Table of Contents

IRS Form 706 (Schedule O) – Charitable, Public, and Similar Gifts and Bequests – In the realm of estate planning, charitable giving isn’t just a noble act—it’s a powerful tool for reducing federal estate taxes. For decedents dying in 2025, where the basic exclusion amount stands at $13,990,000, estates exceeding this threshold face a 40% tax rate on the excess. Enter IRS Form 706 Schedule O, the dedicated schedule for reporting and claiming deductions for charitable, public, and similar gifts and bequests under Internal Revenue Code (IRC) Section 2055. This unlimited deduction can significantly lower your taxable estate, potentially saving your heirs substantial taxes.

Whether you’re an executor navigating Form 706 or an estate planner advising clients, understanding Schedule O is essential. In this comprehensive guide, we’ll break down its purpose, eligibility, step-by-step completion process, and 2025-specific updates. Backed by the latest IRS instructions (revised September 2025), we’ll ensure you’re equipped to maximize these tax benefits while complying with federal rules.

What Is IRS Form 706 Schedule O?

IRS Form 706, the United States Estate (and Generation-Skipping Transfer) Tax Return, is filed by the executor of a U.S. citizen or resident’s estate to calculate federal estate taxes on assets transferred at death. Schedule O is a supporting schedule attached to Form 706, specifically designed to document charitable, public, and similar gifts and bequests that qualify for an estate tax deduction.

Under IRC Section 2055, these transfers are deductible from the gross estate without any dollar limit—unlike income tax charitable deductions. The deduction reduces the taxable estate, directly lowering the estate tax liability. For example, if an estate valued at $15 million includes a $2 million bequest to a qualified charity, only $13 million (plus any other deductions) becomes taxable, potentially keeping it under the 2025 exclusion threshold.

Schedule O ensures the IRS can verify that transfers meet strict qualification criteria, such as going to eligible organizations and being irrevocable. It’s particularly relevant for estates involving wills, trusts, or lifetime gifts includible in the gross estate.

Who Needs to File Schedule O on Form 706?

You must complete and attach Schedule O if the decedent’s estate claims any deduction for transfers under Section 2055. This applies to:

- Estates required to file Form 706: When the gross estate plus adjusted taxable gifts exceeds the basic exclusion amount ($13,990,000 for 2025 decedents).

- Portability elections: Even if no tax is due, filing Form 706 to elect portability of the deceased spousal unused exclusion (DSUE) may require Schedule O if charitable deductions are claimed.

- Non-filing estates: Under the special rule in Treas. Reg. § 20.2010-2(a)(7)(ii), portability filers aren’t required to report full values of marital or charitable assets but must estimate them for the gross estate total.

Executors of nonresident noncitizen estates use Form 706-NA and may attach Schedule O, but deductions are limited to U.S.-situs transfers to domestic entities unless a treaty applies. Always consult a tax professional, as errors can trigger audits or disallowed deductions.

Qualifying Gifts and Bequests for Schedule O Deductions

Not every gift to a charity qualifies. Section 2055 requires transfers to be outright, irrevocable, and for public benefit. Here’s what counts:

Eligible Recipients

Deductions are allowed for bequests, devises, legacies, or transfers to:

- Section 170(c) organizations: Charitable, religious, educational, scientific, or literary entities (e.g., 501(c)(3) nonprofits like universities, hospitals, or foundations) that don’t benefit private individuals or engage in substantial lobbying.

- Government entities: The U.S., states, local governments, or the District of Columbia for public purposes.

- Fraternal societies or trustees: Operating exclusively for religious, charitable, etc., purposes.

- Veterans’ organizations: Incorporated by Act of Congress (e.g., American Legion).

- Qualified gratuitous transfers: To employee stock ownership plans (ESOPs).

- Indian tribal governments: Treated as states under Rev. Proc. 2008-55.

- Conservation easements: Post-death grants under Section 2031(c)(9) for qualified real property interests.

Types of Qualifying Transfers

- Outright bequests: Cash, stocks, real estate, or personal property directly to the charity via will or trust.

- Lifetime transfers: Gifts includible in the gross estate (e.g., under Sections 2035–2038).

- Qualified disclaimers: Irrevocable refusals under Section 2518, if filed timely.

- Termination of powers: Releasing a power to invade or consume property for charitable benefit.

- Split-interest trusts: Only the charitable portion (e.g., in charitable remainder trusts) qualifies; report the full value but deduct only the charity’s share.

Non-Qualifying Transfers

- Conditional gifts where charity receives less than the full amount.

- Transfers benefiting private individuals (e.g., family foundations with personal perks).

- Foreign charities, unless a treaty allows (e.g., under the U.S.-Canada treaty).

The deduction is limited to the property’s fair market value (FMV) at the date of death (or alternate valuation date if elected), reduced by any estate, GST, state death, or other taxes payable from the bequest. For installment payments under Section 6166, subtract estimated interest.

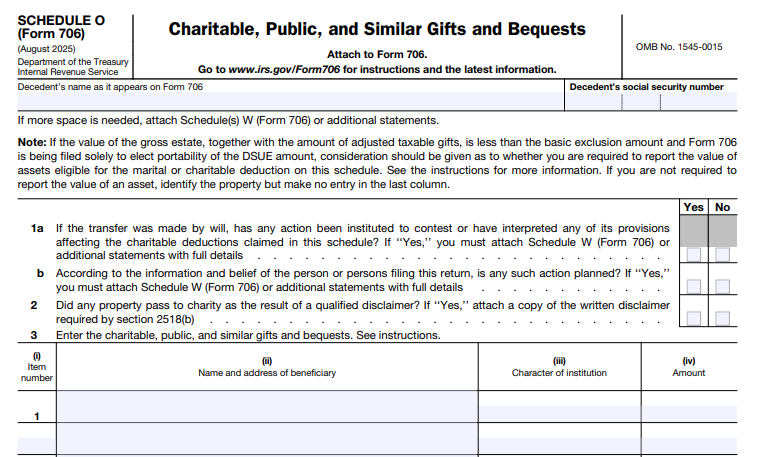

IRS Form 706 (Schedule O) Download and Printable

Download and Print: IRS Form 706 (Schedule O)

Step-by-Step Guide: How to Complete Schedule O

Schedule O requires detailed reporting for each qualifying transfer. Use the redesigned 2025 version (Rev. August 2025) for decedents dying after December 31, 2024. If more space is needed, attach Schedule W (Continuation Schedule).

Key Steps

- Gather Documentation: Collect the will, trust instruments, disclaimers, and appraisals. Verify recipient eligibility via IRS Exempt Organizations Select Check tool.

- Value the Property: Determine FMV as of the valuation date. For non-cash assets like stock or real estate, obtain professional appraisals.

- List Each Transfer: Use the table format on Schedule O. For each item:

- Column (a): Description (e.g., “100 shares of XYZ Corp. stock”).

- Column (b): Date of gift/bequest.

- Column (c): Recipient name and address.

- Column (d): FMV and amount deductible (after reductions).

- Column (e): Reference to will/trust provision.

- Column (f): Any conditions or trust details.

- Handle Special Cases:

- Residuary bequests: Attach a computation showing the charitable share after specific legacies and taxes.

- Trusts: Report only the actuarial value passing to charity; include life tenant ages and income projections.

- Total and Transfer: Sum column (d) on line 8. Enter on Form 706, Part V, line 18 (Recapitulation of Deductions).

- Attach Supporting Evidence:

- Certified will copy.

- Trust agreements.

- Disclaimer documents.

- Sale/purchase verifications if applicable.

| Column | Required Information | Example |

|---|---|---|

| (a) Description | Detailed asset info | “Residence at 123 Main St., valued at $500,000 FMV” |

| (b) Date | Transfer date | “Date of death: 06/15/2025” |

| (c) Recipient | Full name/address | “American Red Cross, 431 18th St NW, Washington, DC 20006” |

| (d) Amount Deductible | FMV minus taxes | “$500,000 minus $20,000 est. state tax = $480,000” |

| (e) Provision | Will clause reference | “Article V, Clause 2” |

| (f) Conditions | Restrictions/trust info | “For disaster relief programs only” |

2025 Updates to Form 706 and Schedule O

The IRS redesigned Form 706 and its schedules in 2025 for better efficiency, separating schedules into standalone PDFs (no longer bundled with the main form). Key changes include:

- Inflation Adjustments: Basic exclusion rises to $13,990,000; special-use valuation ceiling to $1,420,000.

- Closing Letter Fee: Reduced to $56 (from $67) for requests after May 21, 2025.

- No Schedule O-Specific Changes: Procedures remain consistent, but use the updated layout for attachments.

These tweaks streamline filing but emphasize accurate valuations amid rising estate values.

Common Mistakes to Avoid When Filing Schedule O

Even seasoned executors falter here—avoid these pitfalls:

- Ineligible Recipients: Double-check 501(c)(3) status; donor-advised funds may not qualify if not outright.

- Incomplete Valuations: Forgetting tax reductions or using cost basis instead of FMV.

- Missing Attachments: IRS may disallow deductions without proof.

- Overlooking Trusts: Reporting full trust value instead of just the charitable portion.

- Portability Oversights: Underestimating charitable assets for DSUE calculations.

Audits often target large deductions, so retain records for three years post-filing.

Real-World Examples of Schedule O in Action

- Cash Bequest: A decedent leaves $100,000 to a local library (qualified under Section 170(c)). Deduct the full amount on line 1, reducing the taxable estate by $100,000—no tax on that portion.

- Appreciated Stock: $250,000 in stock (basis $50,000) to a university. Deduct FMV ($250,000); heirs avoid capital gains, and the estate saves ~$100,000 in taxes (at 40% rate).

- Residuary Gift: Estate residue of $5 million, with 20% ($1 million) to charity after $800,000 in specific legacies and taxes. Attach computation; deduct $1 million.

- Charitable Remainder Trust: $300,000 trust pays income to family for life, then to charity. Deduct the present value of the remainder interest (~$150,000, per IRS tables).

These examples illustrate how Schedule O turns philanthropy into tax efficiency.

Final Thoughts: Maximize Your Charitable Legacy with Schedule O

Claiming deductions on IRS Form 706 Schedule O isn’t just about compliance—it’s about honoring the decedent’s wishes while shielding family wealth from estate taxes. With no cap on the deduction and 2025’s higher exclusion, strategic giving via wills or trusts can eliminate tax entirely for many estates.

Ready to file? Download the latest forms from IRS.gov/Form706 and consider professional guidance for complex estates. For personalized advice, consult an estate tax attorney or CPA. Your charitable impact today builds a tax-smart tomorrow.

This article is for informational purposes only and not tax advice. Always refer to official IRS resources for your situation.