Table of Contents

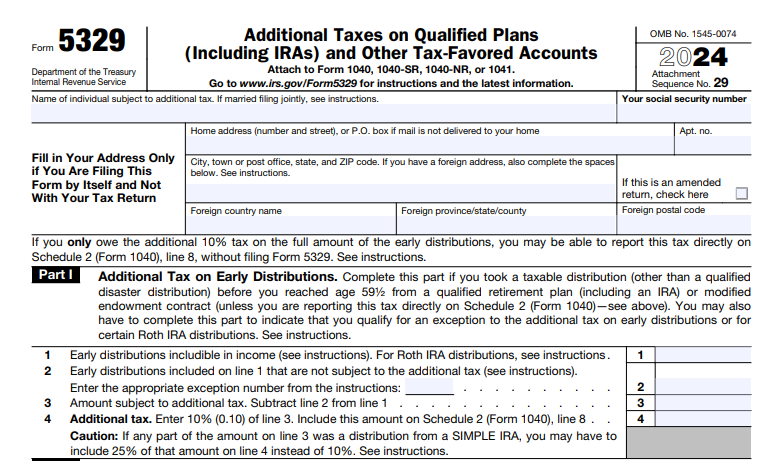

IRS Form 5329 – Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts – Tax season often uncovers unexpected penalties on retirement savings, but IRS Form 5329—Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts—is your key to reporting and potentially waiving them. For tax year 2024 (filed in 2025), this form addresses the 10% early withdrawal penalty, 6% excess contribution taxes, and 25% RMD shortfalls, with updates from SECURE 2.0 Act provisions like exemptions for domestic abuse victims and emergency distributions. As the IRS released draft 2025 instructions in July and updated them in November 2025, staying current prevents costly errors amid rising HSA limits ($4,300 individual/$8,550 family for 2025).

This SEO-optimized guide demystifies IRS Form 5329 for 2025 filers: its purpose, filing triggers, detailed instructions, exceptions, and avoidance strategies. Whether you’re facing an early IRA distribution or HSA overcontribution, mastering how to file Form 5329 can save thousands—file by April 15, 2025 (or October 15 with extension) to comply. Download the latest draft from IRS.gov and attach to your Form 1040.

What Is IRS Form 5329?

IRS Form 5329 calculates and reports additional taxes on early or excess distributions from qualified retirement plans (e.g., 401(k)s, IRAs), education savings accounts (Coverdell ESAs, QTPs), health savings accounts (HSAs), Archer MSAs, and ABLE accounts. It ensures compliance with IRC Sections 72(t) (early distributions), 4973 (excess contributions), and 4974 (RMD failures), preventing double taxation or undue penalties.

Key components for 2025:

- Nine Parts: Cover early distributions (Part I), education/ABLE taxes (Part II), excess contributions to IRAs/HSAs/ESAs (Parts III-VII), ABLE excesses (Part VIII), and RMD shortfalls (Part IX).

- Penalties: 10% on early withdrawals (25% for SIMPLE IRAs in first 2 years); 6% annual on unwithdrawn excesses; 25% on RMD shortfalls (reducible to 10% if corrected timely).

- Updates for 2025: Incorporates SECURE 2.0 expansions, including no age cap on IRA contributions and new exception codes (22 for domestic abuse, 23 for emergencies). Draft form reflects 2025 HSA limits and ABLE employment contribution boosts.

Unlike Form 1040 (which reports income), Form 5329 focuses on penalties—file even if no return is required, enclosing payment. Over 2 million filers use it annually to claim waivers, per IRS data.

IRS Form 5329 Download and Printable

Download and Print: IRS Form 5329

Who Must File IRS Form 5329 in 2025?

You must file Form 5329 for 2024 activity if:

- You took early distributions (before age 59½) from IRAs, 401(k)s, or similar plans without a Form 1099-R exception code.

- You made excess contributions to traditional/Roth IRAs, HSAs, ESAs, MSAs, or ABLE accounts (carry over from prior years).

- You failed to take required minimum distributions (RMDs) (age 73+ for 2024).

- You received taxable distributions from education or ABLE accounts not qualifying for exceptions.

No filing needed if your 1099-R shows code 1 (early with exception) or full rollovers. Spouses file separately on joint returns. For disasters, use Form 8915-F instead. Deadline: April 15, 2025; e-file with 1040 or mail standalone.

| Scenario | Must File Form 5329? | Penalty Trigger |

|---|---|---|

| Early 401(k) withdrawal at age 55 (job separation) | No (exception 01) | None if coded properly |

| Roth IRA excess contribution >$7,000 | Yes | 6% on excess |

| HSA overcontribution (>$4,150 individual) | Yes | 6% annual until corrected |

| RMD shortfall for age 73+ | Yes | 25% on unddistributed amount |

| Domestic abuse distribution (post-2023) | No (exception 22) | Exempt from 10% |

Step-by-Step Guide: How to Fill Out IRS Form 5329 for 2025

Use the 2024 form (draft 2025 available) with instructions from IRS.gov. Attach to Form 1040, line 4 (distributions) or Schedule 2, line 8 (tax). Retain records for audits. Here’s a part-by-part walkthrough for tax year 2024.

Part I: Additional Tax on Early Distributions

- Line 1: Total early distributions includible in income (1099-R Box 2a; Roth from Form 8606 Line 25c).

- Line 2: Excludable amount; enter exception code (e.g., 02: disability; 09: $10k homebuyer; 19: $5k birth/adoption; 22: domestic abuse up to $10k).

- Line 3: Line 1 minus Line 2 (taxable early amount).

- Line 4: If SIMPLE IRA (first 2 years), 25% of Line 3; else 10% of Line 3.

Part II: Tax on Education/ABLE Distributions

- Line 5: Taxable ABLE distributions.

- Line 6: Excludable (e.g., death, scholarships); Line 7: 10% of excess.

Part III: Excess to Traditional IRAs

- Line 9: Prior excess from 2023 Form 5329 Line 17.

- Line 10: 2024 limit ($7k/$8k age 50+) minus contributions.

- Lines 11-12: Add withdrawals/prior returns.

- Line 15: Total excess (if not withdrawn by April 15, 2025).

- Line 17: 6% of Line 16 (year-end IRA value min).

Part IV: Excess to Roth IRAs

Similar to Part III; Line 19: Roth-specific limit (phased by AGI); Line 20: From Form 8606.

Part V: Excess to Coverdell ESAs

Line 27: $2k limit (AGI phaseout); withdraw by June 1, 2025; 6% tax.

Part VI: Excess to Archer MSAs

Line 35: From Form 8853; include employer contributions.

Part VII: Excess to HSAs

Line 43: 2024 limit ($4,150/$8,300; +$1k age 55+); from Form 8889.

Part VIII: Excess to ABLE Accounts

Line 50: Over $18k + employment; tax on net income.

Part IX: Excess Accumulations (RMDs)

Line 52: RMD amount (age 73; Pub. 590-B tables). Line 53: Distributions taken. Line 54: Shortfall x 25% (or 10% if corrected by amended return/end of 2026).

Total tax (Line 60) goes to Schedule 2. For waivers, enter “RC” on Line 54 with explanation.

Exceptions and Waivers: Avoiding Penalties on Form 5329

Claim exceptions on Line 2 to skip the 10% tax—23 codes available, including new 2024+ ones for abuse/emergencies (up to $10k/$22.5k repayable over 3 years). For RMDs, correct within the window (e.g., by 2026) to drop to 10%. Waivers require “reasonable cause” (illness, error); attach statement—no automatic approval.

Common Mistakes to Avoid When Filing Form 5329

- Missing Exceptions: Forgetting code 21 for excess withdrawals leads to unnecessary 10% hits.

- Late Corrections: Excess must be withdrawn by April 15, 2025 (June 1 for ESAs); amend via 1040-X otherwise.

- Carryover Errors: Use prior Form 5329 lines accurately—penalties compound at 6%/year.

- Standalone Filing: Always enclose payment if no 1040; e-file preferred for speed.

- Ignoring SECURE 2.0: Miss new exemptions (e.g., disaster via Form 8915-F) and overpay.

Frequently Asked Questions (FAQs) About IRS Form 5329

When is the deadline to file Form 5329 for 2024 taxes?

April 15, 2025, or October 15 with extension; standalone if no return.

Can I waive the 10% early withdrawal penalty?

Yes, via 23 exceptions (e.g., medical >7.5% AGI); code on Line 2.

What’s the excess contribution limit for HSAs in 2025?

$4,300 individual/$8,550 family (+$1,000 catch-up); 6% penalty if over.

Do Roth conversions trigger Form 5329?

Only if under 59½ and no exception; report on Form 8606 first.

How do I correct an RMD shortfall?

Distribute by year-end, file amended return; tax drops to 10%.

Final Thoughts: Stay Penalty-Free with IRS Form 5329 in 2025

IRS Form 5329 is essential for managing retirement penalties, but proactive planning—like timely RMDs and limit checks—avoids it altogether. With 2025 drafts emphasizing SECURE 2.0 flexibilities, review Pub. 590-A/B and consult a CPA for complexities like disasters. File accurately to protect your nest egg—head to IRS.gov for the latest.

This article is informational only; not tax advice. Verify with IRS.gov or a professional.

Related Searches: IRS Form 5329 instructions 2025, early IRA withdrawal penalty exceptions, excess HSA contribution tax, RMD waiver Form 5329, SECURE 2.0 Form 5329 updates.