Table of Contents

IRS Form 706 (Schedule G) – Transfers During the Decedent’s Lifetime – When navigating the complexities of estate taxes after a loved one’s passing, executors often encounter IRS Form 706—the United States Estate (and Generation-Skipping Transfer) Tax Return. Among its many schedules, Schedule G stands out for its focus on transfers during the decedent’s lifetime that must be included in the gross estate. These lifetime transfers can significantly impact the estate’s taxable value, potentially triggering federal estate taxes if the total exceeds the 2025 basic exclusion amount of $13,990,000.

In this comprehensive guide, we’ll break down what Schedule G entails, why it’s essential for estate tax planning, and how to complete it accurately. Whether you’re an executor, estate planner, or simply researching for future needs, understanding IRS Form 706 Schedule G ensures compliance and minimizes surprises. We’ll draw from the latest IRS instructions (revised September 2025) to provide up-to-date insights.

What Is IRS Form 706?

Before diving into Schedule G, a quick overview of the parent form is helpful. Form 706 is filed by the executor of a U.S. citizen or resident decedent’s estate to calculate federal estate taxes under Internal Revenue Code (IRC) Chapter 11. It also computes generation-skipping transfer (GST) taxes on direct skips under Chapter 13.

Key filing requirements for 2025 decedents include:

- Gross estate + adjusted taxable gifts + specific exemption > $13,990,000: Mandatory filing.

- Portability election: File even if below the threshold to transfer the deceased spousal unused exclusion (DSUE) to a surviving spouse.

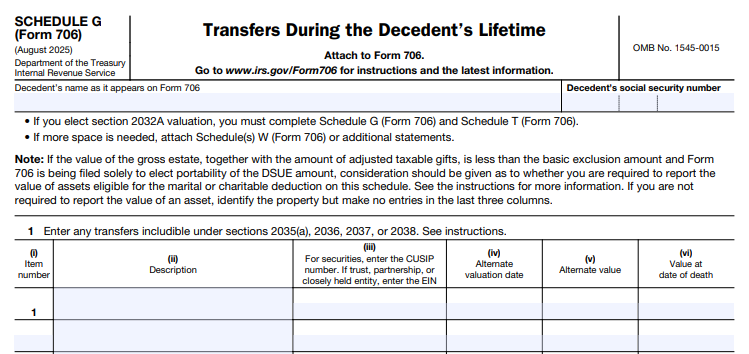

The form includes multiple schedules for categorizing assets, deductions, and credits. Schedule G (August 2025 revision) specifically addresses lifetime transfers includible in the gross estate, ensuring the IRS captures wealth shifted before death to prevent tax avoidance.

The Purpose of Schedule G on Form 706

Schedule G reports certain transfers during the decedent’s lifetime that the IRS deems part of the gross estate under IRC sections 2035 through 2038 and 2041. These rules prevent decedents from reducing their taxable estate through last-minute or retained-interest gifts.

Why does this matter? Lifetime transfers—like gifting assets to family or funding irrevocable trusts—can qualify for the annual gift tax exclusion ($19,000 per donee in 2025). However, if they involve retained control, enjoyment, or occur too close to death, they’re “pulled back” into the estate via Schedule G. This inclusion affects the unified estate-gift tax calculation, where post-1976 taxable gifts are added to the gross estate to determine the tentative tax base.

Failing to report accurately can lead to penalties, including a 20% accuracy-related penalty under IRC section 6662 for understatements. Proper completion also supports deductions like marital or charitable transfers on other schedules.

What Transfers Must Be Reported on Schedule G?

Not all lifetime gifts trigger inclusion—only those fitting specific IRC criteria. Use Worksheet TG in the Form 706 instructions to tally adjusted taxable gifts (post-1976, exceeding annual exclusions). Here’s a breakdown:

| IRC Section | Description | Key Triggers |

|---|---|---|

| 2035(a) | Transfers within 3 years of death | Revocable transfers, life estates, reversionary interests, or powers that would have been includible if retained until death. Review Forms 709 from the prior 3 years (e.g., for a 2025 death, check 2022–2025). |

| 2035(b) | Gift taxes paid within 3 years | Gift taxes on transfers by the decedent or spouse; attach relevant Forms 709. |

| 2036 | Retained life estates or income | Transfers (not sales for full value) where decedent kept income rights, enjoyment, power to designate recipients, annuities, property use, or ≥20% voting rights in a controlled corporation (post-1976). |

| 2037 | Transfers taking effect at death | Possession/enjoyment conditional on surviving decedent; reversionary interest >5% actuarial value returning to decedent/estate. |

| 2038 | Revocable transfers or powers | Power to alter, revoke, or terminate at death (e.g., trustee powers to change beneficiaries); includes relinquishments within 3 years. |

| 2041 | Powers of appointment | General powers exercisable in favor of decedent, estate, or creditors (limited exceptions for health/education standards). |

Other reportable items:

- Taxable gifts: Post-1976 gifts over annual exclusions; split gifts under section 2513 (include predeceased spouse’s portion if applicable).

- QTIP/QDOT elections: Qualified terminable interest property or domestic trusts for non-citizen spouses.

- Charitable remainder trusts: If spouse is sole non-charitable beneficiary.

- Life insurance/annuities: Proceeds with retained powers.

- Trust interests: From revocable or controlled trusts; annual exclusions apply but aren’t excludible here.

If a transfer doesn’t fit neatly, attach a statement with details (date, value, description). Report distributions (including Schedule G amounts) on Form 706, Part IV, line 5a.

IRS Form 706 (Schedule G) Download and Printable

Download and Print: IRS Form 706 (Schedule G)

How to Complete Schedule G: Step-by-Step Instructions

The redesigned 2025 Schedule G (attached to Form 706) uses columns for item number, description (CUSIP/EIN if applicable), date of death value, alternate valuation, and gift tax paid. Use Schedule W for additional space.

- Gather Documents: Collect Forms 709 (last 3+ years), trust agreements, gift deeds, and appraisals. Answer “Yes” to Form 706, Part IV, lines 12 or 13a if applicable.

- List Transfers: For each item:

- Description: Detail property (e.g., “Irrevocable trust funded with $500,000 securities, EIN XX-XXXXXXX”).

- Value: Fair market value (FMV) at death (or alternate date under section 2032); prorate partial interests; deduct encumbrances.

- Gift Tax: Amount paid/payable by decedent/estate.

- Complete Worksheet TG: Tally adjusted taxable gifts (line 2, column c for includible amounts).

- Total and Attach: Sum values; carry to Form 706, Part II. Elect special-use valuation? Complete Schedule T too.

- Special Rules: For split gifts, note predeceased spouse’s details. Estimate future interests reasonably.

File by the 9th month after death; extend via Form 4768 if needed.

Valuation Methods for Lifetime Transfers

Valuation is critical—use FMV at the transfer date for gifts, but death/alternate date for retained interests.

- Gifts: As on Form 709; apply sections 2701–2704 for family-limited partnerships.

- Retained Interests: Full property value at death, proportional for partial retention.

- Reversions/Powers: Actuarial tables from Rev. Rul. 2025-16 for >5% interests.

- Deductions: Reduce by mortgages, taxes; exclude charitable portions.

Appraisals are recommended for complex assets like real estate or closely held businesses.

Real-World Examples of Schedule G Transfers

- Retained Life Estate (Section 2036): Decedent gifts a vacation home to children but continues living there rent-free. Full FMV ($800,000) is includible, even if “informal.”

- Three-Year Gift (Section 2035): $100,000 cash gift to a grandchild in 2024; decedent dies in 2025. Include if revocable or with retained interest; plus any gift tax paid.

- Revocable Trust (Section 2038): Decedent funds an irrevocable trust but retains trustee power to revoke beneficiary designations. Entire trust value ($2M) pulls back.

- Split Gift with Predeceased Spouse: $50,000 gift split 50/50 in 2023; spouse died in 2024. Include decedent’s half plus spouse’s if in spouse’s estate.

These scenarios highlight why early estate planning—beyond simple wills—is vital.

2025 Updates and Key Changes for Form 706 Schedule G

The 2025 revisions emphasize efficiency: Schedules are now separate PDFs, with clearer numbering and portability prompts. No major Schedule G overhauls, but note:

- Inflation Adjustments: Exclusion rises to $13,990,000; annual gift exclusion $19,000.

- Closing Letter Fee: Reduced to $56 (effective May 21, 2025).

- Portability: Easier DSUE elections, but Schedule G gifts still factor into exclusions.

- GST Exemption: Matches estate exclusion at $13,990,000; report direct skips on Schedules R/R-1.

Check IRS.gov/Form706 for drafts and final forms.

Common Mistakes to Avoid When Filing Schedule G

- Overlooking the 3-Year Window: Many forget to review old Forms 709—leading to underreporting.

- Misvaluing Retained Interests: Informal arrangements (e.g., “borrowing” gifted property) count as retention.

- Ignoring Split Gifts: Predeceased spouses’ portions can sneak in unexpectedly.

- No Appraisals: DIY valuations invite audits; use qualified appraisers for FMV.

- Forgetting Attachments: Always include statements for non-standard transfers.

Penalties apply for negligence, so document everything.

Conclusion: Master Schedule G for Smarter Estate Tax Planning

IRS Form 706 Schedule G is more than paperwork—it’s a safeguard against unintended estate tax hikes from lifetime transfers. By reporting retained interests, recent gifts, and revocable powers accurately, executors can streamline filing and optimize deductions. With the 2025 exclusion at $13,990,000, most estates avoid tax, but portability and GST rules make Form 706 worthwhile for many.

Consult a tax professional or estate attorney for personalized advice, especially with trusts or international assets. Download the latest forms and instructions at IRS.gov/Form706 to stay compliant. Proper planning today preserves more for tomorrow—start reviewing those lifetime transfers now.

This article is for informational purposes only and not tax advice. Always refer to official IRS guidance.