Table of Contents

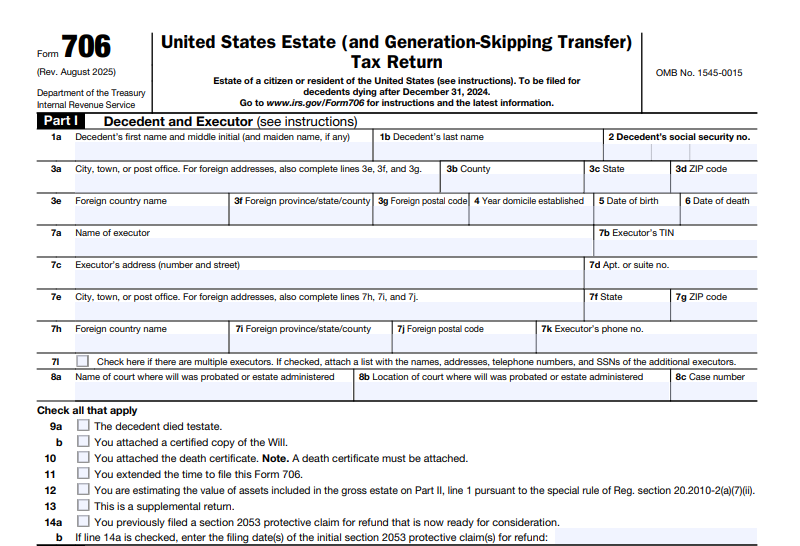

IRS Form 706 – United States Estate (and Generation-Skipping Transfer) Tax Return – As estate planning evolves with inflation adjustments and legislative changes, IRS Form 706 remains a cornerstone for executors managing federal estate taxes. This form, the United States Estate (and Generation-Skipping Transfer) Tax Return, calculates taxes on asset transfers at death while addressing generation-skipping transfers (GSTs). For decedents dying in 2026, the basic exclusion amount rises to $15 million per individual—up from $13.99 million in 2025—thanks to the One Big Beautiful Bill Act’s permanent increase, indexed for inflation. This shields more estates from the 40% top rate, but filing is still required for large estates or elections like portability. This SEO-optimized guide, based on the latest IRS revisions (September 2025 instructions), demystifies Form 706 to help you comply efficiently and minimize liabilities.

What Is IRS Form 706?

IRS Form 706 is the executor’s tool for reporting the gross estate’s fair market value (FMV), applying deductions, and computing federal estate taxes under Chapter 11 of the Internal Revenue Code. It also handles GST taxes on direct skips to beneficiaries two or more generations below the decedent (e.g., grandchildren) under Chapter 13. Key elements include:

- Estate Tax Assessment: On all includible property transferred at death.

- GST Integration: Taxes skips to prevent double exemptions across generations.

- Portability Option: Transfers unused exclusion to a surviving spouse, potentially doubling to $30 million for couples in 2026.

The form (Rev. August 2025) and instructions (Rev. September 2025) incorporate efficiency updates like streamlined schedules and electronic payment fields. Access the latest at IRS.gov for decedents dying after December 31, 2025.

Who Needs to File IRS Form 706 in 2026?

Only estates surpassing thresholds or making elections file Form 706. With the $15 million exemption, fewer than 0.1% of estates will owe tax, but strategic filings preserve options.

| Filing Requirement | Details for 2026 |

|---|---|

| Gross Estate Threshold | File if gross estate + adjusted taxable gifts + specific gift tax exemption > $15,000,000. |

| Portability Election | Required regardless of size to transfer deceased spousal unused exclusion (DSUE) to surviving spouse. |

| GST Direct Skips | Mandatory for taxable skips to skip persons. |

| Special Elections | Needed for alternate valuation (§2032), special-use valuation (§2032A), or conservation easements (§2031(c)). |

U.S. citizens and residents use Form 706; nonresidents file Form 706-NA if U.S.-situs assets exceed $60,000. State taxes may apply independently.

IRS Form 706 Download and Printable

Download and Print: IRS Form 706

Filing Deadlines and Extensions for Form 706

Deadlines are strict to avoid penalties—plan ahead. The return is due 9 months after the decedent’s death. For a January 1, 2026, death, file by October 1, 2026.

- Automatic 6-Month Extension: Submit Form 4768 before the original due date; extends filing but not payment—estimate and pay taxes timely via EFTPS to halt interest.

- Late Portability Relief: For missed DSUE elections, file within 5 years of death per Rev. Proc. 2022-32 or request 9100 relief.

- Where to File: Mail to Department of the Treasury, Internal Revenue Service Center, Kansas City, MO 64999-0002, or use private delivery (333 W. Pershing Road, Kansas City, MO 64108).

The Estate Tax Closing Letter (ETCL) fee dropped to $56 (from $67) for requests after May 21, 2025—request via Pay.gov after 9 months.

Step-by-Step Guide to Completing IRS Form 706

Form 706 demands precision across Parts I-VI and Schedules A-W. Gather essentials: death certificate, will, appraisals, Form 709 (gifts), and Form 712 (insurance).

- Part I & II: Enter executor/decedent details; sum gross estate on line 1.

- Schedules A-W: Detail assets (e.g., realty on A, stocks on B) and deductions (marital on M, charitable on O).

- Part III Elections: Check for alternate/special-use valuation.

- Part IV & V: Compute taxable estate; apply credits (e.g., unified on line 9a: $15M basic exclusion).

- Part VI Portability: Elect DSUE transfer; compute unused amount.

- Sign & Attach: Include exhibits; paper filing only—no e-file.

For GST, allocate the $15 million exemption on Schedules R/R-1. Use worksheets for prior gifts and credits.

How to Value Assets on IRS Form 706

FMV rules: the price between willing buyer/seller as of death (or alternate date)—no duress.

- Standard: Death-date FMV for cash, securities (average high/low), realty, and digital assets (e.g., crypto via exchange quotes).

- Alternate (§2032): Elect to value 6 months later if it lowers value and tax; applies estate-wide.

- Special-Use (§2032A): For farms/business realty, use value (e.g., cash rental method: gross rents minus taxes, divided by interest rate); 2026 ceiling $1,460,000 reduction from FMV via Schedule T—requires 5/8-year use and heir agreements.

- Discounts: 10-15% for lack of control/marketability in entities; document via appraisals.

Round to nearest dollar; attach data for audits.

Calculating the Estate Tax on Form 706

Progressive rates cap at 40% over $1 million. Process:

- Taxable Estate: Gross minus deductions (debts, expenses, marital/charitable).

- Add Gifts: Post-1976 adjusted taxable gifts.

- Tentative Tax: Apply Table A to sum.

- Credits: Unified ($15M equivalent), foreign death (Schedule P), prior transfers (Q).

Portability boosts couples to $30 million. Elect §6166 installments for business-heavy estates (2% interest on first $1,900,000).

Generation-Skipping Transfer (GST) Tax on Form 706

GST taxes skips at 40%, atop estate tax, to curb multi-generation avoidance. Exemption: $15 million in 2026, allocated on Schedule R (direct skips) or R-1 (trusts).

- Inclusion Ratio: Exemption ÷ value; zero = tax-free.

- Types: Direct skips (bequests to grandchildren), taxable distributions, terminations.

- QTIP Election: Treat marital property as QTIP for GST via line 4.

Notify trustees; unused exemption auto-allocates.

Electing Portability on IRS Form 706

Portability transfers unused DSUE to spouses—irrevocable but vital for couples. Steps:

- File complete Form 706 (even no-tax estates).

- Complete Part VI; report estimated values if under threshold.

- DSUE = Basic exclusion minus used amount.

Opt out via checkbox; QDOTs for non-citizens have extras.

Common Mistakes When Filing Form 706 and How to Avoid Them

Pitfalls derail even pros:

- Incomplete Schedules: Omit appraisals—use checklists.

- Valuation Flubs: Cost basis vs. FMV; engage appraisers.

- Portability Misses: Late filings—calendar alerts.

- Gift Overlooks: Ignore adjusted gifts—use worksheets.

- GST Errors: Poor allocation—strategize early.

Audit-proof with CPAs; redesign eases some issues.

Penalties for Late or Incorrect Form 706 Filings

Consequences escalate:

- Late Filing/Payment: 25% under §6651 (waivable for cause).

- Understatement: 20% for negligence (>20% error).

- Fraud: 75%; criminal charges.

- Interest: Daily on balances.

Prepay estimates; extensions help.

Frequently Asked Questions About IRS Form 706

Do I file if under $15 million in 2026?

Only for portability or elections—no tax due otherwise.

E-file possible?

No—paper only.

Estate vs. GST tax?

Estate at death; GST on skips.

Joint property handling?

Proportionate shares on Schedule E.

Late relief?

Form 4768 or Rev. Proc. 2022-32.

More at IRS estate tax resources.

Final Thoughts: Streamline Your 2026 Form 706 Filing

With the $15 million exemption, Form 706 focuses on elections over taxes for most. Yet, accurate valuations, portability, and GST planning secure legacies. Download the 2025 revision (applicable to 2026 deaths) from IRS.gov and consult pros for tailored strategies.

Informational only—not advice. Verify with IRS or advisors.