Table of Contents

IRS Form 56 – Notice Concerning Fiduciary Relationship – Navigating tax obligations as a fiduciary can be complex, especially when managing estates, trusts, or bankruptcy proceedings. If you’re an executor, trustee, guardian, or other fiduciary, understanding IRS Form 56—officially known as the Notice Concerning Fiduciary Relationship—is essential. This form alerts the Internal Revenue Service (IRS) to the start or end of your role, ensuring smooth tax administration for the taxpayer you represent.

In this comprehensive guide, we’ll break down everything you need to know about IRS Form 56, including who must file it, when to submit it, step-by-step filing instructions, and tips to avoid common pitfalls. Updated with the latest IRS instructions from December 2024 (reviewed January 2025), this resource helps fiduciaries stay compliant in 2025.

Whether you’re handling a deceased relative’s estate or overseeing a trust, filing Form 56 protects your legal standing and prevents delays in IRS communications. Let’s dive in.

What Is IRS Form 56?

IRS Form 56 is a critical notification tool used to inform the IRS about the creation or termination of a fiduciary relationship under Internal Revenue Code (IRC) Section 6903. It also serves as notice of qualification under Section 6036 for certain receivers or assignees. Essentially, it establishes you—the fiduciary—as the official point of contact for tax matters related to the taxpayer (e.g., an estate, trust, or individual under guardianship).

Key purposes include:

- Notifying the IRS of your authority: Once filed, the IRS treats you as the taxpayer for filing returns, paying taxes, and receiving notices until the relationship ends.

- Ensuring transparency: It prevents miscommunications, such as tax notices going to the wrong party, which could lead to missed deadlines or penalties.

- No address updates here: Form 56 isn’t for changing addresses—use Form 8822 (individuals) or 8822-B (businesses) instead.

Fiduciaries gain full rights and responsibilities akin to the taxpayer, but this isn’t the same as a power of attorney (use Form 2848 for that). The form is voluntary in the sense that it’s not a tax return, but it’s legally required for proper notification under IRC rules.

As of the 2024 revision (effective for 2025 filings), no major structural changes were made, but the IRS emphasizes timely filing to avoid processing suspensions.

Who Needs to File IRS Form 56?

Not every tax professional or representative files Form 56—it’s specifically for fiduciaries with a legal duty to manage another’s tax affairs. Common roles include:

- Executors or administrators of estates (testate or intestate).

- Trustees of trusts, including testamentary or inter vivos trusts.

- Guardians or conservators appointed by a court.

- Receivers in foreclosure or receivership proceedings.

- Assignees for the benefit of creditors.

- Debtors-in-possession or trustees in bankruptcy (though bankruptcy-specific rules may apply).

- Personal representatives or distributees handling a decedent’s assets.

If multiple fiduciaries exist (e.g., co-executors), each must file a separate Form 56. This applies to scenarios like:

- A dissolved corporation’s liquidator.

- An insolvent taxpayer’s trustee.

- A court-appointed guardian for a minor or incapacitated adult.

Pro Tip: If you’re only an authorized representative (not a fiduciary), skip Form 56 and use Form 2848 to grant limited powers.

When Should You File IRS Form 56?

Timing is crucial—file Form 56 as soon as your fiduciary role begins or ends to keep the IRS informed. Specific deadlines include:

- Creation of relationship: File immediately upon appointment. For receivers or assignees under Section 6036, submit within 10 days of qualification.

- Termination: File when your role ends (e.g., estate distribution complete or trust dissolved). A new fiduciary must then file their own Form 56.

- Ongoing updates: If your authority is limited to specific tax years, note that on the form.

For bankruptcy trustees or debtors-in-possession, Section 6036 notice isn’t always required due to Bankruptcy Code rules. Always check the IRS service center where the taxpayer files returns, or the local Advisory Group Manager for court-appointed roles (see IRS Publication 4235 for contacts).

In 2025, with potential estate tax changes on the horizon, early filing ensures you’re positioned for any audits or refunds.

How to Complete and File IRS Form 56: Step-by-Step Guide

The latest Form 56 (Rev. December 2024) is a straightforward two-page document, but accuracy is key. Download it from IRS.gov. Here’s how to fill it out:

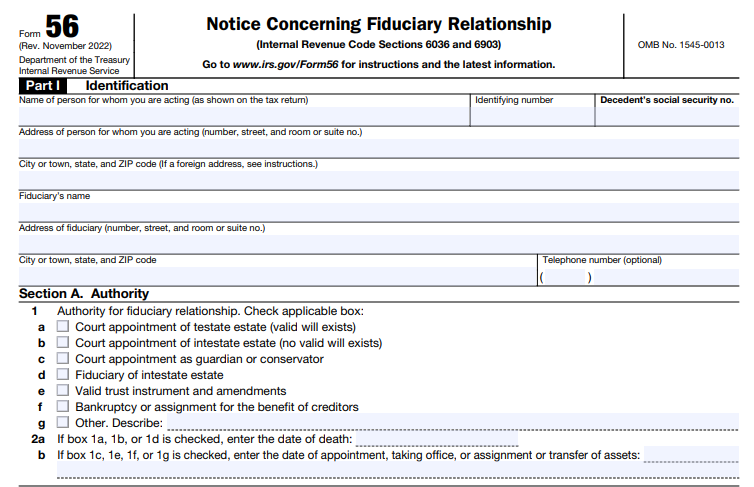

Part I: Identification

- Line 1: Enter the taxpayer’s full name (e.g., decedent’s name and estate name separately if needed).

- Line 3: Provide the taxpayer’s SSN/ITIN (individuals) or EIN (entities). For estates, include the decedent’s SSN from their final Form 1040.

- Line 4: List your address as fiduciary, using the format: street, suite/room, city, state, ZIP (or foreign equivalent).

Section A: Authority

- Check the box for your role (e.g., 1a for testate estate with will; 1e for trust).

- Enter dates: Death (Line 2a) or appointment/transfer (Line 2b).

- Be ready to attach proof (e.g., letters testamentary).

Section B: Nature of Liability and Tax Notices

- Check boxes for applicable taxes (e.g., income, estate, gift).

- If limited to certain years/periods, list them on Line 5.

Part II: Revocation or Termination

- Complete only if ending a prior notice. Include the date of termination and your signature.

Part III: Court and Administrative Proceedings

- For court-appointed roles (non-bankruptcy), list appointment details.

- For assignees, attach a schedule of assets and actions taken.

Part IV: Signature

- Sign under penalty of perjury, including your title and date.

Filing Method: Mail to the IRS center for the taxpayer’s return location (see IRS.gov/filing/where-to-file-forms-beginning-with-the-number-5). E-filing isn’t available—use certified mail for proof. Expect 4-6 weeks for processing.

IRS Form 56 Download and Printabel

Download and Print: IRS Form 56

Required Attachments and Documentation for Form 56

Don’t forget these essentials:

- Letters testamentary or court certificate for estates (Lines 1a/1b).

- Schedule of proceedings if multiple court dates (Part III).

- Asset description and action summary for creditor assignees.

Keep copies of everything— the IRS may request evidence later.

Common Mistakes to Avoid When Filing IRS Form 56

Even experienced fiduciaries slip up. Watch for these:

- Delaying filing: Late notices can suspend IRS actions, causing missed refunds or escalated penalties.

- Incomplete identification: Forgetting the decedent’s SSN or using the wrong EIN.

- Using it for non-fiduciary roles: Don’t file if you’re just a POA holder.

- Omitting attachments: This can invalidate your notice.

- Multiple fiduciaries not filing separately: Each needs their own form.

To mitigate, double-check against the IRS instructions and consult a tax pro if unsure.

Penalties for Not Filing IRS Form 56

Failure to file isn’t just an oversight—it has consequences:

- Suspended processing: The IRS may hold tax matters until notified, delaying resolutions.

- False information penalties: Up to $500 or more under perjury rules.

- Legal risks: Undermines your authority, potentially exposing you to beneficiary lawsuits or IRS audits.

Under IRC Section 6109, providing accurate IDs is mandatory; non-compliance could void your fiduciary status with the IRS.

Related IRS Forms to Know

Form 56 doesn’t stand alone. Pair it with:

- Form 2848: For authorizing representatives (not fiduciaries).

- Form 706: Estate tax return for decedents.

- Form 1041: Trust/estate income tax return.

- Form 56-F: For financial institutions (e.g., banks in receivership).

- Form 8822/8822-B: Address changes.

FAQs About IRS Form 56

1. Is Form 56 required for all estates?

Yes, for executors or administrators acting on tax matters.

2. How long does it take to process?

Typically 4-6 weeks; track via IRS account if available.

3. Can I e-file Form 56 in 2025?

No—paper filing only.

4. What if the fiduciary relationship terminates mid-year?

File immediately and notify the IRS of the new fiduciary.

5. Where can I get the latest Form 56?

Download from IRS.gov/forms-pubs/about-form-56.

For more, visit IRS.gov/Form56.

Final Thoughts: Stay Compliant with IRS Form 56 in 2025

IRS Form 56 is more than paperwork—it’s your gateway to authoritative tax handling as a fiduciary. By filing promptly and accurately, you safeguard assets, ensure timely IRS interactions, and avoid costly errors. With the 2024 instructions still guiding 2025 filings, now’s the time to review your role.

If managing complex estates or trusts, consider consulting a CPA or estate attorney. For the form and full instructions, head to the IRS website. Questions? Drop them in the comments below—we’re here to help demystify tax forms like IRS Form 56.