Table of Contents

IRS Form 4810 – Request for Prompt Assessment Under Internal Revenue Code Section 6501(d) – In the complex world of tax administration, especially for estates and dissolving corporations, time is often of the essence. IRS Form 4810, officially titled “Request for Prompt Assessment Under Internal Revenue Code Section 6501(d),” offers a way to expedite the IRS’s review process for certain tax returns. This form can significantly shorten the standard statute of limitations for tax assessments, providing much-needed closure for fiduciaries and executors. Whether you’re handling a decedent’s estate or winding down a business, understanding how to use Form 4810 can help avoid prolonged uncertainty and potential liabilities.

In this comprehensive guide, we’ll cover everything you need to know about IRS Form 4810, including its purpose, eligibility, filing process, benefits, and more. We’ll draw from official IRS resources to ensure accuracy and relevance as of late 2025.

What Is IRS Form 4810?

IRS Form 4810 is a specialized document used to request an accelerated assessment of taxes under Internal Revenue Code (IRC) Section 6501(d). Normally, the IRS has three years from the filing date (or due date, whichever is later) to assess additional taxes on a return. By filing this form, you ask the IRS to limit this period to 18 months from the date they receive your request.

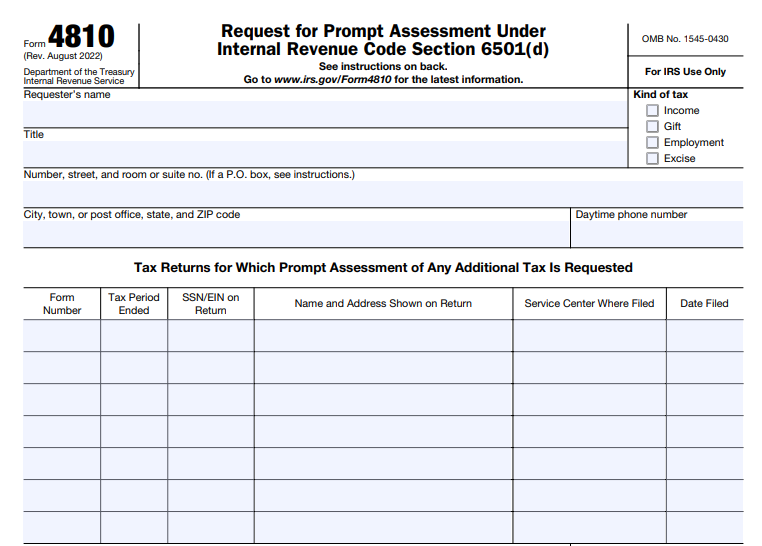

The form is particularly relevant for situations involving finality, such as closing an estate or dissolving a corporation. It’s a one-page form that requires basic information about the taxpayer, the returns in question, and supporting documentation. The current revision of the form is from August 2022, with updates and information available on the IRS website as of September 2025.

Purpose of Filing Form 4810

The primary goal of Form 4810 is to request a “prompt assessment” of any additional taxes owed on specific returns. This is authorized under IRC Section 6501(d), which allows the IRS to shorten the assessment period for certain fiduciaries. Once approved, the IRS will review the returns and either assess additional taxes or close the matter within the 18-month window, barring exceptions like fraud or substantial omissions.

This process provides certainty by limiting the time the IRS can come back with claims. It’s especially useful in estate administration, where executors need to distribute assets without the overhang of potential tax disputes. For dissolving corporations, it helps fiduciaries finalize affairs efficiently.

Who Can File IRS Form 4810?

Form 4810 is typically filed by a fiduciary, which includes:

- Executors or personal representatives of a decedent’s estate.

- Representatives of a dissolving corporation.

You must have the authority to act on behalf of the taxpayer, such as through letters testamentary or letters of administration. Individuals handling their own taxes generally don’t qualify, as the form is designed for representative roles in specific scenarios.

If you’re filing for a decedent, include details like the spouse’s name and Social Security Number (SSN) if applicable. For corporations, specify the status of dissolution—whether it’s completed, in progress, or planned.

When Should You File Form 4810?

You can only file Form 4810 after submitting the relevant tax returns. Do not submit it prematurely, as it must reference filed returns. Common timing includes:

- After filing the decedent’s final Form 1040 (individual income tax return).

- Following submission of Form 1041 (estate or trust income tax return).

- During the dissolution process for corporate returns like Form 1120.

There’s no strict deadline, but filing sooner allows the 18-month clock to start earlier, speeding up resolution. Note that separate requests are needed for any returns filed after the initial Form 4810.

IRS Form 4810 Download and Printable

Download and Print: IRS Form 4810

How to Complete and File IRS Form 4810

Completing Form 4810 is straightforward but requires attention to detail. Here’s a step-by-step guide:

- Gather Information: Collect details on the requester (fiduciary), taxpayer’s name, address, SSN or Employer Identification Number (EIN), and the types of taxes (e.g., income, gift, employment, excise).

- Fill Out the Form:

- Enter the requester’s name, title, address, and phone number.

- Specify the kind of tax and periods covered.

- List the form numbers (e.g., 1040, 1041), tax periods, SSN/EIN, name/address on the return, service center filed, and filing date.

- For decedents, add spouse details if relevant.

- For corporations, check the appropriate dissolution box.

- Attach Required Documents:

- Copies of the tax returns (marked “COPY – DO NOT PROCESS AS ORIGINAL”).

- Letters of administration or testamentary.

- Any other supporting evidence, such as proof of authority.

- Sign and Certify: Sign under penalties of perjury, declaring the information true. Certify no prior fraud penalties; if unable, explain in an attachment.

- Mail the Form: Send to the IRS Service Center where the original returns were filed. For gift tax (Form 709), use the specific address in Florence, KY. Private delivery services are allowed, but not for P.O. boxes. Form 4810 cannot be e-filed; it must be printed and mailed.

If using tax software like TaxSlayer Pro, access the form through the miscellaneous menu, enter data, print, and mail separately.

What Taxes Does Form 4810 Apply To?

The form covers various taxes, including:

- Income (e.g., Forms 1040, 1041, 1120).

- Gift (Form 709).

- Employment.

- Excise.

It applies to returns already filed, and you must specify each type and period.

Effects and Benefits of Filing Form 4810

Filing triggers the IRS to review and assess within 18 months, providing:

- Certainty and Finality: No further assessments after the period, except in cases of fraud or omission.

- Faster Distribution: Executors can safely distribute assets without reserving funds for potential taxes.

- Reduced Burden: Closes tax matters quicker, allowing fiduciaries to wrap up responsibilities.

However, it may invite scrutiny, potentially leading to an audit. It also shortens your window to amend returns. Weigh these risks, especially if returns have complexities.

Common Scenarios for Using Form 4810

- Decedent’s Estates: After filing the final 1040 and any 1041, file to expedite closure and asset distribution.

- Dissolving Corporations: Use during wind-down to limit liability periods on corporate returns.

In estate cases, it fast-tracks assessments, reducing complications with beneficiaries.

Frequently Asked Questions About IRS Form 4810

Can I file Form 4810 electronically?

No, it must be mailed to the appropriate IRS center.

What if I file additional returns later?

Submit a separate Form 4810 for those.

Does filing guarantee no additional taxes?

No, but it limits the time for assessment.

Where can I download Form 4810?

From the IRS website at www.irs.gov/Form4810.

Conclusion

IRS Form 4810 is a powerful tool for fiduciaries seeking prompt resolution of tax matters under IRC Section 6501(d). By shortening the assessment period to 18 months, it offers peace of mind and efficiency in estate and corporate dissolution processes. Always consult a tax professional to ensure it fits your situation, as improper use could lead to unintended audits or issues. For the latest updates, visit the official IRS resources.