Table of Contents

IRS Form 8027 – Employer’s Annual Information Return of Tip Income and Allocated Tips – In the hospitality industry, where tips can account for up to 40% of employee earnings, accurate reporting isn’t just good practice—it’s a federal requirement. IRS Form 8027, Employer’s Annual Information Return of Tip Income and Allocated Tips, helps large food and beverage establishments track charged tips, gross receipts, and allocate unreported tips to ensure fair taxation and Social Security credits. As 2025 comes to a close, with the IRS’s updated instructions released in late 2024 emphasizing electronic filing for efficiency and penalties adjusted for inflation (up to $340 per form for late filings after December 31, 2025), compliance is more critical than ever.

This SEO-optimized guide, based on the official 2025 Instructions for Form 8027 and Publication 531 (Reporting Tip Income), covers the form’s purpose, eligibility, step-by-step completion, deadlines, and strategies to avoid costly errors. Whether you’re a restaurant owner in New York or a casino operator in Las Vegas, mastering Form 8027 ensures your tipped employees receive proper credits while shielding your business from audits and fines up to $680 for intentional disregard. Download the 2025 PDF from IRS.gov and prepare—filing by February 28, 2026 (paper) or March 31 (electronic) keeps your operations tip-top compliant.

What Is IRS Form 8027?

Form 8027 is an annual informational return used by employers in large food or beverage establishments to report total receipts from food/beverages, charged tips (e.g., credit card), directly reported tips, and indirectly allocated tips. It helps the IRS determine if tips meet the 8% gross receipts benchmark (or a lower IRS-approved rate), allocating shortfalls to non-tipped employees like cooks or bussers to prevent underreporting.

Key elements:

- Lines 1–2: Charged receipts and tips.

- Lines 3–4: Gross receipts and total tips reported.

- Line 5: Directly tipped employees.

- Line 6: 8% calculation (or lower rate).

- Line 7: Allocated tips (shortfall).

- Line 8: Unallocated shortfall.

For 2025, the form includes the standard OMB No. 1545-0029 and references electronic filing specs in Publication 1239 (Rev. September 2025). No major structural changes from 2024, but instructions clarify complimentary items as nonallocable and emphasize correcting W-2 allocations before year-end. Allocated tips appear on employees’ W-2s (Box 8) and are taxable, but employees can opt out via Form 4070A if they report more than allocated.

Key Fact: If tips <8% of gross receipts, allocate the difference proportionally—failure to do so risks IRS reallocation and penalties.

Who Must File Form 8027?

Employers operating large food or beverage establishments—where tipping is customary and located in the 50 states or D.C.—must file Form 8027 if they meet the 10-employee test based on 2024 averages. A “large” establishment is one with:

- 10 employees on a typical business day in 2024 (calculate via optional worksheet: total hours / 80 >10).

- Examples: Restaurants, bars, casinos, hotels with dining (even if separate EINs, aggregate if controlled).

File one Form 8027 per establishment; use Form 8027-T for multiple. Exceptions:

- Small establishments (<10 employees).

- Non-tipping venues (e.g., fast-food with no table service).

- Delivery-only operations (tips still reported on W-2s, but no 8027).

E-file required for 10+ forms; all filers must sign under perjury.

Step-by-Step Guide: How to Complete IRS Form 8027 for 2025

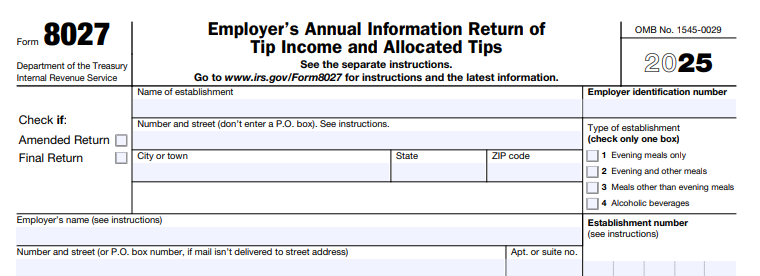

The 2025 Form 8027 is a one-page PDF—use IRS e-file software or approved vendors like Tax1099 for bulk. Gather POS data, tip logs, and payroll records.

1. Header Information

- Name/Address/EIN: Establishment and employer details; check “Yes/No” for charge acceptance.

- Establishment Number: Sequential if multiple (e.g., 001 for main restaurant).

2. Lines 1–2: Charged Tips

- Line 1: Total charged receipts (credit/debit; exclude non-food/beverage).

- Line 2: Total charged tips from those receipts (even if $0).

3. Lines 3–4: Gross Receipts and Tips

- Line 3: Total food/beverage receipts (cash + charged; ≥ line 1).

- Line 4: Total tips reported (direct cash + charged; sum of employee reports).

4. Lines 5–7: Allocation

- Line 5: Directly tipped employees (cumulative who worked any time in 2025).

- Line 6: 8% of line 3 (or lower IRS-approved rate; attach letter).

- Line 7: Allocated tips (line 6 – line 4; allocate via method: gross receipts, hours, or both).

5. Line 8: Unallocated Shortfall

- Line 6 – (line 4 + line 7); explain if >0 (e.g., lower rate).

6. Signature

- Authorized signer (owner/officer); date under perjury.

Pro Tip: Use the optional 10-employee worksheet to confirm filing need; allocate tips proportionally to W-2 Box 8.

Deadlines and How to File Form 8027 for 2025

For 2025 data, file by:

- Paper: February 28, 2026 (with 8027-T if multiple; mail to IRS Austin).

- Electronic: March 31, 2026 (mandatory 10+; via FIRE system per Pub. 1239 Rev. Sept. 2025).

Extensions: Form 8809 (30 days, by Feb. 28/March 31). No employee copies required—tips on W-2s suffice.

Common Mistakes to Avoid When Filing Form 8027

Underreporting tips triggers audits—here’s a table of top errors from IRS data:

| Mistake | Why It Happens | How to Fix/Avoid | Potential Penalty |

|---|---|---|---|

| Wrong Employee Count (Line 5) | Counting only tipped staff. | Include all direct (servers) + indirect (cooks); cumulative for year. | $340/form; reallocation. |

| Miscalculating 8% (Line 6) | Using decimal (.08) vs. percentage (8). | Enter 8 (software multiplies); attach lower-rate letter. | $340/form. |

| Excluding Complimentary Receipts (Line 3) | Omitting free items. | Include as nonallocable if no tip; explain unallocated. | Audit; $60–$340/form. |

| No 8027-T for Multi-Locations | Filing separately without transmittal. | Use 8027-T for >1; aggregate if controlled. | Rejection; penalties. |

| Late Electronic Filing | Missing March 31. | E-file via Pub. 1239; Form 8809 early. | $340+/form (intentional $680). |

| Incorrect EIN/Address | Using SSN or old data. | Verify EIN; full address. | Processing delays; $340/form. |

Correct via amended 8027; respond to notices promptly.

IRS Form 8027 Download and Printable

Download and Print: IRS Form 8027

2025 Updates and Special Considerations for Form 8027

The 2025 instructions (Rev. December 2024) include minor tweaks:

- OMB No.: 1545-0029; e-file specs in Pub. 1239 (Rev. Sept. 2025).

- 10-Employee Test: Based on 2024 hours (>800/month average).

- Lower Rate: Attach IRS letter if <8%; no new approvals mentioned.

- E-Filing Push: Mandatory 10+; FIRE system for all.

- Corrections: Update W-2s before SSA filing; use W-2c for post-January.

- Penalties: $60–$340 late; $680 intentional (inflation-adjusted).

For multi-state ops, check state tip rules (e.g., CA requires separate reporting).

Final Thoughts: Master Tip Reporting with Form 8027 in 2025

IRS Form 8027 is your shield against tip underreporting penalties, ensuring fair allocation and employee benefits. For 2025, confirm your 10-employee status, calculate 8% accurately, and e-file by March 31, 2026, to stay compliant. Establishments: Use POS integration for ease; consult Pub. 531 for methods.

For complex allocations, engage a CPA. This guide is informational; always verify IRS.gov.

Not tax advice. Refer to official IRS sources.

FAQs About IRS Form 8027

Who must file Form 8027 in 2025?

Large food/beverage establishments with >10 employees on average in 2024, where tipping is customary.

What is the 2025 filing deadline for Form 8027?

February 28, 2026 (paper); March 31, 2026 (electronic).

What is the 8% tip rate on Form 8027?

Benchmark for allocation: If reported tips <8% gross receipts, allocate shortfall.

How do I correct a 2025 Form 8027 error?

File amended 8027; update W-2s via W-2c before SSA deadline.