Form 4797

Form 4797 applies to a wide range of assets, ensuring all business-related dispositions are taxed appropriately. Common examples include:

- Depreciable Business Property: Equipment, furniture, computers, and vehicles used in operations.

- Real Property: Buildings, land, or structures held for business purposes (e.g., rental properties or office spaces).

- Specialized Assets: Livestock (cattle/horses held 24/12 months), timber, unharvested crops, or mineral properties.

- Section 1231 Property: Held over one year in a trade/business, potentially qualifying for capital gain treatment.

- Listed Property: Passenger autos or computers with business use drops triggering recapture.

Exclusions: Inventory sold in the ordinary course or personal-use property. For like-kind exchanges, use Form 8824 first.

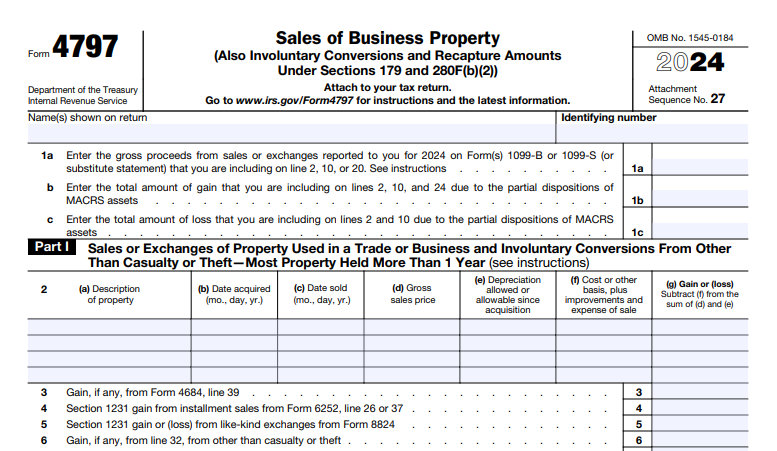

IRS Form 4797 Download and Printable

Download and Print: IRS Form 4797

How to Complete IRS Form 4797: Step-by-Step Guide

Filling out Form 4797 requires gathering sale documents (e.g., Form 1099-S or 1099-B), adjusted basis info from Form 4562, and depreciation schedules. Use positive numbers for gains and parentheses for losses. Here’s a breakdown by part, based on the 2025 instructions.

Part I: Section 1231 Transactions

This section nets gains/losses from business property held over one year, treating net gains as long-term capital gains unless offset by prior losses.

- Line 2: Enter details for each transaction—description, acquisition/sale dates, gross sales price, depreciation allowed, adjusted basis, and gain/loss.

- Line 7: Add gains from Schedule K-1 (boxes 9/10 for S corps/partnerships).

- Line 8: Input nonrecaptured section 1231 losses from the prior five years.

- Line 9: Excess gain after offsets flows to Schedule D as capital gain.

- Line 12: Any recaptured amount treated as ordinary income.

Example: With a $10,000 gain and $15,000 in prior nonrecaptured losses, $10,000 becomes ordinary income on line 12, reducing future offsets.

Part II: Ordinary Gains and Losses

Use for short-term holdings (one year or less) or non-section 1231 items.

- Line 10: Report ordinary gains/losses, like mark-to-market trader elections or section 1244 stock losses (up to $50,000/$100,000 ordinary deduction).

- Lines 11–16: Handle specific items, such as installment sales (via Form 6252) or abandonments.

- Line 18a: Deductible losses from income-producing property (capped by Form 4684).

Tip: Attach a statement for detailed trader transactions.

Part III: Gain from Dispositions of Section 1245, 1250, and Other Property

Focuses on recapture—converting depreciation into ordinary income.

- Lines 19–24 (Worksheet): Calculate gain: Gross sales price (line 20) minus adjusted basis (line 23, after depreciation on line 22).

- Line 25: Section 1245 recapture (full amount for most personal property).

- Line 26: Section 1250 for real property (additional depreciation over straight-line).

- Lines 27–29: Farmland (1252), minerals (1254), or cost-sharing exclusions (1255).

Example: Selling machinery with $20,000 gain and $15,000 depreciation? Recapture $15,000 as ordinary income on line 25.

Report results in Part I or II based on holding period.

Part IV: Recapture of Sections 179 and 280F(b)(2) Deductions

For business use dropping to 50% or less.

- Line 33: Enter prior deductions/depreciation claimed.

- Line 34: Allowable amount at reduced use.

- Line 35: Recapture difference as other income (e.g., on Schedule C); adjust basis upward.

After completing, totals flow to your main return—e.g., line 13 to Form 1040.

Common Mistakes to Avoid When Filing Form 4797

- Forgetting Recapture: Underreporting depreciation turns capital gains into unexpected ordinary income—double-check line 22.

- Incorrect Basis Allocation: When selling bundled assets (e.g., building + land), allocate by fair market value.

- Overlooking K-1 Data: Partners/S corp owners must include Schedule K-1 amounts accurately.

- Missing Attachments: Always include statements for complex items like QOF deferrals or multi-asset sales.

- Holding Period Errors: Misclassifying short- vs. long-term can trigger audits.

Consult Publication 544 (Sales and Other Dispositions of Assets) for more pitfalls.

Tips for 2025 Tax Filers Using IRS Form 4797

- Leverage Software: Tools like TurboTax or H&R Block automate calculations for installment sales or recaptures.

- Track Depreciation Religiously: Use Form 4562 annually to maintain accurate basis records.

- Consider Deferrals: Qualified Opportunity Funds (QOFs) can defer section 1231 gains—enter as negative on line 2(g).

- Plan Sales Strategically: Time dispositions to offset losses against gains, especially with 2025’s stable brackets.

- Seek Professional Help: For multi-property or partnership sales, a CPA ensures compliance amid rising IRS scrutiny on business assets.

Staying proactive can turn a complex sale into a tax-efficient event.

Final Thoughts: Master Form 4797 for Smarter Business Tax Planning

IRS Form 4797 is more than paperwork—it’s your gateway to accurate reporting on sales of business property, helping you navigate depreciation recapture, capital gains, and ordinary income rules. By following this guide and using official IRS resources, you’ll file confidently for 2025. Remember, errors can lead to penalties, so verify your numbers and consider e-filing for faster processing.

For the latest forms and pubs, visit IRS.gov/Form4797. If your situation involves unique elements like international sales or estates, consult a tax advisor. Ready to tackle your business property taxes? Start gathering your records today.