Table of Contents

IRS Form 5074 – Allocation of Individual Income Tax to Guam or the Commonwealth of the Northern Mariana Islands (CNMI) – Navigating U.S. tax obligations with income from U.S. territories like Guam or the Commonwealth of the Northern Mariana Islands (CNMI) can be complex. If you’re a U.S. citizen or resident alien earning income from these areas, IRS Form 5074 plays a key role in fairly dividing your tax liability. As we approach the 2025 tax filing season, this SEO-optimized guide breaks down everything you need to know about Form 5074—from eligibility and filing requirements to step-by-step instructions and common pitfalls. Whether you’re a military family stationed in Guam or a business owner with CNMI ties, understanding this form ensures compliance and avoids double taxation.

Stay informed with the latest from IRS Publication 570 and official guidelines to file confidently by April 15, 2026, for your 2025 returns.

What Is IRS Form 5074?

IRS Form 5074, officially titled “Allocation of Individual Income Tax to Guam or the Commonwealth of the Northern Mariana Islands (CNMI),” is an informational form that helps the IRS calculate how much of your U.S. income tax should be allocated to these territories. It prevents double taxation by mirroring the U.S. Internal Revenue Code, allowing Guam and CNMI to collect taxes on income sourced there.

The form is essential for U.S. taxpayers with territorial income, ensuring that taxes paid to the U.S. are properly credited or redirected. For tax year 2025, no major structural changes have been announced, but always verify via IRS.gov for updates.

Purpose of Form 5074

Form 5074 allocates your total U.S. tax liability based on the proportion of your income sourced from Guam or CNMI. The IRS uses this data to determine the territory’s share, which you then pay directly to Guam or CNMI. This system promotes equity, as both territories apply U.S.-like tax rates and rules.

It’s particularly relevant amid rising remote work and military relocations, where cross-territory income is common.

Who Needs to File IRS Form 5074?

Not everyone with Guam or CNMI connections files Form 5074. Eligibility hinges on residency status, income thresholds, and filing location.

Filing Requirements for Guam and CNMI Residents

- Bona Fide Residents: If you’re a bona fide resident of Guam or CNMI for the entire 2025 tax year (meeting the 183-day presence test or closer connection rules), file your full return—including worldwide income—with the territory’s tax authority. You generally skip the U.S. return and Form 5074, unless self-employment income triggers a separate U.S. filing for Social Security/Medicare taxes.

- Non-Bona Fide U.S. Citizens or Resident Aliens: If you’re not a bona fide resident but have Guam or CNMI source income, file Form 1040 (or 1040-SR) with the IRS. Attach Form 5074 if:

- Your adjusted gross income (AGI) is $50,000 or more.

- You have at least $5,000 in gross income from Guam or CNMI sources.

For joint filers, apply the thresholds to the spouse with the higher AGI (ignoring community property laws). If that spouse is a bona fide resident, file with the territory instead.

- Nonresident Aliens: File a U.S. Form 1040-NR for U.S.-source income and a separate territorial return for Guam/CNMI income. Form 5074 typically isn’t required unless you’re treated as a resident alien.

- Special Cases: Military personnel on active duty in Guam/CNMI may qualify as bona fide residents if previously established. Civilian spouses can elect the service member’s residency under the Military Spouses Residency Relief Act (MSRRA).

Income sourcing follows IRC Sections 861–865 and Section 937. Wages are sourced where services are performed; interest where the payer is located; dividends where the corporation is organized.

Key Sections of IRS Form 5074

Form 5074 is straightforward, with three parts focusing on income, adjustments, and payments. Download the 2025 version from IRS.gov.

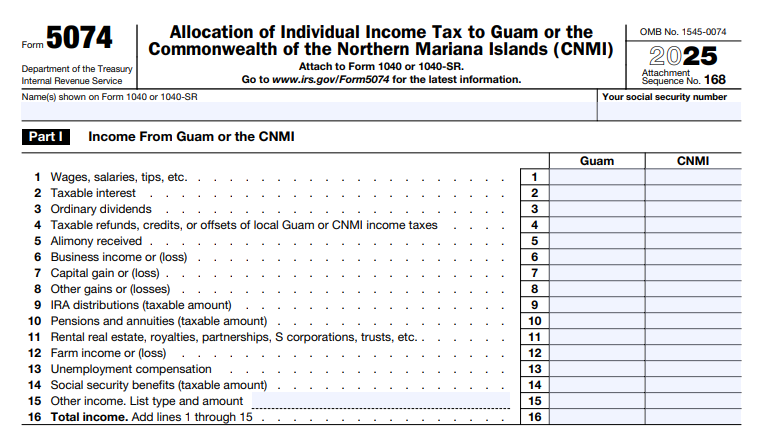

Part I: Income From Guam or the CNMI

List all 2025 gross income sourced to the territory on lines 1–15, including:

- Wages/salaries/tips (where performed; de minimis exception for short-term work ≤90 days and ≤$3,000).

- Interest/dividends/refunds of territorial taxes.

- Business/capital gains (real property where located; personal property at seller’s residence).

- Pensions/IRAs/Social Security (if attributable).

Total on line 16. Use Schedule 1 (Form 1040) for additional items.

Part II: Adjustments to Income From Guam or the CNMI

On lines 17–29, report deductions tied to territorial income, such as:

- Educator expenses, HSA contributions, self-employment tax (pro-rated by territorial self-employment income/total).

- IRA/student loan interest (pro-rated by compensation ratio).

- Early withdrawal penalties from territorial accounts.

Subtract from Part I total for AGI on line 30.

Part III: Payments of Income Tax to Guam or the CNMI

Detail credits on lines 31–35:

- Estimated payments to the territory.

- Withholding from U.S. government/military wages in Guam/CNMI.

- Other wage withholding.

These reduce your U.S. liability.

IRS Form 5074 Download and Printable

Download and Print: IRS Form 5074

How to Complete and File IRS Form 5074

- Determine Sourcing: Review Pub. 570 for rules. Track records meticulously.

- Fill Parts I–III: Use your Form 1040 worksheets; pro-rate where needed.

- Attach and Submit: Staple to your U.S. return. Mail to IRS Austin, TX (no payment) or Charlotte, NC (with payment).

- E-File Option: Available via tax software; ensure Form 5074 uploads correctly.

- Amended Returns: Use Form 1040-X with revised 5074.

For joint returns, the higher-AGI spouse’s status dictates filing jurisdiction.

Deadlines for Filing Form 5074 in 2025

Form 5074 follows your U.S. return deadline:

- Due Date: April 15, 2026, for calendar-year filers (extensions to October 15 via Form 4868).

- Estimated Taxes: Quarterly to the jurisdiction of your first payment; switch if needed.

- Penalties: Late filing incurs failure-to-file (up to 25% of tax due) and interest.

Bona fide residents file with Guam/CNMI by similar dates—check local rules.

Recent Changes to IRS Form 5074 for Tax Year 2025

The 2025 form mirrors prior years, with no box revisions noted. However, ongoing IRS emphasis on self-employment tax for territorial residents remains—file Form 1040-SS if applicable, even without income tax liability. Pub. 570 updates highlight NIIT exemptions for bona fide residents but advise consulting territorial agencies for mirrored rules.

Common Mistakes to Avoid with Form 5074

- Misclassifying Residency: Overlooking the bona fide test leads to incorrect jurisdiction filing.

- Underreporting Sourced Income: Forgetting pro-rata adjustments inflates U.S. liability.

- Joint Return Errors: Basing on wrong spouse’s AGI causes double taxation.

- De Minimis Oversight: Qualifying short-term work exclusions can reduce reportable income.

- Missing Attachments: Forgetting Form 5074 with your 1040 triggers notices.

Seek a tax advisor for military or multi-territory scenarios.

Frequently Asked Questions (FAQs) About IRS Form 5074

Who qualifies as a bona fide resident of Guam or CNMI?

You need 183+ days presence or a closer connection; military orders may preserve status.

Do I file Form 5074 if I’m a bona fide resident?

No—file solely with the territory unless self-employment requires U.S. reporting.

What if my AGI is under $50,000 but I have territorial income?

Skip Form 5074; report on Form 1040 but no allocation needed.

How does Form 5074 prevent double taxation?

It credits territorial payments against U.S. liability via mutual agreements.

Where do I get Form 5074 for 2025?

Download from IRS.gov or order via phone; instructions included in Pub. 570.

Final Thoughts: Simplify Your Guam or CNMI Tax Allocation with Form 5074

IRS Form 5074 ensures fair tax sharing for U.S. taxpayers tied to Guam or CNMI, minimizing burdens in these vital territories. By meeting thresholds and sourcing income accurately, you’ll avoid penalties and streamline filing. As 2025 ends, review your residency and records now.

For personalized advice, consult a tax professional or the IRS International Taxpayer Service. Visit IRS.gov/Form5074 for downloads and Pub. 570 for deeper insights.

This article provides general information, not tax advice. Always verify with official sources.