Table of Contents

IRS Form 656 – Offer in Compromise – Tax debt can feel like an insurmountable burden, especially when interest and penalties pile on, threatening your financial stability. But there’s hope: the IRS Offer in Compromise (OIC) program lets eligible taxpayers settle for less than owed—sometimes pennies on the dollar—if full payment would cause hardship or if there’s doubt about the liability. At the center is IRS Form 656, the Offer in Compromise application, part of the comprehensive Form 656-B booklet. For 2025, with no major program changes but updated forms (Rev. 4-2025) emphasizing online submission and low-income waivers, OIC acceptance rates hover around 25-35% for viable cases. This SEO-optimized guide, based on the latest IRS resources, covers eligibility, step-by-step filing, fees, and tips to boost approval odds amid the program’s focus on “reasonable collection potential” (RCP).

What Is IRS Form 656?

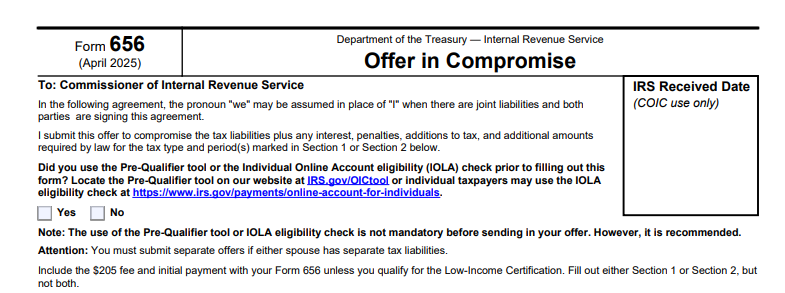

IRS Form 656 is the core application for an OIC, where you propose a settlement amount based on your ability to pay, assets, income, and expenses. It’s used for three main grounds: Doubt as to Collectibility (can’t pay full amount), Effective Tax Administration (payment causes economic hardship or is unfair), or Doubt as to Liability (dispute the debt amount). The form identifies tax types, periods, and your offer (lump-sum or periodic payments), while Form 656-B provides instructions and financial statements (Form 433-A/B).

Key features:

- Settlement Flexibility: Offers can be cash, installments, or asset sales; minimum based on RCP (assets + future disposable income).

- Irrevocable Terms: If accepted, stay compliant for 5 years or risk default.

- Public Disclosure: Accepted offers are viewable in a public inspection file.

The April 2025 revision (Rev. 4-2025) streamlines Section 965(h)(3) references for repatriation taxes and aligns with e-submission via Individual Online Account. Download Form 656-B from IRS.gov for the full booklet (PDF, 28 pages).

Who Qualifies for an Offer in Compromise in 2025?

Not everyone qualifies—OIC isn’t a quick fix for willful non-filers. Use the IRS Pre-Qualifier Tool to check eligibility before applying. Approval hinges on proving the IRS couldn’t collect the full amount reasonably.

| Qualification Type | Criteria for 2025 |

|---|---|

| Doubt as to Collectibility | RCP < full debt; complete Form 433-A (individuals) or 433-B (businesses) showing income/expenses/assets. |

| Effective Tax Administration | Agree on debt but payment causes hardship (e.g., basic living expenses strained) or is inequitable (e.g., special circumstances like illness). |

| Doubt as to Liability | Dispute debt amount—use Form 656-L; no financial statement needed. |

| General Requirements | Filed all returns, current on estimated payments, no bankruptcy; low-income waiver if AGI ≤ chart in Form 656 Section 1. |

Success tips: 25-35% acceptance rate; rejected if RCP ≥ debt or non-compliance. IRS won’t compromise restitution or DOJ-referred cases.

Filing Deadlines and Submission for Form 656 in 2025

No strict deadline—submit anytime, but act before collection escalates (e.g., liens). Processing takes 6-24 months; appeals within 30 days of rejection.

| Submission Method | Details |

|---|---|

| Online | Via Individual Online Account (irs.gov/account)—easiest for individuals; instant confirmation. |

| To sites in Form 656-B (e.g., Kansas City for most); certified mail recommended. | |

| To designated IRS addresses in booklet—secure upload for docs. | |

| Extensions | None for filing; payments continue during review. |

Include $205 fee ($0 low-income) and initial payment (20% lump-sum or first monthly). Returns applied to debt if rejected.

Step-by-Step Guide to Completing IRS Form 656

Gather tax transcripts, financials, and asset lists. Use Form 656-B instructions for details.

- Section 1: Basic Info – Taxpayer name, SSN, address; low-income certification (AGI ≤ $62,000 single/$125,000 joint in 2025—chart varies by family size).

- Section 2: Offer Terms – Select Doubt as to Collectibility/ETA/Liability; propose amount ($1 min, based on RCP); payment type (lump-sum: ≤5 payments; periodic: 6-24 months).

- Section 3: Tax Debts – List types/periods (e.g., 1040 for 2022-2024); separate forms for individual/business.

- Section 4: Initial Payment – Enclose check/money order; note if low-income waiver.

- Section 5: Joint Offer – Spouse signs if applicable; remains joint post-divorce unless amended.

- Section 6: Employer ID – For business offers.

- Section 7: Terms & Conditions – Read/acknowledge (e.g., 5-year compliance, public disclosure).

- Section 8: Signature – Sign under penalty of perjury; date.

- Attach Forms – 433-A/B (financials), ID/docs, $205 fee/initial payment.

- Submit – Online/mail/email; track via IRS account.

For Doubt as to Liability, use Form 656-L—no fee/financials.

Calculating Your Offer Amount on Form 656

The IRS bases approval on RCP: (Net asset equity) + (Future disposable income × months to collect). Minimum offer ≈ RCP.

| Component | 2025 Calculation |

|---|---|

| Assets | FMV minus encumbrances (e.g., home equity $50K after mortgage). |

| Income/Expenses | Monthly disposable = income – allowable expenses (Pub. 656 standards: $3,000/month family of 4 housing/food). |

| Offer Minimum | Lump-sum: RCP; Periodic: RCP ÷ 12 × 24 months (min 24). |

Use Pre-Qualifier Tool for estimate; low offers rejected if RCP higher.

IRS Form 656 Download and Printable

Download and Print: IRS Form 656

Fees and Initial Payments for Form 656 in 2025

- Application Fee: $205 (non-refundable); $0 if low-income certified (AGI ≤ chart).

- Initial Payment: Non-refundable; 20% of lump-sum offer or first monthly for periodic; $0 low-income during review.

- Waivers: Low-income per Form 656 Section 1; payments applied to debt if rejected.

Total upfront: $205 + 20% (e.g., $10K offer = $2,010).

What Happens After Submitting Form 656?

- Acknowledgment: IRS letter within 2 weeks; processing 6-24 months.

- Review: May request more info; collections suspended, liens possible.

- Accepted: Terms effective; comply 5 years; liens released post-payment.

- Rejected: Appeal via Form 13711 within 30 days; 25% reversal rate.

- Withdrawn: Refund fee/payments if requested.

Scam alert: Beware “OIC mills”—use IRS-authorized pros.

Common Mistakes When Filing Form 656 and How to Avoid Them

Low acceptance stems from pitfalls—boost odds:

- Underestimating RCP: Inflated expenses—use national standards.

- Incomplete Financials: Missing Form 433-A/B—attach all docs.

- Non-Compliance: Unfiled returns—file first.

- Low Offers: Below RCP—use Pre-Qualifier.

- Wrong Type: Doubt as to Liability for collectibility—match grounds.

Hire enrolled agents; success jumps 50% with pros.

Penalties and Risks of an Unsuccessful Form 656

No direct penalty for applying, but:

- Rejected Offers: Payments applied to debt; no refund.

- Default Post-Acceptance: Full debt revives + interest.

- Liens: IRS may file during review.

- Fraud: Criminal charges for false statements.

Appeal rejections; alternatives like installment agreements if denied.

Frequently Asked Questions About IRS Form 656

What’s the 2025 OIC application fee?

$205 ($0 low-income); non-refundable.

Can I apply online in 2025?

Yes—via Individual Online Account for faster processing.

How long does OIC processing take?

6-24 months; appeals add 3-6.

Does OIC stop collections?

Yes—suspended during review.

What’s the OIC success rate in 2025?

25-35% for processed offers; higher with pros.

Visit IRS.gov/oic for more.

Final Thoughts: Settle Your Tax Debt Strategically with IRS Form 656 in 2025

IRS Form 656 offers a path out of overwhelming debt, potentially slashing balances by 50%+ for those proving hardship or doubt. With the April 2025 update’s online tools and low-income waivers, now’s the time to pre-qualify and apply—download Form 656-B from IRS.gov, calculate RCP accurately, and seek expert help for 35%+ approval odds. Remember, OIC isn’t forgiveness—it’s a compromise for fresh starts.

This article is informational only—not tax advice. Consult IRS.gov or a professional.