Table of Contents

IRS Form 8023 – Elections Under Section 338 for Corporations Making Qualified Stock Purchases – In the complex world of corporate acquisitions, understanding tax elections can significantly impact your bottom line. IRS Form 8023 plays a crucial role in allowing corporations to make elections under Section 338 of the Internal Revenue Code following a qualified stock purchase (QSP). This election can transform a stock acquisition into a deemed asset sale, offering potential tax advantages like basis step-ups for depreciation and amortization. Whether you’re a purchasing corporation, tax professional, or business owner, this guide breaks down everything you need to know about Form 8023, including filing requirements, benefits, and recent updates as of 2025.

What Is IRS Form 8023?

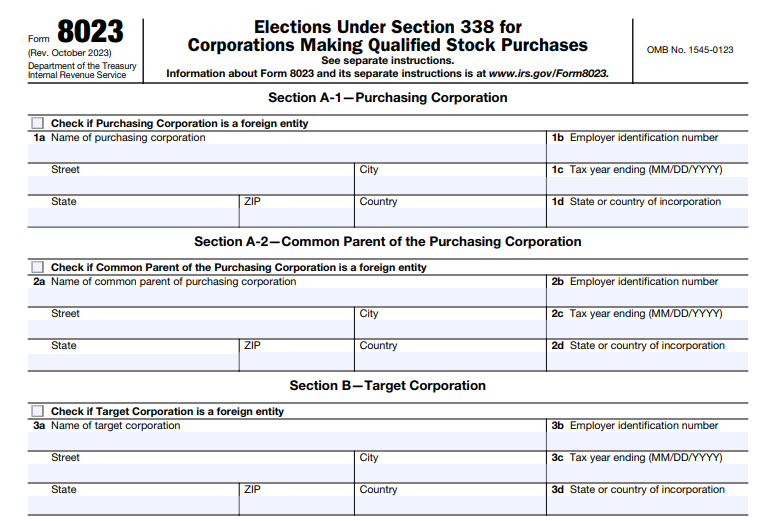

IRS Form 8023, titled “Elections Under Section 338 for Corporations Making Qualified Stock Purchases,” is the official document used by purchasing corporations to elect special tax treatment for acquisitions. It enables the recharacterization of a stock purchase as an asset acquisition for federal income tax purposes. This form is essential when a corporation acquires control of another through a QSP, allowing the target company to be treated as if it sold its assets at fair market value.

The form was last revised in October 2023, with updates incorporating 2D barcode technology for faster processing and minor redesigns to improve digital intake. As of January 2025, no major legislative changes have been noted, but always check IRS.gov for the latest developments.

Understanding Section 338 Elections

Section 338 of the Internal Revenue Code permits certain stock purchases to be treated as asset acquisitions. There are two primary types of elections:

Section 338(g) Election

This election treats the target corporation as selling all its assets to a “new” target on the acquisition date, with the “old” target recognizing any gain or loss. The purchaser benefits from a stepped-up basis in the assets, which can lead to higher deductions for depreciation and amortization.

Section 338(h)(10) Election

Available only in specific scenarios, such as when the target is part of a selling consolidated group, an affiliate, or an S corporation, this joint election treats the transaction as an asset sale followed by a liquidation. The tax burden often shifts to the sellers, and it’s particularly useful for S corporations where all shareholders must consent.

A key requirement is that the election must follow a QSP, and for foreign targets like controlled foreign corporations (CFCs), additional notices to U.S. shareholders are mandatory to validate the election.

What Is a Qualified Stock Purchase (QSP)?

A QSP is the foundation for a Section 338 election. It occurs when a purchasing corporation acquires at least 80% of the target’s voting power and 80% of the value of its stock within a 12-month acquisition period. Preferred stock under Section 1504(a)(4) is excluded from these calculations. The acquisition date is the first day these thresholds are met, not necessarily the closing date.

| Key QSP Elements | Description |

|---|---|

| Voting Power Threshold | At least 80% |

| Value Threshold | At least 80% |

| Time Frame | Within 12 months |

| Exclusions | Certain preferred stock |

Track step acquisitions, options, and affiliated purchases carefully, as they can affect eligibility.

IRS Form 8023 Download and Printable

Download and Print: IRS Form 8023

Who Must File Form 8023?

Typically, the purchasing corporation files Form 8023. For a Section 338(h)(10) election, it’s a joint filing requiring signatures from both the purchaser and the seller (e.g., the common parent of the selling group or all S corporation shareholders). In cases involving foreign purchasing corporations not filing U.S. returns, U.S. shareholders may make the election.

If multiple targets share the same acquisition date and affiliation, one form can cover them with attached schedules. Related forms include:

- Form 8883: For asset allocation under Section 338 or 1060.

- Form 5471: For foreign corporations.

How to File IRS Form 8023: Step-by-Step Instructions

Filing Form 8023 involves detailed information about the parties involved. Here’s a breakdown:

- Gather Details: Include EINs, tax year endings, countries of incorporation, and acquisition dates for the purchasing corporation, target, and any common parents or shareholders.

- Complete Sections:

- Section A: Purchasing corporation and its common parent.

- Section B: Target corporation.

- Section C: Selling group, affiliate, or shareholders.

- Section D: Acquisition details.

- Section E: Specify the election type (338(g), 338(h)(10), or gain recognition).

- Attach Schedules: For multiple purchasers, targets, or signatures.

- Sign Under Penalties of Perjury: All required parties must sign, with attachments for multiples.

- Submit: Electronically fax to 844-253-9765 (with cover sheet) or mail to IRS in Ogden, UT.

Coordinate with Form 8883 for purchase price allocation using the residual method across asset classes (I-VII).

Deadlines and Penalties for Form 8023

File by the 15th day of the 9th month after the acquisition date. Late filings may qualify for automatic extensions or relief under Section 301.9100-3 if good faith is shown, but penalties and interest could apply. Recent IRS guidance emphasizes strict deadlines, and failures like untimely notices to U.S. shareholders can invalidate elections.

Benefits and Tax Implications of a Section 338 Election

Benefits

- Basis Step-Up: Purchasers get fair market value basis in assets, boosting deductions.

- Tax Shift: In 338(h)(10), sellers bear the gain recognition, often preferable for buyers.

- Simplification: Maintains stock purchase legally while achieving asset treatment tax-wise.

Tax Implications

- Gains/Losses: Target recognizes gains on deemed sale, potentially triggering recapture or ordinary income.

- State Variations: Not all states conform to federal treatment.

- Anti-Churning Rules: May limit amortization for pre-1993 intangibles.

- Cross-Border: Interacts with GILTI, Subpart F, and foreign credits.

Special Considerations for 2025

As of December 2025, a recent IRS private letter ruling (PLR 202550011) highlights the importance of timely notices for foreign targets, granting extensions in good-faith cases. No broad changes to Section 338 have been enacted, but digital enhancements to Form 8023 improve processing. For S corporations or consolidated groups, early consent gathering is key to avoid pitfalls.

Conclusion: Navigating Form 8023 Successfully

Mastering IRS Form 8023 and Section 338 elections can optimize tax outcomes in corporate deals. Consult trusted sources like the IRS website and professional advisors to ensure compliance. By understanding QSP requirements, filing deadlines, and strategic benefits, you can make informed decisions that align with your business goals in 2025 and beyond. For the most current information, visit IRS.gov/Form8023.