Table of Contents

IRS Form 7217 – Partner’s Report of Property Distributed by a Partnership – In the complex world of partnership taxation, staying compliant with IRS requirements is crucial for partners receiving property distributions. IRS Form 7217, officially titled “Partner’s Report of Property Distributed by a Partnership,” plays a key role in reporting the basis of distributed property and any necessary adjustments. Introduced to ensure accurate basis tracking under Internal Revenue Code Section 732, this form helps prevent tax discrepancies and supports proper reporting on individual tax returns. Whether you’re a partner in a business partnership or a tax professional, understanding Form 7217 is essential for navigating distributions effectively. This guide covers everything you need to know, from filing requirements to detailed instructions.

What Is IRS Form 7217 and Its Purpose?

Form 7217 is a reporting document used by partners who receive property distributions from a partnership. Its primary purpose is to document the basis of the distributed property, including any basis adjustments required under Section 732(a)(2) or (b). This ensures that partners correctly calculate their tax basis in the received assets, which affects future gain or loss recognition when the property is sold or disposed of.

Unlike cash distributions, which are often straightforward, property distributions can involve complex basis allocations. The form applies to both non-liquidating and liquidating distributions but excludes distributions consisting solely of money or marketable securities treated as money under Section 731(c). It also doesn’t cover payments for services under Section 707(a)(1) or disguised sales under Section 707(a)(2)(B). By filing this form, partners provide a clear record that aligns with the partnership’s Schedule K-1 (Form 1065) reporting.

For tax years beginning in 2024 or later, use the December 2024 revision of Form 7217. This recent update reflects the IRS’s ongoing efforts to streamline partnership reporting amid evolving tax laws.

Who Must File Form 7217?

Any partner receiving a distribution of property from a partnership must file Form 7217 if the distribution is subject to Section 732. This includes individuals, corporations, or other entities acting as partners. A separate form is required for each distribution date during the tax year, even if multiple distributions are part of the same transaction.

Exceptions include:

- Distributions of only cash or marketable securities treated as cash.

- Transactions treated as payments for services or disguised sales.

If you’re unsure whether a distribution qualifies, review your Schedule K-1 (Form 1065), particularly Box 19, Code C, which details distributed property. Partnerships provide this information to assist with your filing.

When and How to File Form 7217

Form 7217 must be attached to your annual tax return for the tax year in which the property distribution occurred. The due date aligns with your tax return deadline, including any extensions. For example, individual partners typically file by April 15 (or the next business day), while extensions can push this to October 15.

To file:

- Complete the form using information from your Schedule K-1.

- Attach it to your Form 1040 (for individuals), Form 1120 (for corporations), or other applicable return.

- If electronic filing, ensure the form is included as a PDF attachment if required by your software.

No separate mailing is needed; it’s submitted with your return. Always keep records of calculations, as the IRS may request them during audits.

IRS Form 7217 Download and Printable

Download and Print: IRS Form 7217

Breaking Down Form 7217: Parts and Line-by-Line Instructions

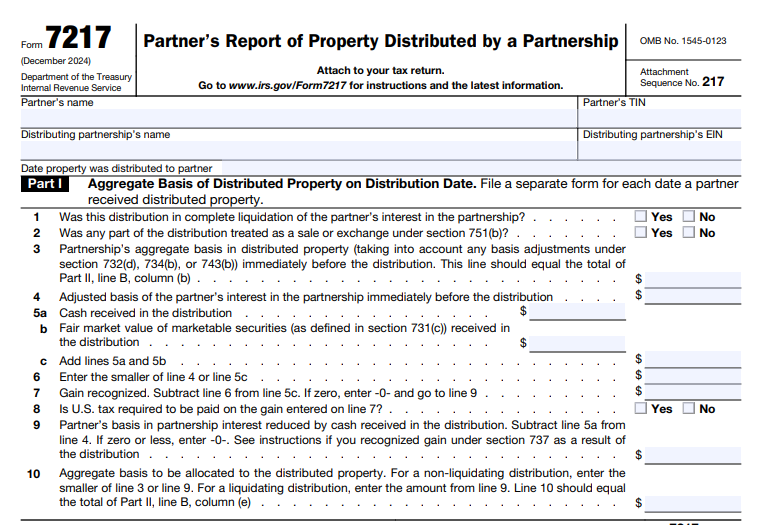

Form 7217 is divided into two main parts: Part I for aggregate basis calculations and Part II for allocating basis to individual properties.

Part I: Aggregate Basis of Distributed Property

- Line 1: Indicate if the distribution is a complete liquidation of your partnership interest.

- Line 2: Check if any part is treated as a sale under Section 751(b). If yes, attach a statement with calculations.

- Line 3: Enter the partnership’s aggregate basis in the distributed property (excluding cash).

- Line 4: Your adjusted basis in the partnership before the distribution.

- Lines 5a and 5b: Money and marketable securities received.

- Line 8: Check if you paid U.S. tax on any gain from excess money distributions.

- Line 9 and 10: Calculate the basis to allocate, adjusting for distribution type.

Part II: Allocation of Basis

This section details each property:

- Column (a): Description of the property.

- Column (b): Partnership’s basis before distribution.

- Columns (c)(i)-(iv): Indicators for special adjustments (e.g., Sections 732(d), 734(b), 743(b)).

- Column (d): Fair market value (FMV).

- Column (e): Your basis after Section 732 application.

Use as many pages as needed for multiple properties.

Basis Adjustments Under Section 732 Explained

Section 732 governs how basis is determined in distributed property. For non-liquidating distributions, your basis is generally the partnership’s basis, but limited under 732(a)(2) if it exceeds your remaining outside basis. In liquidating distributions, the aggregate basis equals your outside basis minus money received, allocated per 732(c).

Allocation rules prioritize matching partnership basis, then unrealized appreciation, and finally FMV proportions. Special adjustments (e.g., 732(d) for elective basis shifts) must be noted.

Real-World Examples of Form 7217 in Action

To illustrate, consider a non-liquidating distribution: A partner with a $10,000 outside basis receives $4,000 cash and property worth $8,000 (partnership basis). The property basis is capped at $6,000.

In a liquidating scenario: A partner receives cash and multiple assets; basis is allocated first to basis-matching items, then appreciation, ensuring accurate tax treatment.

Potential Penalties and Important Reminders

While specific penalties for Form 7217 aren’t detailed, failure to report accurately can lead to general underpayment penalties or audit adjustments. Always attach required statements, like for Section 751(b), and consult a tax advisor for complex cases.

Key definitions include “outside basis” (your partnership interest basis) and “deemed distributions” under Section 752(b).

Conclusion: Stay Compliant with Form 7217

Mastering IRS Form 7217 ensures proper handling of partnership property distributions, minimizing tax surprises. By accurately reporting basis adjustments, partners maintain compliance and optimize their tax positions. For the latest updates, check IRS.gov, as legislation may introduce changes. If you’re dealing with distributions in 2025 or beyond, review your Schedule K-1 promptly and file on time. Consult a qualified tax professional for personalized advice.