Table of Contents

IRS Form 56-F – Notice Concerning Fiduciary Relationship of Financial Institution – IRS Form 56-F, officially titled Notice Concerning Fiduciary Relationship of Financial Institution, is a specialized tax form used to inform the Internal Revenue Service (IRS) about the establishment, change, or termination of a fiduciary relationship involving a financial institution, such as a bank or thrift. This form is distinct from the more commonly used Form 56, which applies to general fiduciary relationships (e.g., estates or individuals). Understanding Form 56-F is essential for federal agencies or appointed fiduciaries managing insolvent or troubled financial institutions.

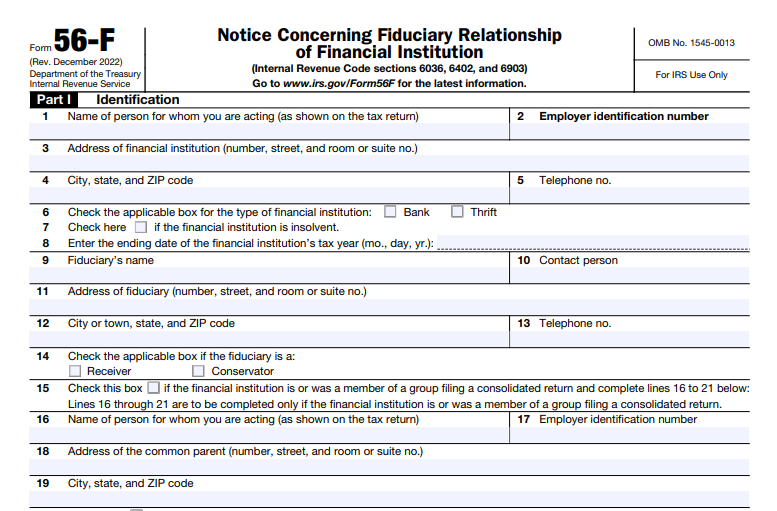

As of December 2025, the latest revision of Form 56-F is from December 2022, available on the official IRS website.

What Is IRS Form 56-F?

Form 56-F notifies the IRS when a federal agency—typically the Federal Deposit Insurance Corporation (FDIC) or another authorized entity—acts as a fiduciary (receiver or conservator) for a financial institution. This ensures the IRS directs all tax-related notices, correspondence, and liabilities to the correct party.

Key purposes include:

- Notifying the IRS under Internal Revenue Code (IRC) sections 6036, 6402, and 6903.

- Handling situations like bank failures or insolvencies where a federal agency takes control.

- Directing tax communications (e.g., for income, employment, or excise taxes) to the fiduciary.

Unlike Form 56, which is for personal estates, trusts, or non-financial entities, Form 56-F is exclusively for financial institutions (banks or thrifts).

Who Must File Form 56-F?

The filer is typically a federal agency acting as:

- A receiver (e.g., FDIC in a bank closure).

- A conservator.

Private individuals or entities do not use this form for general fiduciary roles. If the fiduciary relationship involves a non-financial entity, use Form 56 instead.

When to File IRS Form 56-F

File Form 56-F:

- Within 10 days of appointment as a receiver or conservator.

- When the financial institution becomes insolvent (check the appropriate box on the form).

- For termination or revocation of the fiduciary relationship.

- In subsequent tax years if the fiduciary role continues.

This timely filing is critical to avoid misdirected IRS notices and potential compliance issues.

IRS Form 56-F Download and Printable

Download and Print: IRS Form 56-F

How to Complete and File Form 56-F

Download the latest Form 56-F (Rev. December 2022) from IRS.gov.

Key sections include:

- Part I: Identification – Details of the financial institution (name, EIN, address, tax year end).

- Indicate if the institution is a bank/thrift and if insolvent.

- Fiduciary information (name, address, contact).

- Part II: Authority – Evidence of appointment (attach court orders or documents).

- Specify if notices should go to the fiduciary.

- Consolidated Returns – Additional lines if part of a consolidated group.

- Part III: Revocation or Termination – For ending the relationship.

- Signature – Under penalties of perjury.

Where to File:

- For certain purposes (e.g., section 6402(j) or 6903), specific addresses may apply (check the form instructions).

- Generally, send to the IRS service center or Advisory Group Manager with jurisdiction.

- Refer to Publication 4235 for Collection Advisory Group contacts.

Always attach supporting documents, such as court orders.

Key Differences Between Form 56 and Form 56-F

| Feature | Form 56 | Form 56-F |

|---|---|---|

| Primary Use | General fiduciary relationships (e.g., estates, trusts) | Fiduciary relationships for financial institutions only |

| Who Files | Executors, trustees, guardians | Federal agencies (e.g., FDIC as receiver/conservator) |

| IRC Sections | 6903, 6036 | 6036, 6402, 6903 |

| Filing Timeline | Generally upon creation/termination | Within 10 days of appointment |

| Common Scenarios | Decedent estates, incapacitated individuals | Bank failures, insolvencies |

Important Notes and Updates for 2025

- No major revisions to Form 56-F have been issued since December 2022.

- In March 2025, the IRS sought public comments on both Form 56 and Form 56-F under the Paperwork Reduction Act, indicating ongoing review but no immediate changes.

- Always check IRS.gov for the latest version and instructions.

- Failure to file promptly can lead to IRS correspondence being sent to the wrong party, complicating tax compliance.

For official guidance, visit the IRS page on About Form 56-F or download the form directly. If you’re a fiduciary for a financial institution, consult a tax professional or the appointing agency to ensure compliance.

This guide is based on current IRS publications and forms as of December 2025. Tax laws can change, so verify with the IRS for the most up-to-date information.