Table of Contents

IRS Form 706 (Schedule M) – Bequests, etc., to Surviving Spouse – In estate planning, preserving wealth for your loved ones is paramount, especially amid the 40% federal estate tax rate on amounts exceeding the 2025 basic exclusion of $13,990,000. For married couples, the unlimited marital deduction under IRC Section 2056 offers a lifeline, allowing transfers to a surviving spouse to pass tax-free—deferring taxes until the second spouse’s death. This is where IRS Form 706 Schedule M comes in: the key schedule on the United States Estate (and Generation-Skipping Transfer) Tax Return for claiming this deduction.

Whether you’re an executor filing Form 706 or an advisor optimizing a client’s plan, mastering Schedule M can slash estate taxes dramatically. In this SEO-optimized guide, we’ll explore its purpose, eligibility, completion steps, and 2025 updates, drawing from the IRS’s September 2025 instructions and Section 2056 regulations. Maximize your marital deduction while ensuring compliance—your family’s financial legacy depends on it.

What Is IRS Form 706 Schedule M?

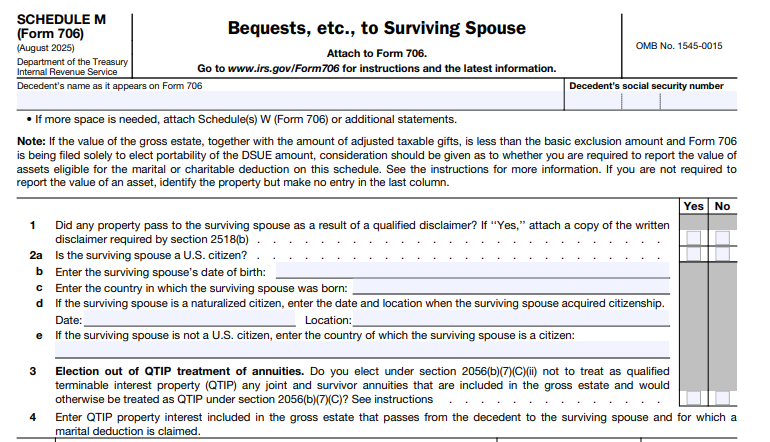

IRS Form 706 calculates federal estate and generation-skipping transfer (GST) taxes for decedents’ estates exceeding the applicable exclusion amount. Schedule M, revised August 2025, is the dedicated attachment for reporting the marital deduction—deducting the value of property interests passing from the decedent to the surviving spouse.

Under Section 2056(a), this unlimited deduction subtracts qualifying transfers from the gross estate (valued on Schedules A–I), reducing the taxable estate without limits. For instance, a $20 million estate leaving $10 million to a U.S. citizen spouse deducts the full $10 million, leaving only $10 million taxable (minus other deductions). It’s irrevocable and applies only to interests included in the gross estate, preventing double taxation across spouses.

Schedule M handles outright transfers, trusts, annuities, and elections like Qualified Terminable Interest Property (QTIP) under Section 2056(b)(7). For non-citizen spouses, it ties into Qualified Domestic Trusts (QDOTs) via Section 2056A. The total from Schedule M flows to Form 706, Part V, line 21.

Who Needs to File Schedule M on Form 706?

Attach Schedule M if claiming any marital deduction on Form 706, required for:

- Taxable estates: Gross estate + adjusted taxable gifts > $13,990,000 (2025 threshold).

- Portability elections: Filing solely to transfer the Deceased Spousal Unused Exclusion (DSUE) amount, even if no tax due—report estimated values for marital assets under Treas. Reg. § 20.2010-2(a)(7)(ii).

- U.S. citizen/resident decedents: With property passing to a surviving spouse.

- Non-citizen spouses: If using a QDOT; otherwise, no deduction without one.

Omit if no deduction is claimed (enter zero on Form 706). Nonresident noncitizens use Form 706-NA, with Schedule M limited to U.S.-situs property. Always verify with IRS Exempt Organizations tools or a tax pro—errors can trigger audits or lost deductions.

Qualifying Property Interests for the Marital Deduction

Section 2056 allows deductions for interests “passing” to the spouse, but terminable interests (e.g., life estates with remainders to others) are nondeductible unless electing QTIP treatment. Key qualifiers:

Eligible Transfers

- Outright bequests: Cash, real estate, stocks, or personal property directly to the spouse via will or trust.

- Joint interests: Surviving joint tenancy or tenancy by the entirety (full value if decedent furnished all consideration).

- Life estates with power: Spouse’s life interest + general power of appointment over the entire interest (exercisable alone, in all events).

- Insurance/annuities: Proceeds payable to spouse; joint/survivor annuities under Section 2039.

- Powers of appointment: Spouse as appointee or taker in default.

- QTIP property: Terminable interests (e.g., income for spouse’s life, remainder to kids) elected as QTIP—full value deductible if spouse gets all income annually/more frequently and has power over the whole.

- QDOT for non-citizens: Property to a trust with U.S. trustee(s), deferring tax on distributions.

Non-Qualifying Interests

- Terminable without QTIP: E.g., life estate where remainder goes to non-spouse, allowing post-termination enjoyment.

- Partial interests from mixed assets: Reduce by nondeductible portions (e.g., $100,000 bequest from $110,000 asset with $10,000 retained for child).

- Foreign spouses without QDOT: No deduction; annual gift exclusion rises to $190,000 in 2025.

- Disclaimers: Only if qualified under Section 2518.

Valuations use fair market value (FMV) at death (or alternate date), reduced by encumbrances, federal/state/GST taxes paid from the interest, and administration expenses. Actuarial values for life estates use Section 7520 tables (per Rev. Rul. 2025-16).

IRS Form 706 (Schedule M) Download and Printable

Download and Print: IRS Form 706 (Schedule M)

Step-by-Step Guide: How to Complete Schedule M

Use the August 2025 Schedule M (standalone PDF). Attach continuation sheets (Schedule W) if needed. Gather: will/trust docs, appraisals, tax computations.

Key Steps

- Header and Elections:

- Line 1: Check “Yes” for qualified disclaimer; attach copy.

- Line 3: For Section 2039 annuities, check “Yes” to elect out of QTIP (irrevocable).

- Part IV, Line 14: If QDOT, check box and detail trust (name, EIN, trustees, value).

- Report Property Interests:

- Line 4: Table for each transfer—(i) Item number; (ii) Description (CUSIP/EIN for securities, will clause); (iii) Value before taxes.

- For QTIP: List terminable interests; presumed election if deducted.

- Residue: Attach computation (after non-probate, legacies, taxes).

- Adjustments:

- Lines 5–10: Subtotals for real/personal property, annuities, other.

- Lines 13a–13d: Subtract federal estate/GST (13a), state death/GST (13b–13c) taxes from the interest; net to Line 14.

- Totals and Transfer:

- Line 14: Net marital deduction to Form 706, Part V, line 21.

- Line 15: QTIP value from predeceased spouse (Schedule F).

- Attachments:

- Will/certified copy, trusts, disclaimers, QDOT agreements, actuarial computations.

| Line/Column | Required Info | Example |

|---|---|---|

| Line 4(ii) Description | Asset details, reference | “50% interest in residence at 123 Main St. (Schedule A, Item 1); Will Article III” |

| Line 4(iii) Value | Pre-tax FMV | “$500,000 (appraised 12/05/2025)” |

| Line 13a Federal Taxes | Amount paid from interest | “$20,000 estate tax allocation” |

| Line 14 Total | Net deduction | “$480,000 after taxes” |

For partial QTIP: Use formula (deducted amount / total value).

2025 Updates to Form 706 and Schedule M

The IRS redesigned Form 706 in 2025: Schedules now standalone PDFs for easier e-filing. Key inflation adjustments:

- Basic exclusion/DSUE: $13,990,000 (up from $13.61M in 2024).

- GST exemption: Matches at $13,990,000.

- Non-citizen gift exclusion: $190,000 annual.

- Closing letter fee: $56 (down from $67, post-May 21, 2025).

- Section 7520 rates: Updated in Rev. Rul. 2025-16 for valuations.

No Schedule M-specific changes, but portability filers must estimate marital assets. Sunset risk: Post-2025, exemption halves (~$7M, inflation-adjusted), amplifying marital strategies.

Common Mistakes to Avoid on Schedule M

Pitfalls can disallow deductions:

- No QTIP election: Terminable interests default nondeductible—attach statement.

- QDOT oversights: Non-citizen transfers without U.S. trustee/withholding.

- Valuation errors: Forgetting tax reductions or using basis vs. FMV.

- Double-dipping: Deducting same property under Sections 2053/2056.

- Missing attachments: IRS rejects without proof; retain 3+ years.

Audits spike on large deductions—document everything.

Real-World Examples of Schedule M Deductions

- Outright Bequest: $2M cash to spouse (Will Clause 2)—deduct full FMV on Line 4.

- Joint Home: $1M residence (50% decedent’s)—deduct $500,000 (Schedule A cross-ref).

- QTIP Trust: $3M trust (income to spouse, remainder to kids)—elect QTIP; deduct $3M minus $100K taxes = $2.9M.

- QDOT Annuity: $500K to non-citizen spouse’s QDOT—deduct full, defer tax on distributions.

- Life Estate: Spouse (age 65) gets income from $400K property + power—actuarial value ~$200K deductible.

These save ~$1.2M in taxes (40% rate) per $3M deducted.

Final Thoughts: Leverage Schedule M for Tax-Free Spousal Transfers

IRS Form 706 Schedule M empowers couples to defer estate taxes indefinitely via the unlimited marital deduction, complementing 2025’s $13.99M exclusion and portability. Pair with QTIP/QDOT for flexibility, but plan ahead—2026 sunset looms.

Download forms at IRS.gov/Form706; consult a CPA or estate attorney for tailored advice. Secure your legacy today—tax-free transfers build tomorrow’s wealth.

This guide is informational, not advice. Verify with IRS resources for your circumstances.