Table of Contents

IRS Form 706 – United States Estate (and Generation-Skipping Transfer) Tax Return – Navigating federal estate taxes can be complex, especially with high-value estates. IRS Form 706, the United States Estate (and Generation-Skipping Transfer) Tax Return, is essential for reporting and calculating taxes on large estates. This guide explains what Form 706 is, who must file it, current exemptions, and key filing details based on the latest IRS information as of 2025.

What Is IRS Form 706?

IRS Form 706 is the official tax return used by the executor of a decedent’s estate to:

- Compute the federal estate tax imposed under Chapter 11 of the Internal Revenue Code.

- Calculate the generation-skipping transfer (GST) tax under Chapter 13 for direct skips (transfers to grandchildren or lower generations).

The form accounts for the decedent’s gross estate, including assets like real estate, stocks, cash, life insurance proceeds, annuities, trusts, and jointly owned property. Deductions (e.g., debts, marital transfers, charitable bequests) reduce the taxable estate. It also allows election of portability for unused exemption to a surviving spouse.

Form 706 applies only to estates of U.S. citizens or residents. Nonresident non-citizens use Form 706-NA.

Who Must File IRS Form 706 in 2025?

Not every estate requires Form 706. Filing is mandatory if:

- The decedent was a U.S. citizen or resident.

- The gross estate plus adjusted taxable gifts (post-1976) and specific exemptions exceeds the basic exclusion amount of $13,990,000 for decedents dying in 2025.

Even if the estate is below this threshold and no tax is due, filing is required to:

- Elect portability of the deceased spousal unused exclusion (DSUE) amount to the surviving spouse.

The executor (or person in possession of property if no executor) files the return. Only one complete return is needed, even with multiple executors.

2025 Estate Tax Exemption and Rates

For decedents dying in 2025, the federal estate tax exemption (basic exclusion amount) is $13,990,000 per individual. Married couples can effectively shield up to $27,980,000 through portability.

Estates below this amount generally owe no federal estate tax. Above it, the tax rate is progressive, reaching a maximum of 40% on amounts over $1 million.

The GST tax exemption matches the estate tax exemption at $13,990,000 for 2025.

Note: Some sources indicate a potential increase to $15,000,000 for 2026 deaths due to recent legislation, but confirm with the IRS for deaths after 2025.

Understanding the Generation-Skipping Transfer (GST) Tax on Form 706

The GST tax is a flat 40% tax on transfers that skip generations (e.g., to grandchildren or great-grandchildren) to prevent avoiding estate taxes across generations.

Form 706 reports GST tax on direct skips at death via Schedules R and R-1. Executors can allocate the decedent’s GST exemption to reduce or eliminate this tax.

Filing Deadline and Extensions for Form 706

- Due date: 9 months after the date of death.

- Extensions: File Form 4768 for an automatic 6-month extension to file (not to pay). Special rules allow late portability elections in some cases.

Pay any tax due by the original deadline to avoid penalties. File at the IRS Kansas City processing center (or specified addresses for supplemental documents).

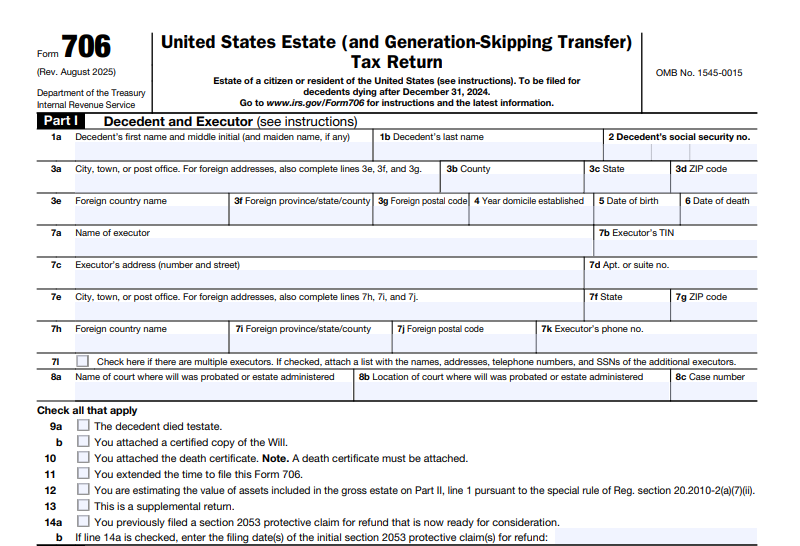

IRS Form 706 Download and Printable

Download and Print: IRS Form 706

How to Complete and File IRS Form 706

Form 706 is detailed, with multiple schedules:

- Parts 1-6: Decedent info, tax computation, elections (e.g., alternate valuation, special-use valuation), and portability.

- Schedules A-I: Itemize gross estate assets (real estate, stocks, insurance, etc.).

- Schedules J-O: Deductions (funeral expenses, debts, marital/charitable bequests).

- Schedules R/R-1: GST tax computation and exemption allocation.

- Other schedules: For special valuations, credits, or protective claims.

Attach required documents: death certificate, will, appraisals, and prior gift tax returns (Form 709).

Value assets at fair market value on the date of death (or alternate 6-month date if elected). Professional appraisers are often needed for complex assets.

Recent Updates to Form 706 (2025)

The latest revision (September 2025) includes:

- Confirmation of the $13,990,000 exemption for 2025 deaths.

- Reduced estate tax closing letter fee to $56 (effective May 2025).

- Guidance on digital assets and consistent basis reporting.

Always download the current form and instructions from IRS.gov.

Frequently Asked Questions About IRS Form 706

Do I need to file Form 706 if no tax is owed?

Yes, if electing portability or if the estate exceeds the filing threshold.

What if the estate qualifies for special valuations?

Elect special-use valuation (for farms/businesses) or conservation easements to reduce taxable value.

Can I pay estate tax in installments?

Yes, for closely held businesses (over 35% of adjusted gross estate) under section 6166.

For personalized advice, consult a tax professional or estate planning attorney. Visit IRS.gov for the latest Form 706 and instructions.

This guide is for informational purposes only and reflects IRS guidelines as of late 2025. Tax laws change, so verify current requirements.