Table of Contents

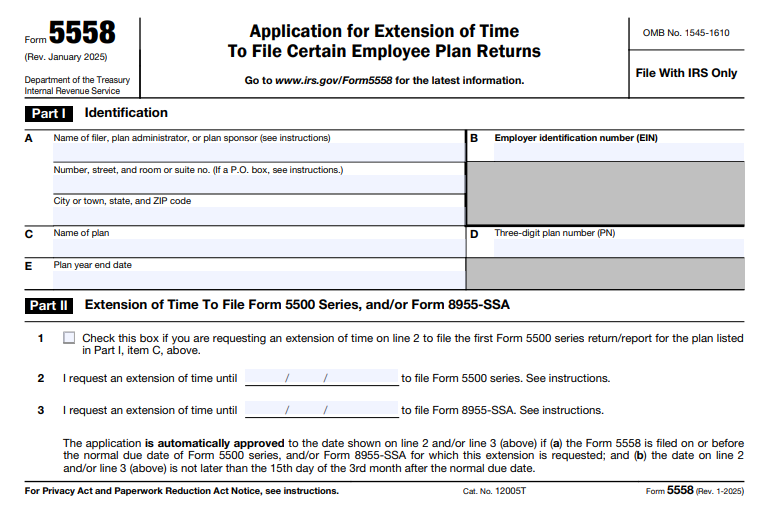

IRS Form 5558 – Application for Extension of Time to File Certain Employee Plan Returns – is a critical tool for plan administrators and employers managing retirement or employee benefit plans. This form allows you to request a one-time automatic extension of up to 2½ months for filing certain employee plan returns, helping avoid costly late-filing penalties. As of 2025, the latest revision (January 2025) is in effect, and electronic filing is now available.

Understanding Form 5558 instructions and deadlines ensures compliance with IRS requirements for Forms like 5500 and 8955-SSA. This comprehensive guide covers everything you need to know about filing IRS Form 5558 in 2025.

What Is IRS Form 5558?

Form 5558, titled Application for Extension of Time to File Certain Employee Plan Returns, is used to request an extension for specific IRS filings related to employee benefit plans. It provides an automatic approval if filed timely and correctly—no IRS response is needed.

Key update: As of January 9, 2024, Form 5558 is no longer used for extensions of Form 5330 (Return of Excise Taxes Related to Employee Benefit Plans). Instead, use Form 8868 for those.

The current version is Form 5558 (Rev. January 2025), available on the official IRS website.

Which Forms Can Be Extended with Form 5558?

IRS Form 5558 extends the filing deadline for:

- Form 5500: Annual Return/Report of Employee Benefit Plan

- Form 5500-SF: Short Form Annual Return/Report of Small Employee Benefit Plan

- Form 5500-EZ: Annual Return of One-Participant (Owners/Partners and Their Spouses) Retirement Plan or Foreign Plan

- Form 8955-SSA: Annual Registration Statement Identifying Separated Participants with Deferred Vested Benefits

You can use a single Form 5558 to extend both the Form 5500 series and Form 8955-SSA for the same plan. However, a separate form is required for each distinct plan (e.g., one for a defined benefit plan and another for a profit-sharing plan).

Extension Length and Deadlines

The standard extension is 2½ months from the original due date. Most plans have a due date of the last day of the 7th month after the plan year ends (e.g., July 31 for calendar-year plans ending December 31).

- Extended due date: Typically October 15 for calendar-year plans.

- The requested date cannot exceed the 15th day of the 3rd month after the normal due date.

Important: The extension applies only to filing—not to paying any taxes or premiums (e.g., PBGC premiums).

Automatic Extension Exception

You may qualify for an automatic extension without filing Form 5558 if:

- The plan year matches the employer’s tax year.

- The employer has an approved extension for its federal income tax return (e.g., Form 7004) beyond the normal plan return due date.

This extends the plan filing to the tax return’s extended due date. However, you cannot further extend it with Form 5558 after the normal due date.

IRS Form 5558 Download and Printable

Download and Print: IRS Form 5558

How to File Form 5558 in 2025

As of January 1, 2025, you have two options:

- Electronic Filing: Through the DOL’s EFAST2 system (same as for Form 5500).

- Paper Filing: Mail to

Department of the Treasury

Internal Revenue Service Center

Ogden, UT 84201-0045

When to File: On or before the original due date of the return(s) being extended.

Key Filing Tips:

- Use only one plan per form (no lists or multiple plans).

- No signature required for Form 5500 series or 8955-SSA extensions.

- Ensure EIN, plan name, and plan number match exactly with prior filings to avoid denial.

- If this is the first Form 5500 series filing for the plan, check the appropriate box.

Download the latest Form 5558 PDF from irs.gov/Form5558.

Common Mistakes to Avoid

- Filing late: Results in automatic denial (CP216H notice).

- Mismatched information (EIN, plan name, or number).

- Including multiple plans or attachments.

- Using an outdated form version.

- Assuming it extends tax payments or PBGC filings.

Late filings can trigger penalties up to $250 per day (increased under the SECURE Act).

Why File Form 5558?

Timely extensions prevent penalties while giving you extra time to accurately complete complex returns like Form 5500. For 2024 plan years (due in 2025), many administrators use Form 5558 to align with tax season preparations.

For official guidance, visit the IRS pages:

Consult a tax professional or retirement plan expert for your specific situation. Staying compliant with IRS Form 5558 ensures smooth employee plan reporting.