Table of Contents

IRS Form 5695 – Residential Energy Credits – As energy costs continue to rise and sustainability becomes a priority for homeowners, the IRS offers powerful incentives to offset the expense of green upgrades. In 2025, IRS Form 5695 remains your key tool for claiming the Residential Clean Energy Credit and Energy Efficient Home Improvement Credit—two non-refundable tax breaks expanded under the Inflation Reduction Act (IRA) of 2022. These credits can slash up to 30% off qualifying installations, potentially saving you thousands on solar panels, heat pumps, insulation, and more.

But with the Residential Clean Energy Credit set to expire after December 31, 2025, due to the One Big Beautiful Bill Act, now’s the time to act if you’re considering a home energy upgrade. This guide breaks down everything you need to know about Form 5695, eligibility, qualified expenses, and step-by-step filing instructions. Whether you’re a first-time filer or maximizing credits for multiple projects, we’ll help you navigate the process to reduce your 2025 tax bill.

What Is IRS Form 5695?

IRS Form 5695, titled “Residential Energy Credits,” is the official IRS worksheet used to calculate and claim federal tax incentives for energy-efficient home improvements and clean energy installations. Introduced in 2006, it was significantly enhanced by the IRA, renaming and expanding previous credits to encourage broader adoption of renewable technologies.

For tax year 2025, Form 5695 covers:

- Part I: Residential Clean Energy Credit – For major renewable energy systems like solar panels or geothermal heat pumps.

- Part II: Energy Efficient Home Improvement Credit – For smaller efficiency upgrades like windows, doors, or audits.

These are non-refundable credits, meaning they reduce your tax liability dollar-for-dollar but won’t result in a cash refund beyond what you owe. Any unused portion of the Residential Clean Energy Credit carries forward to future years (though post-2025 expiration limits this). Attach Form 5695 to your Form 1040 when filing.

Key 2025 update: Starting January 1, 2025, you’ll need to include a four-character Qualified Manufacturer Identification Number (QMID) or 17-character Product Identification Number (PIN) for certain items in Part II, verifiable via the IRS Energy Credits Online Portal. Manufacturers registering by April 30, 2025, qualify retroactively to December 31, 2024.

Residential Clean Energy Credit: Unlock 30% Savings on Renewables

The Residential Clean Energy Credit (formerly the Residential Energy Efficient Property Credit) offers a straightforward 30% credit on qualified costs for installing clean energy systems in your home. No lifetime cap applies, and it’s available for both your primary residence and secondary homes (e.g., vacation properties) in the U.S. This credit applies to property placed in service during 2025, including labor for onsite preparation, assembly, and installation.

Who Qualifies?

- Homeowners (not renters) who own and use the property as a residence.

- Joint occupants must prorate costs based on their payment shares; each files a separate Form 5695.

- Excludes new construction costs but includes homes under reconstruction.

- Subsidies (e.g., utility rebates) reduce qualifying costs unless included in your income.

What Qualifies for the Credit?

Eligible property must generate, store, or distribute clean energy for your home. Here’s a breakdown:

| Qualified Property | Description | Key Requirements |

|---|---|---|

| Solar Electric Property | Solar panels or photovoltaic systems generating electricity. | Generates power for home use; includes multifunctional solar roofing tiles. |

| Solar Water Heating Property | Systems heating water using solar energy. | At least 50% solar-derived; certified by Solar Rating Certification Corporation or equivalent. |

| Small Wind Energy Property | Turbines producing electricity. | Home-connected; no size limit specified. |

| Geothermal Heat Pump Property | Ground-source heat pumps for heating/cooling. | Meets Energy Star criteria at purchase. |

| Battery Storage Technology | Home batteries storing energy (e.g., from solar). | Minimum 3 kWh capacity; connected to your home’s system. |

| Fuel Cell Property | Electrochemical systems converting fuel to electricity. | ≥0.5 kW capacity, >30% efficiency; $500 credit per 0.5 kW (max $1,000 for 1 kW). Excludes pools/hot tubs. |

Credit Amount: 30% of total qualified costs, with no annual limit (except fuel cells). For example, a $20,000 solar system yields a $6,000 credit.

2025 Expiration Note: Claim before December 31, 2025, for full eligibility—systems must be fully installed and operational by year-end.

Energy Efficient Home Improvement Credit: Boost Efficiency with Annual Limits

The Energy Efficient Home Improvement Credit targets everyday upgrades to cut energy waste. It’s limited to your main U.S. home and offers 30% of costs, but with annual caps to prevent overuse. This credit replaced the prior $500 lifetime Nonbusiness Energy Property Credit starting in 2023.

Who Qualifies?

- Owners of an existing primary residence (not new builds).

- Property must last ≥5 years; original installation required.

- Joint filers aggregate costs on one form; joint occupants prorate.

What Qualifies for the Credit?

Focus on building envelope improvements and efficient appliances. All must meet standards like Energy Star, Consortium for Energy Efficiency (CEE) highest tier, or International Energy Conservation Code (IECC) as of January 1, 2021.

| Category | Examples | Annual Limit |

|---|---|---|

| Qualified Energy Efficiency Improvements | Insulation/air sealing; exterior windows/skylights (Energy Star); exterior doors (Energy Star, $250 per door, $500 total). | $1,200 overall (includes below). |

| Residential Energy Property | Central AC (CEE highest tier, $600); natural gas/propane/oil water heaters/furnaces/boilers (CEE/2021 Energy Star, $600 each); electrical panel upgrades (NEC-compliant, $600); heat pumps/heat pump water heaters (CEE highest, combined with biomass); biomass stoves/boilers (≥75% efficiency, $2,000 combined). | $1,200 overall ($600 per item for most); $2,000 for heat pumps/biomass. |

| Home Energy Audits | Professional inspection by a certified auditor identifying savings. | $150 per audit. |

Credit Amount: 30% of costs, prorated if limits exceeded. For instance, $4,000 in windows and a $1,000 audit = $1,350 credit ($1,200 max for windows/doors + $150 audit).

2025 Requirement: Report QMID/PIN for items like windows, doors, and audits.

IRS Form 5695 Download and Printable

Download and Print: IRS Form 5695

Step-by-Step Guide: How to Fill Out IRS Form 5695 for 2025

Download the 2025 Form 5695 and instructions from IRS.gov. Gather receipts, manufacturer certifications, and audits—don’t attach them, but keep for records.

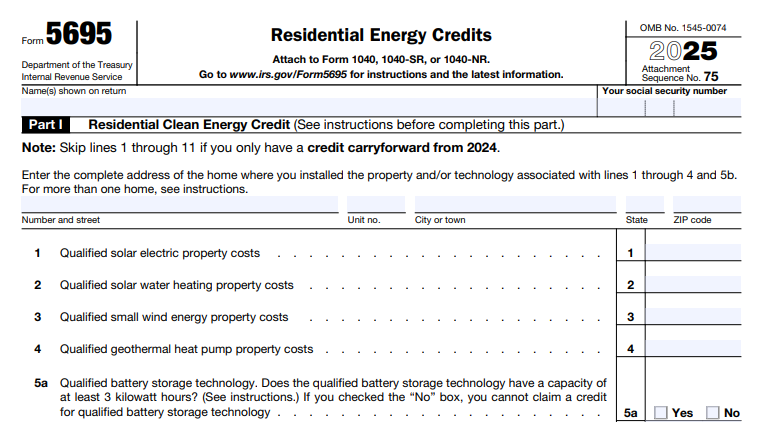

Part I: Residential Clean Energy Credit

- Header: Enter your home’s address (use the one with highest costs; attach a statement for multiples).

- Lines 1–6: Input costs for solar electric (1), solar water heating (2), wind (3), geothermal (4), battery storage (5b if ≥3 kWh), and fuel cell (8, after capacity check on 7).

- Line 9: Total costs (sum 1–6b, 8).

- Line 10: Multiply by 30% (0.30 × line 9).

- Line 13: Add carryforward from 2024 (line 16 of prior form).

- Line 14: Use the Residential Clean Energy Credit Limit Worksheet (subtract other credits from your tax liability on Form 1040, line 18).

- Line 15: Smaller of lines 13 or 14.

- Line 16: Carryforward (line 13 minus 15).

Part II: Energy Efficient Home Improvement Credit

- Lines 17a–17e: Confirm eligibility (U.S. main home, original use, etc.).

- Lines 18–20: Costs for insulation (18), doors (19), windows/skylights (20); note 2025 QMID/PIN.

- Lines 21–25: Confirm U.S. property; costs for AC (22), water heaters (23), furnaces (24), panels (25).

- Lines 26–27: Audit costs (26c, max $150).

- Lines 28–29: Heat pumps (29a–b), biomass (29c–e, max $2,000).

- Line 30: Total qualified costs.

- Line 31: Use the Energy Efficient Home Improvement Credit Limit Worksheet (similar to Part I).

- Line 32: Credit amount (30% of line 30, limited by 31).

Transfer totals from lines 15 and 32 to Schedule 3 (Form 1040), line 5. File by April 15, 2026.

Common Mistakes to Avoid When Filing Form 5695

- Forgetting Documentation: No certifications? No credit. Rely on manufacturer statements but retain them.

- Ignoring Limits: Overclaim on Part II? Prorate or lose excess.

- New Construction Confusion: Part II excludes builds; use Part I for clean energy in new homes.

- Joint Filers/Occupants: Prorate correctly—spouses combine, others allocate by payment.

- Subsidies: Deduct rebates from costs.

- 2025 PIN Oversight: Missing QMID/PIN invalidates Part II claims.

Why Claim Residential Energy Credits in 2025? The Bigger Picture

Over 3.4 million households claimed $8 billion in these credits through 2024, with averages of $5,000 for clean energy and $880 for efficiency. Beyond taxes, expect lower utility bills (e.g., solar ROI in 6–10 years) and increased home value. With the Residential Clean Energy Credit ending post-2025, installations must wrap by year-end for eligibility.

Consult a tax pro for complex setups, like multiple homes or business-use portions. For state incentives, check DSIREusa.org.

Ready to go green and save? Download Form 5695 today and turn your home into a tax-advantaged powerhouse. Questions? The IRS helpline (800-829-1040) or Energy.gov’s Savings Hub has more.

This article is for informational purposes only and not tax advice. Verify with the IRS for your situation.