Table of Contents

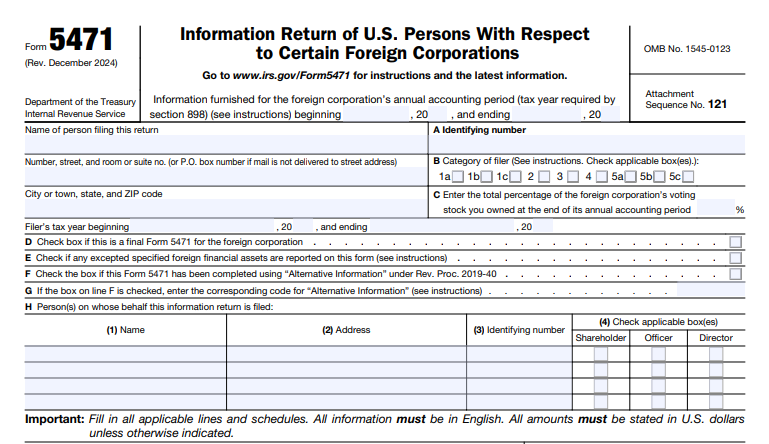

IRS Form 5471 – Information Return of U.S. Persons With Respect To Certain Foreign Corporations – In an increasingly globalized economy, many U.S. citizens, residents, and entities find themselves involved with foreign corporations. Whether you’re an officer, director, or shareholder, navigating U.S. tax obligations is crucial to avoid hefty penalties. IRS Form 5471, officially titled “Information Return of U.S. Persons With Respect To Certain Foreign Corporations,” plays a pivotal role in this process. This guide breaks down everything you need to know about Form 5471 for tax year 2025, including filing requirements, deadlines, penalties, and recent updates. We’ll draw from official IRS sources and expert insights to ensure accuracy and compliance.

What Is IRS Form 5471?

Form 5471 is an information return required by the IRS to report U.S. persons’ interests in certain foreign corporations. Unlike a traditional tax return that calculates owed taxes, this form provides the IRS with detailed data on foreign entities to enforce tax laws under Internal Revenue Code (IRC) sections 6038 and 6046. It’s essential for transparency, helping the IRS track income, earnings, and transactions that might impact U.S. tax liabilities, such as those related to Controlled Foreign Corporations (CFCs).

The form requires attachments like various schedules that detail financials, taxes paid, earnings and profits (E&P), transactions, and more. For 2025, the form has been revised as of December 2025, incorporating updates to reflect new legislation and reporting needs.

Who Must File Form 5471?

Not every U.S. person with international ties needs to file Form 5471. The requirement applies to specific “U.S. persons,” which include U.S. citizens, residents, domestic partnerships, corporations, estates, and trusts. You must file if you fall into one of the following categories of filers:

- Category 1: U.S. shareholders of a Specified Foreign Corporation (SFC) or CFC under certain conditions. Note: Exceptions exist if no U.S. shareholder owns stock attributable to the filer.

- Category 2: U.S. persons who become officers or directors of a foreign corporation where a U.S. person acquires stock meeting a 10% ownership threshold.

- Category 3: U.S. persons acquiring stock that results in 10% ownership or additional stock increasing ownership by 10%.

- Category 4: U.S. persons controlling a foreign corporation for an uninterrupted period of at least 30 days during the tax year.

- Category 5: U.S. shareholders owning at least 10% of a CFC’s voting power or value.

These categories ensure the IRS captures information from those with significant control or ownership. For startups or expats with foreign entities, this form is particularly relevant to report offshore operations.

Filing Requirements and Deadlines for 2025

Filing Form 5471 is tied to your U.S. tax return deadline. Attach it to your Form 1040 (for individuals), Form 1120 (for corporations), or other applicable returns. Key deadlines for tax year 2025 include:

- Individuals: April 15, 2026 (or June 17, 2026, if living abroad).

- Corporations: March 17, 2026.

Extensions for your main tax return automatically extend Form 5471’s deadline. Electronic filing is encouraged for accuracy and speed. If you’re a Category 1 filer, you might be exempt under certain conditions, but always verify with IRS instructions.

Key Schedules and Information Required

Form 5471 isn’t filed alone; it includes multiple schedules based on your situation. Here’s a breakdown:

- Schedule E: Reports taxes paid or accrued by the foreign corporation.

- Schedule G-1: Details cost-sharing arrangements.

- Schedule H: Current earnings and profits.

- Schedule I-1: Income inclusions for U.S. shareholders.

- Schedule J: Accumulated E&P.

- Schedule M: Transactions between the foreign corporation and related parties.

- Schedule O: Organization, reorganization, or stock acquisitions/dispositions.

- Schedule P: Previously taxed E&P (PTEP).

- Schedule Q: Income, deductions, taxes, and assets by income groups.

- Schedule R: Distributions from foreign corporations.

For 2025, a new Schedule H-1 has been introduced to report a CFC’s adjusted net income or loss for Corporate Alternative Minimum Tax (CAMT) purposes. Gather documents like financial statements, ownership records, and transaction logs to complete these.

Penalties for Not Filing or Late Filing Form 5471

Non-compliance can be costly. The IRS imposes a $10,000 penalty per foreign corporation per annual accounting period for failure to file a complete and timely Form 5471. If the failure continues after IRS notification, additional $10,000 penalties apply every 30 days, up to $50,000 per return. There are also potential penalties under section 6707A for failing to report certain transactions.

Recent court rulings have debated the IRS’s authority to assess these penalties, with some decisions affirming assessment rights under Section 6038(b). Penalty relief may be available for reasonable cause, but don’t rely on it—proactive filing is key.

Recent Changes to Form 5471 for Tax Year 2025

The IRS continues to update Form 5471 to align with evolving tax laws. For 2025:

- New Schedule H-1: Replaces the prior Worksheet H-1 for CAMT reporting.

- One Big Beautiful Bill Act (OBBBA) Impacts: Effective for CFC years after December 31, 2025, this modifies CFC ownership rules, transition rules for dividends, and repeals certain deferral elections under Section 898.

- §987 Reporting Revisions: Updates to how currency gain/loss is reported on the form.

These changes stem from broader tax reforms, including the 2025 Tax Act, which introduces significant shifts for international taxation. Consult the latest IRS instructions (Rev. December 2024) for full details.

IRS Form 5471 Download and Printable

Download and Print: IRS Form 5471

How to File Form 5471 Step-by-Step

- Determine Your Category: Review IRS instructions to confirm if you qualify.

- Gather Information: Collect foreign corporation details, including EIN (if applicable), financials, and ownership data.

- Complete the Form and Schedules: Use tax software or consult a professional for accuracy.

- Attach to Your Tax Return: File electronically via e-file or mail if necessary.

- Seek Professional Help: For complex situations, work with a tax advisor specializing in international tax.

Tools like Bloomberg Tax Workpapers can streamline preparation.

Conclusion

Mastering IRS Form 5471 is vital for U.S. persons with foreign corporation ties to maintain compliance and avoid penalties. With updates for 2025 emphasizing new schedules and legislative changes, staying informed is more important than ever. If you’re unsure about your obligations, consult a tax professional or visit the IRS website for personalized guidance.

Frequently Asked Questions (FAQs)

What happens if I forget to file Form 5471?

You could face a $10,000 penalty per corporation, with additional fines for continued non-compliance.

Is Form 5471 required for all foreign investments?

No, only for specific ownership or control levels in foreign corporations.

Are there any exemptions for small shareholders?

Yes, thresholds like 10% ownership apply, and some categories have exceptions.

How do recent tax laws affect Form 5471?

The OBBBA and other 2025 reforms introduce changes to CFC rules and new reporting requirements.

For more details, refer to official IRS resources or trusted tax advisors. This guide is for informational purposes and not tax advice.