Table of Contents

IRS Form 4835 – Farm Rental Income and Expenses – As a landowner renting out farmland for crop or livestock production, understanding how to report your income and expenses accurately is crucial for tax compliance. IRS Form 4835, Farm Rental Income and Expenses, is the key tool for passive farm rental arrangements where you don’t actively manage the farm. This guide breaks down everything you need to know about Form 4835 for tax year 2025, including who needs to file, step-by-step instructions, and differences from other forms. Whether you’re new to farm rentals or optimizing your deductions, this SEO-optimized resource will help you navigate the process efficiently.

Last updated: December 3, 2025. Always consult a tax professional or the latest IRS publications for personalized advice.

What Is IRS Form 4835?

IRS Form 4835 is designed for reporting farm rental income based on production shares of crops or livestock produced by a tenant, rather than fixed cash rents. It’s specifically for landowners or sub-lessors who do not materially participate in the farm’s operation or management—for self-employment tax purposes. This makes the income passive, exempting it from self-employment taxes but subject to passive activity loss limitations.

Key purposes include:

- Capturing gross rental income from production-based shares (e.g., a percentage of harvested crops).

- Deducting related rental expenses like repairs, insurance, and depreciation.

- Flowing net income or (limited) losses to Schedule E (Form 1040), lines 40 and 42.

Unlike active farming income, Form 4835 treats rentals as a passive activity under IRS rules. For 2025, there are no major structural changes to the form, but updates to depreciation limits and bonus depreciation rules may impact your calculations (more on this below).

Who Should File Form 4835?

Not every farm rental scenario requires Form 4835. It’s ideal for passive landlords, but here’s a quick eligibility checklist:

- Yes, file if:

- You own or sub-lease farmland and receive income based on crop/livestock production (e.g., 50% of the harvest).

- You do not materially participate in farm operations (see below for tests).

- The rental qualifies as a passive activity under passive loss rules.

- No, use alternatives if:

- You’re the tenant: File Schedule F (Form 1040) instead.

- You do materially participate: Report on Schedule F as active farm income, subject to self-employment tax.

- You receive flat cash rent: Report directly on Schedule E (Form 1040), Part I.

- You’re an estate, trust, partnership, or S corporation: Use Schedule E or Form 8825.

For qualified joint ventures (e.g., spouses co-owning a rental farm without material participation), each spouse can file a separate Form 4835. Attach the form to your Form 1040, 1040-SR, or 1040-NR.

| Scenario | Form to Use | Why? |

|---|---|---|

| Passive crop-share rental | Form 4835 | No material participation; passive income. |

| Active farm management | Schedule F | Material participation; self-employment tax applies. |

| Cash rent for pasture | Schedule E, Part I | Not production-based. |

| Tenant farming | Schedule F | Operator reports production income. |

Understanding Material Participation: The Key to Form 4835 Eligibility

Material participation is the IRS’s way of distinguishing active farmers from passive landlords. If you meet any of the seven tests, your rental becomes non-passive, shifting reporting to Schedule F. For 2025, the tests remain unchanged, but track your hours meticulously to avoid audits.

The 7 Material Participation Tests

To qualify, satisfy at least one:

- 500-Hour Test: You participate more than 500 hours in the farm activity during the year.

- Primary Participant Test: Your participation is substantially all the work in the activity (or you log >100 hours and no one else does more).

- Facts and Circumstances Test: Based on all facts, you’re actively involved (e.g., approving tenants, setting terms, or overseeing repairs).

- 5-of-10-Year Test: You materially participated in 5 of the prior 10 years.

- Personal Service Test: Your participation constitutes substantially all personal services in the activity.

- 50% Ownership Test: You own >50% and participate >100 hours (while others participate ≤100 hours).

- Farm Landlord-Specific Test: You perform at least three of these: Pay ≥50% of production costs; furnish ≥50% of equipment/livestock; advise on operations; inspect the farm ≥3 times/year; make management decisions; work ≥100 hours over ≥5 weeks; or show significant involvement.

If your interest (including spouse’s) is <10% by value, you can’t actively participate. For rentals, material participation allows soil/water conservation deductions but triggers self-employment tax.

Pro Tip: Keep detailed logs of decisions, inspections, and hours—IRS audits often scrutinize this.

IRS Form 4835 Download and Printable

Download and Print: IRS Form 4835

How to Fill Out IRS Form 4835: Step-by-Step Instructions

Form 4835 is straightforward but requires accurate income conversion and expense allocation. Use the cash method unless accrual is required. Here’s a line-by-line breakdown for 2025.

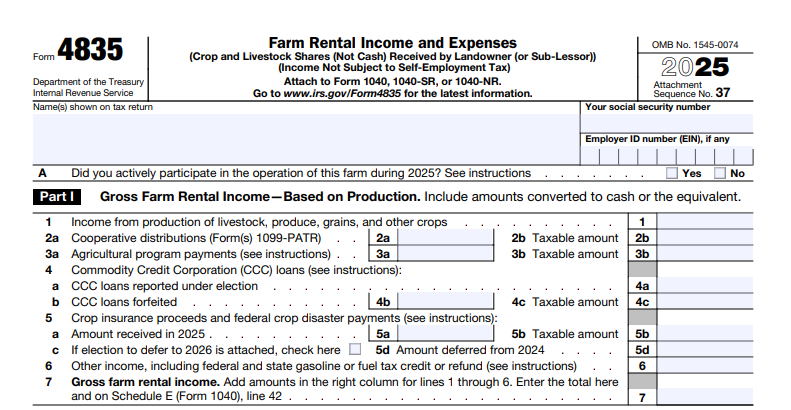

Header and Line A

- Enter your name, SSN, and EIN (if applicable).

- Line A: Check “Yes” if you actively participated (e.g., made management decisions or arranged services). This affects passive loss rules but doesn’t change form use.

Part I: Gross Farm Rental Income—Based on Production

Report income when converted to cash or equivalent (e.g., fair market value if crops are sold or fed to livestock). Total flows to Schedule E, line 42.

| Line | Description | Tips for 2025 |

|---|---|---|

| 1 | Income from livestock, produce, grains, other crops | Include production shares at FMV; add crop shares fed to livestock as income (deduct as feed expense). |

| 2a–2b | Cooperative distributions (Form 1099-PATR) | Enter total (2a); taxable amount (2b)—see Schedule F instructions. |

| 3a–3b | Agricultural program payments | Total received (3a); taxable portion (3b). |

| 4a–4c | CCC loans | Report elected/forfeited loans; taxable amount (4c). |

| 5a–5d | Crop insurance/federal disaster payments | Report 2025 receipts (5a); defer eligible amounts to 2026 by checking 5c and attaching statement. Include 2024 deferrals (5d). |

| 6 | Other income (e.g., fuel tax refunds) | Include machinery rental in crop-shares (no SE tax). |

| 7 | Gross farm rental income | Sum lines 1–6 (right column). |

Part II: Expenses—Farm Rental Property

Deduct only rental-related costs (not personal or production expenses). Capitalize certain costs under Section 263A (e.g., inventory production). No personal/living expenses.

| Line | Description | 2025 Notes |

|---|---|---|

| 8 | Car/truck expenses | Use standard mileage (70¢/mile) or actual; attach Form 4562 if needed. |

| 9–11 | Chemicals, conservation, custom hire | Conservation limited to 25% of gross farm income; must follow approved plan. |

| 12 | Depreciation/Section 179 | Up to $2.5M deduction (phase-out >$4M property); 100% bonus depreciation for qualified property post-Jan. 19, 2025. Attach Form 4562. |

| 13–18 | Employee benefits, feed, fertilizers, freight, fuel, insurance | Allocate business portion only. |

| 19a–19b | Interest (mortgage/other) | May require Form 8990 for limitations. |

| 20–30g | Labor, pension, rent/lease, repairs, seeds, storage, supplies, taxes, utilities, veterinary, other | Specify “other” items; capitalize via line 30g if applicable (note “263A”). |

| 31 | Total expenses | Sum lines 8–30g. |

| 32 | Net farm rental income (loss) | Line 7 minus 31. If loss, apply passive/at-risk rules (see below). |

| 34a–34c | If loss: At-risk status | Check boxes; complete Form 6198 if not fully at risk, then Form 8582 for passive limits. Deductible loss to Schedule E, line 40. |

Passive Loss Rules: Losses are limited to passive income unless you’re a real estate professional or meet exceptions. Use Form 8582. For 2025, no changes, but track carryovers.

Example: If you receive $20,000 in crop shares (Line 1) and $5,000 in expenses (Line 31), report $15,000 net income on Schedule E. If expenses total $25,000, the $5,000 loss may be limited—enter $0 on Line 32 and calculate allowable loss on Line 34c.

Form 4835 vs. Schedule F: Key Differences for Farmers

Confusing these forms is a common pitfall. Schedule F is for active farming profits/losses, while Form 4835 is passive rental-focused.

| Feature | Form 4835 (Passive Rental) | Schedule F (Active Farming) |

|---|---|---|

| Participation | No material involvement | Material participation required |

| Income Types | Production shares, program payments (passive) | Sales of raised/bought products, full program payments |

| Expenses | Rental-specific (e.g., repairs, depreciation); no soil conservation unless active | Full farm costs (e.g., feed, labor, seeds); soil conservation deductible |

| Tax Treatment | No SE tax; passive loss limits | SE tax on net earnings; full loss deductions |

| Reporting | Net to Schedule E | Direct to Form 1040; integrates with Form 4797 for sales |

| 2025 Impact | Bonus depreciation applies to rental assets | Same, plus higher SE tax cap ($176,100) |

Switch to Schedule F if you start participating more—reclassify to claim broader deductions.

Common Mistakes to Avoid When Filing Form 4835

- Misclassifying Income: Don’t report cash rent here—use Schedule E.

- Overlooking FMV: Always value crop shares at fair market value.

- Ignoring Capitalization: Capitalize production costs; don’t deduct them outright.

- Passive Loss Oversights: Forfeit deductions by skipping Form 8582.

- No Records: Lack of participation logs can trigger audits.

2025 Tax Tips for Farm Rental Landowners

- Maximize Depreciation: Leverage 100% bonus depreciation for new equipment placed in service after January 19, 2025.

- Election Options: Defer crop insurance proceeds to 2026 if cash flow is tight.

- Conservation Planning: Get NRCS approval early for deductible expenses.

- Software Tools: Use IRS-approved e-file software like TurboTax for seamless integration (though always verify with IRS sources).

- Deadlines: File by April 15, 2026 (or October 15 with extension); farmers get automatic 6-month extensions for Schedule F-related forms.

FAQ: IRS Form 4835 Essentials

Q: Does Form 4835 income count toward self-employment tax?

A: No, if passive—it’s reported on Schedule E without SE tax.

Q: Can I deduct home office expenses on Form 4835?

A: Only if exclusively used for rental management; allocate via Form 8829 if qualifying.

Q: What if my rental turns active mid-year?

A: Prorate and potentially amend to Schedule F.

For the latest forms and pubs, visit IRS.gov. This guide is based on official 2025 IRS resources—download Form 4835 PDF today to stay compliant.

Sources: IRS Publication 225 (2025), Form 4835 Instructions.