Table of Contents

IRS Form 6198 – At-Risk Limitations – In the high-stakes world of investments and business ventures, the allure of tax deductions for losses can be tempting—but the IRS has safeguards to ensure you’re only deducting what you’ve truly risked financially. IRS Form 6198, At-Risk Limitations, is the critical tool that calculates how much of a loss from an at-risk activity (like partnerships, rentals, or equipment leasing) you can claim, preventing deductions exceeding your economic stake. For the 2025 tax year, the form (Rev. November 2025) remains structurally unchanged from 2024, but with inflation-adjusted penalties rising to $60–$340 per form for late filings after December 31, 2025, and ongoing references to Publication 925 for passive activity coordination, accuracy is paramount.

This SEO-optimized guide, based on the official 2025 Instructions for Form 6198 and IRS Publication 925 (Passive Activity and At-Risk Rules, Rev. February 2025), covers the form’s purpose, who files it, step-by-step completion, deadlines, and common errors to sidestep. Whether you’re a real estate investor offsetting rental losses or a partner in a startup claiming deductions, Form 6198 ensures compliance while safeguarding against disallowed claims that could trigger audits. Download the 2025 PDF from IRS.gov and attach to your Form 1040 by April 15, 2026—don’t let unclaimed losses evaporate due to at-risk rules.

What Is IRS Form 6198?

Form 6198 is a three-part worksheet used to determine the profit (or loss) from an at-risk activity, your amount at risk for the current year, and the deductible loss allowable under Internal Revenue Code Section 465. At-risk rules limit deductions to the money or property you’ve personally invested or are liable for, excluding nonrecourse loans or protected losses, to prevent “negative basis” deductions.

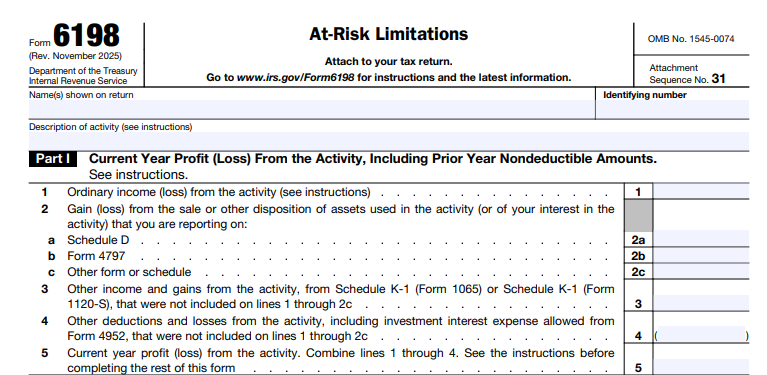

The form’s structure:

- Part I: Current year profit/loss and simplified at-risk amount.

- Part II: Detailed at-risk computation (increases/decreases).

- Part III: Deductible loss and recapture rules.

For 2025 (Rev. November 2025, Cat. No. 24881A), instructions integrate with Form 8582 for passive activities and emphasize carryforwards for disallowed losses (indefinite, unlike some NOLs). Attach to Schedule C/E/F (Form 1040), Form 4835, or Form 1120; e-file supported. File a separate form per activity.

Key Fact: At-risk rules apply after basis limits but before passive activity limits—disallowed losses carry forward until you increase your at-risk amount or fully dispose of the activity.

Who Must File Form 6198?

File Form 6198 if you have a loss from an at-risk activity and your at-risk amount is less than the loss, or to recapture prior deductions when risk decreases. At-risk activities include:

- Farming (Schedule F).

- Real estate rentals (Schedule E).

- Partnerships/S corporations (Schedule E, K-1).

- Equipment leasing or oil/gas with nonrecourse financing.

- Any trade/business with losses.

Filers:

- Individuals: Sole proprietors, partners, S-corp shareholders.

- Estates/Trusts: With at-risk investments.

- Closely Held C-Corps: Under Sec. 465(a)(1)(B) (5 or fewer own >50% value).

When Required:

- Current-year loss > at-risk amount.

- Prior-year deductions > new at-risk (recapture).

- Even if no loss, if tracking carryforwards.

Exceptions:

- No at-risk activity (e.g., portfolio income).

- Full at-risk (deduct all losses).

- Corporations not closely held (no limitations).

One form per activity; group if similar (Pub. 925).

Step-by-Step Guide: How to Complete IRS Form 6198 for 2025

The 2025 Form 6198 is three pages—download from IRS.gov and use software for carryforwards. Complete per activity.

1. Part I: Current Year Profit/Loss (Lines 1–5)

- Line 1: Activity description.

- Line 2: Form/Schedule (e.g., Schedule E).

- Line 3: Profit (enter as positive).

- Line 4: Loss (positive number).

- Line 5: Net (3 – 4; if profit, stop—no at-risk needed).

2. Part II: Simplified Computation (Lines 6–10) – Optional

- Lines 6–10: Quick at-risk (prior + increases – decreases – prior losses).

- If ≥ line 5 loss, deduct full; else, complete Part III.

3. Part III: Detailed Computation (Lines 11–20)

- Line 11: Prior-year at-risk (from 2024 line 20).

- Lines 12–15: Increases (contributions, income, loans you’re liable for).

- Lines 16–19: Decreases (withdrawals, losses, nonrecourse loans).

- Line 20: Current at-risk (11 + 12–15 – 16–19).

4. Deductible Loss (Line 21)

- Smaller of line 5 or 20; report on return.

- Carryover: Line 5 – 21 (indefinite).

Pro Tip: Exclude nonrecourse debt (protected loans) from at-risk; document liability.

Deadlines and How to File Form 6198 for 2025

Attach to your return (1040/1120/1065)—due April 15, 2026 (individuals; extendable to October 15 via 4868/7004). E-file or paper mail to IRS center.

- Partnerships/S-Corps: Attach to 1065/1120-S; partners/shareholders compute personally.

- Carryforward: Annual update; no expiration.

- Amended: Within 3 years via 1040-X/1120X.

Retain records (loans, contributions) 3+ years.

Common Mistakes to Avoid When Filing Form 6198

At-risk errors disallow 15% of losses—here’s a table of pitfalls:

| Mistake | Why It Happens | How to Fix/Avoid | Potential Consequence |

|---|---|---|---|

| Including Nonrecourse Debt | Counting protected loans. | Exclude; only recourse/personal liability. | Disallowed loss; carryforward only. |

| Forgetting Increases (Lines 12–15) | Omitting contributions. | Add cash/loans you’re liable for. | Understated at-risk; smaller deduction. |

| No Prior-Year Link (Line 11) | Lost 2024 line 20. | Track carryforwards annually. | Permanent disallowance. |

| Activity Grouping | Treating separately. | Group similar (Pub. 925); one form per. | Fragmented losses. |

| Recapture Oversight | Risk decrease without reporting. | If line 20 < prior, recapture on line 21. | Additional tax + penalty. |

| Late Filing | Missing return due. | Attach timely; extend return. | $60–$340/form. |

Amend via X-forms; audit-proof with loan docs.

2025 Updates and Special Considerations for Form 6198

The 2025 Form 6198 (Rev. Nov. 2025) is unchanged:

- OMB No.: 1545-0712; Cat. No. 24881A.

- Coordination: After basis (Form 8582), before passive (Pub. 925 Rev. Feb. 2025).

- Carryforward: Indefinite for unallowed losses.

- Recapture: When at-risk drops below prior deductions.

- Closely Held Corps: File if 5 or fewer own >50%.

- Partnerships: Partners compute on K-1; entity reports.

Monitor TCJA excess business loss changes post-2025.

Final Thoughts: Safeguard Deductions with Form 6198 in 2025

IRS Form 6198 is your frontline defense against disallowed losses, capping deductions at your true economic risk while carrying forward the rest. For 2025, document liabilities meticulously, complete per activity, and attach by April 15, 2026—essential for real estate or partnership investors. With Pub. 925 coordination, pair with passive rules for full compliance.

Consult a CPA for nonrecourse analysis. This guide is informational; verify IRS.gov.

Not tax advice. Refer to official IRS sources.

FAQs About IRS Form 6198

What is Form 6198 used for in 2025?

Calculating deductible losses limited by at-risk amounts in activities like rentals or partnerships.

Who files Form 6198?

Individuals, estates, trusts, and closely held C-corps with at-risk losses.

What happens to disallowed losses on Form 6198?

Carry forward indefinitely until at-risk increases or activity disposes.

Is Form 6198 required for all business losses?

No—only at-risk activities with losses > at-risk amount.

IRS Form 6198 Download and Printable

Download and Print: IRS Form 6198