Table of Contents

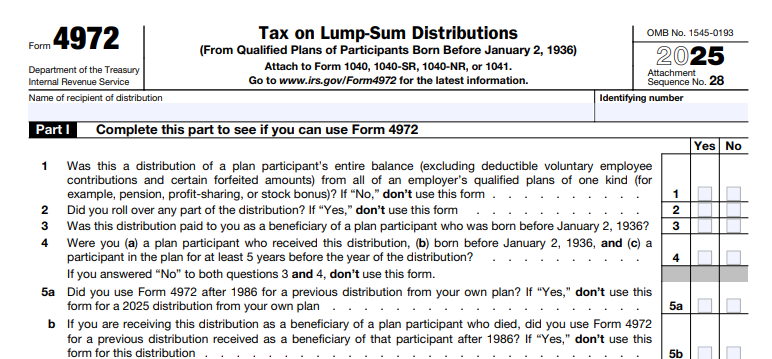

IRS Form 4972 – Tax on Lump-Sum Distributions – Retirement planning often involves tough decisions, like taking a lump-sum distribution from a qualified plan such as a pension or 401(k). While this can provide immediate access to funds, it risks a hefty tax bill in a single year. Fortunately, for those born before January 2, 1936, IRS Form 4972, Tax on Lump-Sum Distributions, offers special relief through options like 10-year tax averaging or a 20% capital gains rate on certain portions, potentially slashing your liability significantly. As the IRS released the 2025 draft form on April 14, 2025, with no structural changes from prior years, this grandfathered benefit remains available—though increasingly rare as the eligible population ages.

This SEO-optimized guide, based on the official 2025 Form 4972 instructions and IRS Publication 575 (Pension and Annuity Income), covers the form’s purpose, eligibility, step-by-step completion, deadlines, and key considerations. If you’re an estate executor handling a legacy distribution or a retiree born before 1936 evaluating options, Form 4972 could save thousands in taxes. Download the 2025 PDF from IRS.gov and explore if this relic of pre-ERISA tax law works for you.

What Is IRS Form 4972?

Form 4972 is a specialized tax computation form used to calculate the federal income tax on a qualified lump-sum distribution from a qualified retirement plan, applying special rules like 10-year averaging or a 20% capital gains election for participants born before January 2, 1936. A lump-sum distribution is the complete payout of all amounts from one type of plan (e.g., all pensions) in a single tax year, often triggered by separation from service, death, or plan termination.

The form’s structure:

- Part I: Ordinary income portion (10-year averaging).

- Part II: Capital gain election (20% rate on pre-1979 appreciation).

- Part III: Death benefit exclusion.

- Part IV: Total tax computation and entry on Form 1040/1041.

For 2025, the draft form (Cat. No. 13187U) retains its layout, with instructions referencing Form 1099-R (Code A for lump-sums) and Publication 575 for net unrealized appreciation (NUA) treatment. Attach to Form 1040, line 16 (check box 2), or Form 1041, Schedule G, line 1b. These options are grandfathered under pre-1986 rules, unavailable for post-1975 participants unless qualifying under special conditions.

Key Fact: Without Form 4972, lump-sums are taxed at ordinary rates (up to 37%), but averaging spreads tax over 10 years at 1986 brackets (max 50%), often yielding savings for large distributions.

Who Must File Form 4972?

File Form 4972 if you (or your estate/trust) received a qualified lump-sum distribution in 2025 from a qualified plan and were born before January 2, 1936, to elect special tax treatment. Eligible recipients include:

- Individuals: Plan participants or beneficiaries (e.g., spouses, but not non-spouse heirs for capital gain election).

- Estates/Trusts: For distributions to beneficiaries born before 1936.

- Plans: Qualified pensions, profit-sharing, 401(k)s, or stock bonus plans.

Qualified Lump-Sum Defined:

- Total payout from all plans of one type in one year.

- Includes ordinary income, capital gains (pre-1974 participation), and NUA in employer securities.

- Excludes after-tax contributions, IRD, or non-plan assets.

Ineligible If:

- Born January 2, 1936, or later (no averaging/capital gain election).

- Partial distribution or rollover to IRA.

- Non-qualified plans (e.g., 403(b)s, unless grandfathered).

For alternate payees (e.g., QDRO), eligibility passes through the participant. No separate filing if no election—report on Form 1040 as ordinary income.

Step-by-Step Guide: How to Complete IRS Form 4972 for 2025

The 2025 Form 4972 is a four-part PDF—download from IRS.gov and use tax software for calculations. Gather Form(s) 1099-R and prior-year records for averaging.

1. Gather Data

- 1099-R: Total distribution (Box 1), taxable (Box 2a), NUA (Box 6), code A (Box 7).

- Birth date: Confirm pre-1936.

- Prior years: AGI/tax for 10-year averaging (1986 tables in instructions).

2. Part I: Ordinary Income (Lines 1–12)

- Line 1: Total lump-sum (all 1099-R Box 1).

- Line 2: Minus after-tax/rollover.

- Line 3: Capital gain portion (pre-1974; from plan admin).

- Line 4–6: Death benefit (up to $5,000; line 3 if applicable).

- Line 7: Ordinary (line 1 – 2 – 3 – death).

- Line 8–12: 10-year averaging: Divide line 7 by 10, add to prior AGI, apply 1986 brackets (10%–50%).

3. Part II: Capital Gain Election (Lines 13–19)

- Line 13: Capital gain (line 3).

- Line 14: Multiply by 20%.

- Line 15–19: If electing, tax on gain (20% rate); otherwise, ordinary.

4. Part III: Death Benefit (Lines 20–23)

- Line 20: Eligible death benefit (line 3 or $5,000).

- Line 21–23: Exclusion calculation.

5. Part IV: Total Tax (Lines 24–30)

- Line 24: Ordinary tax (Part I).

- Line 25: Capital gain tax (Part II).

- Line 26: Death exclusion (Part III).

- Line 27–30: Total tax; enter on 1040 line 16 (box 2).

Pro Tip: Elect both averaging and 20% gain if beneficial—run scenarios in software; NUA taxed at sale, not distribution.

Deadlines and How to File Form 4972 for 2025

Attach Form 4972 to your 2025 Form 1040, 1040-SR, 1040-NR, or 1041—due April 15, 2026 (extendable to October 15 via Form 4868/7004). E-file (recommended) or paper mail to IRS center.

- Distribution Deadline: Report 2025 lump-sums on 2025 return.

- Election Irrevocable: Once made, can’t change for future distributions from same plan.

- Amended: Use 1040-X within 3 years if missed.

Refunds in 21 days for e-file; include 1099-Rs as support.

Common Mistakes to Avoid When Filing Form 4972

Grandfathered rules trip up 25% of filers—here’s a table of errors:

| Mistake | Why It Happens | How to Fix/Avoid | Potential Consequence |

|---|---|---|---|

| Ineligible Birth Date | Assuming post-1935 qualify. | Confirm pre-Jan. 2, 1936; no averaging otherwise. | Ordinary rates (up to 37%); no relief. |

| Partial Distribution | Rollover portion included. | Exclude rollovers; report only qualifying. | Incorrect tax; audit. |

| Wrong Averaging Years | Using current brackets. | Apply 1986 tables (10%–50%); Pub. 575 worksheet. | Overpayment; amended return needed. |

| Ignoring NUA (Line 3) | No employer stock. | Report appreciation separately; taxed at sale. | Double taxation risk. |

| No Election (Part II) | Skipping capital gain. | Elect 20% if pre-1974 participation; irrevocable. | Higher ordinary tax. |

| Wrong Attachment | Filing without 1040. | Attach to line 16 (box 2); e-file supported. | Processing delay. |

Amend with 1040-X; retain 1099-Rs 3 years.

IRS Form 4972 Download and Printable

Download and Print: IRS Form 4972

2025 Updates and Special Considerations for Form 4972

The 2025 draft (Rev. April 2025) is unchanged structurally:

- OMB No.: 1545-0075; Cat. No. 13187U.

- Grandfathered Only: Pre-1936 birth; no new eligibility.

- 10-Year Averaging: 1986 brackets (max 50%); AGI from prior years needed.

- 20% Capital Gain: On pre-1974 ordinary income portion.

- NUA: Box 6 on 1099-R; taxed at sale (0%/15%/20%).

- Death Benefits: Up to $5,000 exclusion (Part III).

- Estates/Trusts: Eligible if beneficiary pre-1936; report on 1041.

For QDROs/alternate payees, election applies if participant qualifies. Post-TCJA, no changes, but monitor sunset 2025.

Final Thoughts: Unlock Relief with Form 4972 in 2025

IRS Form 4972 provides rare tax relief for pre-1936 retirees facing lump-sum hits, using averaging or 20% gains to ease the burden. For 2025, confirm eligibility via birth date, gather 1099-Rs, and attach by April 15, 2026—potentially saving 20%+ on taxes. With fewer qualifying annually, act if eligible; otherwise, consider rollovers to IRAs.

Consult Pub. 575 or a CPA for NUA/QDROs. This guide is informational; verify IRS.gov.

Not tax advice. Refer to official IRS sources.

FAQs About IRS Form 4972

Who qualifies for Form 4972 in 2025?

Participants/beneficiaries born before January 2, 1936, with qualified lump-sum distributions.

What is 10-year averaging on Form 4972?

Spreads ordinary income tax over 10 years using 1986 brackets (10%–50%).

Can estates file Form 4972?

Yes, if the beneficiary was born before 1936.

Is Form 4972 e-file compatible?

Yes—attach electronically or paper to 1040/1041.