Table of Contents

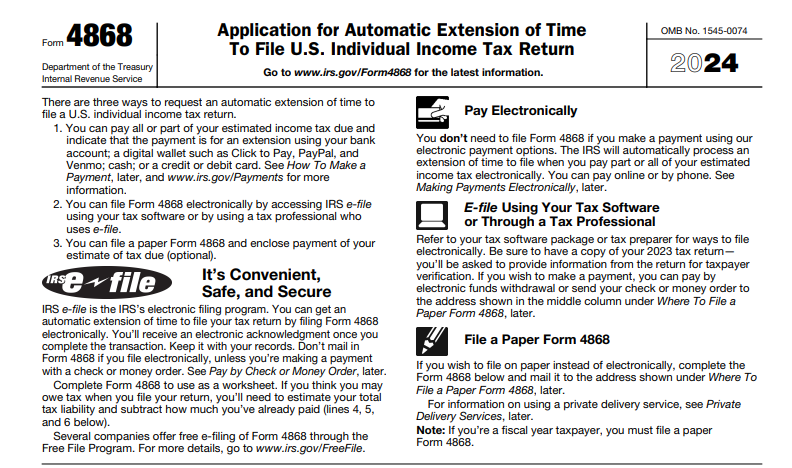

IRS Form 4868 – Application for Automatic Extension of Time to File U.S. Individual Income Tax Return – Tax season can feel overwhelming, especially if you’re juggling complex finances or unexpected delays. Enter IRS Form 4868, the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return—a simple tool that grants eligible taxpayers an extra six months to submit their federal return without the hassle of justification. For the 2024 tax year (filed in 2025), the deadline to request this extension was April 15, 2025, pushing your filing date to October 15, 2025. With the IRS emphasizing electronic filing amid ongoing modernization efforts, including the 2025 Modernized e-File schema updates for Form 4868 version 4.0, getting it right is easier than ever.

This SEO-optimized guide covers everything about IRS Form 4868 for 2025: its purpose, eligibility, step-by-step filing instructions, payment requirements, and pitfalls to dodge. Whether you’re a busy professional or expat, mastering how to file a tax extension with Form 4868 can save you from late-filing penalties up to 5% per month. Download the latest PDF from IRS.gov and e-file by the deadline to stay compliant.

What Is IRS Form 4868?

IRS Form 4868 is a one-page IRS form designed for U.S. citizens, residents, and certain non-residents to request an automatic six-month extension on filing their individual income tax return (Form 1040, 1040-SR, 1040-NR, or 1040-SS). Unlike extensions for businesses (Form 7004) or non-automatic requests (Form 2350), Form 4868 provides instant approval—no explanation needed—as long as it’s filed timely and accurately.

Key highlights for 2025:

- Extension Length: Six months from the original due date (e.g., April 15 to October 15 for calendar-year filers).

- No Payment Extension: It only delays filing; taxes owed are still due April 15 to avoid interest (around 8% annually) and late-payment penalties (0.5% per month, up to 25%).

- 2025 Updates: The form incorporates e-file enhancements and disaster relief provisions, with automatic extensions for affected areas (e.g., up to February 2026 for certain 2025 storms).

Over 14 million taxpayers use Form 4868 annually to avoid the 5% monthly late-filing penalty. It’s ideal for those needing time to gather documents or maximize deductions.

IRS Form 4868 Download and Printable

Download and Print: IRS Form 4868

Who Is Eligible to File IRS Form 4868 in 2025?

Most individual taxpayers qualify for Form 4868, but it’s not for everyone:

- Eligible Filers: U.S. citizens/residents filing Forms 1040/1040-SR/1040-SS; non-residents filing Form 1040-NR. Includes single-member LLCs treated as disregarded entities.

- Special Cases:

- Expats or military abroad: Automatic two-month extension to June 16, 2025; Form 4868 adds four more months.

- Disaster Victims: Automatic relief (e.g., November 3, 2025, for certain states like Texas).

- Ineligible: Businesses (use Form 7004), estates/trusts (Form 1041 extensions), or those wanting IRS to compute tax.

If your name or address changed, update via SSA (name) or Form 8822 (address) first. No ITIN required for the extension, but you’ll need one for your full return.

| Eligibility Factor | Details for 2025 |

|---|---|

| Tax Forms Covered | 1040, 1040-SR, 1040-NR, 1040-SS |

| Extension Duration | 6 months (automatic) |

| Special Groups | Expats (+2 months auto), Disaster Areas (varies) |

| Exclusions | Businesses, Estates, Trusts |

Step-by-Step Guide: How to Fill Out and File IRS Form 4868 for 2025

Filling Form 4868 takes minutes—use it as a worksheet to estimate taxes first. The 2024 version (for 2025 filings) is available on IRS.gov; e-file for free via IRS Free File or partners like TaxZerone. Deadline: April 15, 2025 (or next business day if holiday).

Step 1: Gather Your Info

- Estimate total 2024 tax liability (use last year’s return or tax software).

- Note withholdings, credits, and payments (e.g., estimated taxes).

- For non-residents without U.S. wages: Prepare to check Line 9.

Step 2: Complete the Form Line-by-Line

- Lines 1-3: Enter name, SSN/ITIN, and address (use current; doesn’t update IRS records automatically).

- Line 4: Total 2024 tax liability estimate (include self-employment, alternative minimum tax).

- Line 5: Federal income tax withheld (from W-2s, 1099s).

- Line 6: 2024 estimated tax payments and credits (e.g., EITC, child tax credit applied early).

- Line 7: Subtract Lines 5+6 from Line 4 (balance due; pay to avoid penalties).

- Line 8: Confirmation number if paying electronically (Direct Pay, EFTPS, card via IRS.gov).

- Line 9: Check if no U.S. wages and due date is June 16, 2025.

Sign and date—electronic signatures work for e-filing.

Step 3: Choose Your Filing Method

- E-File (Recommended): Free via IRS Free File, tax software, or providers (e.g., ExpressExtension). Instant approval; pay via EFW (bank draft). If rejected, perfect within 5 days.

- Paper Mail: Print, sign, and mail to IRS address based on state (e.g., Department of the Treasury, Internal Revenue Service, Austin, TX 73301-0045 for most). Postmark by April 15; include payment (check to “United States Treasury,” note “2024 Form 4868” and SSN). No cash.

Step 4: Make Payment

Pay at least 90% of owed tax by April 15 via IRS Direct Pay, EFTPS, card (fees apply), or check. Use Form 4868 as a voucher if mailing payment without e-filing.

Why File a Tax Extension? Benefits and 2025 Considerations

Requesting via Form 4868 buys time to optimize deductions, gather records, or consult pros—without late-filing fees. In 2025, with IRS focus on e-filing (over 90% processed faster), it’s seamless. Expats benefit from combined extensions, and disaster filers get bonus relief. However, underpayment triggers 0.5% monthly interest—pay accurately.

Common Mistakes to Avoid When Filing Form 4868

- Underestimating Tax: Leads to penalties; overestimate if unsure (overpayments refund later).

- Missing Deadline: Extension invalid after April 15.

- No Payment: Interest accrues immediately.

- Wrong Address/Name: Use SSA/Form 8822 updates.

- Paper vs. E-File: Mail delays risk postmark issues; e-file confirms instantly.

Frequently Asked Questions (FAQs) About IRS Form 4868

What’s the deadline to file Form 4868 for 2024 taxes?

April 15, 2025, for most; June 16 for non-residents without U.S. wages.

Does Form 4868 extend time to pay taxes?

No—it only extends filing. Pay by April 15 to avoid penalties.

Can I e-file Form 4868 for free in 2025?

Yes, via IRS Free File or partners, regardless of income.

What if I’m in a disaster area?

Check IRS.gov for automatic extensions (e.g., to February 2026 for 2025 storms).

Is there a penalty for filing Form 4868?

No, but late or incomplete requests trigger return penalties.

Final Thoughts: Secure Your Extension with Form 4868 Today

IRS Form 4868 is a taxpayer’s best friend for stress-free tax season, offering automatic relief without red tape. As October 15, 2025, approaches for extended 2024 returns, e-file now via IRS Free File to lock in compliance. Remember, it’s filing—not payment—that gets extended. For tailored advice, consult a tax pro or IRS.gov resources like Pub. 54 for expats.

This article is informational only; not tax advice. Always verify with the IRS.

Related Searches: IRS Form 4868 instructions 2025, tax extension deadline 2025, e-file Form 4868 free, Form 4868 mailing address, automatic tax extension rules.