Table of Contents

IRS Form 6781 – Gains and Losses from Section 1256 Contracts and Straddles – is essential for traders and investors dealing with futures, options, and certain hedging strategies. This form reports gains and losses from Section 1256 contracts and straddles, ensuring compliance with IRS mark-to-market rules and special tax treatments. As of December 2025, the latest version is the 2025 Form 6781, available directly from the IRS website.

What Is IRS Form 6781?

IRS Form 6781, titled Gains and Losses From Section 1256 Contracts and Straddles, is used to report:

- Gains and losses on Section 1256 contracts under mark-to-market accounting rules (Internal Revenue Code Section 1256).

- Gains and losses from straddle positions under Section 1092.

You must attach this form to your tax return (e.g., Form 1040, 1065, or 1120-S) if you have applicable transactions. Brokers often report these on Form 1099-B (boxes 8-11), but it’s your responsibility to accurately complete Form 6781.

What Are Section 1256 Contracts?

Section 1256 contracts include:

- Regulated futures contracts.

- Foreign currency contracts.

- Non-equity options (e.g., broad-based index options).

- Dealer equity options and dealer securities futures contracts.

These contracts are subject to mark-to-market (MTM) rules: Each year-end, open positions are treated as sold at fair market value (FMV) on the last business day of the tax year. Unrealized gains or losses are reported as if realized.

Key tax benefit: Gains/losses are split 60% long-term capital and 40% short-term capital, regardless of holding period. This often results in lower effective tax rates compared to ordinary short-term gains.

Net losses from Section 1256 contracts can be carried back up to 3 years (elect on Form 6781, Box D) to offset prior gains, subject to limitations.

What Are Straddles?

A straddle is offsetting positions in similar property that substantially reduce risk (e.g., holding a call and put option on the same asset). Under Section 1092:

- Losses on one leg may be deferred until the offsetting gain is recognized.

- Special rules apply to “identified straddles” and “mixed straddles” (combining Section 1256 and non-1256 positions).

Straddles prevent tax-motivated deferral of income or conversion of short-term to long-term gains. Part II of Form 6781 reports straddle gains/losses separately.

IRS Form 6781 Download and Printable

Download and Print: IRS Form 6781

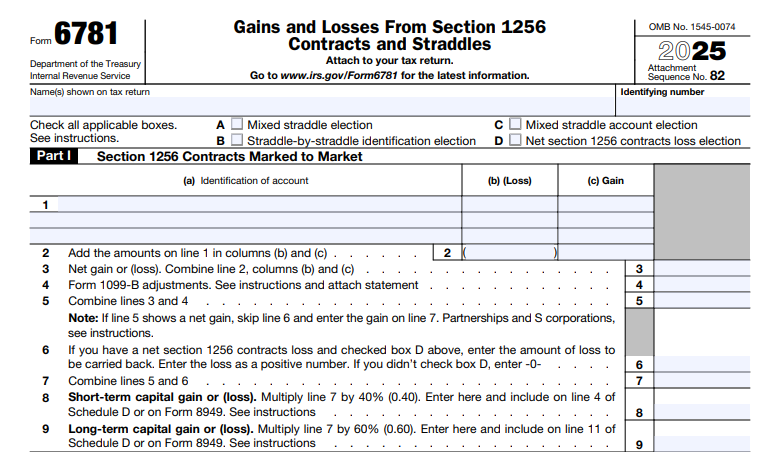

How to Complete Form 6781 (2025)

Form 6781 has three parts:

Part I: Section 1256 Contracts

- Report mark-to-market gains/losses on lines 1-7.

- Aggregate net gain/loss on line 7.

- Split: 40% short-term (line 8), 60% long-term (line 9).

- Transfer to Schedule D (Form 1040).

Part II: Straddles

- Section A: Losses.

- Section B: Gains.

- Attach a statement listing each straddle and components.

Part III: Unrecognized Gains on Year-End Positions

- Memo entry only (for positions with recognized losses).

Check applicable boxes for elections (e.g., mixed straddle, net loss carryback).

Filing and Deadlines for Tax Year 2025

- Attach to your 2025 tax return.

- Due April 15, 2026 (or extension).

- Download the official 2025 Form 6781 PDF from irs.gov.

Common Mistakes to Avoid

- Forgetting mark-to-market on open positions.

- Misapplying the 60/40 split.

- Ignoring straddle loss deferral rules.

- Not attaching required statements for straddles.

Consult IRS Publication 550 (Investment Income and Expenses) for detailed guidance.

Why This Matters for Traders

Proper use of Form 6781 ensures favorable 60/40 tax treatment on Section 1256 contracts and avoids penalties for unreported straddles. For complex portfolios, consider professional tax advice.

Sources: IRS.gov (Form 6781 2025, About Form 6781, Instructions for Schedule D 2025); Internal Revenue Code Sections 1256 and 1092.

Stay compliant—file accurately for tax year 2025!